April 13, 2022 Mid-Week Market Update

$SPY $QQQ $IWM $TNX

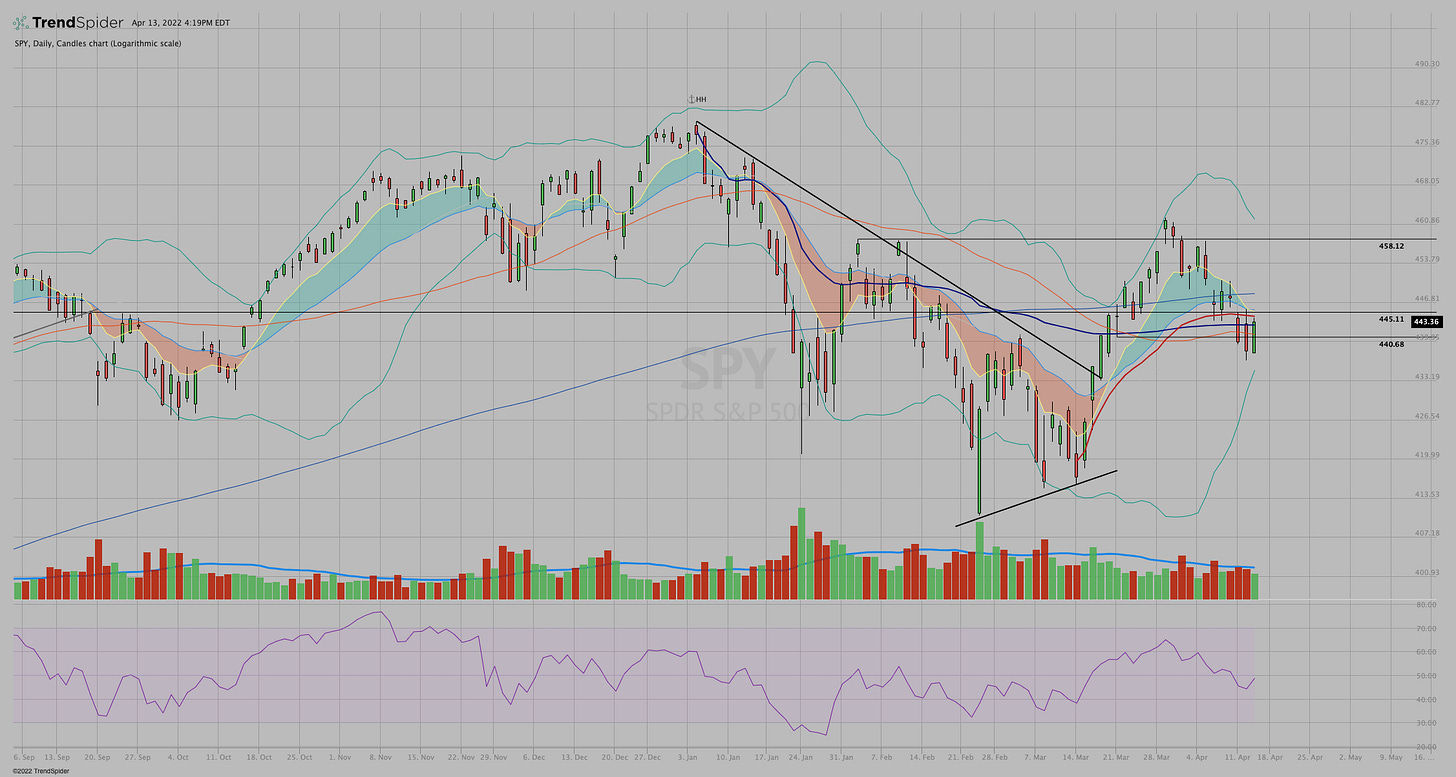

$SPY buying kept coming in all day long and it closed near the highs giving a large green candle for the first time since April 4. It’s a nice day, but there’s still much work to be done.

Still below:

200 sma

8/21 emas — which are sloping downward with the 8 below the 21

3/14/22 low AVWAP

Barely above:

50 sma

1/4/2022 high AVWAP

It’s still chopping in a range.

The Bollinger Bands are still contracting.

Guilty until proven innocent.

$QQQ and $IWM are still similar, but weaker.

We’re starting to hear grumblings of “peak inflation.” Who knows if that will turn out to be true. But it’s being discussed as a possibility. And any good news around inflation, interest rates, supply chains, Ukraine, etc ought to be good for at least a short-term market rally.

While not a direct representation of inflation, this long-term (going back to 1980) chart of 10-year treasury rates is making the rounds. (hat tip @CarterBWorth and @TheChartReport )

The idea is that the action around this trendline will be an indicator of meaningful change in the interest rate environment.

If rates get above this line and stay there, then higher rates are here and likely to stay.

If this trendline proves to be resistance, then rates are likely to continue in accordance with the long-term trend.

A retracement at this line would provide some relief for the heavy market, especially the high-growth tech sector.

We shall see.