Fed Eve: Indices Rest as Leaders Hold Ground

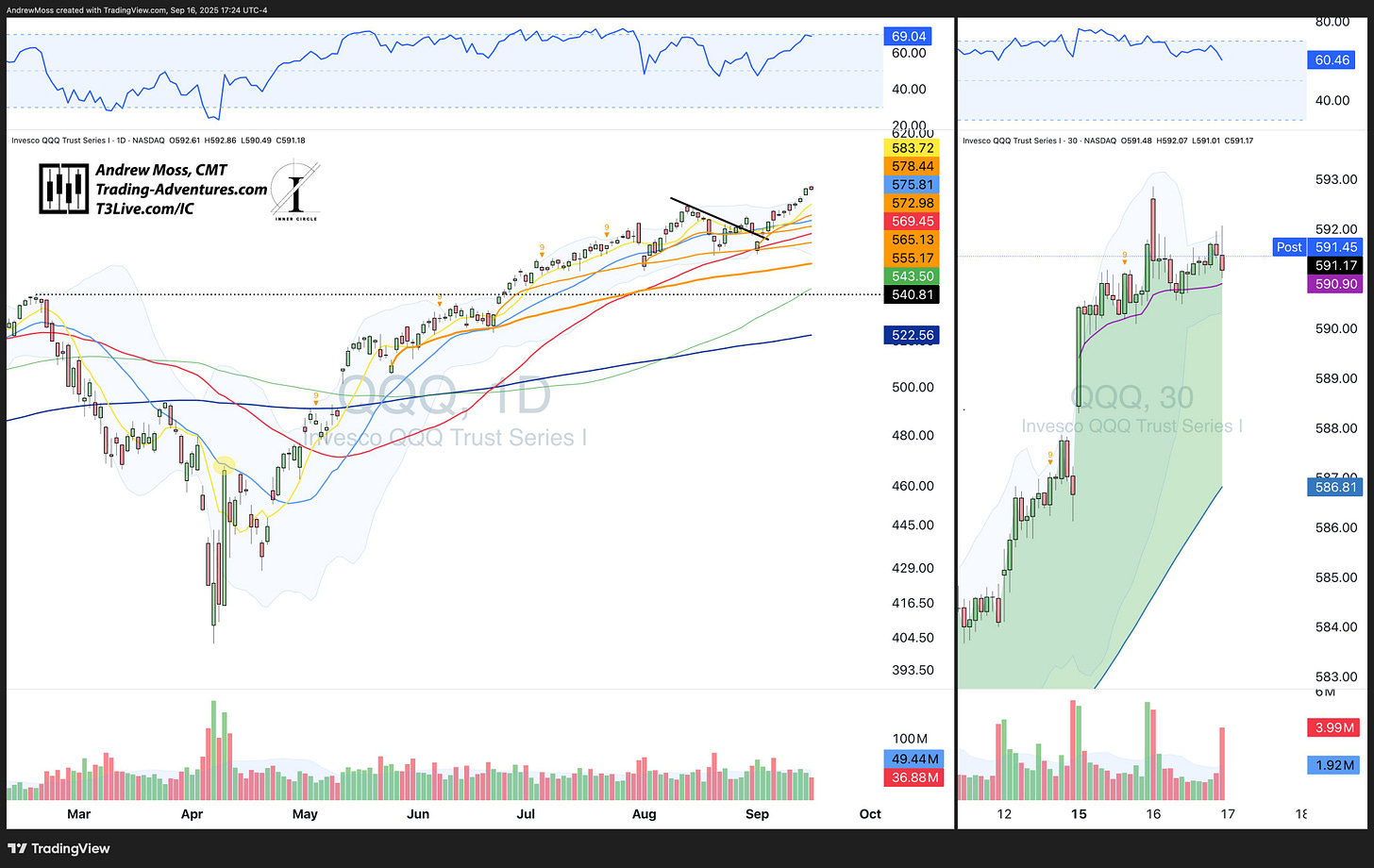

QQQ (barely) snaps the winning streak — tomorrow’s story is Powell, the dot plot, and market reaction.

📊 Daily Market Recap — Tuesday, Sept 16, 2025

Market Overview

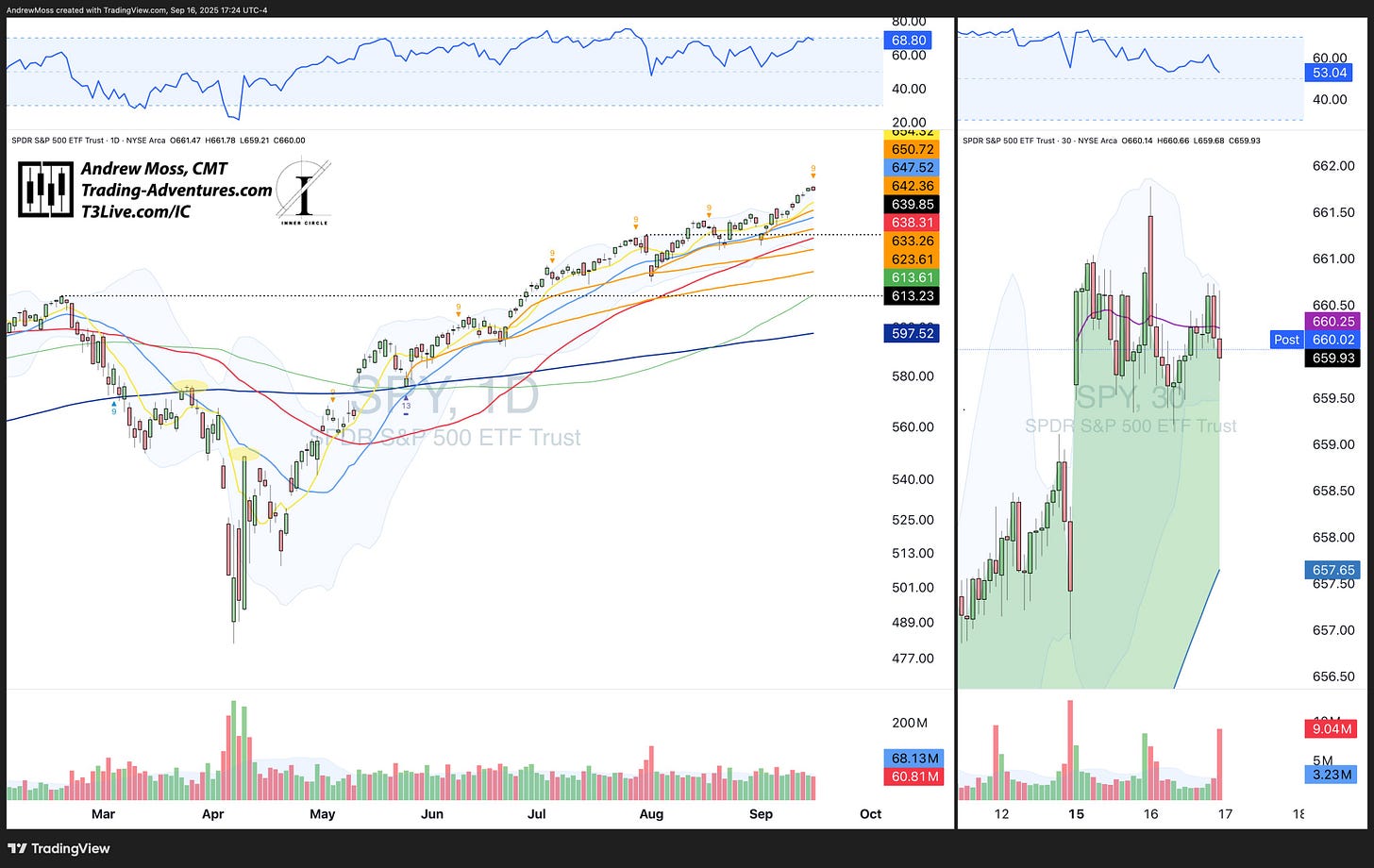

The Nasdaq (QQQ) came just 50 cents shy of logging its 10th straight green day, snapping the streak with a marginal red close. The S&P 500 (SPY) finished slightly lower, slipping under its weekly VWAP while still carrying a daily DeMark 9 sell signal.

With the FOMC decision on deck tomorrow, today’s session was more about digestion than trend.

Leaders and Tone

Tesla (TSLA) reclaimed the critical $420 pivot and closed strong at $421.62.

Apple (AAPL) tagged the ~$241 pivot before pulling back — constructive price action.

Google (GOOGL) pushed further past its Fib extension zone in the morning, then consolidated gains into the close. RSI > 87 = very extended.

Microsoft (MSFT) tested the all-time high AVWAP, but faded from early strength.

➡️ Takeaway: Big Tech is holding up, but buyers didn’t press for breakouts ahead of Powell.

Themes and Flows

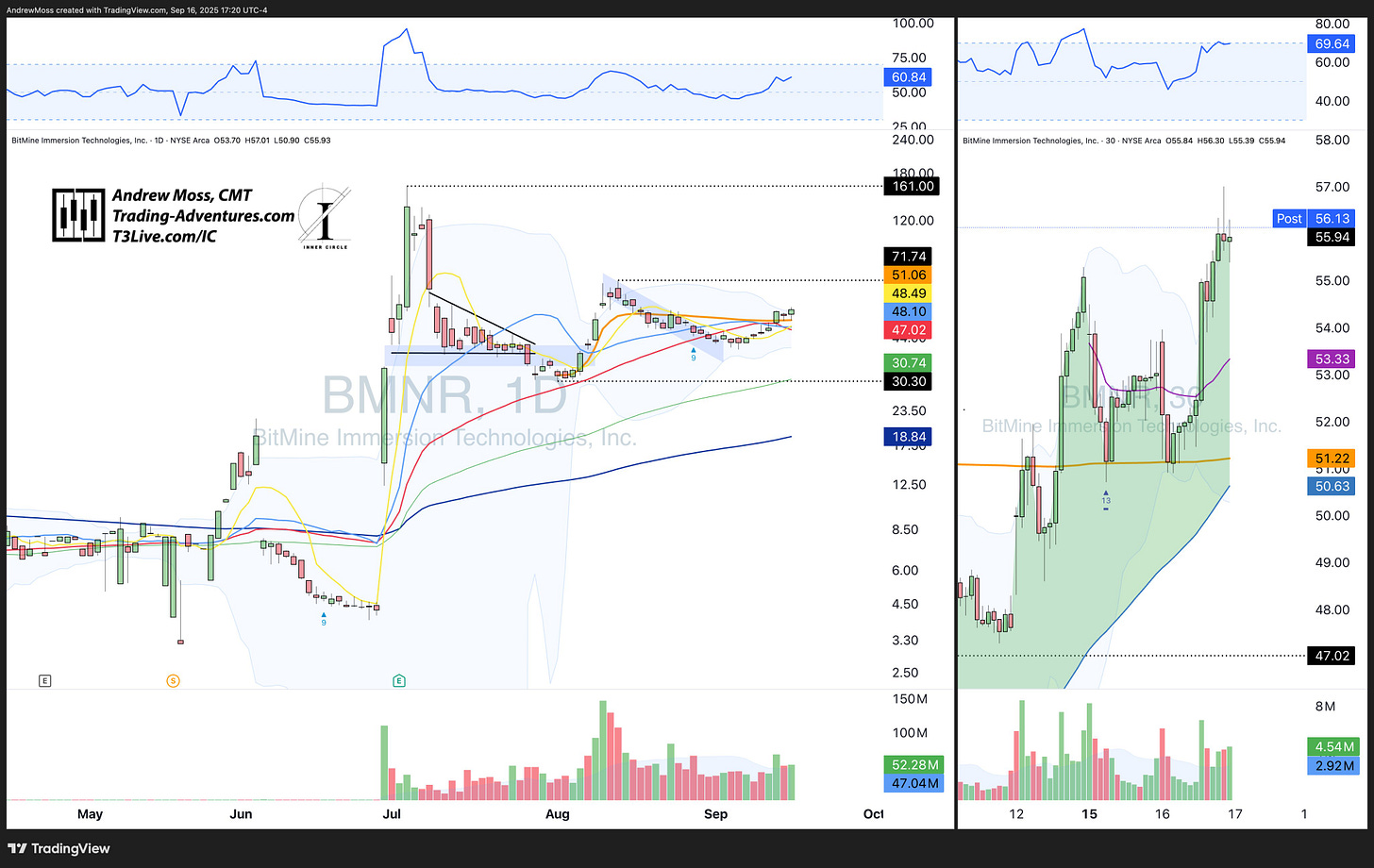

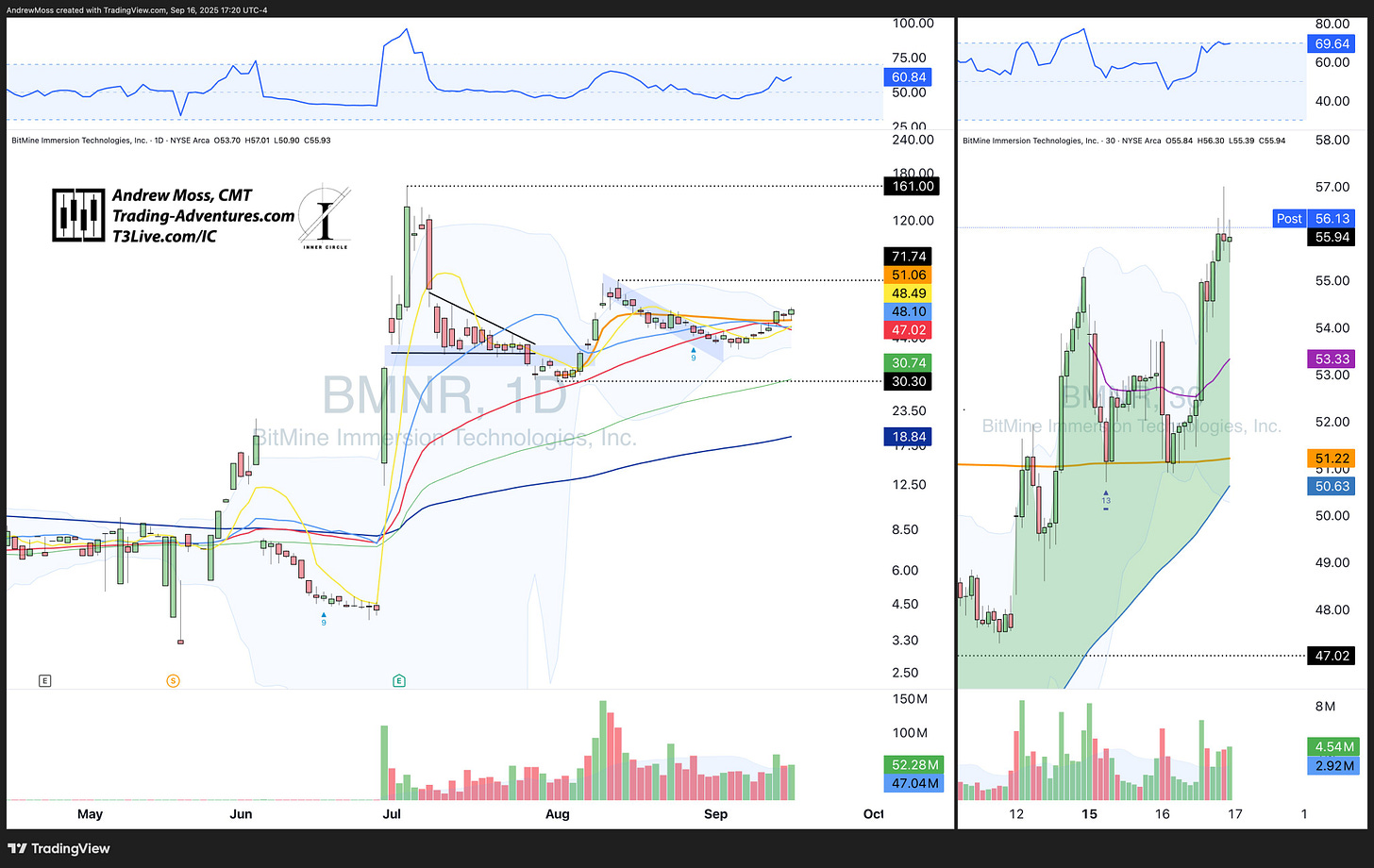

BMNR surged to 57 before pulling back, getting some help from an ETH bounce.

MP Materials (MP) held its pivot but couldn’t push through the 21-day MA.

Oracle (ORCL) gapped higher on TikTok chatter, but profit-taking set in quickly.

Takeaway: Leadership was selective.

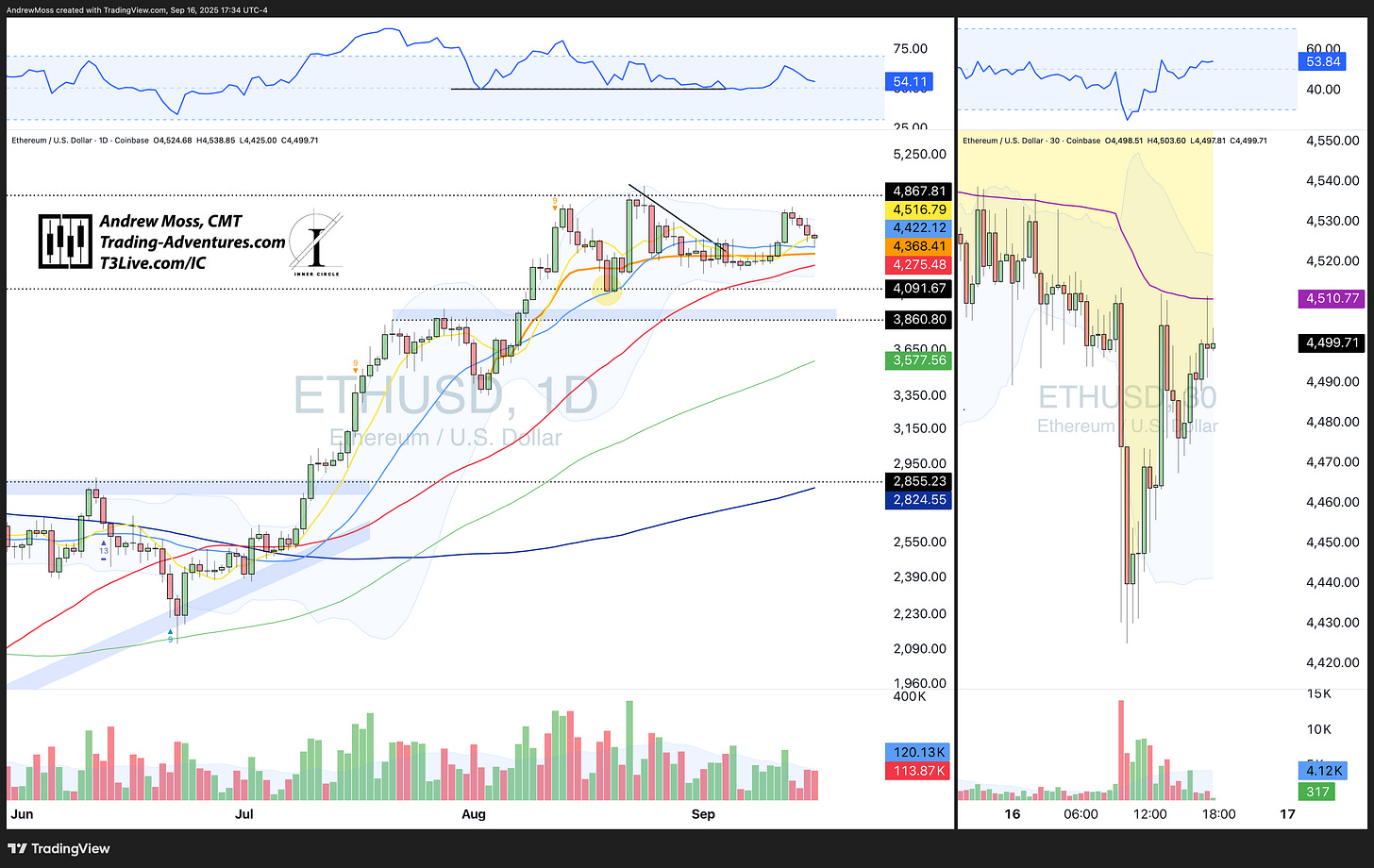

Crypto Check

Ethereum (ETH) pulled back to its 21-day MA near 4420 before bouncing late. That strength helped fuel sympathy trades like BMNR.

Final Takeaway

Today was a pause day into the Fed. Sector leaders like TSLA, BMNR, and AAPL showed relative strength, but the indices leaned cautious.

Tomorrow brings the Fed decision. A 25 bps cut is widely expected — the bigger question is the dot plot and Powell’s tone. Markets will be watching closely for:

Signals on how far the Fed is willing to go in easing.

Whether Powell leans more hawkish on inflation risk or dovish on growth concerns.

Reaction in rates/credit markets, which could dictate equity follow-through.

Positioning suggests traders are leaning toward a “sell the news” outcome. But with consensus skewed that way, the higher-probability setup may be chop and volatility as the market digests.

➡️ The story tomorrow is not the cut itself, but the forward guidance. Stay tactical, avoid overcommitting, and let the market show its hand.

Looking For More?

Elevate Your Trading Adventure Even Further With These Offerings.

EpicTrades Options Newsletter

Real-time trade ideas and insights, providing actionable trading insights focusing on options trades with short-term horizons, aiming to capitalize on weekly market movements.

The approach includes detailed reasoning for trades, specific options, and profit targets. It focuses on quick gains with a minimal time commitment from subscribers.

The Inner Circle

The Inner Circle is a Virtual Trading Floor (VTF) at T3 Live. I’ve been working and trading with this group since 2022. You may have noticed the logo in the watermarks on my charts.

Founded by David Prince and led by him, Rick March, and Kira Turner, the Inner Circle is a community of elite traders, including hedge fund managers, family office heads, corporate executives, financial advisors, and even professional poker players.

Fundamental, Macro, and Technical Analysis all combine to find and discuss the best opportunities in current markets.

The Disclosures

***This is NOT financial advice. This is NOT a recommendation to buy, sell, or trade any security. The content presented here is intended for educational purposes only.