Daily Recap – Stocks Lose Short-Term Momentum as the Dollar Rallies

QURE and AMD show relative strength.

Note:

This post is a little different from my usual Market Update articles. I’ve been sharing quick daily recaps like this on X — short, structured summaries of the day’s action with key levels and takeaways.

I wanted to share one here to see if readers find this format useful. I wanted to share one here to gauge interest. If you find this format useful, let me know in the comments or by tapping the ❤️ near the top of this page.

The Markets

Stocks started near pivot highs and sold off mid-morning, taking all major indices below their rising 5-day moving averages. A modest afternoon bounce limited losses, but no strong reversal signals yet.

Standout Moves

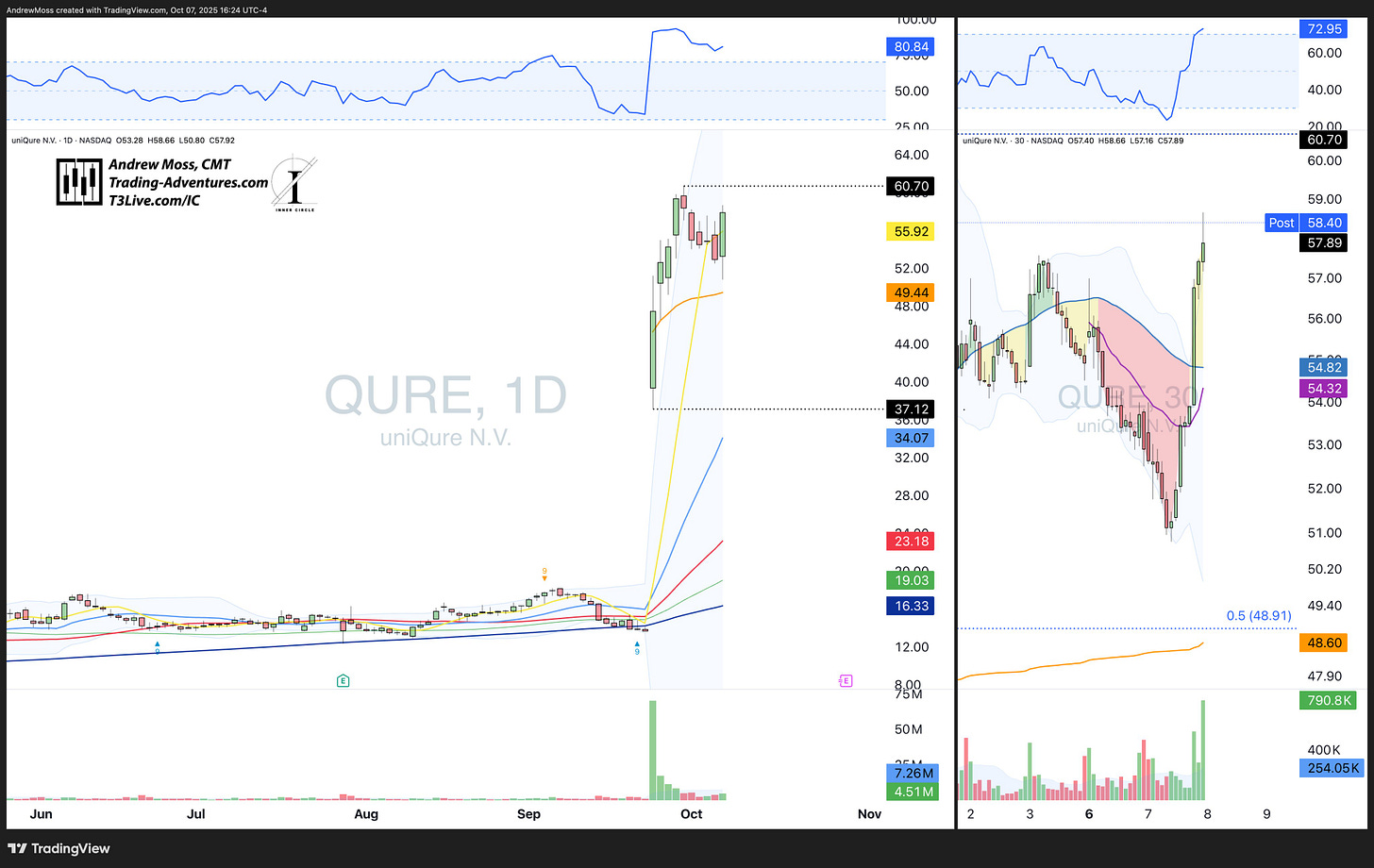

QURE

Dipped into the low 50s before ripping to finish above 58. Textbook momentum reversal from deep intraday weakness.

TSLA — Sell the News

Traded near 450 early and closed at 433 (-20 pts). The “affordable model” reveal didn’t impress; price action confirmed it.

RKT

Fourth straight down day, testing the 100-day MA and nearly the 50% retrace of this year’s 10 → 20 move.

Low: 15.85 | Close: 16.28. Watching for stabilization near trend support.

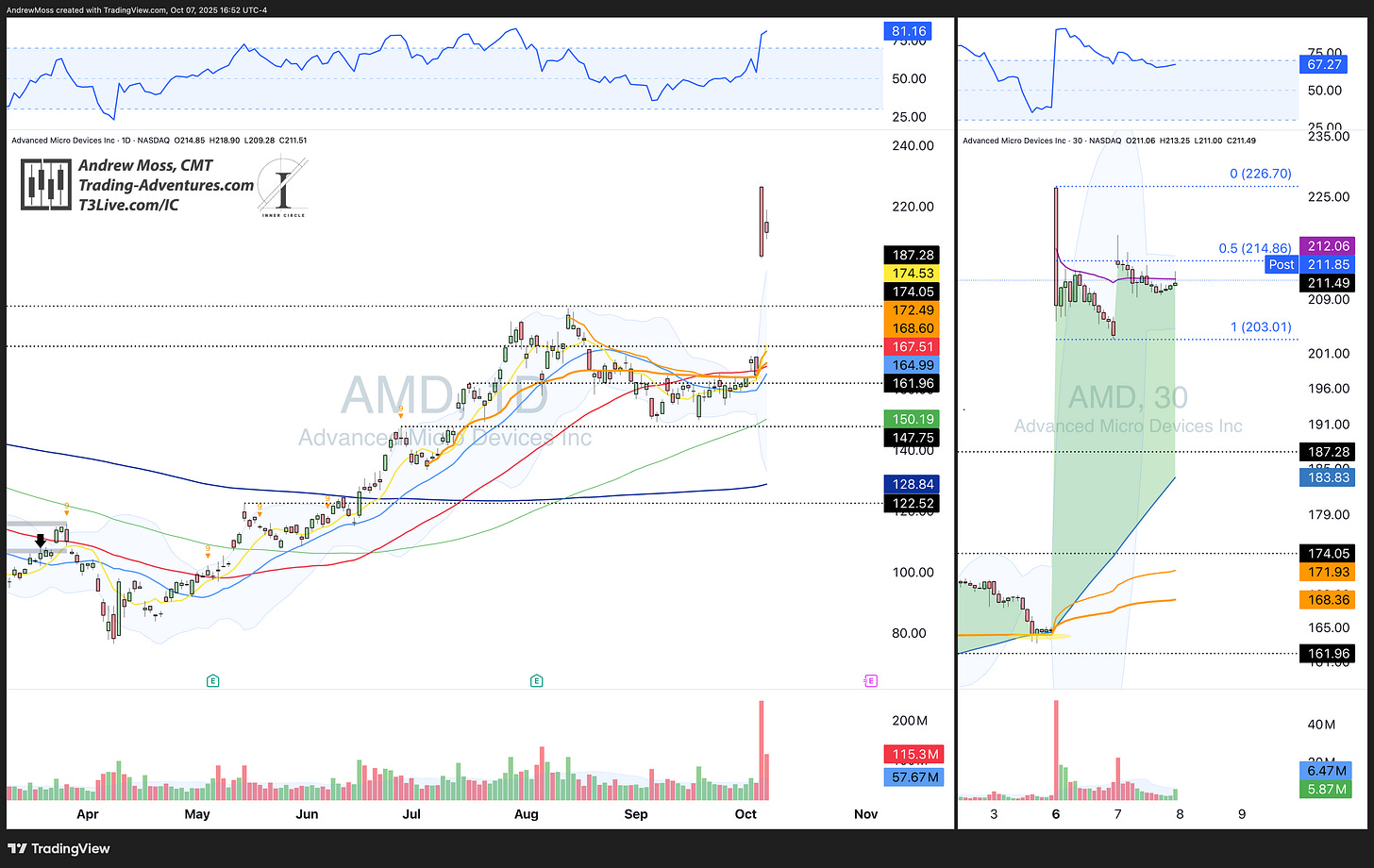

AMD

Held roughly half of Monday’s explosive range and closed +3.8%. Constructive digestion after a big move.

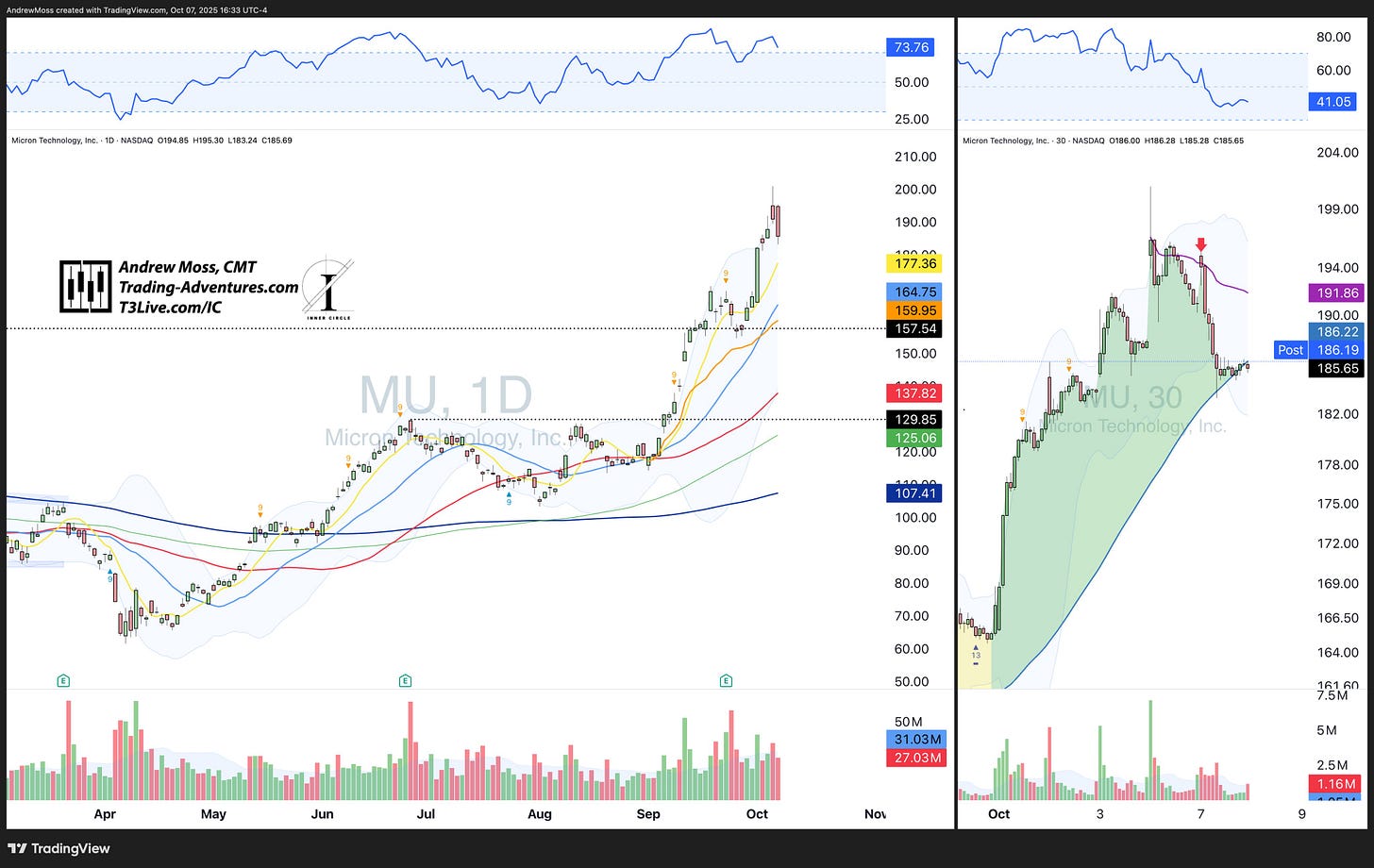

MU

Still digesting recent gains. Quick tag of the week-to-date AVWAP at the open, then a fade to close below the 5-day MA.

Macro Check

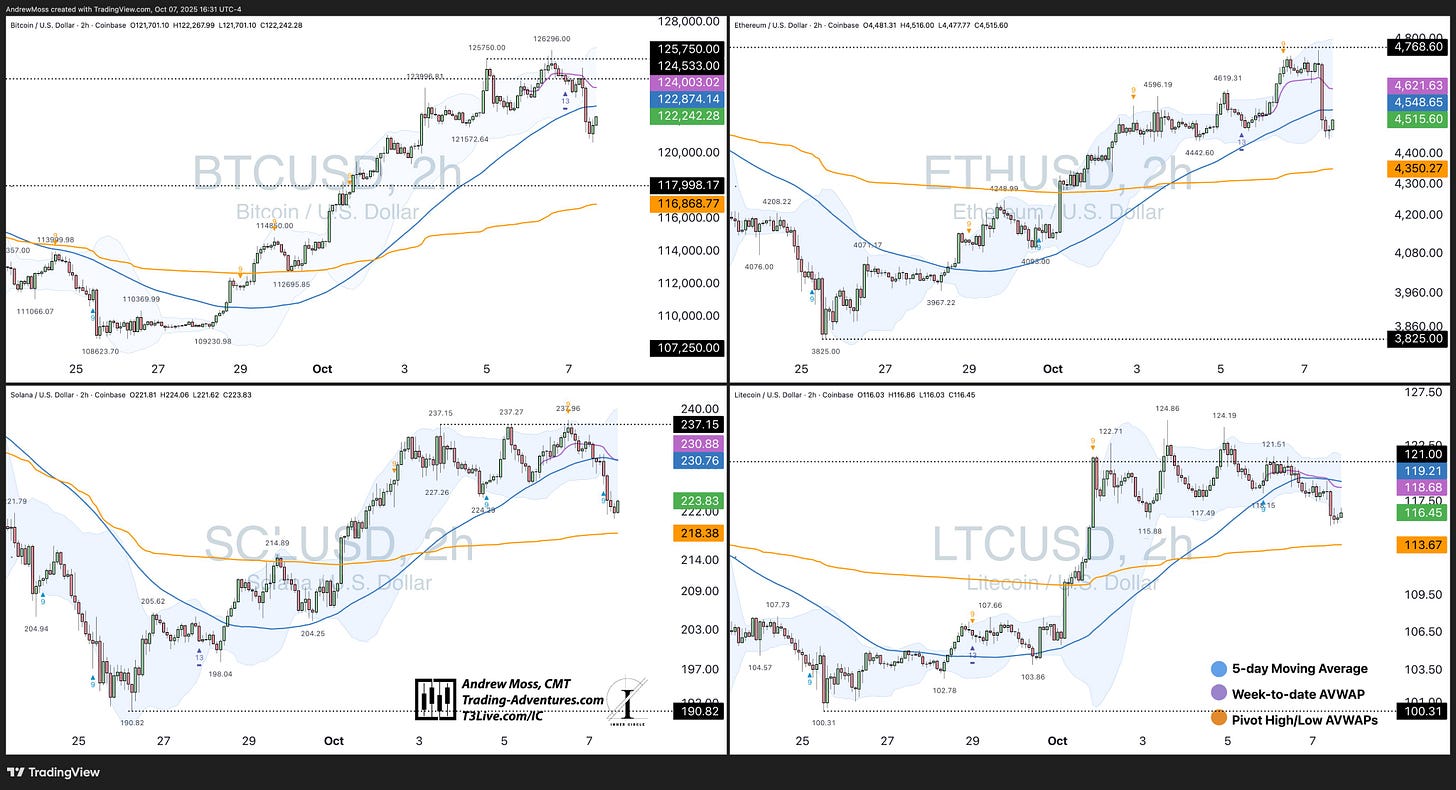

Crypto

After Monday’s surge, majors cooled off: BTC -2%, ETH -3.9%, SOL -4%. Healthy pause; many still above key VWAP zones.

U.S. Dollar

DXY / $DX1! extended its rally—now back above all key MAs except the 200-day and reclaimed the anchored VWAP from the May 12 pivot high. Dollar strength continues to pressure risk assets in the short term.

Key Takeaways

Indices lost short-term momentum.

AMD and QURE showed relative strength.

TSLA = sell the news.

Dollar rally is pressing into multi-month resistance zones.

Looking Ahead

Tomorrow brings mortgage data, Fed speakers, and the FOMC minutes.

I’ll have updates and setups as structure develops — follow for daily recaps and weekly charts.

💬 If you’d like to see more of these short daily recaps here on Substack, drop a quick comment or tap the ❤️ at the top of the page. Your feedback helps shape what I share next.

Looking For More?

Elevate Your Trading Adventure Even Further With These Offerings.

EpicTrades Options Newsletter

Real-time trade ideas and insights, providing actionable trading insights focusing on options trades with short-term horizons, aiming to capitalize on weekly market movements.

The approach includes detailed reasoning for trades, specific options, and profit targets. It focuses on quick gains with a minimal time commitment from subscribers.

The Inner Circle

The Inner Circle is a Virtual Trading Floor (VTF) at T3 Live. I’ve been working and trading with this group since 2022. You may have noticed the logo in the watermarks on my charts.

Founded by David Prince and led by him, Rick March, and Kira Turner, the Inner Circle is a community of elite traders, including hedge fund managers, family office heads, corporate executives, financial advisors, and even professional poker players.

Fundamental, Macro, and Technical Analysis all combine to find and discuss the best opportunities in current markets.

The Disclosures

***This is NOT financial advice. This is NOT a recommendation to buy, sell, or trade any security. The content presented here is intended for educational purposes only.