Fed Day Doldrums?

Midweek Market Update - June 14, 2023

The Market

For the last year or more ‘Fed Day’ has been a momentous event. The market moved (or didn’t move) completely based on the anticipation of the rate decision announcement and subsequent press conference. Today’s result won’t likely be any different. So far things are fairly quiet as we await 2:00 PM.

But this Fed Day does feel a little different. The anxiety isn’t as high. The futures market is signaling that there will be a pause. Everybody seems to agree. And the price action for several weeks has supported that view.

As we see the $SPX give successive breakouts, the VIX sink to its lowest levels in years, and many stocks make some monster moves, there is a faint cry of ‘all clear’ echoing down Wall St.

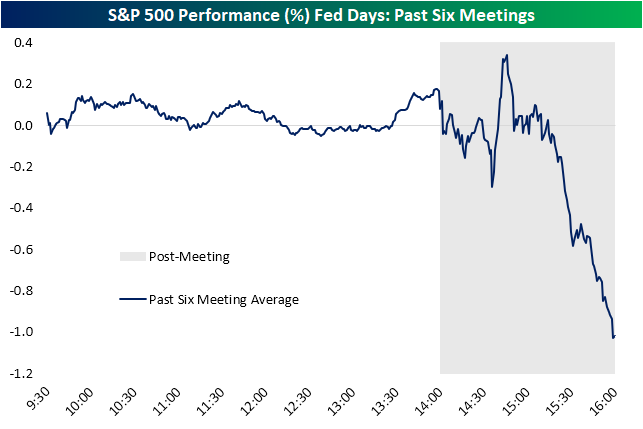

Now as sentiment shifts more positive right when many technical indicators are signaling a potential pullback we have to ask if this will be a ‘sell the news’ event.

By the time you read this, the answer will be known. For now, here’s a chart from Bespoke Invest showing the average SP 500 movements over the past six Fed meetings.

Was it different this time?

Late update: It was a little different.

The Charts

SPY puts in a doji candle for the day. Indecision. It’s not uncommon for these to show up at turning points.

QQQ keeps its strength and closes near the highs of the day. Extension is still a factor.

IWM was a bit ‘all over the place’ but ultimately held the retest of the downtrend line and bounced at the 8-day MA.

DIA touched the 8-day MA before bouncing. Still working its way toward the top of the box.

BTC Bitcoin continues to go nowhere fast. But not exactly acting bullish either.

The Closing Bell

Reminder; this is the only note this week. It’s time to unplug for some rest and relaxation with the family.

There will likely be occasional updates on Twitter if you’d like to follow there. Otherwise, I’ll be back in your inboxes on June 28.

And don’t forget, I will be on Conversations with a Pro with Greta Wall that evening at 5:00 PM. The link for registration and viewing will be available very soon.

The Disclosures

***This is NOT financial advice. NOT a recommendation to buy, sell, or trade any security. The content presented here is intended for educational purposes only.

Andrew Moss is an associated member of T3 Trading Group, LLC (“T3TG”) a SEC registered broker/dealer and member of FINRA/SIPC. All trades placed by Mr. Moss are done through T3TG.

Statements in this article represent the opinions of that person only and do not necessarily reflect the opinions of T3TG or any other person associated with T3TG.

It is possible that Mr. Moss may hold an investment position (or may be contemplating holding an investment position) that is inconsistent with the information provided or the opinion being expressed. This may reflect the financial or other circumstances of the individual or it may reflect some other consideration. Readers of this article should take this into account when evaluating the information provided or the opinions being expressed.

All investments are subject to the risk of loss, which you should consider in making any investment decisions. Readers of this article should consult with their financial advisors, attorneys, accountants, or other qualified investors prior to making any investment decision.

POSITION DISCLOSURE

June 14, 2023, 4:00 PM

Long: —

Short: —

Options symbols are denoted as follows:

Ticker, Date, Call/Put, Strike Price

Example: VXX1218C30 = VXX 12/18 Call with a $30 strike