Breakdown, Not Breakout

Momentum fades as volatility rises. Futures break below key VWAPs, and conviction across the tape continues to slip.

The Markets

It was another sharp turn today.

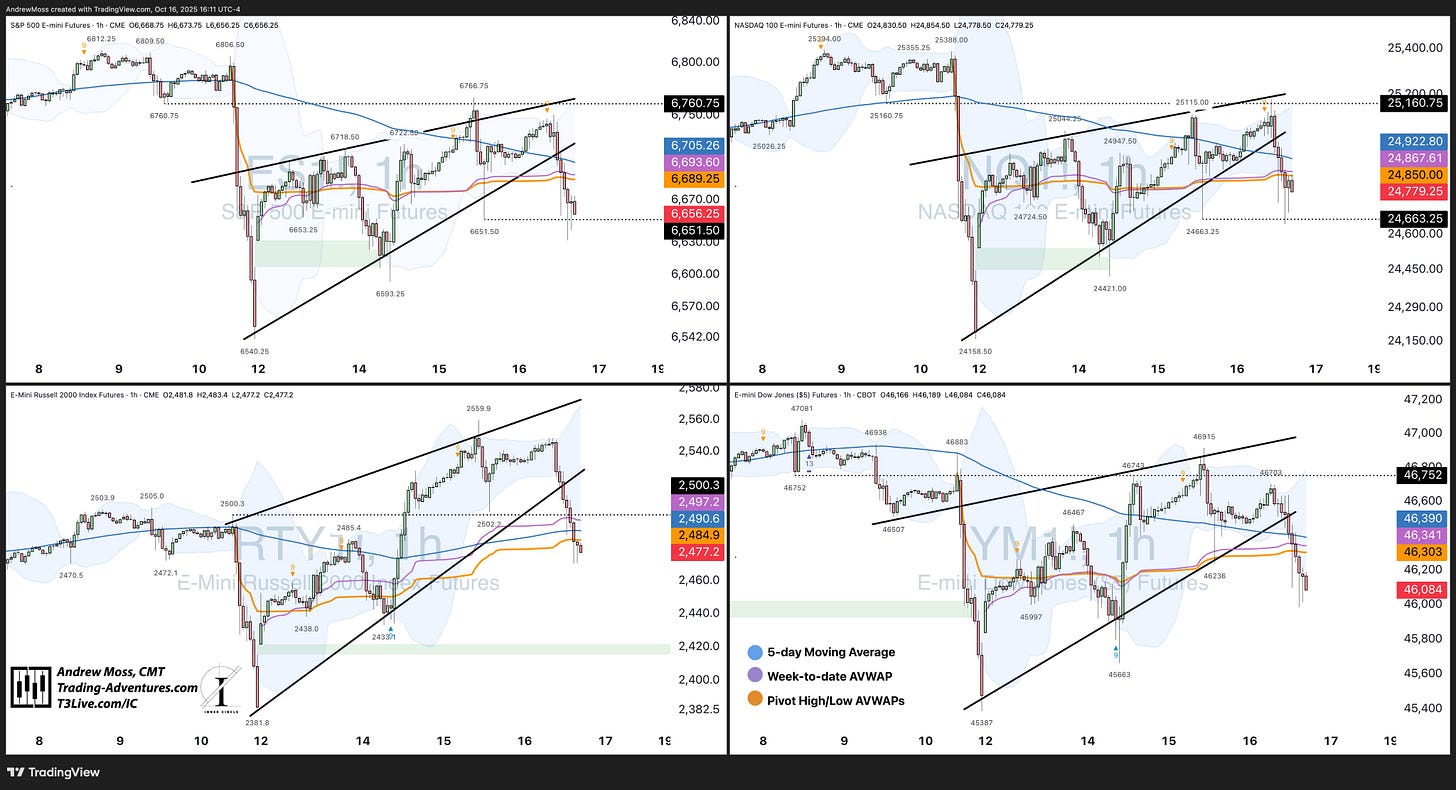

Stock futures broke down from the rising wedge structures that had been building all week, closing below the 5-day, below the VWAPs, and below the week-to-date anchored VWAPs.

That’s a clear shift in tone that says plenty.

ES NQ RTY YM

Momentum that favored dip-buyers now looks unsettled.

What began as another overnight rally quickly turned into a steady selloff, as volatility and reaction intensity picked up again in the afternoon. The tape feels different — more uncertain, more twitchy.

Under the Surface

Underneath the indices, the picture continues to deteriorate.

Former leadership areas — Quantum, Rare Earths, and Drones — saw deeper losses. These high-beta names are showing the first cracks in conviction.

Meanwhile, AAPL and META continue to drift lower.

MSFT and NVDA are both caught between key moving averages, a sign of indecision more than strength.

TSLA remains the relative standout, holding up best among the large-cap leaders, but even there, momentum feels cautious — not confident.

Breadth is thinning, leadership is narrowing, and conviction is fading.

The market isn’t falling apart, but it’s no longer rising cleanly either.

Crypto & Volatility

The same tone extended into crypto.

Bitcoin has slid back near the $107K zone, while Ethereum and Solana also faded. The action remains corrective, and there’s little evidence of sustainable strength for now.

The VIX continued higher, rising again to close just under 25.5 — its highest zone since April. That uptick in volatility matches the broader tone of the market: wider ranges, sharper reactions, and less predictability.

The Takeaway

There will be setups ahead — there always are — but for now, the climate doesn’t favor pressing.

This is the kind of environment that rewards patience, discipline, and risk management, not prediction.

When volatility expands and rhythm breaks, awareness becomes your edge. Trendlines and structures are still useful, but they’re guides, not guarantees.

Patience over prediction.

Discipline over impulse.

The market’s tone has shifted. Adjust with it.

A Note for Traders

Every market cycle has its rhythm — expansion, exhaustion, recalibration.

When conditions tighten, it’s tempting to fight the chop or chase old leaders. But professional trading is less about catching every move and more about waiting for your move.

This week’s tape is reminding us that conditions change fast. Staying alert, adaptable, and patient is the job.

As always — see it clearly, trade it cleanly, and keep your capital safe for when the odds realign.

💬 If you’d like to see more of these short daily recaps here on Substack, drop a quick comment or tap the ❤️ at the top of the page. Your feedback helps shape what I share next.

Looking For More?

Elevate Your Trading Adventure Even Further With These Offerings.

EpicTrades Options Newsletter

Real-time trade ideas and insights, providing actionable trading insights focusing on options trades with short-term horizons, aiming to capitalize on weekly market movements.

The approach includes detailed reasoning for trades, specific options, and profit targets. It focuses on quick gains with a minimal time commitment from subscribers.

The Inner Circle

The Inner Circle is a Virtual Trading Floor (VTF) at T3 Live. I’ve been working and trading with this group since 2022. You may have noticed the logo in the watermarks on my charts.

Founded by David Prince and led by him, Rick March, and Kira Turner, the Inner Circle is a community of elite traders, including hedge fund managers, family office heads, corporate executives, financial advisors, and even professional poker players.

Fundamental, Macro, and Technical Analysis all combine to find and discuss the best opportunities in current markets.

The Disclosures

***This is NOT financial advice. This is NOT a recommendation to buy, sell, or trade any security. The content presented here is intended for educational purposes only.