From Frustration to Follow-Through — Buyers Step In at Key Levels

Early weakness tested discipline again before buyers stepped in and reclaimed structure into the close.

Note:

Appreciate all the positive feedback on these new daily recaps.

I started posting them on X to help traders follow structure in real time, and it’s been great to see so many of you enjoying them here, too.

Keep the comments and suggestions coming — it helps me make each one better.

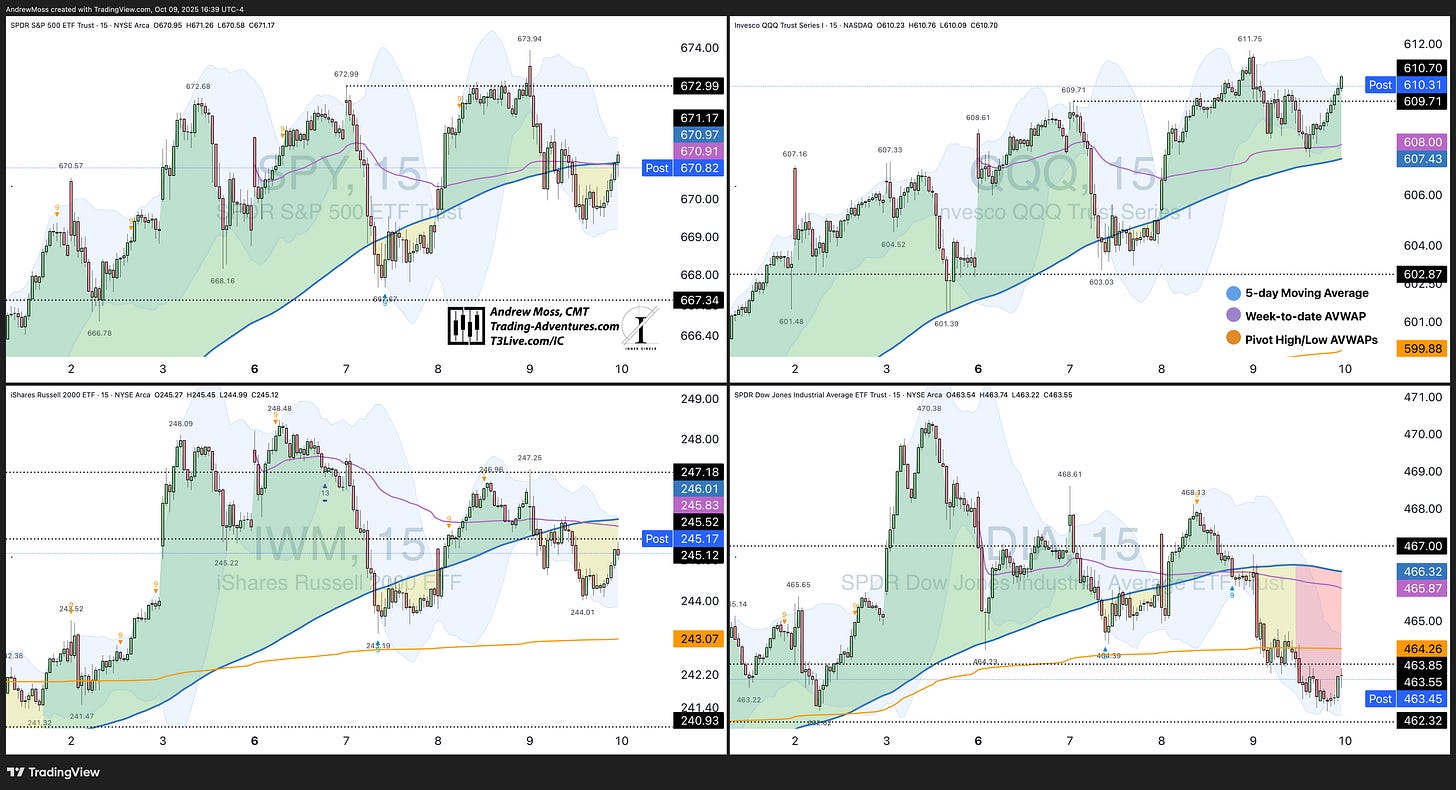

The Markets

A volatile open tested patience, but the market rewarded discipline.

SPY broke below its 5-day and week-to-date anchored VWAP before reclaiming both late in the day.

QQQ only needed a quick touch of its week-to-date anchored VWAP to find buyers and close strong.

IWM finished constructively, while DIA trailed as BA lost altitude.

Key Names

AAPL flipped yesterday’s setup—sharp selloff from the open, late bounce. A shakeout before another attempt higher?

AMD dipped into the 229s, found support, and continued after-hours—leadership intact.

AMZN sold to the 221 zone (5-day/AVWAP) and ripped back to 227, closing over the 50-day—very constructive.

META showed standout strength—steady climb all session. Now above the 8-day, 100-day, and the 724.74 pivot. Next reference levels: ~746 (21-day) and ~753 (50-day + earnings AVWAP).

TSLA tested the 21-day early, rallied late. Watch for a move over 437–442 (5-day, 8-day, WTD AVWAP, and that 439.74 pivot) for confirmation.

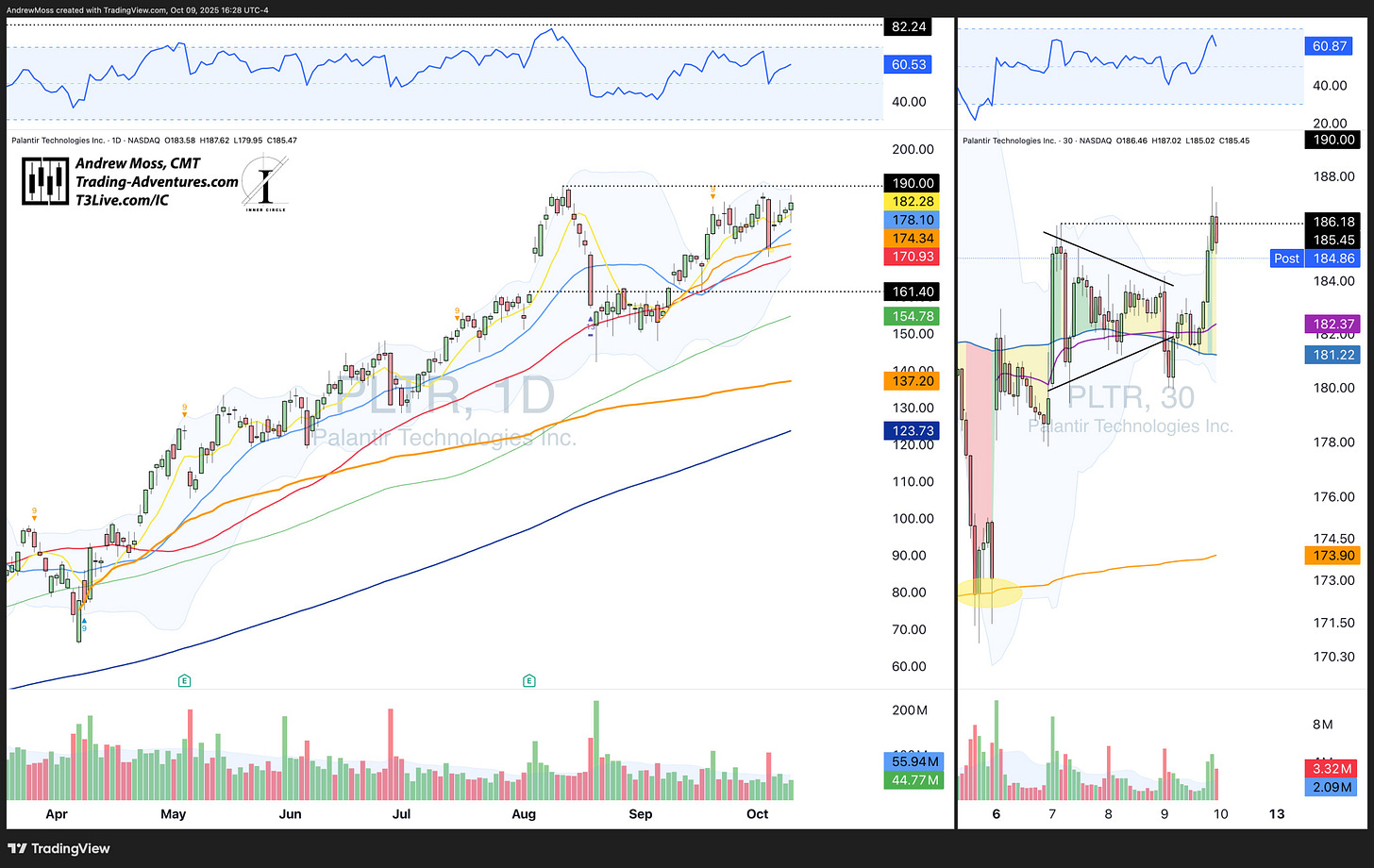

PLTR was messy intraday but held the 5-day on the retest and gave a very solid bounce before it closed mid-range in the 185s. Eyes on 190.

CRVW posted a strong day two above the 138.92 pivot; room toward 148–149.

RKT double-bottomed near 15.72, bounced to WTD AVWAP resistance, and closed on the 100-day. It’s trying to put in a bottom. But watch for confirmation.

Big Picture

Morning weakness was bought where structure mattered.

Indices and key tech reclaimed short-term levels and rallied into the close. Follow-through Friday will tell us if momentum carries or if this was just reflexive digestion.

Know your levels. Let price tell the story.

Coming Up (Friday): University of Michigan sentiment/expectations, multiple Fed speakers, and auctions—near-term catalysts as indices probe higher.

💬 If you’d like to see more of these short daily recaps here on Substack, drop a quick comment or tap the ❤️ at the top of the page. Your feedback helps shape what I share next.

Looking For More?

Elevate Your Trading Adventure Even Further With These Offerings.

EpicTrades Options Newsletter

Real-time trade ideas and insights, providing actionable trading insights focusing on options trades with short-term horizons, aiming to capitalize on weekly market movements.

The approach includes detailed reasoning for trades, specific options, and profit targets. It focuses on quick gains with a minimal time commitment from subscribers.

The Inner Circle

The Inner Circle is a Virtual Trading Floor (VTF) at T3 Live. I’ve been working and trading with this group since 2022. You may have noticed the logo in the watermarks on my charts.

Founded by David Prince and led by him, Rick March, and Kira Turner, the Inner Circle is a community of elite traders, including hedge fund managers, family office heads, corporate executives, financial advisors, and even professional poker players.

Fundamental, Macro, and Technical Analysis all combine to find and discuss the best opportunities in current markets.

The Disclosures

***This is NOT financial advice. This is NOT a recommendation to buy, sell, or trade any security. The content presented here is intended for educational purposes only.