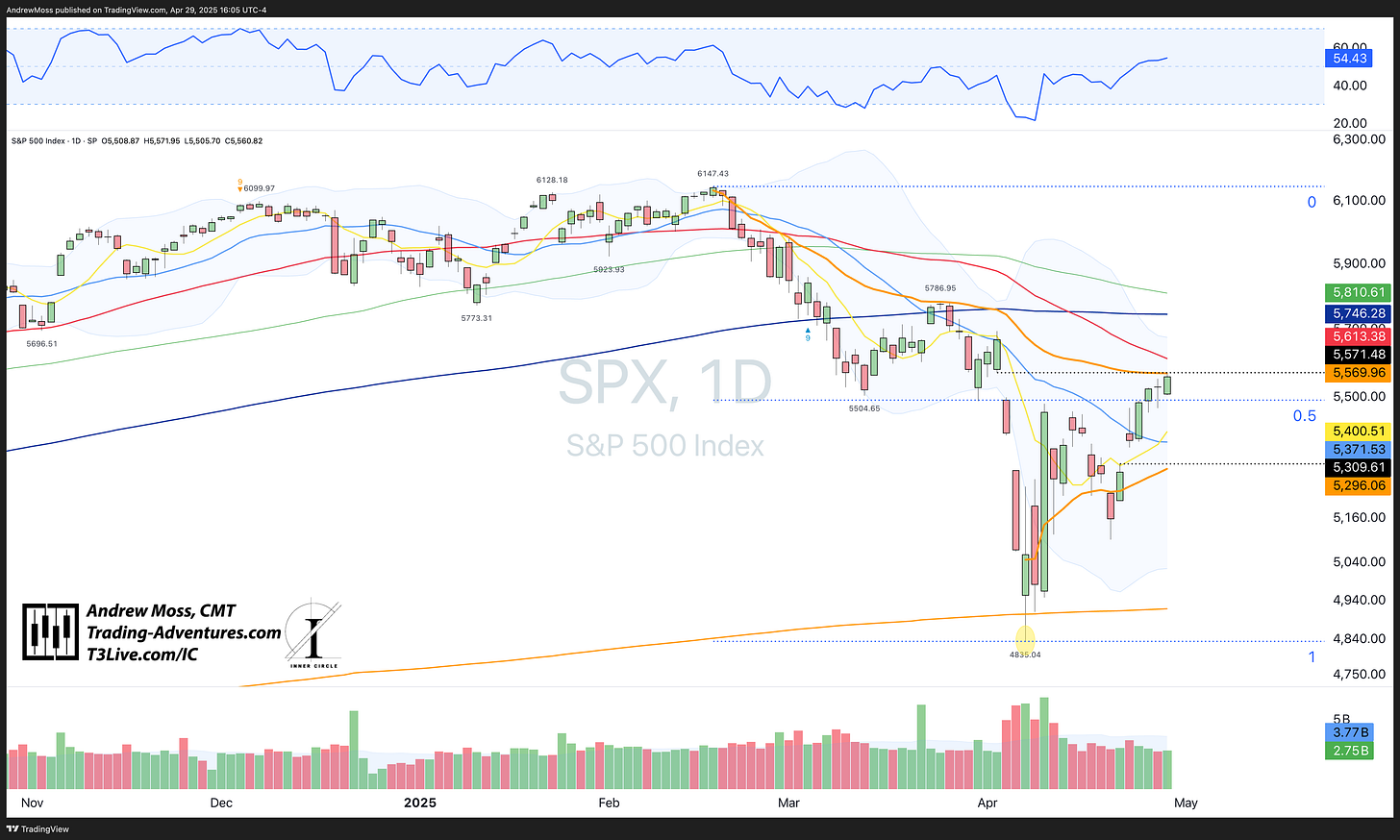

5570

The line in the sand

The Markets

Plus nine percent in six trading days, into multiple layers of potential resistance, and with four of the Magnificent Seven reporting earnings into an environment of tariffs, tape bombs (social media posts and headlines), and heightened uncertainty.

That’s the situation the SP 500 index is facing.

Apple, Amazon, Meta, and Microsoft will announce their latest quarterly results within the next twenty-four to forty-eight hours. Collectively, those companies represent roughly one-fifth of the index. The reaction to those earnings announcements will have a material impact on whether or not ‘The Stock Market’ gets over the 5570 level or not.

A failure to get above wouldn’t necessarily mean that the Bears win. This potential resistance, if it proves to be actual resistance, could lead to three different outcomes.

Consolidation at or near that level before moving higher

Rejection that leads to a test of the bottom range of ‘The Pinch’

Absolute rejection that sends stocks back to recent lows, or beyond

Let’s go to the charts for a better look.

The Charts

SPX is testing the upper boundary of ‘the Pinch’ zone at ~5570. There is also a gap pivot at 5571, adding to potential resistance. The RSI is back over the halfway mark, and price has recovered more than 50% of the 2/19 - 4/7 selloff.

Volume has been less than average every day since the flurry of activity near the low, and looks especially low today.

QQQ is out of its ‘pinch’ area, and also above the 50% selloff retracement level. But it has a pivot high and the 50-day MA as potential resistance overhead, ~$477.60 - $479.56.

RSI is 55.34 while the volume is well below average.

IWM has been drifting higher and into the $196.70 pivot for the last five trading days. That pivot is one layer of potential resistance, followed by a pivot high AVWAP near $199 and the 50-day MA at $200.53.

RSI is > 50. Volume has been well below average.

DIA is also testing a pivot low at $407.25, although this one is more recent, having been made just last month. Next above are three more potential resistance areas: pivot high AVWAP, the 50-day MA, and another pivot, all coming in between $414 and $416.55.

RSI and volume? Yep. You guessed it.

TLT has joined stocks in the substantial recovery and is back over all of its key moving averages, except the 200-day, up around $92.

DXY US Dollar Futures (DX1!) have not been able to find the strength for a recovery. Instead, it looks to be forming more of a continuation pattern, hinting that lower prices are still to come.

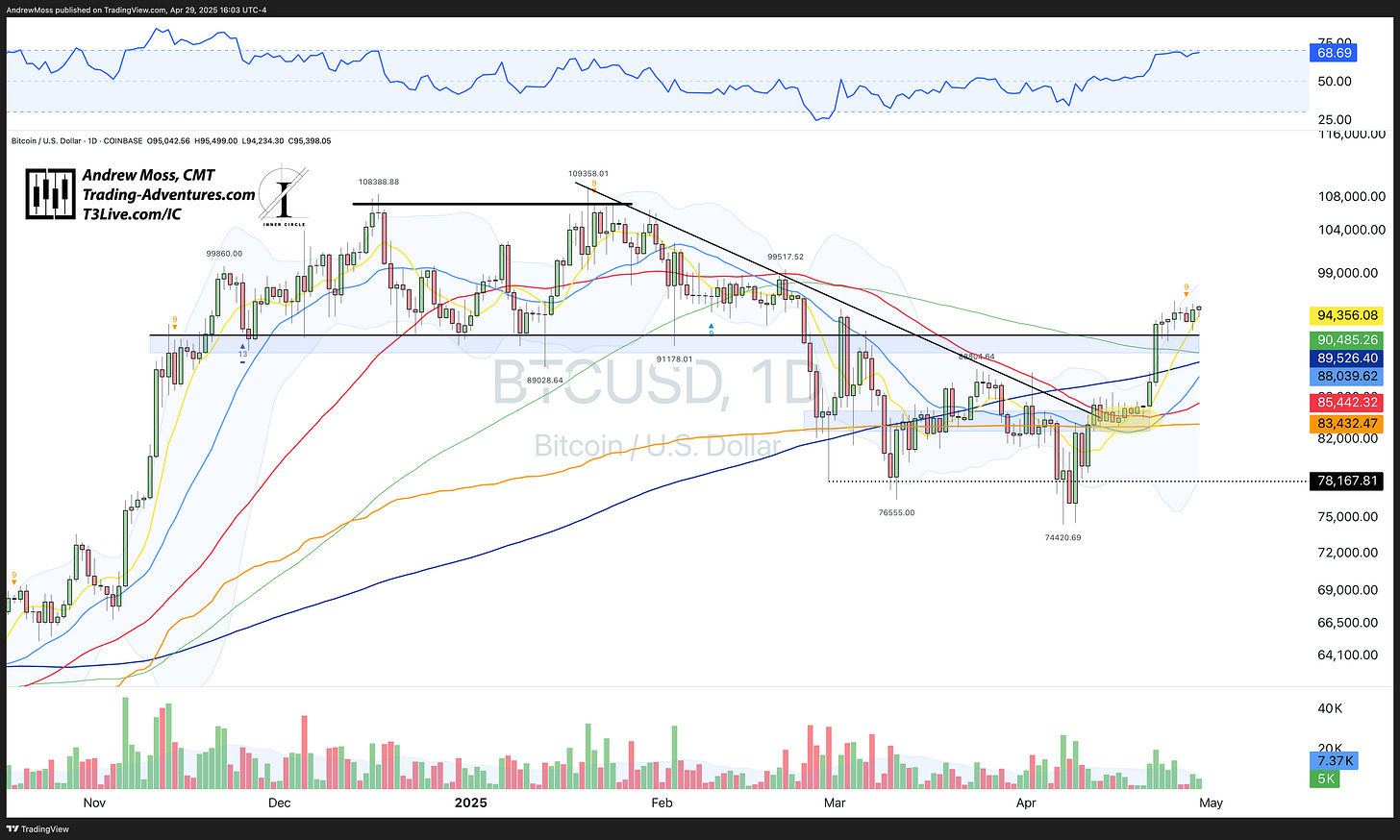

BTC over the last few weeks has — broken above the trendline, broken out above the short-term consolidation (yellow shaded) area, moved back over the pivot/congestion area from late last year, and been able to stay there. An impressive display of strength and stability while most everything else has been under pressure.

The Trade

Unless you’re into the earnings ‘crap shoot’ trades, this is mostly a ‘wait and see’ market. It’s not sexy or exciting. But that’s where we are.

A significant move off the lows, into multiple layers of potential resistance, with one-fifth of the S&P 500 reporting earnings, is not the best place to chase stocks. Rather, most active traders (this author included) have trimmed a good bit of anything bought lower, have some dry powder (cash) available, and possibly even some slight hedges.

Of course, one Presidential Tweet/Post/Truth Social Message could blow that whole plan to smithereens (or prove it to be extremely prudent) at any moment.

Patience.

Looking For More?

Elevate Your Trading Adventure Even Further With These Offerings.

EpicTrades Options Newsletter

Real-time trade ideas and insights, providing actionable trading insights focusing on options trades with short-term horizons, aiming to capitalize on weekly market movements.

The approach includes detailed reasoning for trades, specific options, and profit targets. It focuses on quick gains with a minimal time commitment from subscribers.

Don’t miss the next trade! Hit the link to get your real-time alerts.

The Inner Circle

The Inner Circle is a Virtual Trading Floor (VTF) at T3 Live. I’ve been working and trading with this group since 2022. You may have noticed the logo in the watermarks on my charts.

Founded by David Prince and led by him, Rick March, and Kira Turner, the Inner Circle is a community of elite traders, including hedge fund managers, family office heads, corporate executives, financial advisors, and even professional poker players.

Fundamental, Macro, and Technical Analysis all combine to find and discuss the best opportunities in current markets.

The Disclosures

***This is NOT financial advice. This is NOT a recommendation to buy, sell, or trade any security. The content presented here is intended for educational purposes only.