Back On Top

Monday Market Update

The Markets

The major stock market indexes rose for the third consecutive day today.

With that, SPY, QQQ, IWM, and DIA prices are all back over their 50-day MAs, the last challenge of the key moving averages. So, the short-term trend continues, though there is still work to be done to solidify the strength. The reason? Only the 8 and 200-day MAs are sloping meaningfully higher.

The 21 and 50-day MAs are still mostly flat.

Let’s go to the charts.

The Charts

SPY is up 3.5% in four trading days and back on top of all the key moving averages. The 50-day has a very slight upward slope while the 21-day is still moving lower. More time and consolidation will be needed to get them all higher together.

QQQ only needed two trading days to go from below to above the 8/21/50-day MAs and YTD AVWAP. The all-time closing high is barely more than 1% higher now.

IWM is back over the critical $197-$200 area and has filled a gap.

DIA makes it 4/4 indexes back on top of the KMAs.

TLT some relief from longer-term treasury yields has helped stocks on the recent climb. Short-term momentum has switched back to positive here as well. $92-$93 will be a substantial test of resistance, though.

DXY US Dollar futures found a top and fell quickly. They’re now testing the previous pivot high for support with the 50 and 2000-day MAs nearby.

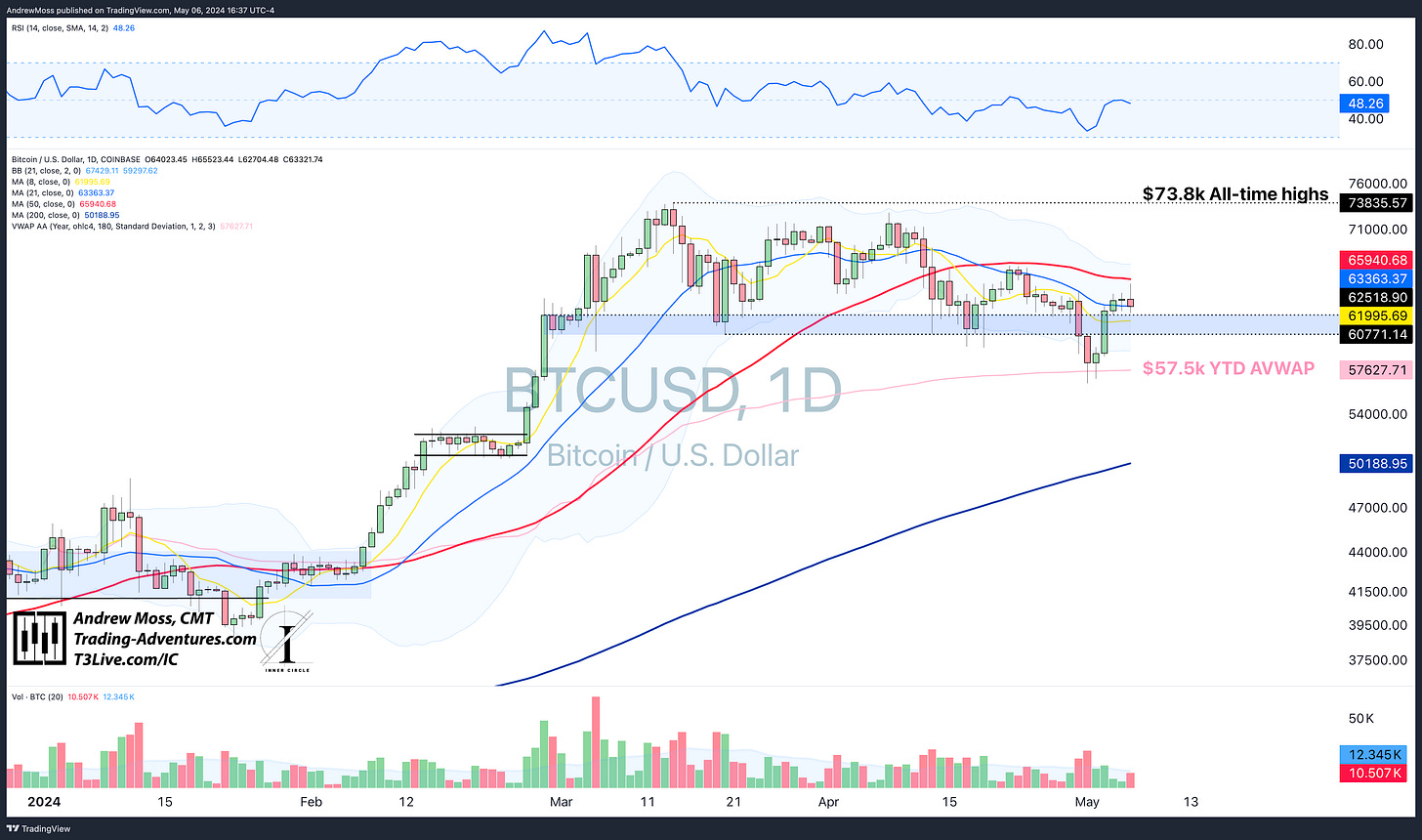

BTCUSD is still maintaining the bounce from the YTD anchored VWAP. It needs to emulate its stock index friends and move above the 50-day MA to unlock the next step higher.

The Trade

The trade hasn’t changed much from last week, even though the indexes have. Being very specific and doing less still makes sense for the shorter-term, tactical trader. We’ll keep market trends (or lack thereof) in mind, but don’t be afraid to take the best setups when they come.

In the longer term, there probably isn’t much to do. Indexes haven’t dipped far enough to create especially attractive dip-buying opportunities. And they aren’t yet breaking out to present a momentum trade higher, though that could happen anytime. SPY is only 1.5% away from the highs.

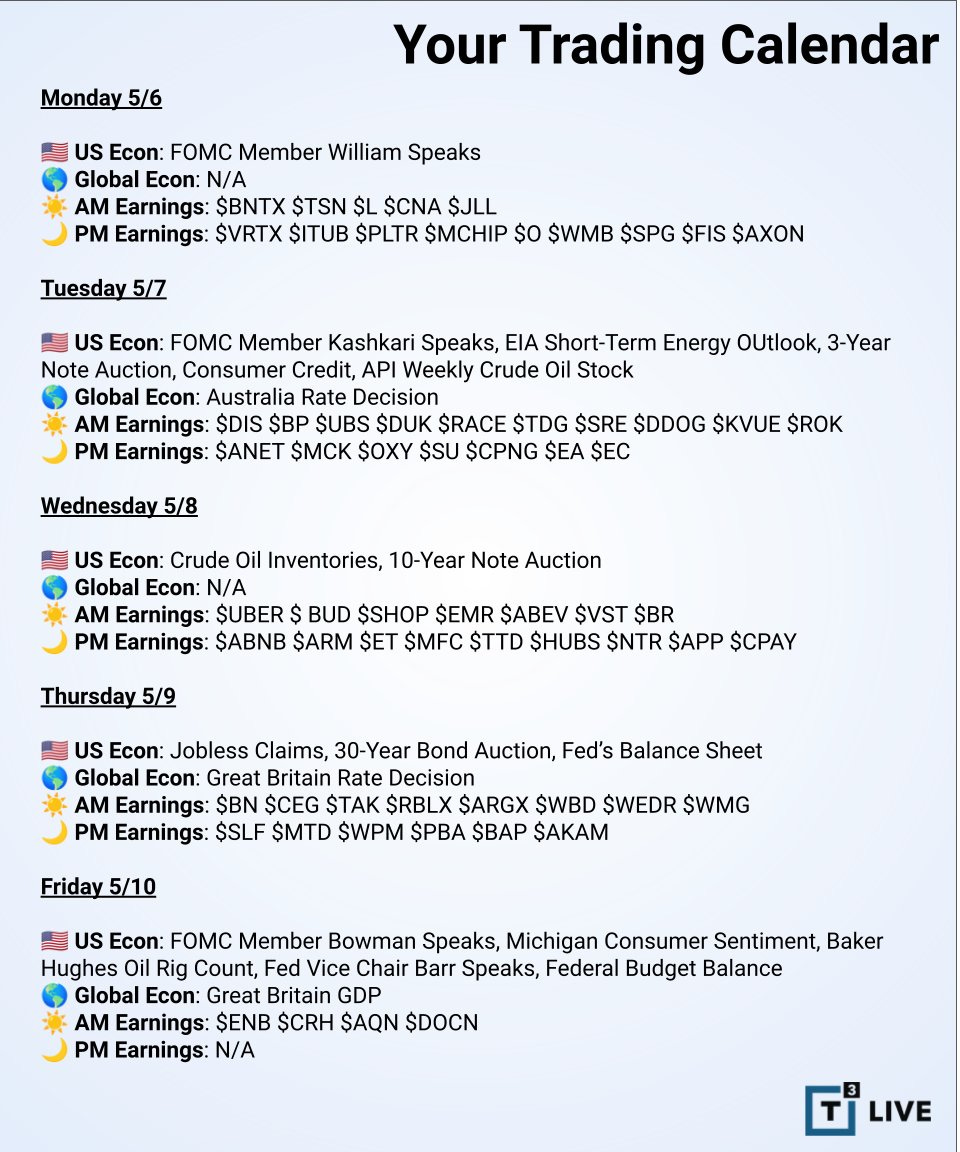

Economic data is light this week, but a slew of earnings reports is still coming. We’ll see if that shakes some good setups from the trading tree.

Elevate Your Trading

Education, training, and support for your Trading Adventure.

Options Trades - Weekly trade ideas are delivered to your email or text messages in language you can easily understand.

Check out EpicTrades from David Prince and T3 Live. Epic Trades from David Prince

Community - Are you an experienced trader seeking a community of professionals sharing ideas and tactics? Visit The Inner Circle, T3 Live’s most exclusive trading room - designed for elite, experienced traders.

The Inner Circle at T3 Live

Prop Trading - Or perhaps you are tested and ready to explore a career as a professional proprietary trader? 3 Trading Group has the technology and resources you need.

Click here to start the conversation:

T3TradingGroup.com

The Disclosures

***This is NOT financial advice. This is NOT a recommendation to buy, sell, or trade any security. The content presented here is intended for educational purposes only.

Andrew Moss is an associated member of T3 Trading Group, LLC (“T3TG”), an SEC-registered broker/dealer and member of FINRA/SIPC. All trades placed by Mr. Moss are done through T3TG.

Statements in this article represent that person’s opinions only and do not necessarily reflect those of T3TG or any other person associated with T3TG.

Mr. Moss may hold an investment position (or may be contemplating holding an investment position) that is inconsistent with the information provided or the opinion being expressed. This may reflect the financial or other circumstances of the individual, or it may reflect some other consideration. Readers of this article should consider this when evaluating the information provided or the opinions being expressed.

All investments are subject to the risk of loss, which you should consider in making any investment decisions. Readers of this article should consult with their financial advisors, attorneys, accountants, or other qualified investors before making any investment decision.

POSITION DISCLOSURE

May 6, 2024, 4:00 PM

Long: ENVX0621C10, IMNM, IWM, SMCI0510P780, TSLA, VKTX0621C85

Short:

Options symbols are denoted as follows:

Ticker, Date, Call/Put, Strike Price

Example: VXX1218C30 = VXX 12/18 Call with a $30 strike