Bitcoin Parties Like Its $99,999

...It got really high and then dealt with the hangover

The Markets

Stocks had a digestion day today while Bitcoin gets frenzied.

Stock indexes were mostly uneventful. But bonds and the Dollar continue to add to the ‘tailwind’ story.

SPY and QQQ booked inside days, resting and digesting some of yesterday’s big meal. DIA and IWM moved a bit lower to test some potential support areas.

Meanwhile, Bitcoin finally gave the breakout move, topping at $104,000. But it didn’t hang around long.

Profit takers were active all day, pushing prices back down to test the breakout, which looked like it would hold. Then, massive selling came in after hours, sending the cryptocurrency down to $92,000.

Let’s go to the charts to recap the action.

I am pleased to announce the launch of reader-supported subscriptions to Trading-Adventures.com. For just $15 a month, you can enhance your Trading Adventure and further support this work.

Go deeper than the indexes to analyze market moves beneath the surface.

More charts, more analysis, and more education to improve your trading and enhance your success.

Subscribe now to support this Trading Adventure and take a significant step forward on your own. It's all available for less than a cup of coffee each week.

Been here a while and enjoy the freebies? No worries. Free subscribers will continue to receive the Market Update articles twice a week.

And you can help in other ways.

Share Trading Adventures

Forward this email to friends, family, coworkers, and fellow traders

Thank you for considering a paid subscription to Trading Adventures. I look forward to supporting you on your trading journey!

The Charts

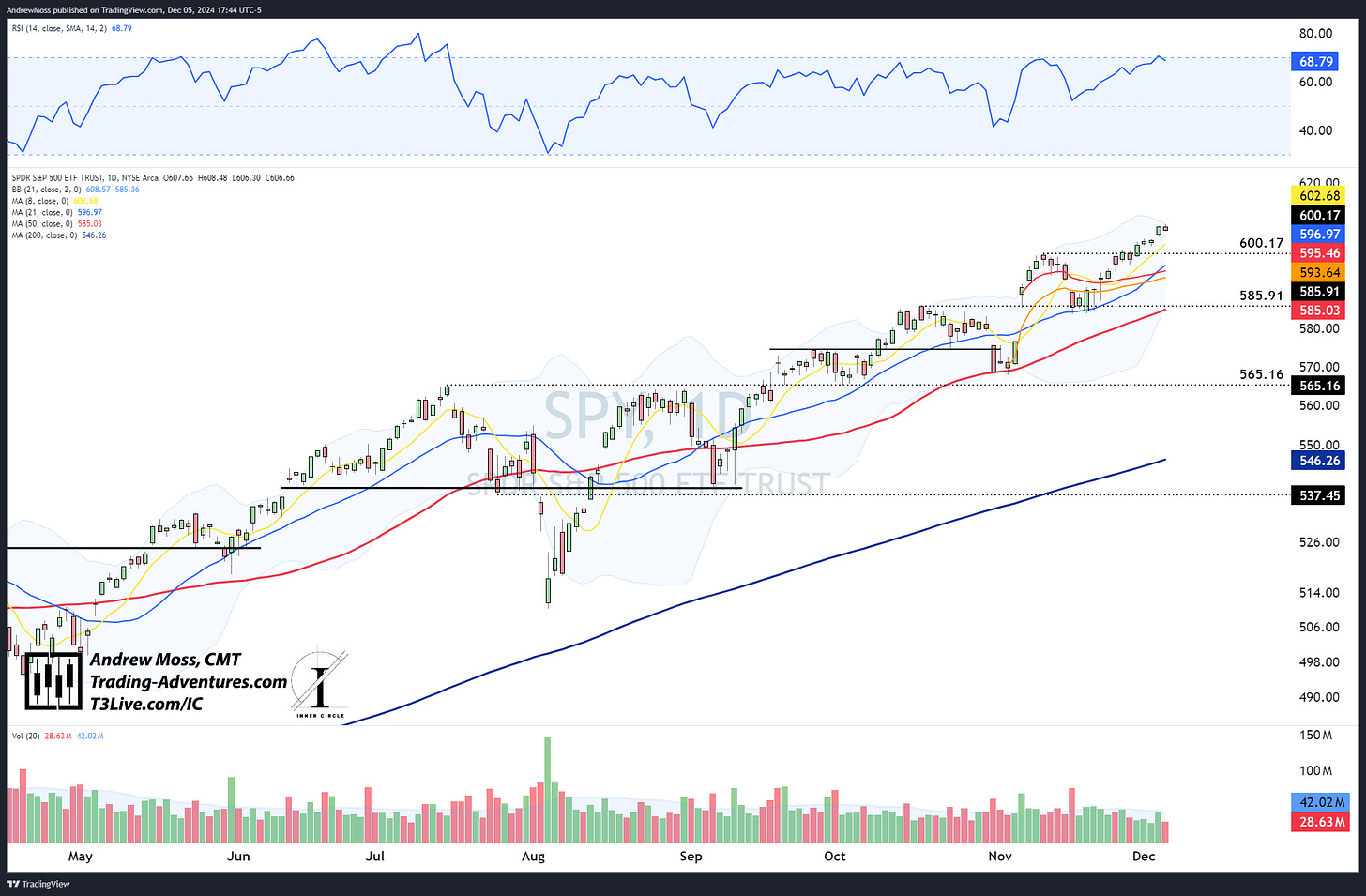

SPY has an inside day while touching the upper Bollinger Band. Volume was light, and RSI avoided becoming overbought. Potential support comes in below at various moving averages, pivots, and anchored VWAPs - $602, $600, $594-$597, and then $585-6, where the 50-day MA is.

QQQ action rhymes with SPY and $515-$516 is the first potential support level, should we see more selling. Then, we have other MAs and AVWAPs sprinkled in from $513 to $503.

IWM put its daily high at the 8-day MA and its daily low at the AVWAP from the November 19 dip, which tested the $226.69 pivot. The next areas to watch below are $236-7 and $232.

DIA closed just below the 8-day MA and has a pivot high at $444.87, followed by a collection of levels between $441 and $433.

TLT continues its climb. After giving a wide range yesterday, which closed at the highs, it came back briefly to touch its 200-day MA and climbed further throughout the day.

DXY Dollar futures are also doing their part, adding to the ‘tailwind’ story by falling further below the 21-day MA, which the 8-day MA is nearly crossing.

BTCUSD goes crazy. Last night, the alerts sounded, signaling that the venerable $100,000 level had been hit. It mostly chopped around in the overnight session, and by regular market hours, the profit takers had begun selling. It looked orderly until a flash lower sent the price down near $92,000 this evening.

As of now (6:15 PM), it has regained about half of the sharp move lower. Busy day.

The renewed volatility isn’t a great sign, but it isn’t completely unexpected, given the intense attention paid to $100k. Now, we have to watch to see if recovery continues or if this changes the overall picture in the near term.

The Trade

Balance.

The action in Bitcoin is a stark reminder of why, as active traders, we take some profit while it’s available. This can be a cumbersome task in an especially bullish environment, as we’ve been experiencing.

Sell too much, and it keeps going up. Wrong.

Don’t sell enough, and it moves down sharply. Wrong.

It’s a ‘path of least regret.’

Not knowing the future, we are charged with the endeavor of trying to maintain a Goldilocks level of exposure — owning enough, but not too much.

Emotions dictate that this balance point varies for everyone.

Using this Bitcoin example, a trader who booked some profits early in the day may feel better about buying some back on the dips. A trader still in a full position will likely feel pressured by the lost potential gains or by being negative in the position altogether.

As traders and analysts, when viewing charts, levels, and support or resistance points, it's easy to get hyper-focused on the math, gain (or loss) of financial capital, and mechanical execution of trades.

However, as humans and emotional people, we should not neglect the potential degradation of mental and emotional capital.

This is where both the art and science of trading come together. There is no singular correct approach. There is only the correct approach for you.

How do you find that approach?

Time, experience, and yes — loss and regret.

The Disclosures

***This is NOT financial advice. This is NOT a recommendation to buy, sell, or trade any security. The content presented here is intended for educational purposes only.

Looking For More?

Elevate Your Trading Adventure Even Further With These Offerings.

EpicTrades Options Newsletter

Real-time trade ideas and insights, providing actionable trading insights focusing on options trades with short-term horizons, aiming to capitalize on weekly market movements.

The approach includes detailed reasoning for trades, specific options, and profit targets, focusing on quick gains with less time commitment required from subscribers.

The Inner Circle

The Inner Circle is a Virtual Trading Floor (VTF) at T3 Live. It’s the group I’ve been working and trading with since 2022. You may have noticed the logo in the watermarks on my charts.

Founded by David Prince and led by him, Rick March, and Kira Turner, the Inner Circle is a community of elite traders, including hedge fund managers, family office heads, corporate executives, financial advisors, and even professional poker players.

Fundamental, Macro, and Technical Analysis all combine to find and discuss the best opportunities in current markets.