Closing the gap

Weekend Market Review November 18, 2022

Welcome to the weekend. Let’s catch up on some current events.

Bitcoin is still crashing

FTX, the cryptocurrency exchange, and the celebrities that promoted it are being named in lawsuits

Sam Bankman-Fried (SBF) - the CEO of FTX - is having a meltdown in real time while trying to justify his actions

Elon Musk closed the Twitter offices for the weekend after giving the remaining employees a stiff ultimatum. And people seem to be in awe of the fact that the platform is still operating

The government of Qatar has told World Cup fans there will be no drinking allowed; AFTER the fans and players got there. One beer couldn’t hurt, right? How stiff could the punishments really be?

Wow! That's a lotta headlines for one week.

What did they do to the stock market? Let's take a look.

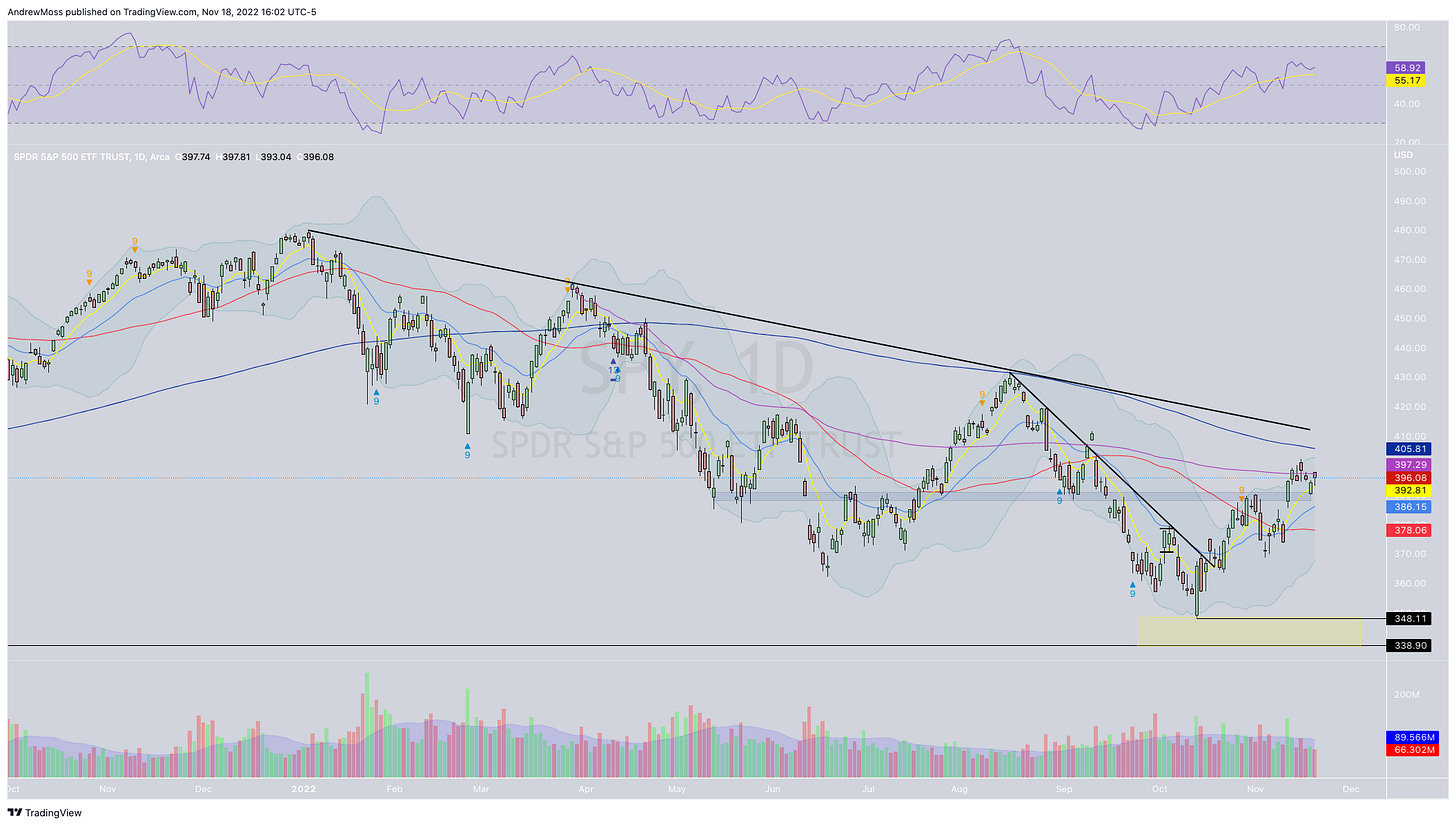

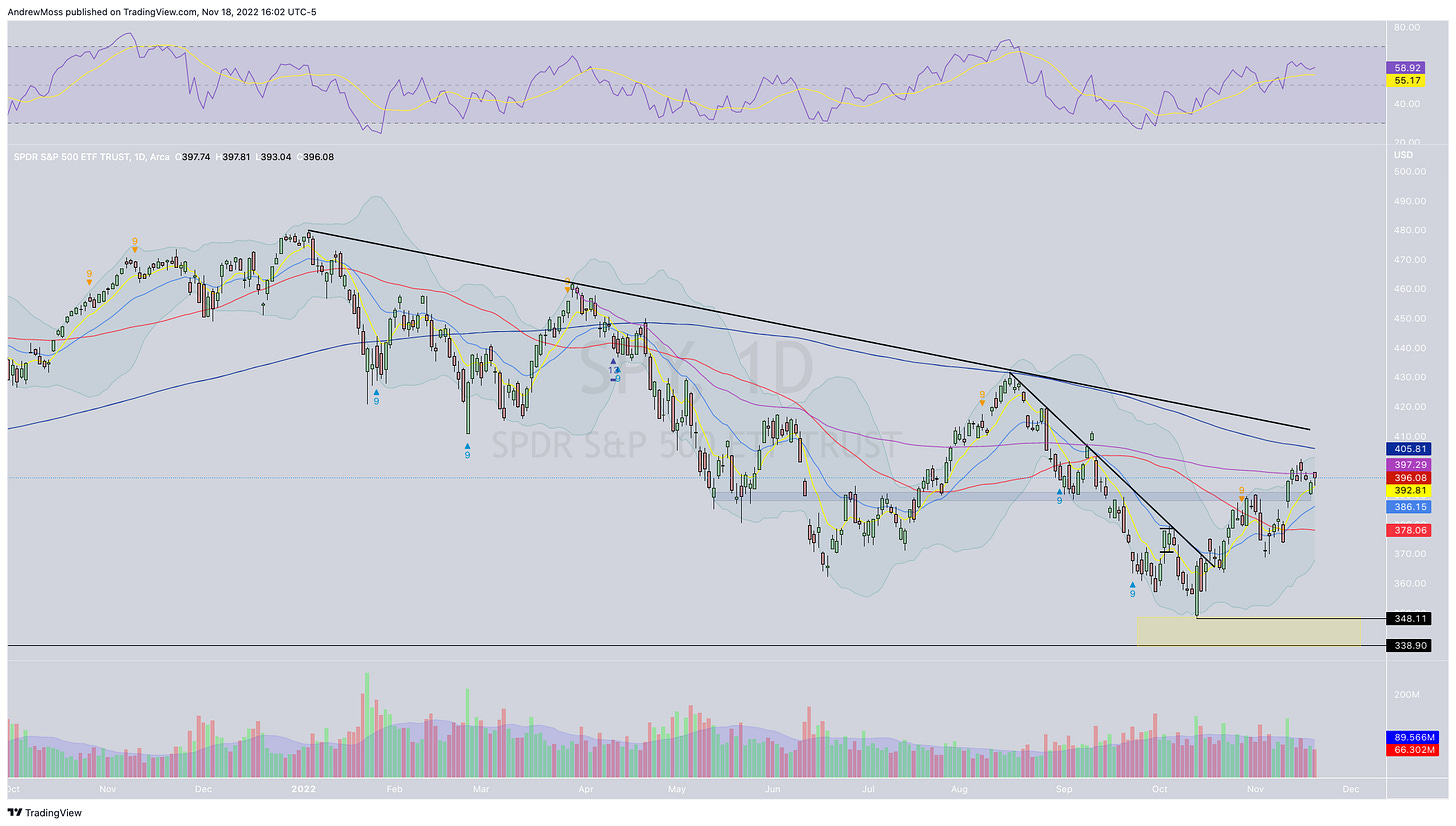

The markets

The major indexes closed the extension gap and today are mostly chopping around on the upper side of the 8-day EMA. The action doesn't feel especially good, but a rally into the close helped. And as long as prices are above yesterday's low, and even better, the aforementioned 8-day EMA, the short-term momentum is still with the bulls.

$SPY - danced around and ultimately closed just below the March high anchored VWAP

$QQQ - Closed right above the August high anchored VWAP

$IWM. - Closed the week just above the 8-day EMA

$DXY - Chopping sideways all week

$VIX - bounced on Tuesday, but the trend is still lower

Bull and bear case

I was asked earlier today if I thought the move from 11/3 to 11/15 and the bullish consolidation pattern from 11/15 to today, 11/18 formed a bull flag pattern.

This is one potential bull case. The implications of that pattern on SPY could result in a potential measured move price objective in the $425 area. While it is a possibility, it's not the cleanest of patterns.

It could also be disrupted by the longstanding downtrend line and a downward-sloping 200-day MA along the way.

A better potential bull case is found by looking at the same pattern beginning at the October 13 low and extending into next week. This higher probability scenario aligns more closely with the bigger picture and shows a price objective that is in close proximity to supporting factors;

the downtrend line

the 200-day moving average

and the historically strong Thanksgiving holiday week

The short-term bear case is simple. If prices get below the 8 and 21-day EMAs, and the low from CPI day - Thursday 11/10 - then momentum is gone and a move lower becomes much more probable.

We'll see how it shakes out.

What I'm reading and listening to

Last Saturday I chatted about the markets with David Yocum - @YocumsCharting.

David knows his way around the charts and is a great interviewer.

We talked about

Stock Market indexes

some individual names

the Real World vs the Virtual World

some key market areas showing relative strength that should have your attention

Have a look!

Keep up with David on YouTube and Twitter. He’s got a bright future ahead of him in technical analysis and trading.

From Twitter

Patience is still THE most important skill in trading

The next most important skill in trading is Position Sizing. I've studied position sizing intensely over the years. I still picked up a ton of new and useful knowledge from this book.

Everybody loves a spontaneous eruption of “Take me Home Country Roads.” Even in Germany.

Find what works for you 😂

Anything else?

I’m including more links than usual this week as I’ve been very busy sharing lots of educational material. Here’s a partial recap in case you missed any of it:

Want to learn more about extension and how to use this concept to improve your trading?

The Chart Report is the best daily market recap for chart lovers. Patrick Dunwila and his team curate the best technical analysis from the day and send it out in a quick, easy-to-read note. And I'm not just saying that because they were nice enough to include my work on 3 of 5 days last week. 😉 😂

If you want to read more of what I read, sign up here.

That's it for this week. Thanks always for reading, subscribing, and sharing with your friends and family. And don’t forget - Weekly charts every Saturday morning. Come clarify your big-picture view and get ready for the coming week — historically one of the most bullish of the year!

Have a fantastic weekend.

***This is NOT financial advice. NOT a recommendation to buy, sell, or trade any security. The content presented here is intended for educational purposes only.

Andrew Moss is an associated member of T3 Trading Group, LLC (“T3TG”) a SEC registered broker/dealer and member of FINRA/SIPC. All trades placed by Mr. Moss are done through T3TG.

Statements in this article represent the opinions of that person only and do not necessarily reflect the opinions of T3TG or any other person associated with T3TG.

It is possible that Mr. Moss may hold an investment position (or may be contemplating holding an investment position) that is inconsistent with the information provided or the opinion being expressed. This may reflect the financial or other circumstances of the individual or it may reflect some other consideration. Readers of this article should take this into account when evaluating the information provided or the opinions being expressed.

All investments are subject to risk of loss, which you should consider in making any investment decisions. Readers of this article should consult with their financial advisors, attorneys, accountants or other qualified investors prior to making any investment decision.

POSITION DISCLOSURE

November 18, 2022 4:15 PM

Long: COIN122P45, QQQ1125C285, SPY1125C395, DKNG1216C15, PYPL1216C90, SHOP1125C37.5

Short: COIN122P30, QQQ1125C300, SPY1125C405, DKNG1216C20, PYPL1216C100, SHOP1125C45

Options symbols are denoted as follows:

Ticker, Date, Call/Put, Strike Price

Example: VXX1218C30 = VXX 12/18 Call with a $30 strike

OMG-Can you not change the colour of your chart background. Puke gray mist really ruins your good content. I'll bookmark when you fix this.

ED

Thank you very much for your feedback Ed. I am honored that you feel such passion about my charts.