Fed day again? Do we have to?

It's been nice not hearing from Jay Powell and the Federal Reserve for a few weeks. But we knew it wouldn't last forever and today we had another version of "The Most Important Fed Day Ever!"

All was well as the clock struck 2:00 PM and the announcement of a very expected 75 basis point Fed Funds rate hike was made. Even better, the accompanying language seemed to hint at a pause in the pace of rate increases.

Up, up and away.

Then the equally anticipated Press Conference started at 2:30 PM and Powell said, and I'm paraphrasing, "Not so fast."

So where does that leave things?

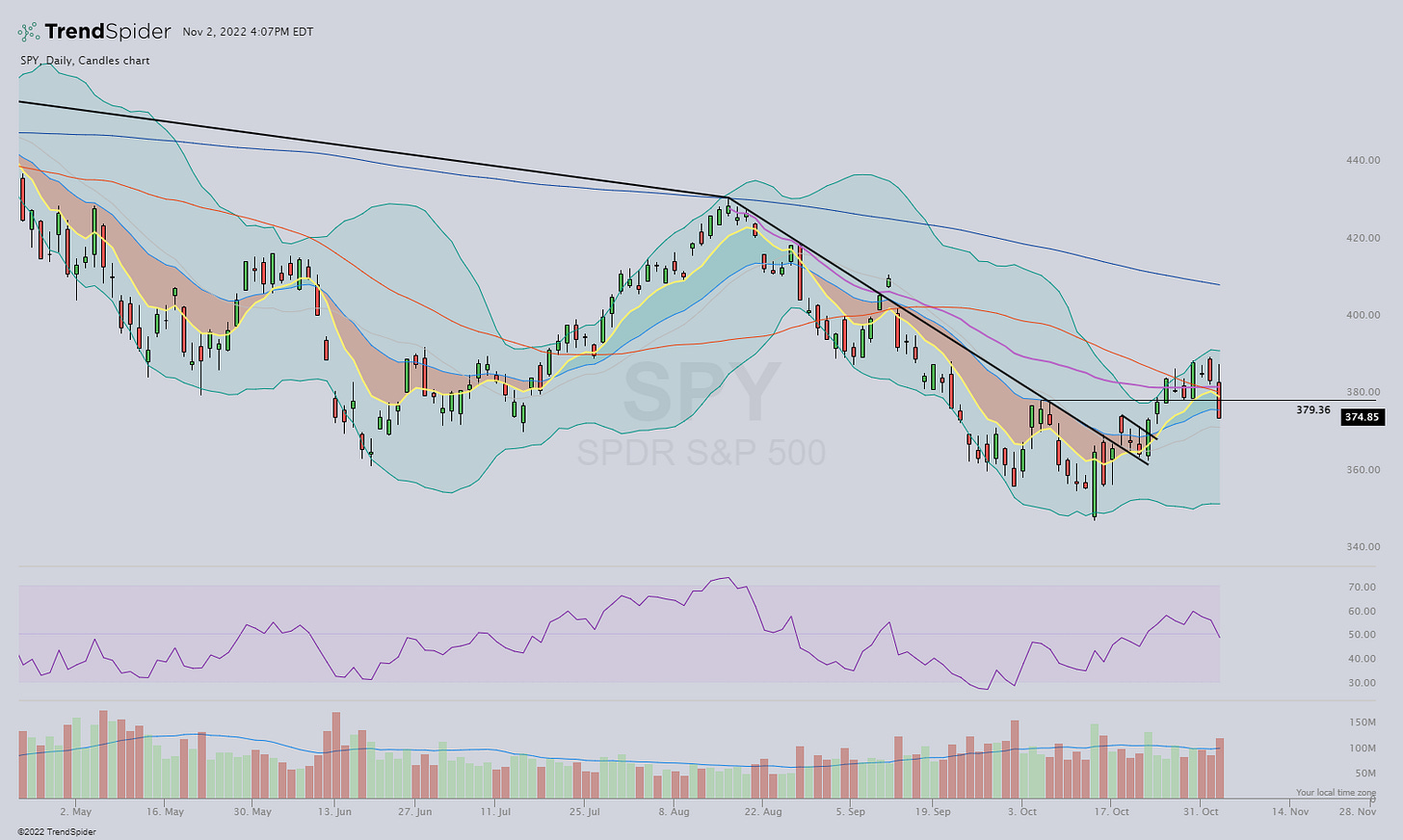

After the initial whipsaw stocks found some direction and moved sharply lower into the close.

$SPY lost the 21-day EMA and the 8-day is now curling down.

$QQQ led the way lower and closed below its 8/21-day moving averages, leaving it vulnerable to more selling.

$IWM lost the 8-day EMA but is still above the 21-day EMA and the 50-day SMA. That doesn't feel very optimistic considering the overall conditions.

The move looks to be signaling the end of this rally sequence and the action looks similar to previous selloffs supposedly sparked by Fed comments or CPI data. That's just another reminder that despite even the best stories or data otherwise, stock prices continue to be driven by: inflation, the Dollar, the Fed, interest rates, and headlines about all of those.

This market is still "guilty until proven innocent" and risk management is still job #1.

Stay nimble, know your sell rules, and stick to them.

***This is NOT financial advice. NOT a recommendation to buy, sell, or trade any security. The content presented here is intended for educational purposes only.

Andrew Moss is an associated member of T3 Trading Group, LLC (“T3TG”) a SEC registered broker/dealer and member of FINRA/SIPC. All trades placed by Mr. Moss are done through T3TG.

Statements in this article represent the opinions of that person only and do not necessarily reflect the opinions of T3TG or any other person associated with T3TG.

It is possible that Mr. Moss may hold an investment position (or may be contemplating holding an investment position) that is inconsistent with the information provided or the opinion being expressed. This may reflect the financial or other circumstances of the individual or it may reflect some other consideration. Readers of this article should take this into account when evaluating the information provided or the opinions being expressed.

All investments are subject to risk of loss, which you should consider in making any investment decisions. Readers of this article should consult with their financial advisors, attorneys, accountants or other qualified investors prior to making any investment decision.

POSITION DISCLOSURE

Long: DRI, MCK

Short:

Options symbols are denoted as follows:

Ticker, Date, Call/Put, Strike Price

Example: VXX1218C30 = VXX 12/18 Call with a $30 strike