Fibonacci Day, Thanksgiving, and World Cup

Mid-week Market Update November 23, 2022

Happy Fibonacci Day - 11/23

The Fibonacci sequence, named after Italian mathematician Leonardo Fibonacci, can be used as a tool to measure price extension and retracement. The numeric sequence is based on the idea of the Golden Ratio or Golden Mean and has countless implications in the world of mathematics and science.

The sequence starts with 0 and 1 and then the third number is added as the sum of the preceding two.

[0+1=1] [1+1=2] [1+2=3] and so on. The result is this string of numbers

0,1,1,2,3,5,8,13,21,34,55,89,144

and continues ad infinitum. As it does the ratio gets closer and closer to the Golden Mean of 1.618.

This ratio and its inverse 0.618 (along with 0, 0.382, and 1) are then used to plot various extension and retracement levels on price charts. I recently shared this on a weekly chart of the US Dollar Index $DXY, pointing out the confluence of the 38.2% retracement level with the 40-week moving average and previous support/resistance.

Today let's look at a shorter sequence by plotting the extension of the recent move in SPY from the low on Thursday 11/10, to the high on Tuesday 11/15. This move is seeing follow-through now after working off the extension and touching the 8-day EMA. So where might it go next?

SPY

As we look for further upside notice how the 1.618 extension level lines up closely with the daily bull flag price objective (first identified in “Closing the Gap”) and the downtrend line.

While I don't subscribe to the notion that this measurement has any consistent predictive ability, I do believe it adds a layer of probability. These occurrences happen frequently and I always find them fascinating.

QQQ is also looking better after allowing some time for the 8/21-day EMAs to catch up. It’s breaking higher from a bullish consolidation pattern today and is now solidly above the VWAP anchored to August 16th.

IWM, the recent laggard of these three indexes is also improving. But it has several layers of potential resistance to deal with just above. The 200-day moving average is very near the current price. Then there is a downtrend line dating back to the all-time high. That is followed by the Jan. 4 AVWAP, and finally the 190-191 price level. Plenty of levels to watch.

The falling US Dollar continues to provide a tailwind after a quick bounce,

as does a declining $VIX.

All bullish developments.

Thanksgiving is upon us and will soon give way to the biggest retail shopping day of the year, Black Friday. Electronics retailers, discount clubs, and department and big box stores will be looking to book the bulk of their profits through the Christmas shopping season. Will it be enough to keep this chart heading higher?

XRT - retail gets ready for Black Friday

World Cup is underway and has many countries lining up against each other on the pitch. While it is entertaining to watch the footballers show off their skills it is also useful to look at another contest - in the charts.

Relative strength is often mentioned here as a tool for identifying market leaders are many different timeframes. Pitting countries (more specifically the various stock index ETFs of those countries) against each other in a relative strength comparison chart can show where we may want to focus our global trading and investing efforts. I have some weekly comparison charts below.

But first, let's examine the host country, Qatar on its own.

$QAT - Even though it's rich in oil, the country ETF hasn't been immune to the global selloff in 2022.

Argentina vs Saudi Arabia - Argentina was handed a huge upset in group play, losing 2-1 to Saudi Arabia.

$ARGT/$KSA - The overall trend of this chart confirms the Saudi victory. Although the Argentines could be staging a comeback. Don’t count them out yet.

France vs Australia - France, the defending World Cup Champs handily defeated Australia 4-1.

$EWQ/$EWA - This comparison chart indicates that, while susceptible to wild swings, overall the two countries are more evenly matched.

Spain vs Japan - As I type this Spain, a regular powerhouse in world futbol, is beating Japan 5-0 6-0 7-0.

$EWP/$EWJ - This chart gives a contrarian view, with the long-term trend in favor of a Japanese victory.

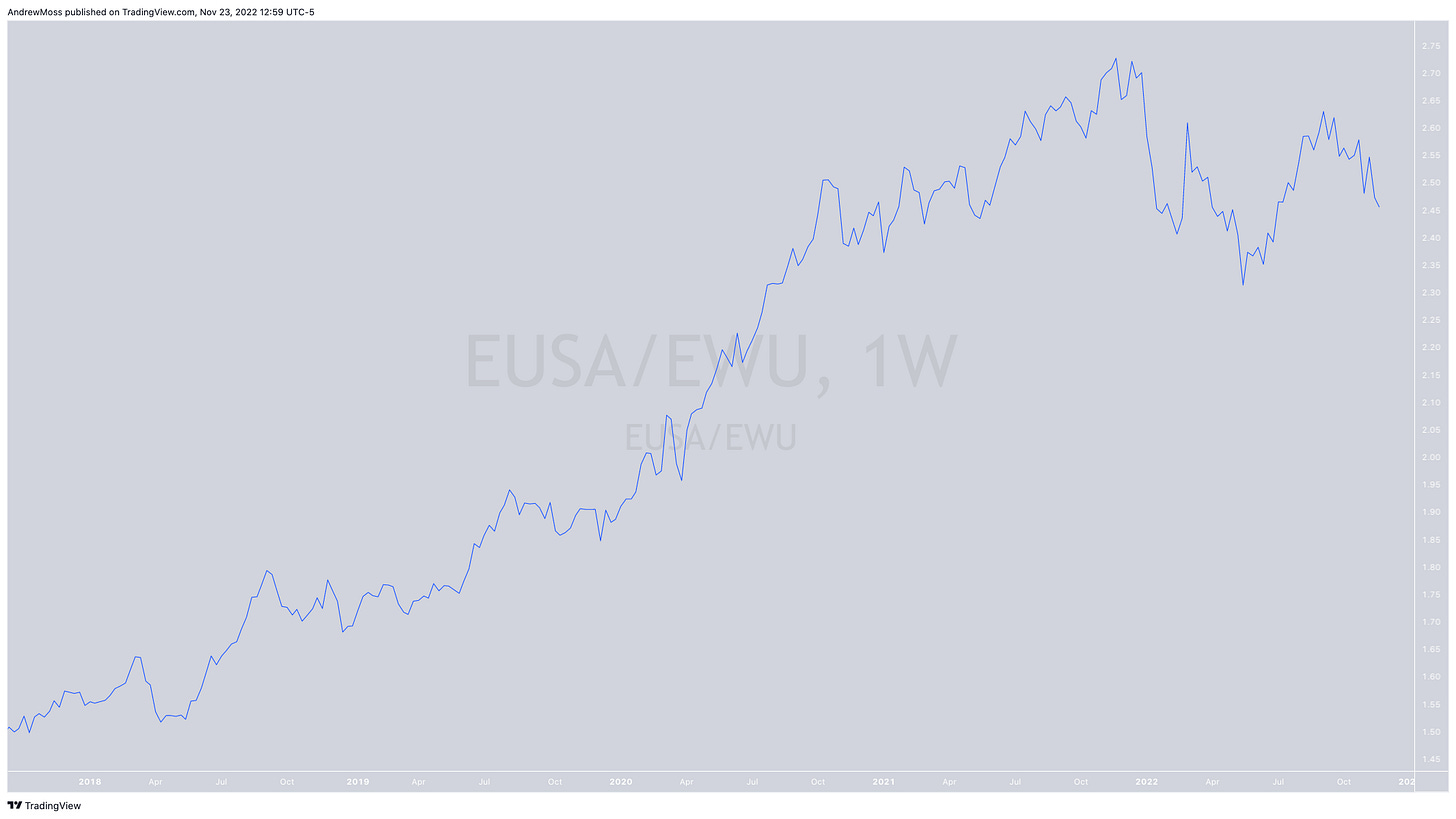

USA vs England - The next match for the United States is Friday vs. England. Will this chart predict the game-winner?

$EUSA/$EWU - American fans hope so!

There are many World Cup matches left to play. And an endless supply of relative strength charts to examine. Maybe we’ll check in on these again later in the tournament.

With sincere gratitude and thanksgiving;

Thank you for reading, sharing, and subscribing!

It is truly an honor to have you all here. The steady rise in readership and the inflow of new subscribers is way up there on my list of things for which I am grateful.

I hope you all have a great day with your family and loves ones.

Friday is a half-day for the market so there will not be a Weekly Market Review. There will be weekly charts on Twitter Saturday morning. So grab some coffee and a plate of leftovers and join me then.

***This is NOT financial advice. NOT a recommendation to buy, sell, or trade any security. The content presented here is intended for educational purposes only.

Andrew Moss is an associated member of T3 Trading Group, LLC (“T3TG”) a SEC registered broker/dealer and member of FINRA/SIPC. All trades placed by Mr. Moss are done through T3TG.

Statements in this article represent the opinions of that person only and do not necessarily reflect the opinions of T3TG or any other person associated with T3TG.

It is possible that Mr. Moss may hold an investment position (or may be contemplating holding an investment position) that is inconsistent with the information provided or the opinion being expressed. This may reflect the financial or other circumstances of the individual or it may reflect some other consideration. Readers of this article should take this into account when evaluating the information provided or the opinions being expressed.

All investments are subject to risk of loss, which you should consider in making any investment decisions. Readers of this article should consult with their financial advisors, attorneys, accountants or other qualified investors prior to making any investment decision.

POSITION DISCLOSURE

November 23, 2022 4:00 PM

Long: COIN1202P45, PYPL, PYPL1216C90, QQQ1125P290, SHOP1125C37.5, SPY1125P400

Short: COIN1202P40

Options symbols are denoted as follows:

Ticker, Date, Call/Put, Strike Price

Example: VXX1218C30 = VXX 12/18 Call with a $30 strike