A Round Trip For Rotation As The Favorites Return

The Markets

In the first half of this week, we saw the US dollar futures drop sharply while bonds (TLT), small caps (IWM), energy (XLE), and biotech (XBI) surged higher.

The buying rotation was well on display, with those names and sectors performing the best.

Today, we see a slight change. As strength in the early leaders of the week diminished, technology (XLK, QQQ) and the favorites (TSLA, NVDA) started to shine again.

NVDA — After breaching and then quickly recovering (signal) the $115.14 pivot low Monday morning, NVDA has risen while respecting technical levels very well.

The WTD AVWAP (purple line - right panel) provided support on the first few tests (another signal). Then the 5-day MA (blue line - right panel) was resistance on Tuesday, flipping to support (more signals) Wednesday morning.

The technical sequence is on display again today as the August low AVWAP acted as resistance first and then support later in the day. (You guessed it, an R to S flip is a signal).

We can not predict which potential support or resistance levels will give way and which will be impassable. But we can read the signs and signals along the way, using them to identify opportunities and manage risk.

The Charts

SPY continued the bounce into day four and has moved above the potential bull flag while trading back above all key moving averages. Pivot highs are near $609-$610 for potential resistance, while support could come in first at the 8-day MA $602.91 and the ~$598 — the 21 and 50-day MAs and the Jan. 13 pivot low AVWAP.

QQQ is working hard to maintain the ‘higher low’ and establish a new ‘higher high.’ To confirm this, we need a close above $531.52, and a move back over $539.15 would add to the strength.

IWM started the day strongly, but by the time the market opened at 9:30 AM, the day’s high was behind it. The 50-day MA continues to be a price magnet, with the action staying very close to that indicator for the better part of the last three weeks.

DIA closed virtually on the 8-day MA, staying comfortably contained in the ~$444 to $451 channel. Energy builds for a trip to new highs as the gap between the 8 and 21-day MAs narrows.

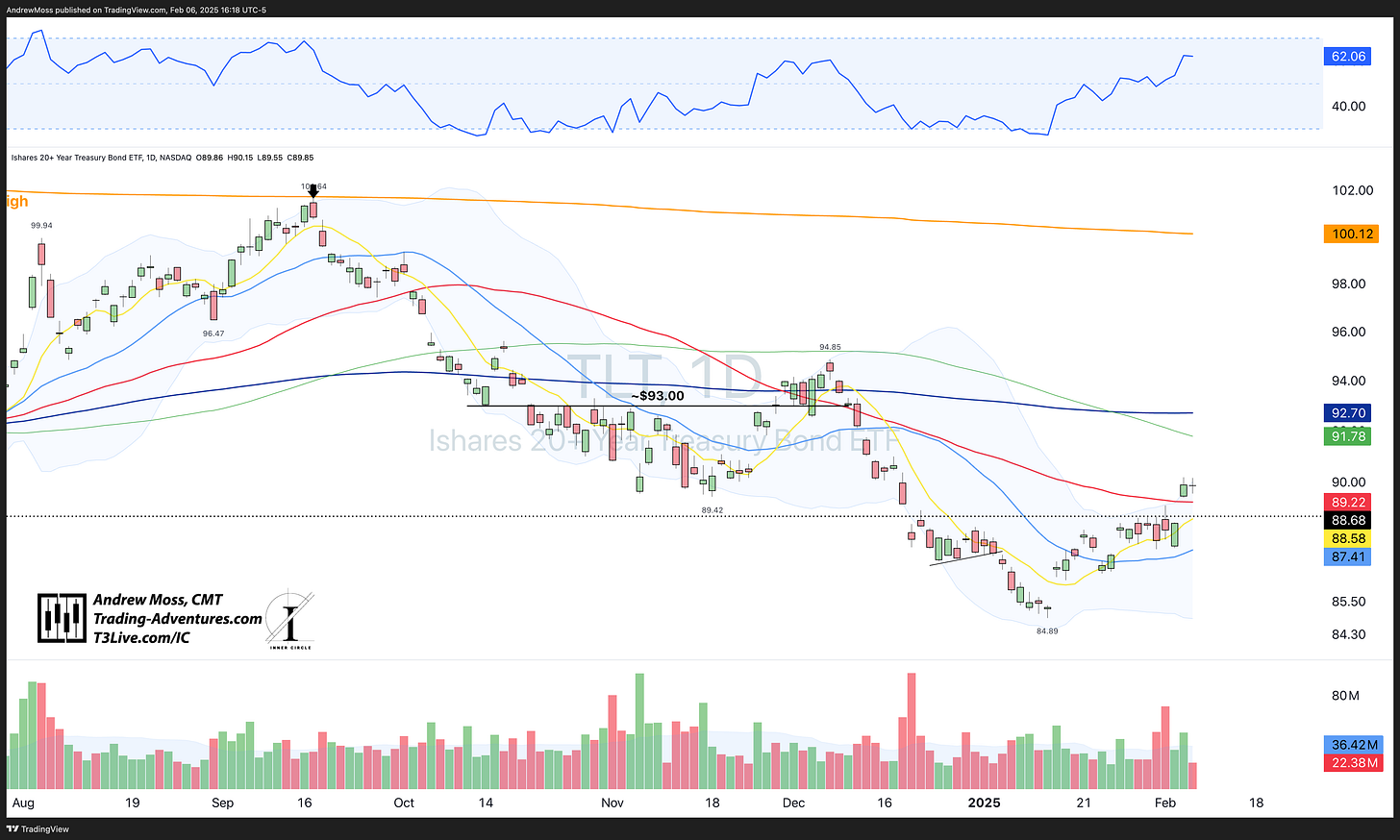

TLT is back over the $88.68 pivot, and the 50-day MA as bond improvement continues.

DXY After failing to make a new high on Monday’s rally, US Dollar futures have come back down below the 8/21/50-day MAs and are testing the $107.05 pivot area. The tailwind for stocks has been evident and observable this week.

BTCUSD The long consolidation continues as Bitcoin can not build and keep enough traction to move into new highs. It is below the 8/21/50-day MAs, while the early Nov. AVWAP and the 100-day MA are colliding near $95,000. Maybe those factors can squeeze it enough to force a break in one direction or another.

The Trade

This morning, I cautioned against chasing Day 4 higher in the indexes while mentioning potential opportunities in some individual names. That caution turned out to be most applicable to small caps (IWM) and industrials (DIA) as SPY and QQQ held up well, though a bit erratic this afternoon while doing so.

Being cautious doesn’t have to mean doing nothing. While waiting is almost always better than forcing a trade, proper planning and preparation can take “forcing” out of the equation. That means being ready with pre-identified areas of interest. Where would you like to be a buyer as the stocks on your watchlist pull back?

As the indexes move higher and beyond the chop and consolidation ranges while dragging their 5-day MAs higher, we want to be ready for dips that successfully test support. A retest of rising MAs can be best, but support can come from many different sources.

Today, TSLA touched its AVWAP from Oct. ‘24 earnings and began to bounce. Then, after a couple of attempts, it was able to clear the $373.04 pivot low, closing up nicely from where it traded earlier in the day.

If it continues higher tomorrow, the WTD AVWAP (purple line - right panel) and the falling 5-day MA (blue line- right panel) will be potential resistance levels to watch.

If you’re not using these tools in your trading, why not? What’s stopping you?

If you have questions about how, when, and where to apply them, let me know with a message or comment.

Looking For More?

Elevate Your Trading Adventure Even Further With These Offerings.

EpicTrades Options Newsletter

Real-time trade ideas and insights, providing actionable trading insights focusing on options trades with short-term horizons, aiming to capitalize on weekly market movements.

The approach includes detailed reasoning for trades, specific options, and profit targets. It focuses on quick gains with a minimal time commitment from subscribers.

The Inner Circle

The Inner Circle is a Virtual Trading Floor (VTF) at T3 Live. I’ve been working and trading with this group since 2022. You may have noticed the logo in the watermarks on my charts.

Founded by David Prince and led by him, Rick March, and Kira Turner, the Inner Circle is a community of elite traders, including hedge fund managers, family office heads, corporate executives, financial advisors, and even professional poker players.

Fundamental, Macro, and Technical Analysis all combine to find and discuss the best opportunities in current markets.

The Disclosures

***This is NOT financial advice. This is NOT a recommendation to buy, sell, or trade any security. The content presented here is intended for educational purposes only.