Coiled and Cautious Into a Catalyst Cluster

The week’s biggest moves haven’t happened yet.

The Markets

Stocks opened higher Tuesday morning, riding the fading momentum from last week’s strength in tech. But intraday action was choppy and lower — a clear sign that markets are on pause as they stare down a cluster of major catalysts over the next 72 hours.

It’s all packed in:

FOMC rate decision and Powell press conference Wednesday

PCE inflation data Thursday morning

Mega-cap earnings from Microsoft, Meta, Apple, and Amazon

NFP jobs report on Friday

It’s not just one event — it’s four heavyweight drivers, each with potential to shift sentiment, reprice expectations, or spark rotation. Add to that a market that’s extended but resilient, and you get the current tone: cautious, compressed, and waiting for direction.

The Charts

SPY opened higher but couldn’t hold the gains. Price remains well above its rising 8-day and 21-day moving averages, but today’s reversal reflects hesitancy ahead of the week’s earnings and economic events. The uptrend is intact, but slightly extended and possibly in need of rest or digestion.

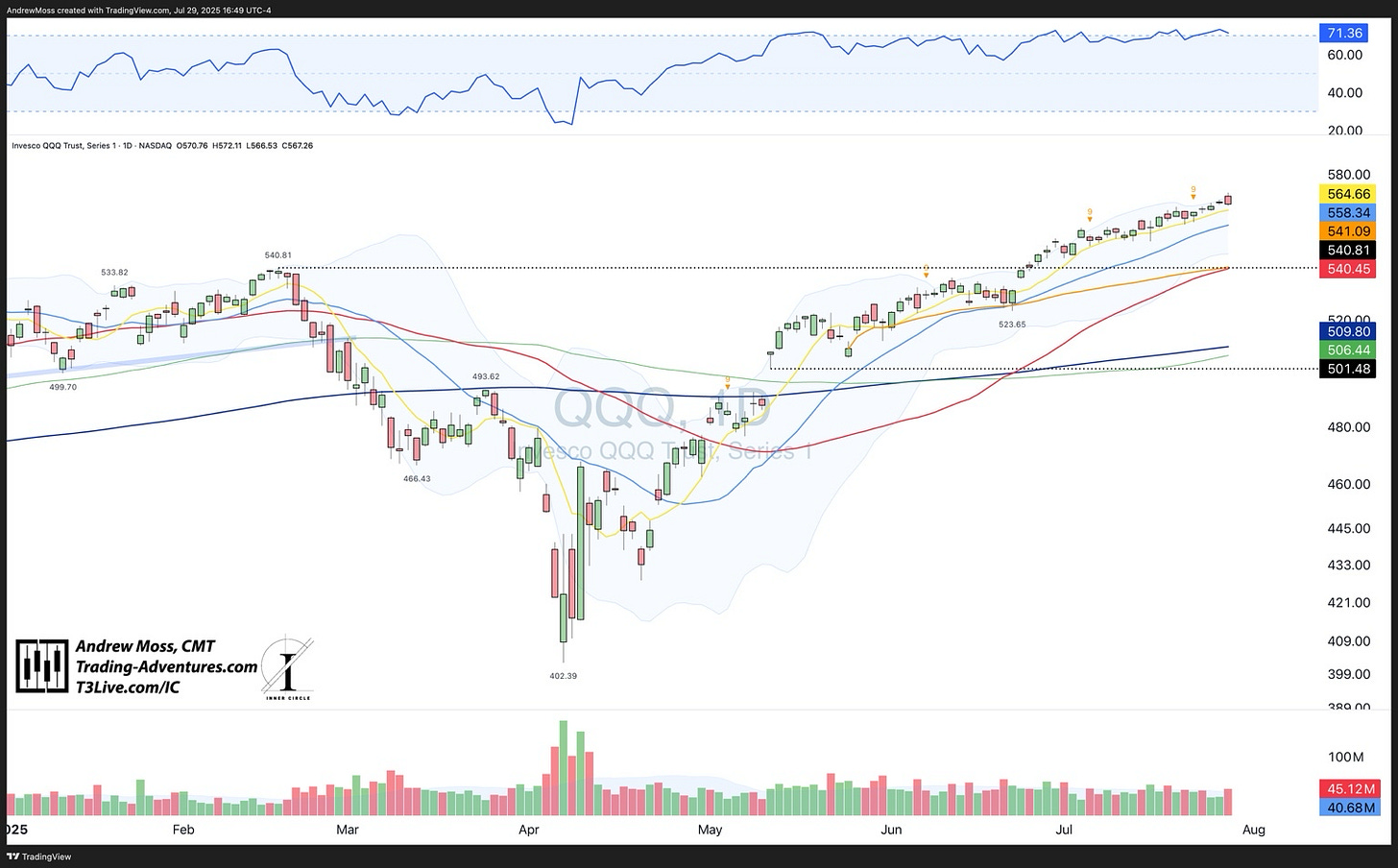

QQQ continues to lead, holding its upper Bollinger Band and staying comfortably above short-term moving averages. But like SPY, it saw intraday selling, and earnings from key components will be the next directional driver. Until then, expect a wait-and-see tone.

IWM remains the laggard. It too opened strong but failed to hold intraday gains and is now below the 8-day and very near the 21-day MA. Small-caps still struggle to attract sustained interest, and today’s action reinforces the hesitation of the risk-on trade beneath the surface.

DIA is relatively stable considering the dismal action from UNH and the sharp pop-and-drop reversal from BA.

TLT put in a notable green day, moving well above its 8, 21, and 50-day moving averages. Solid action ahead of tomorrow’s rate decision— something to watch closely.

U.S. Dollar Futures (DX1!) are pushing into a key resistance area near 99 after forming a higher low and breaking out from a rounded bottom pattern. Price is now challenging the neckline of that base while reclaiming all short-term moving averages. Momentum is building — RSI has cleared 60 — and there’s some above. This strength adds weight to the macro tone of “wait-and-see,” and could pressure risk assets if it continues.

BTC continues consolidating in the recent range, but price has now slipped below the 8 and 21-day MAs. While still well above the 50-day and 100-day, this shift signals a pause in upside momentum.

The range between ~115,000 support and ~123,000 resistance remains well-defined, and the overall pattern is still constructive — a high-level coil following a strong move off the May and June lows. Volume is declining, suggesting a wait-and-see posture from market participants.

A decisive move back above the 8 and 21-day MAs would improve short-term posture. Until then, Bitcoin remains neutral to cautiously bullish — not leading, but not breaking down either.

VIX is included mainly as a reminder of the extreme highs and lows seen over the last 12 months. The pop today is notable, but not necessarily indicative of significant change yet.

The Trade

We remain in a bull market—but it’s an extended one, heading into a potentially volatile stretch. Seasonality is no longer a tailwind, sentiment has become more crowded, and the potential for macro or earnings disappointments is elevated.

That said, the technical trends are still strong. Most major ETFs are holding rising short- and intermediate-term moving averages, and leadership in tech continues to support the broader tape.

This is a market that favors selective participation—not blanket exposure. Keep your focus on relative strength and tight risk management. Watch for key reactions to Powell’s comments and Thursday’s earnings releases.

We’ll be ready either way.

Looking For More?

Elevate Your Trading Adventure Even Further With These Offerings.

EpicTrades Options Newsletter

Real-time trade ideas and insights, providing actionable trading insights focusing on options trades with short-term horizons, aiming to capitalize on weekly market movements.

The approach includes detailed reasoning for trades, specific options, and profit targets. It focuses on quick gains with a minimal time commitment from subscribers.

The Inner Circle

The Inner Circle is a Virtual Trading Floor (VTF) at T3 Live. I’ve been working and trading with this group since 2022. You may have noticed the logo in the watermarks on my charts.

Founded by David Prince and led by him, Rick March, and Kira Turner, the Inner Circle is a community of elite traders, including hedge fund managers, family office heads, corporate executives, financial advisors, and even professional poker players.

Fundamental, Macro, and Technical Analysis all combine to find and discuss the best opportunities in current markets.

The Disclosures

***This is NOT financial advice. This is NOT a recommendation to buy, sell, or trade any security. The content presented here is intended for educational purposes only.