April 18, 2022 Weekly Start

$SPY $QQQ $IWM

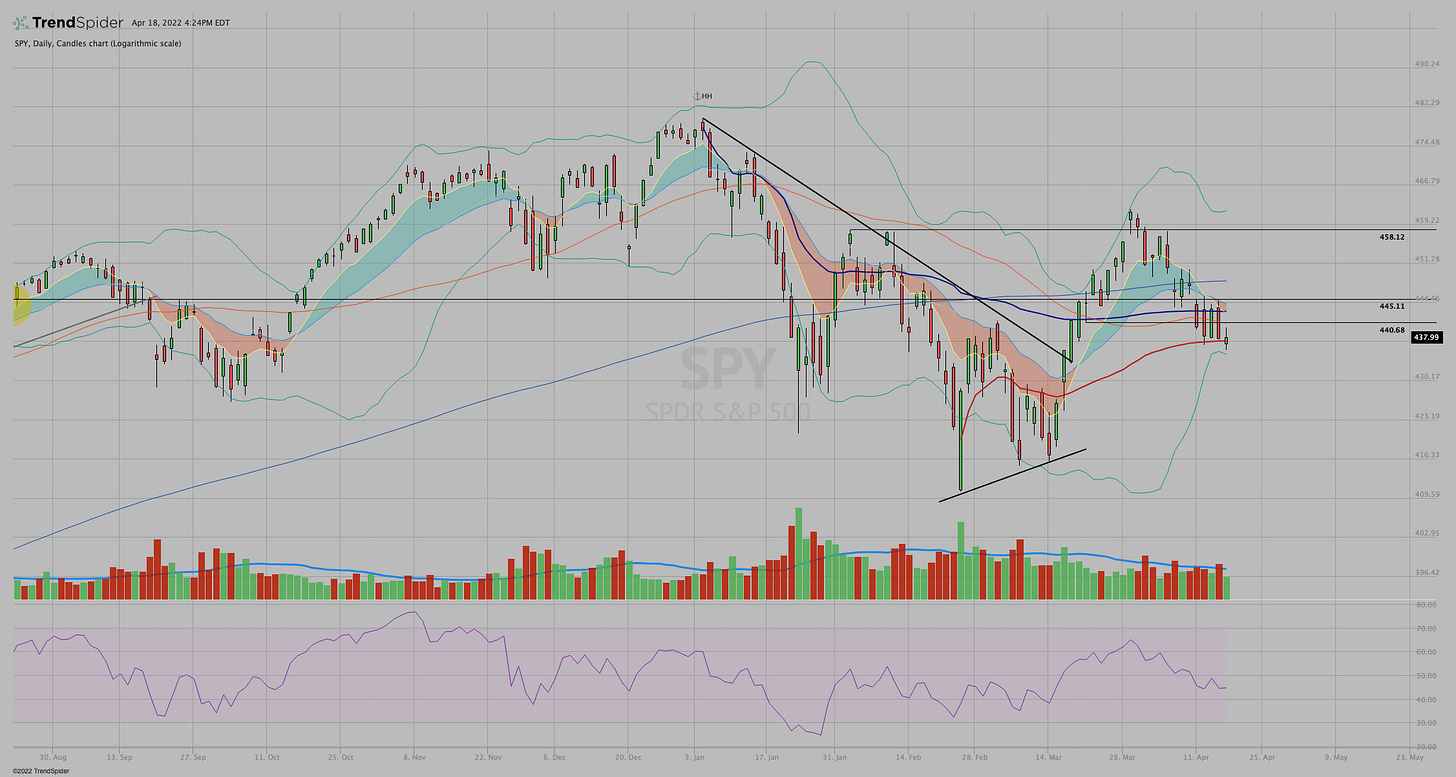

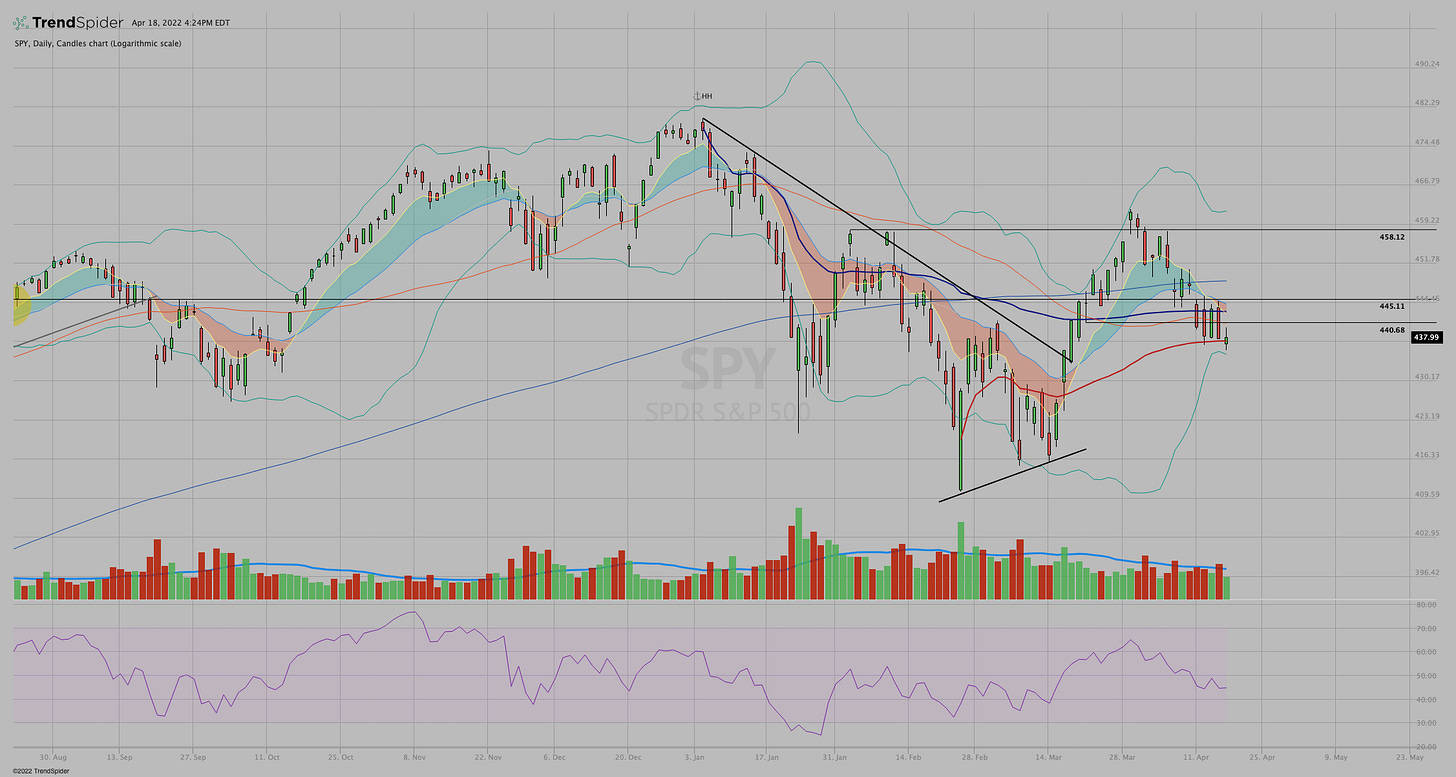

Last week’s market review assigned a “guilty until proven innocent” status. Today’s action was sleepy and range-bound. The market hasn’t proven anything bullish yet.

There is much recent bullish commentary regarding:

Sentiment — extremely low levels like we’re seeing now have been contrarian indicators and can signal a bounce

Seasonality — the month of April is historically one of the strongest of the year

Inflation — Some early indications suggest that it may have peaked

But the charts just aren’t confirming any of that.

$SPY is trading right around the March low AVWAP. Losing this level would add to the bearish case.

A rally into the close helped the daily candle not look as bad. And that price action continued after 4:00 PM on James Bullard’s (Federal Reserve) comments about future rate hikes, GDP, and unemployment.

Let’s see if that strength is still there in the morning.

In the meantime, stay on your toes and manage your risk.