FED Day

Midweek Market Update

The Markets

Are you ready?

It’s another “Most Important Announcement Ever” kinda day. The market expects Jerome Powell to announce a 0.50% (50 basis points) rate cut this afternoon. The potentially tricky part is that we’re already trading very near new highs ahead of the event.

Is a 50 bps cut already priced in?

What if we only get a 25 bps cut? Does the market sell off?

Here are the charts from before the opening bell.

The Charts

SPY opened near new highs yesterday, moved up, and then cooled off. Still a positive day, but it does show a potential reversal.

Challenges: Fed Day and the degree of extension above the 8-day MA.

Advantages: Close to new highs, above all key MAs, RSI is only ~60

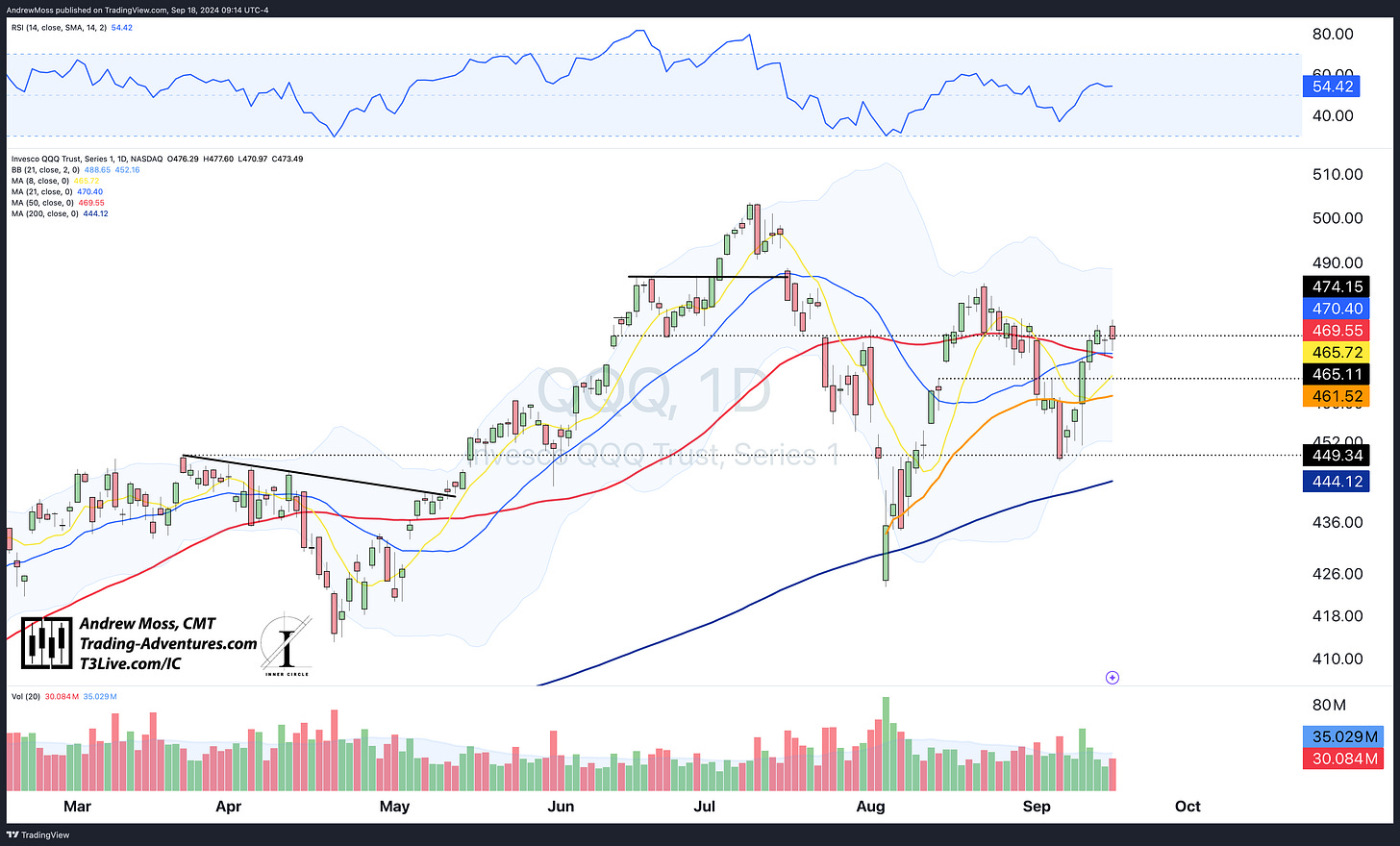

QQQ is shaping up and back above all key MAs but not running away. A favorable Fed meeting could send this back to $485-$490 very quickly before consolidating some and heading on to new highs.

IWM ran out of steam yesterday and shows a potential reversal. The Fed news will dictate all the action here.

DIA continues to lead and doesn’t show much indication of slowing down. Banks, healthcare, and materials are strong and could propel this one further ahead.

TLT keeps riding the 8 and 21-day MAs up and up and up while RSI tip-toes under 70, avoiding overbought status.

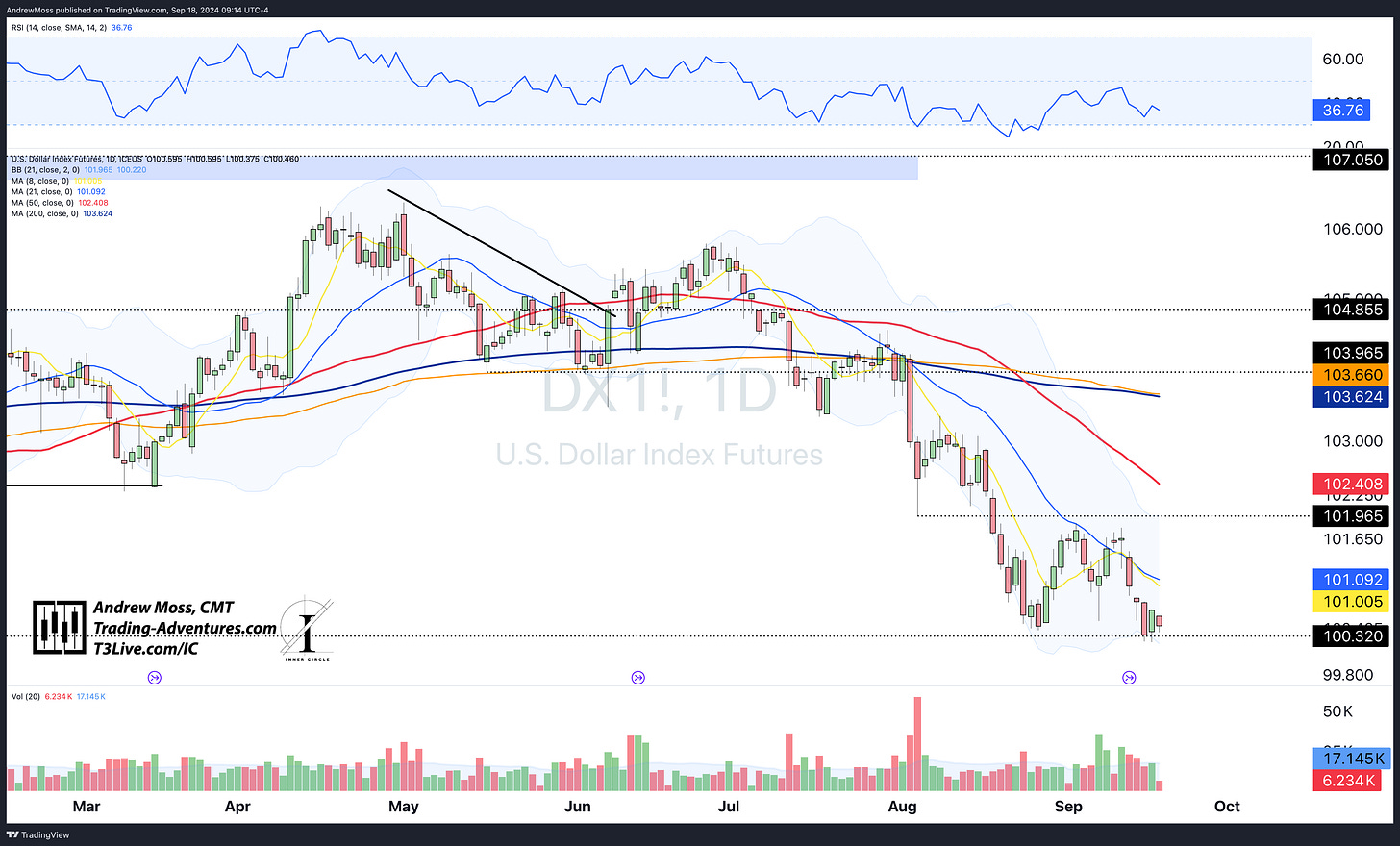

DXY The Dollar is finding support at anticipated levels. Stocks will want to see a move down to new lows.

BTCUSD is back over $58,500, but not without a retest. Bulls certainly don’t want to see it below there again.

The Trade

If Jerome Powell sounds easy, dovish, and accommodating, look for small caps to kick into gear and head higher.

If he sounds a bit cautious or otherwise falls short of expectations, large-cap M7-type stocks will likely maintain leadership if they sell off a bit first.

And if JPow threads the needle just right and paints the perfect Goldilocks scenario, there’s no reason why SPY and DIA shoot straight to new highs with QQQ playing quick catch-up.

We shall see.

Elevate Your Trading

Education, training, and support for your Trading Adventure.

Options Trades - Weekly trade ideas are delivered to your email or text messages in language you can easily understand.

Check out EpicTrades from David Prince and T3 Live. Epic Trades from David Prince

Community - Are you an experienced trader seeking a community of professionals sharing ideas and tactics? Visit The Inner Circle, T3 Live’s most exclusive trading room - designed for elite, experienced traders.

The Inner Circle at T3 Live

Prop Trading - Or perhaps you are tested and ready to explore a career as a professional proprietary trader? 3 Trading Group has the technology and resources you need.

Click here to start the conversation:

T3TradingGroup.com

The Disclosures

***This is NOT financial advice. This is NOT a recommendation to buy, sell, or trade any security. The content presented here is intended for educational purposes only.

Andrew Moss is an associated member of T3 Trading Group, LLC (“T3TG”), an SEC-registered broker/dealer and member of FINRA/SIPC. All trades placed by Mr. Moss are done through T3TG.

Statements in this article represent that person’s opinions only and do not necessarily reflect those of T3TG or any other person associated with T3TG.

Mr. Moss may hold an investment position (or may be contemplating holding an investment position) that is inconsistent with the information provided or the opinion being expressed. This may reflect the financial or other circumstances of the individual, or it may reflect some other consideration. Readers of this article should consider this when evaluating the information provided or the opinions being expressed.

All investments are subject to the risk of loss, which you should consider in making any investment decisions. Readers of this article should consult with their financial advisors, attorneys, accountants, or other qualified investors before making any investment decision.

POSITION DISCLOSURE

September 18 2024, 4:00 PM

Long: XBI0920C105

Short:

Options symbols are denoted as follows:

Ticker, Date, Call/Put, Strike Price

Example: VXX1218C30 = VXX 12/18 Call with a $30 strike