4/6/22 mid-week market update

In the words of the Anchorman Ron Burgundy, “Well, that (de) escalated quickly.”

Over the weekend we examined the weekly shooting star candlestick pattern on $SPY and $QQQ. Then on Monday in “Off to a good start” we looked at Friday’s hammer candlestick and Monday’s confirming price action. And now, two days later all of that is gone and it kind of feels like we’re watching a tennis match.

So what’s next?

The one thing that seems clear is that the bulls and bears are in an ongoing tug-of-war. Choppy action can be hard to deal with. But so far the indexes are still in neutral territory.

$SPY has support below in the 441–443 price range. 443 is an area that dates back to August of 2021. That price held today and buying came in to stop the slide. The VWAP anchored to the low of March 14, 2022, and the 50-day moving average are also in the area. Who knows if it will help. These are reference points of which to be mindful.

Holding above this area is the first step to higher prices. If the level is lost then there is substantial room below and the possibility of revisiting $SPY 410 will be a higher probability.

On the upside, we really want to see $SPY back above 458–460 to open up another bullish move higher.

$QQQ has a similar-looking chart but with a neutral range of 350–370.

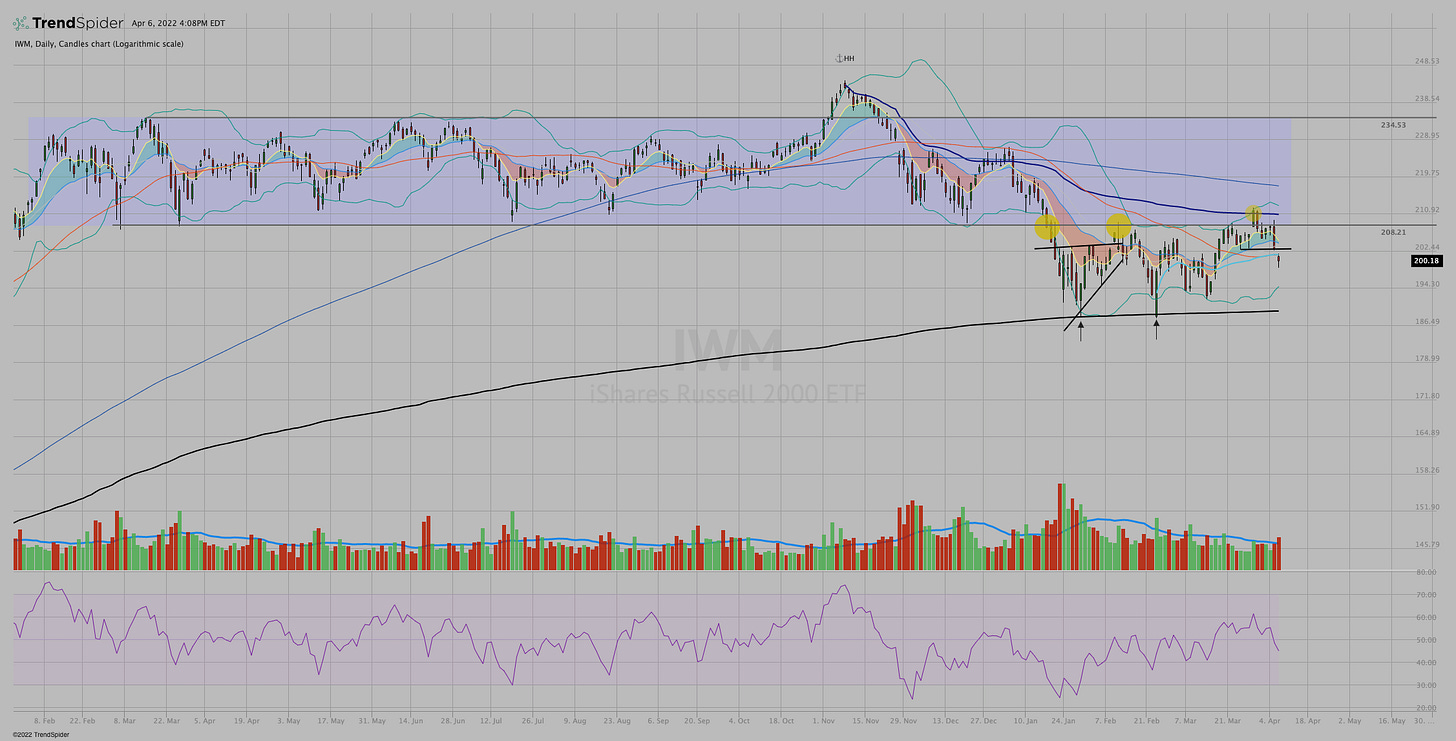

$IWM is a little more concerning as there has been failed move back into the sideways range of 14 months now and a solid rejection at the VWAP anchored to all-time-highs of November 8, 2021.

So, as always — have a plan and follow it. Know your time frame, know what you own, and know how and where you will limit your risk.

Good luck and trade ’em well.