Bitcoin Flies - MicroStrategy Flops

And NVDA moves a lot but doesn't go very far

Bitcoin rises above $98,000

MSTR finds a top

NVDA moves a lot but doesn’t go very far

Small caps get legs

And Large caps close the gap

I am pleased to announce the launch of reader-supported subscriptions to Trading-Adventures.com. For just $15 a month, you can further support this work and enhance your Trading Adventure.

Go deeper than the indexes to analyze market moves beneath the surface.

More charts, more analysis, and more education to improve your trading and enhance your success.

Subscribe now to support this Trading Adventure and take a significant step forward on your own. It's all available for less than a cup of coffee a week.

Been here a while and enjoy the freebies? No worries. Free subscribers will continue to receive the Market Update articles twice a week.

And you can help in other ways.

Share Trading Adventures

Forward this email to friends, family, coworkers, and fellow traders

Thank you for considering a paid subscription to Trading Adventures. I look forward to supporting you on your trading journey!

The Markets

NVDA earnings are out, and they have surpassed expectations.

EPS Reported $0.81 versus estimates of $0.74

Revenue Reported $35.08 B versus estimates of $33.17 B

The results were excellent, but not enough to Wow the street and send the stock sharply higher. The good news is reverberating, though, and lifting the mood of stock buyers across the board.

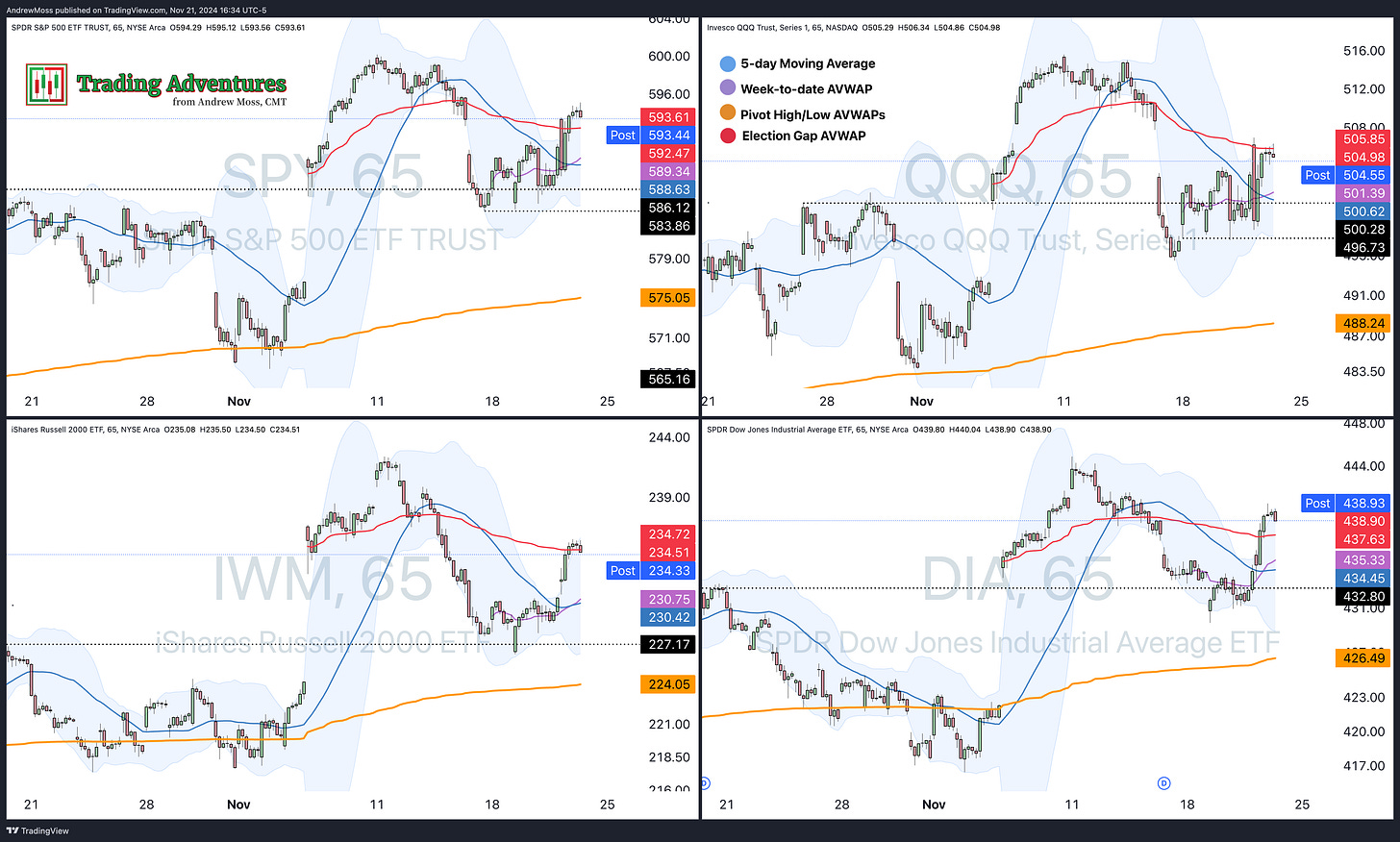

The major indexes are all higher for the day and the week, trading over their 5-day MAs and with two of the four back over the post-election anchored VWAPs, which we’ve been watching closely, signaling that short-term momentum is trying to return.

However, the biggest story (and trade) of the day was MicroStrategy MSTR.

With Bitcoin rising significantly, MSTR, officially listed as a software company, has benefited greatly.

The reason?

In 2020, CEO and co-founder Michael Saylor famously started buying Bitcoin heavily, marking a drastic shift in business strategy. The move has been wildly profitable, increasing the company’s value from approximately $440 Million in 2020 to more than $80 Billion today.

In March 2020, the stock traded at a split-adjusted low of $9/share. Today, it moved above $547, capping off a recent move of +430% in 77 trading days since it touched its 200-day moving average (near $102 at that time) on August 5, 2024, just after an earnings report.

At today’s highs, the stock was more than 40% above its 8-day MA with an RSI reading of more than 85. The price was ripe for a pullback.

Selling an incredibly strong stock short is not an easy move. And certainly not for the faint of heart. But the setup did entice scores of traders, many of whom cashed out with handsome profits after a drop of more than -$170 from the highs.

Daily chart

5-minute chart

The Inner Circle team had the game plan ready and executed beautifully. If you’d like to learn more about this group of elite traders, click the link near the bottom of the page.

Now, let’s go to the rest of the charts.

The Charts

SPY closed above the 8-day MA and post-election AVWAP, closing the recent Friday morning gap after wrestling with the 21-day MA for a week. RSI held above 50 for this pullback, and the volume has been about average.

QQQ closed just under its 8-day MA and the post-election AVWAP after trading above for much of the day. It did stay over the $503.52 pivot level, though it has yet to fill the recent gap.

IWM is the star, rising 1.5% today and nearly 3.5% above this week's low. The 8-day MA didn’t hold it back today, though it did find resistance at the post-election AVWAP.

DIA rounds out the big four, also getting above its 8-day MA, the same AVWAP, and the recent pivot high of $433.20. Volume was very high for the day.

TLT continues to stumble as we wait to see if it's trying to carve out a bottom or if this is consolidation ahead of continuation lower.

DXY US Dollar futures are moving higher again after a brief trip to the 8-day MA earlier this week.

BTCUSD keeps making new highs, trading above $98,000 this afternoon.

The Trade

For swing trades and longer-term positions, we’ll continue to focus on finding low-risk setups in names with recent strength and leadership.

More of those ideas are coming to paid subscribers in another report.

For active traders, there are extension plays to pounce on, as described with today’s MSTR short sale.

If you’re an active trader looking for a smart and supportive community, visit the link below to learn more about The Inner Circle at T3 Live.

Whatever your preference, make sure it fits your style, your timeframe, and your risk tolerance.

The Disclosures

***This is NOT financial advice. This is NOT a recommendation to buy, sell, or trade any security. The content presented here is intended for educational purposes only.

Looking For More?

Elevate Your Trading Adventure Even Further With These Offerings.

EpicTrades Options Newsletter

Real-time trade ideas and insights, providing actionable trading insights focusing on options trades with short-term horizons, aiming to capitalize on weekly market movements.

The approach includes detailed reasoning for trades, specific options, and profit targets, focusing on quick gains with less time commitment required from subscribers.

The Inner Circle

The Inner Circle is a Virtual Trading Floor (VTF) at T3 Live. It’s the group I’ve been working and trading with since 2022. You may have noticed the logo in the watermarks on my charts.

Founded by David Prince and led by him, Rick March, and Kira Turner, the Inner Circle is a community of elite traders, including hedge fund managers, family office heads, corporate executives, financial advisors, and even professional poker players.

Fundamental, Macro, and Technical Analysis all combine to find and discuss the best opportunities in current markets.