Flat Markets, Divergent Trends, and AI Curiosity

When the averages stop trending, the mind starts wandering.

Note: this article strays from the norm a bit. I hope you enjoy the brief thought detour.

The Flatline

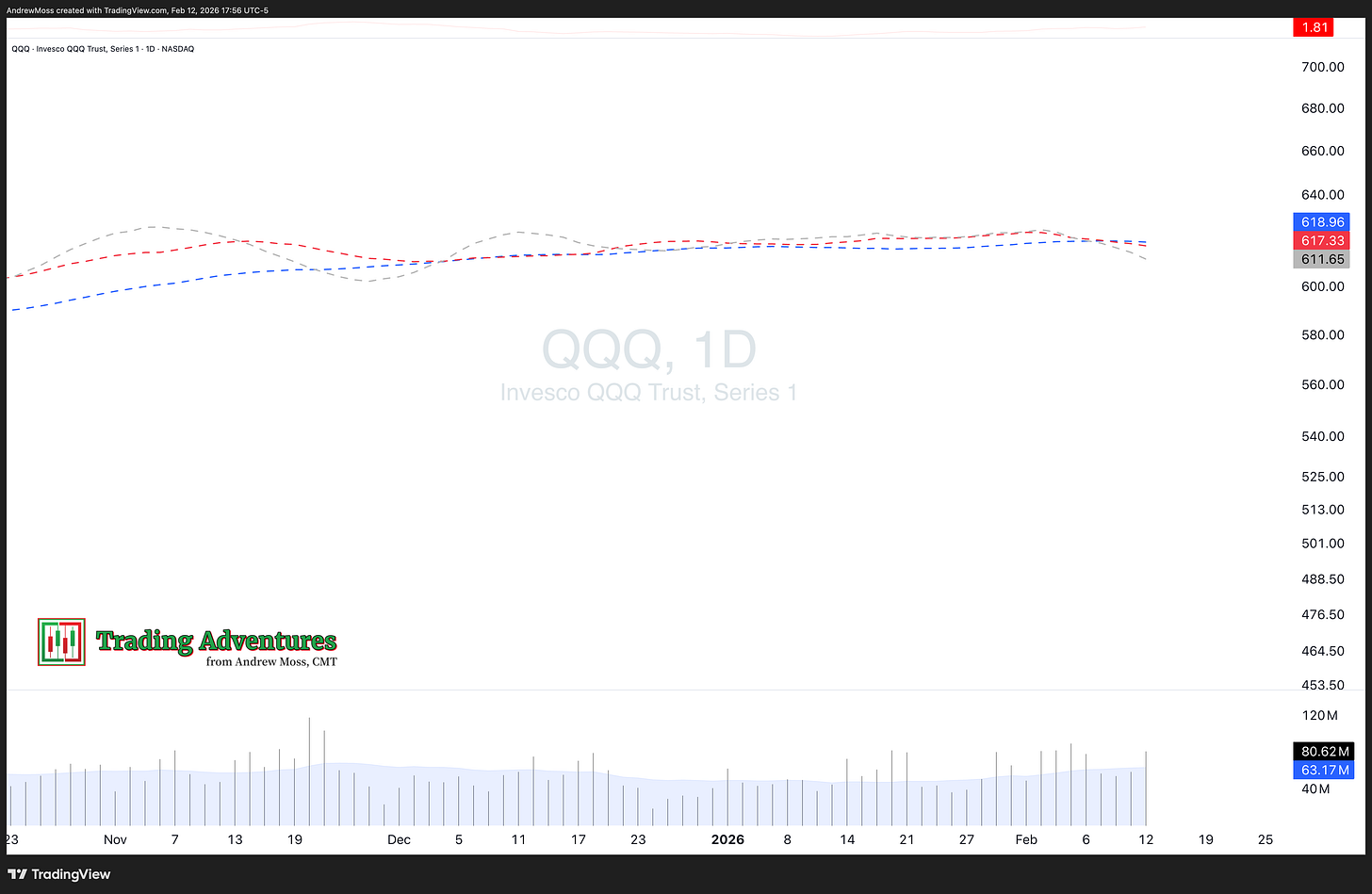

Take a look at this chart of QQQ. You might notice something missing.

This view shows only the 10, 20, and 50-day moving averages — no price, no candles, no noise.

When you strip everything else away, the message is simple:

There is no trend since October.

It’s flat.

Nothing.

Zilch.

Nada.

The 10, 20, and 50 are all moving sideways and compressed together. There’s no expansion and no sustained directional movement. That absence of separation tells you everything you need to know.

Flatline.

QQQ — Nasdaq 100 ETF (10/20/50-Day MAs Only)

(No price. Structure only.)

The Contrast

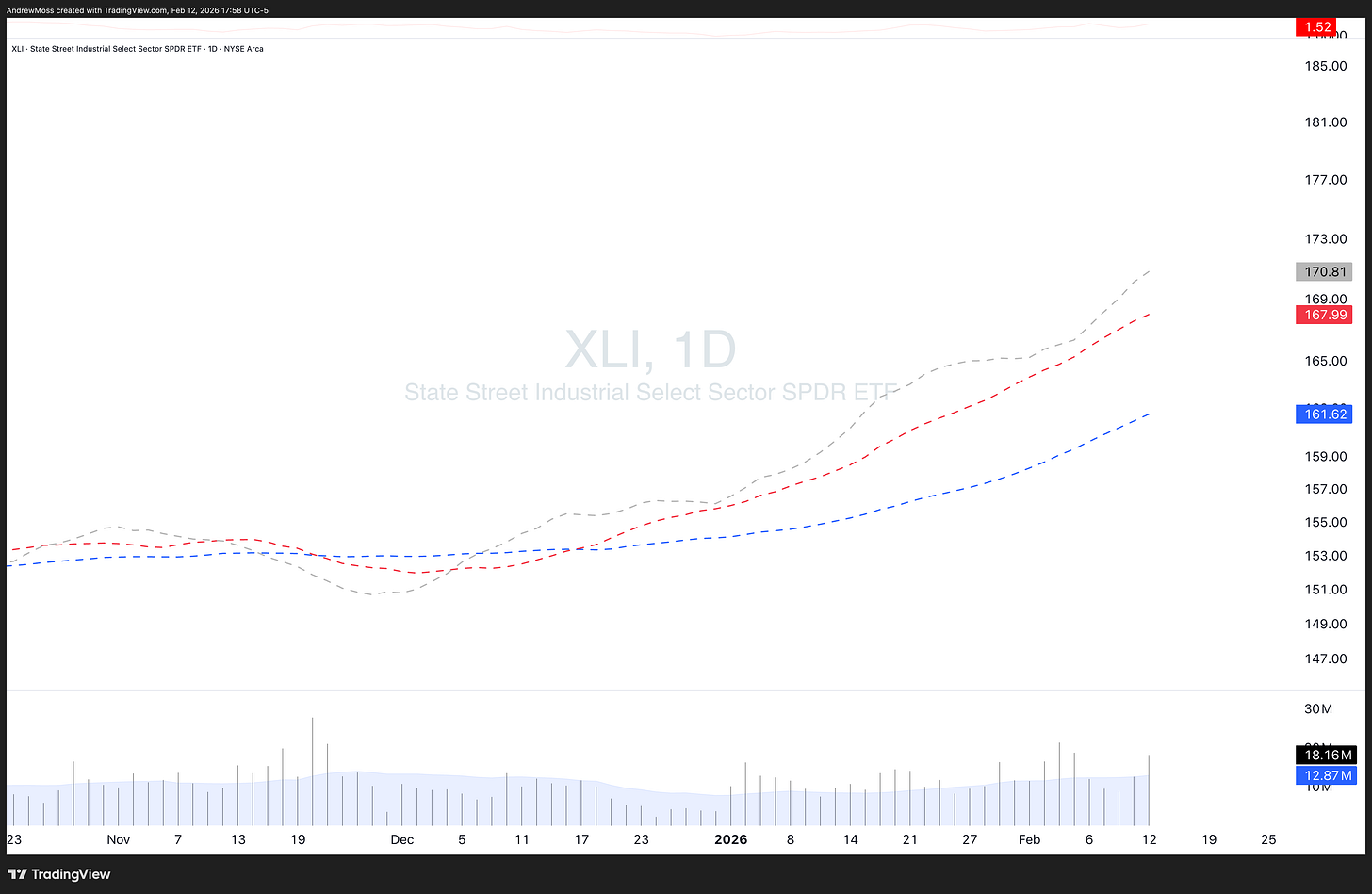

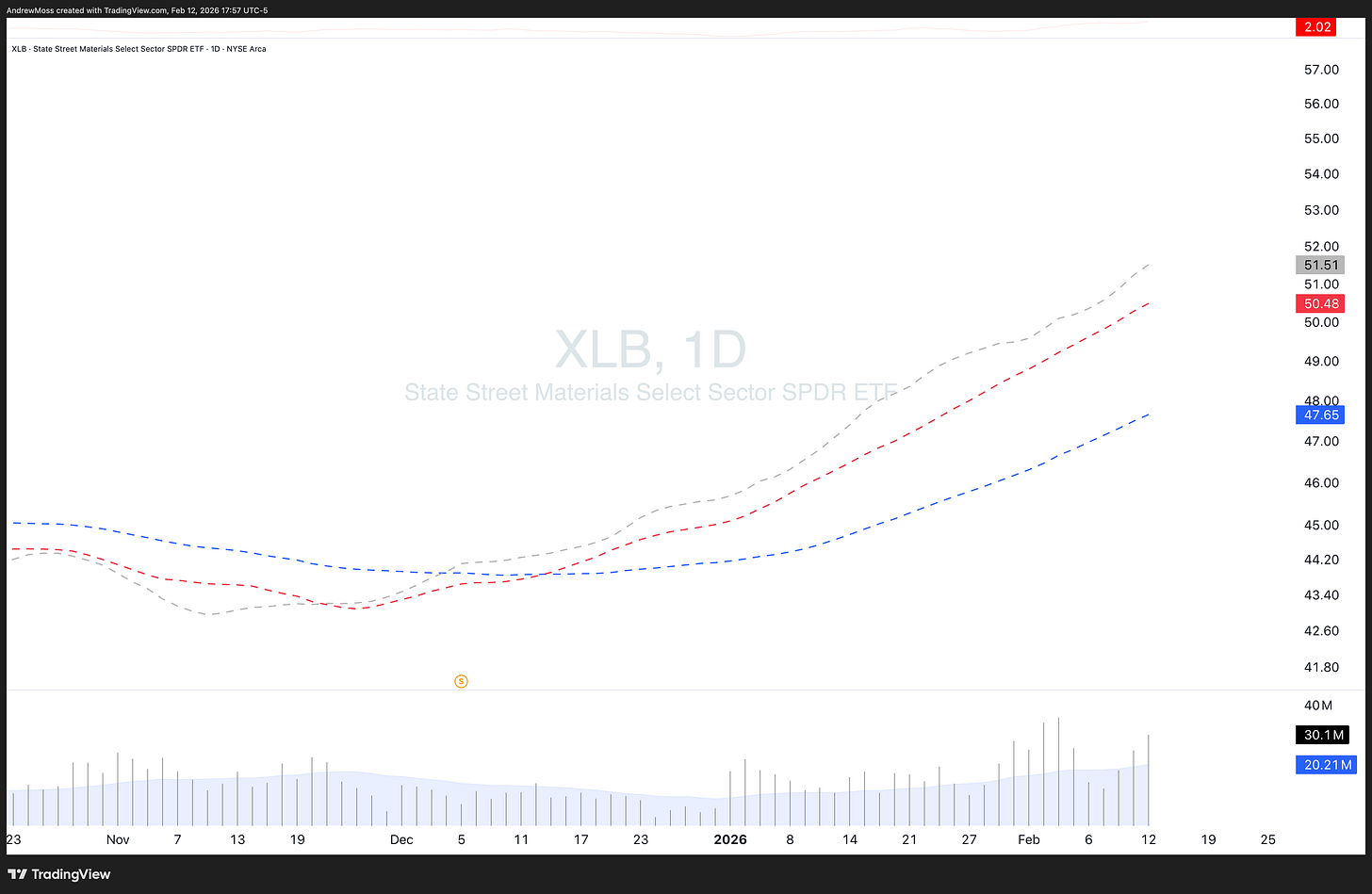

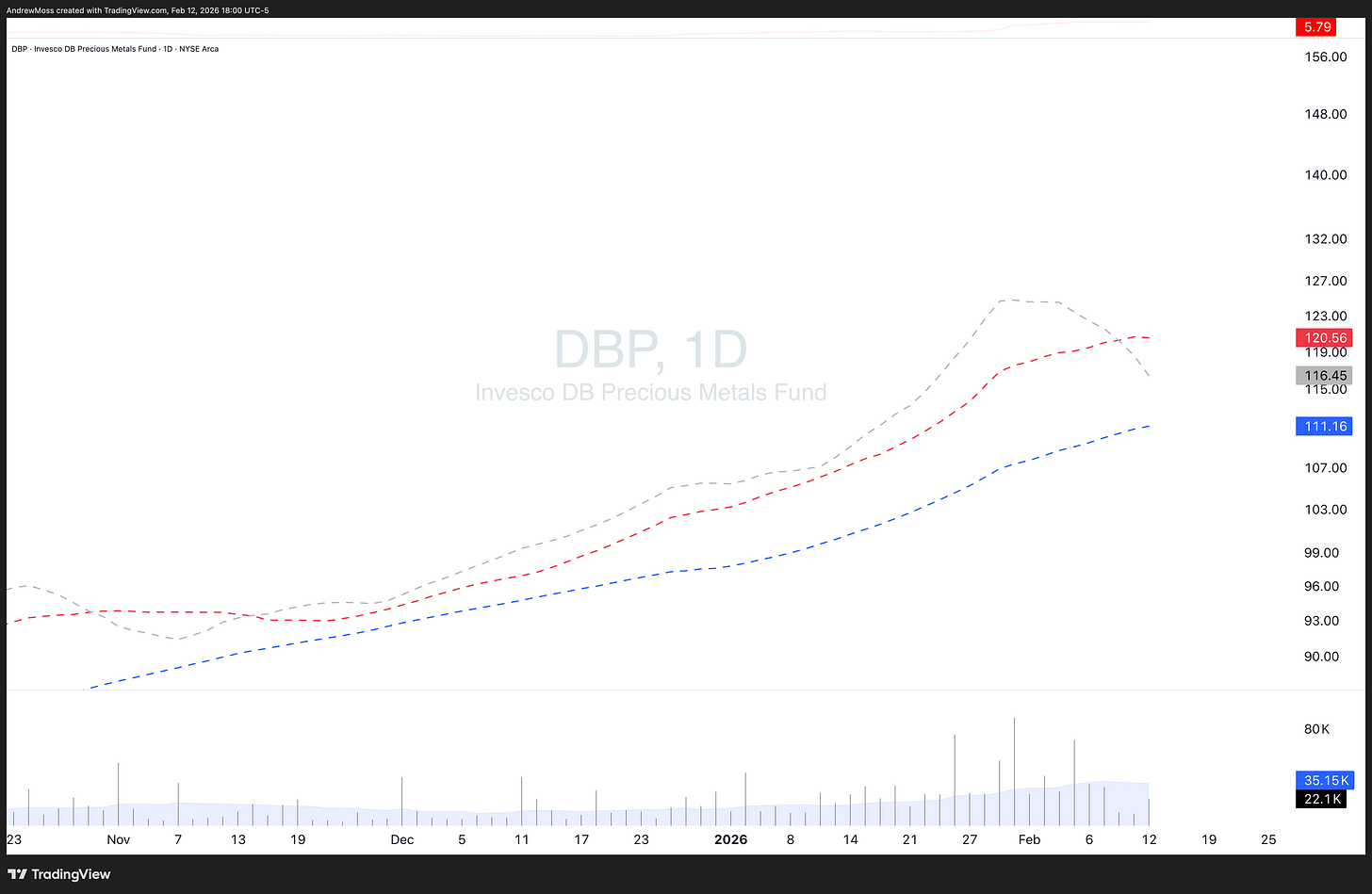

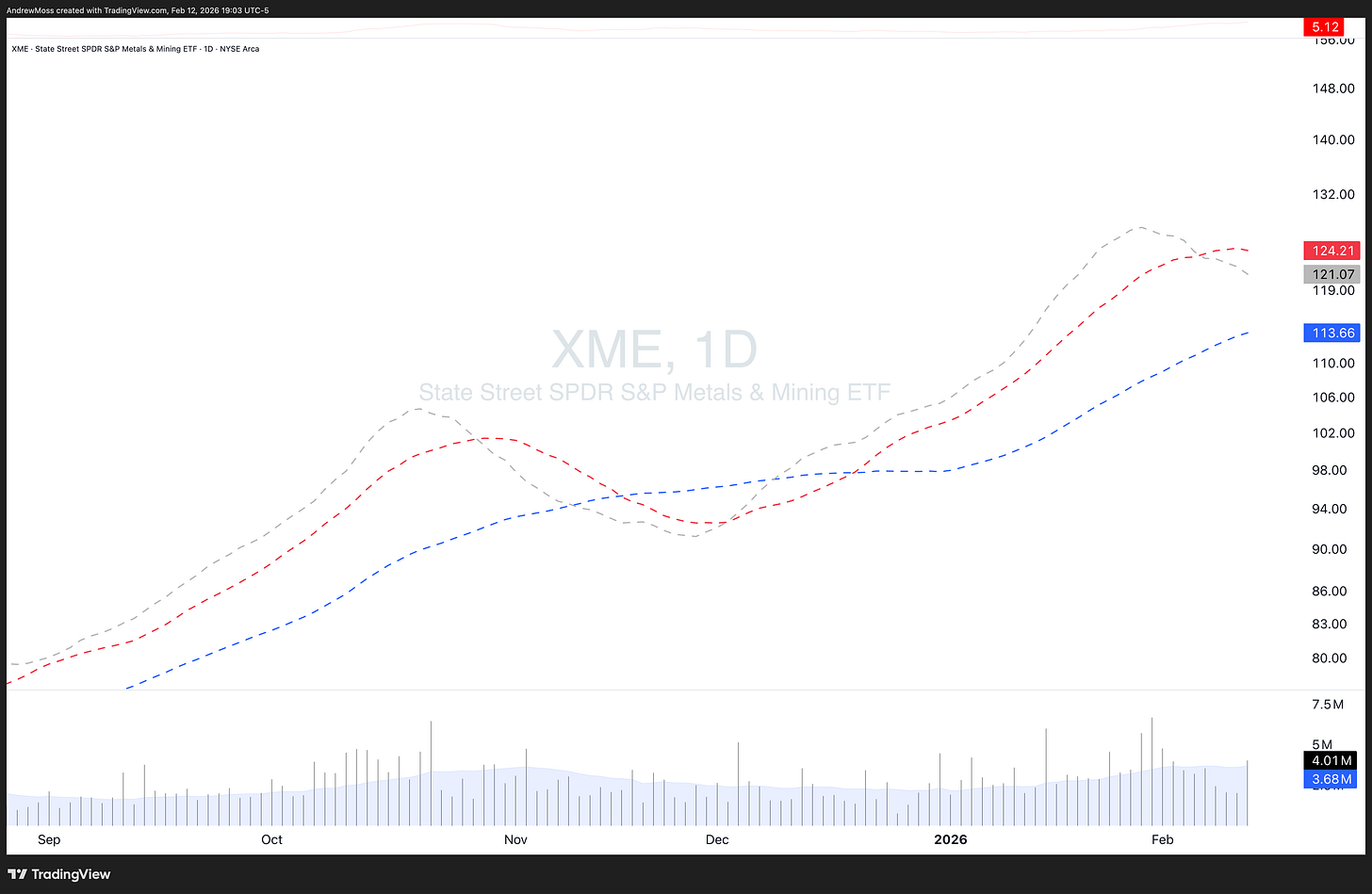

Now consider this similar view of industrials, materials, and metals (both precious and base) — areas that have been very strong.

XLI — Industrials Sector SPDR

XLB — Materials Sector SPDR

DBP — Precious Metals Fund

XME — Metals & Mining ETF

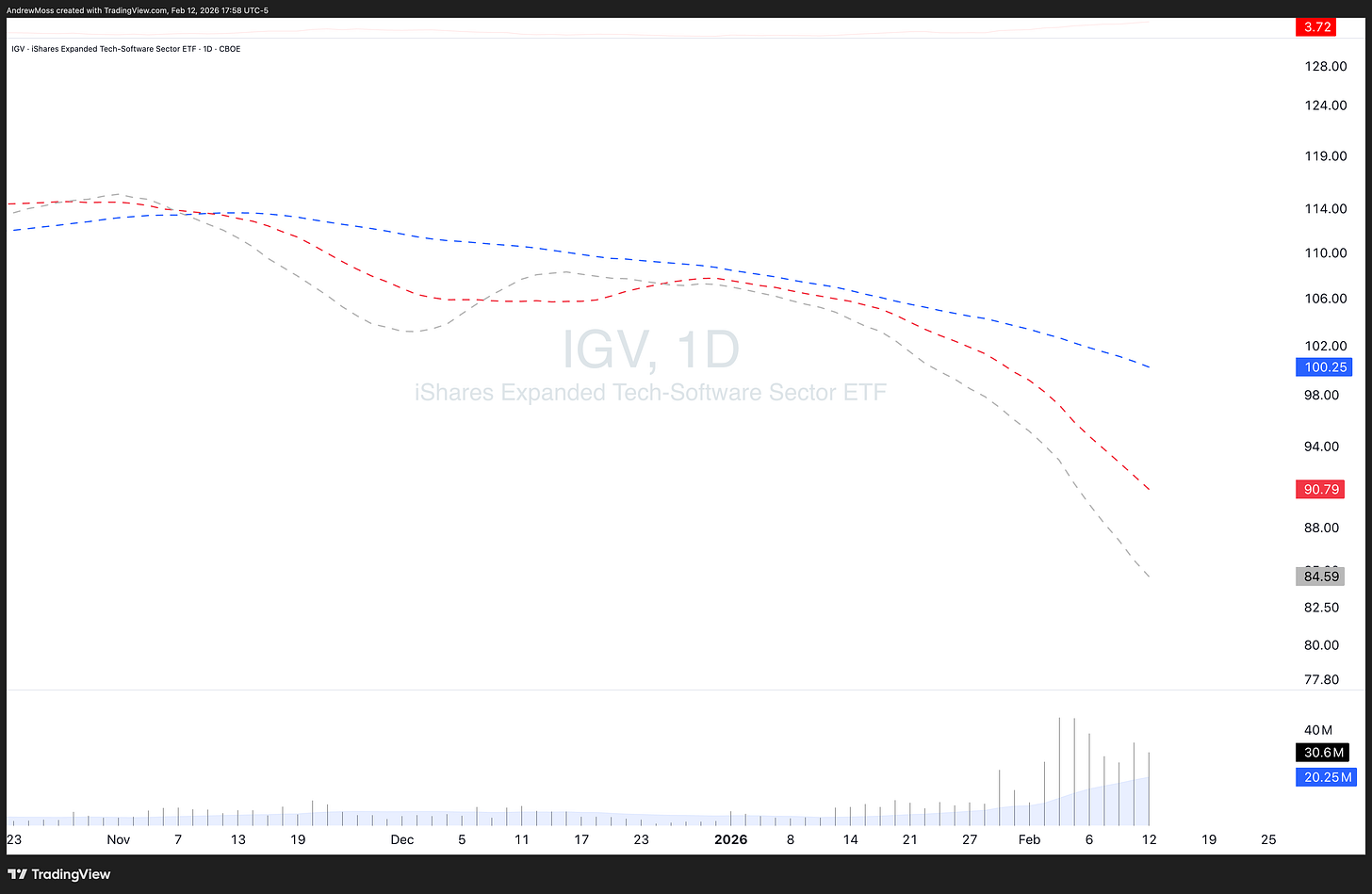

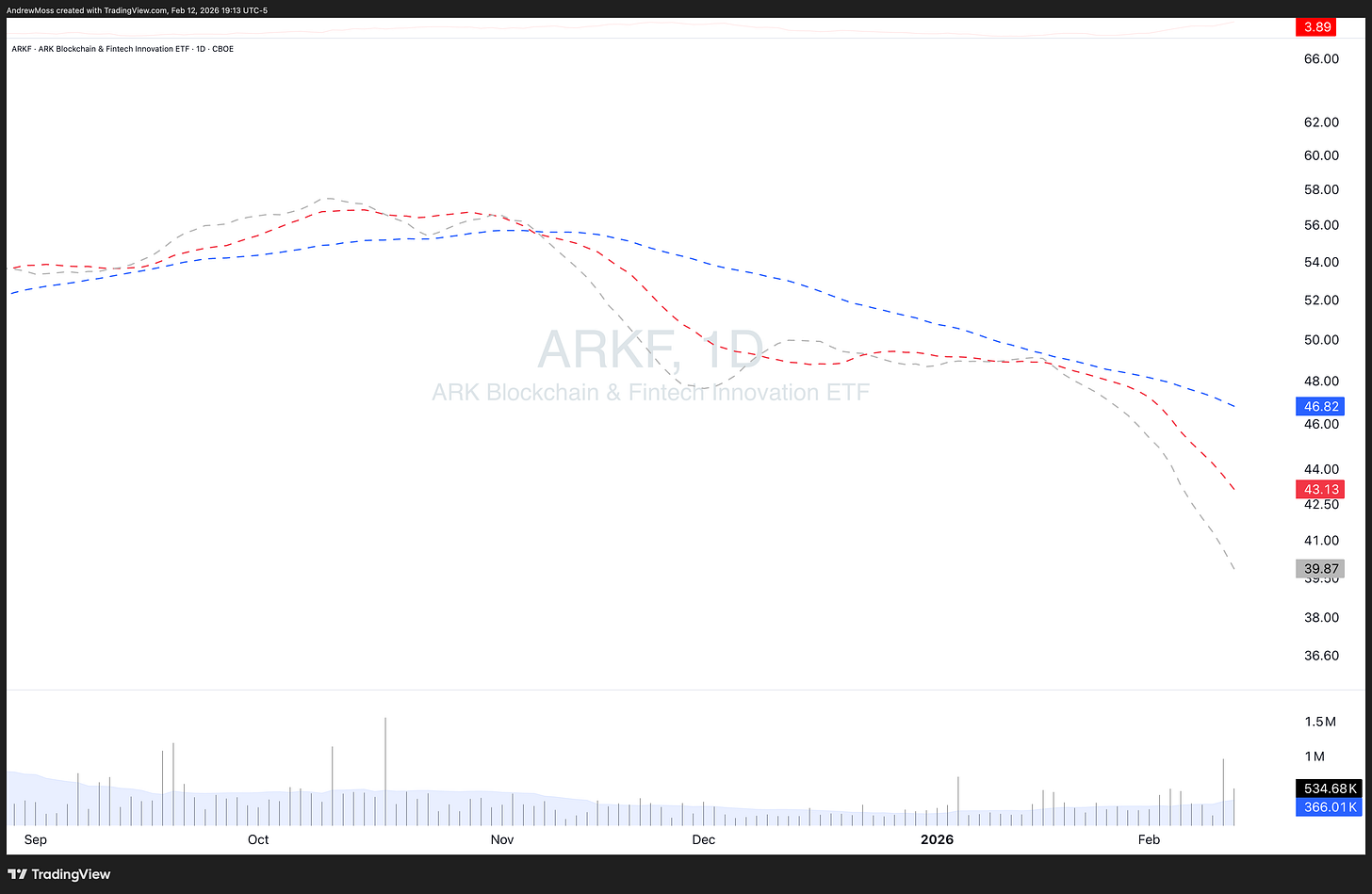

Finally, here’s Software and FinTech (heavily software dependent), which, as we know have been incredibly weak.

The contrast matters.

IGV — Software ETF

ARKF — FinTech Innovation ETF

Notice the averages (not that there is anything else on these charts to notice). They are not flat. They have movement, slope, and action

Some parts of the market are strong, trending, and holding up just fine. Others have been clobbered, falling persistently and without relief.

That divergence is real, and it’s visible in the structure.

Resolution: Higher or Lower?

We’ve talked ad nauseam about breadth and participation being pretty strong. A lot of areas of the market are doing fine. The economy. Employment. Etc. From that perspective, this could easily resolve higher.

However, we’ve also had a pretty steep sell-off today, and that has become a recurring theme.

We cannot get to new highs in SPY or QQQ.

IWM? Yes. DIA? Yes.

Thinking and digging a little deeper:

Potential caveat: DIA is a 30-stock, price-weighted index.

(CAT is one of the highest-priced components.)

Small caps IWM could simply be rotation. They could be going up because there are limited attractive places to put money right now. Trend followers and momentum chasers are following the strength. That doesn’t automatically translate into broad index momentum.

A Brief Detour

Now, bear with me here while I tippy-toe out onto the limb of supposition and away from the trunk objective analysis.

There’s been a lot of commentary this week about AI and the effects it’s already having on jobs, the economy, and people.

One of my sons is training to become an electrician. AI is not coming for his job. If you have to be physically on-site — building, crafting, constructing — moving and assembly parts and materials with your hands in a way that is not easily automated — AI is not coming for your job. Not first at least.

On the other hand, if you’re a software engineer, a developer, or a code writer, that’s a different conversation.

Now go back and look at the charts.

Materials and industrials are strong.

Software is weak.

Connected? Maybe.

So What?

As a trader, I don’t care.

It’s interesting to consider cause and effect. It’s interesting to put pieces together logically.

But as a trader, I don’t care.

The only things that matter are:

Did you see a setup?

Did you take the trade?

Did you manage your risk?

Did you get paid?

That’s it.

Only price pays.®

The reason a market or stock moves is rarely known in real time. The explanation almost always comes after. Explore curiosity if you want, but don’t get caught up in “why.”

As a trader, focus on price. Look for the setups. Manage your risk. That’s the job.

But as a person, I think. We think. We get curious. We ponder.

Maybe it’s the boring index price action and lack of trend that sets my mind to wander. Or maybe it’s real curiosity about the future and the effects — positive and negative — that AI will have.

I don’t buy into pessimism or doomsday scenarios.

Markets adapt. People adapt.

Capital flows where opportunity exists.

But change is real. And change creates both disruption and opportunity. Those shifts are worth exploring. They’re worth preparing for.

Just don’t confuse curiosity with conviction.

As traders, we stay grounded in price. We let structure lead. We manage risk. And we adapt as the evidence changes.

Everything else is just thought exercise.

If you made it this far, thanks for letting your mind wander with me. Saturday morning we’ll return to structure, levels, and price.

You know — the part we actually trade.

If you like how I think here, this is where that thinking is applied every day.

Important: This content is provided for educational purposes only. If you’re reading this online, please review the full disclosure here.