And...Just Like That

From Dip to Breakout — What This Week’s Action Tells Us

The Markets

Just like that — we’re back at highs.

Major indexes are reclaiming momentum, with price action improving across large caps, small caps, tech, and industrials. What looked like late-summer chop is giving way to renewed momentum.

Breadth is showing signs of life. Rotation is broadening. And sentiment, while warming, hasn’t yet tipped into euphoria.

The backdrop remains a mix of optimism and caution: cooling labor data has markets leaning toward Fed easing, while earnings and sector leadership continue to steer the tape.

Let’s go to the charts.

The Charts

SPY eeks out a new closing high as it jumps over the short-term moving averages and begins to press on the upper Bollinger Band. RSI is rising again. And it appears that momentum has returned.

QQQ isn’t far behind. No new high, yet. But they are back over the MAs and staying above the short-term trendline. RSI so far has held the 50 mark.

IWM keeps the streak going. 3 for 3 so far on positive moves from the major indexes. Last week’s pivot high still looms overhead. But the strong 3-day MA is showing promise.

DIA makes it four for four on green action. And like the small-caps — not quite over the recent highs, but looking to have a good start.

BTCUSD Bitcoin, meanwhile, is gross and lazy. No upside follow-through here as RSI stays below 50, and the potential resistance levels (pivot areas and moving averages) have become actual resistance.

ETHUSD Ethereum is struggling too, as Bitcoin weighs on the entire crypto space. There’s still hope as it hangs on tightly to the pivot low AVWAP. But another failed attempt at the short-term trendline isn’t helping. Keep watching RSI as it gets closer to losing the bullish upper half.

The Trade

The recent dip was a gift for some. It’s not always easy, but it is often a reminder of why discipline matters. Pullbacks in strong trends often provide the best risk-reward opportunities.

From here:

Stay with the trend — price action is confirming higher highs and higher lows.

Manage risk — every level higher is a chance to consider tighter stops and sharper awareness.

Buy at support — not in the middle of extended moves, but when price offers structure.

Stay process-oriented — follow your system, not emotions.

This market continues to reward patience, discipline, and respect for the tape.

The next catalyst is Friday’s NFP report at 8:30 a.m. ET, which could shake up the rate-cut narrative.

📢 One More Thing - One More Time

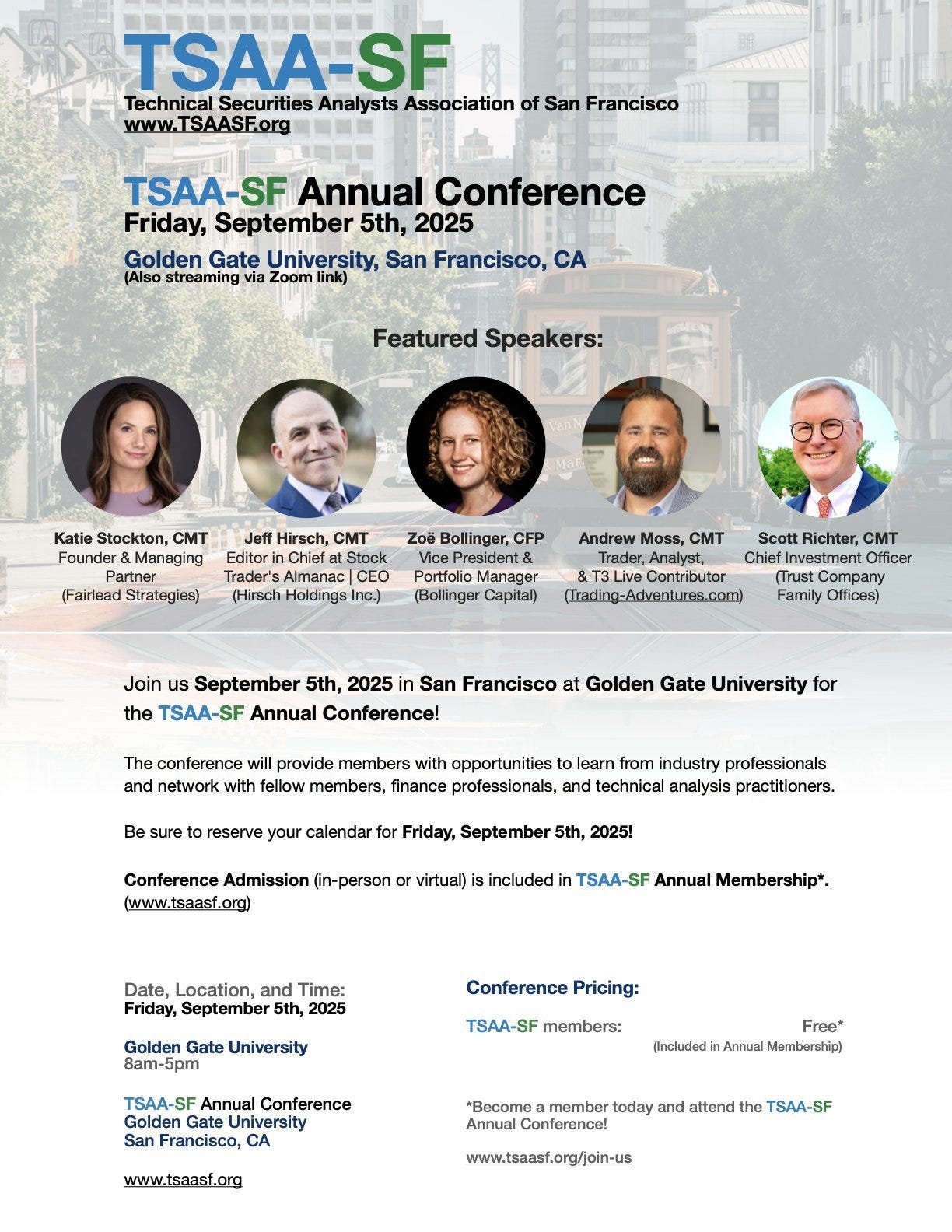

Tomorrow I’ll be speaking at the TSAA-SF Annual Conference in San Francisco.

It’s sure to be one of the great events of the year for traders, technicians, and market professionals — with speakers like Katie Stockton, Jeff Hirsch, Zoë Bollinger, and Scott Richter on the lineup.

If you’re attending in person at Golden Gate University or tuning in virtually, I look forward to connecting with you there.

Details in this flyer—

📌 Quick note: There will be no Weekly Charts this Saturday due to travel for the conference.

Thanks for Reading

If you’ve found these Market Updates helpful, here’s how you can help keep them coming — consider a paid subscription:

All posts remain public. No locked content. Just charts, signals, and steady updates to help you navigate markets with confidence.

Looking For More?

Elevate Your Trading Adventure Even Further With These Offerings.

EpicTrades Options Newsletter

Real-time trade ideas and insights, providing actionable trading insights focusing on options trades with short-term horizons, aiming to capitalize on weekly market movements.

The approach includes detailed reasoning for trades, specific options, and profit targets. It focuses on quick gains with a minimal time commitment from subscribers.

The Inner Circle

The Inner Circle is a Virtual Trading Floor (VTF) at T3 Live. I’ve been working and trading with this group since 2022. You may have noticed the logo in the watermarks on my charts.

Founded by David Prince and led by him, Rick March, and Kira Turner, the Inner Circle is a community of elite traders, including hedge fund managers, family office heads, corporate executives, financial advisors, and even professional poker players.

Fundamental, Macro, and Technical Analysis all combine to find and discuss the best opportunities in current markets.

The Disclosures

***This is NOT financial advice. This is NOT a recommendation to buy, sell, or trade any security. The content presented here is intended for educational purposes only.