Getting Bored Of The Same 'Ol Thing?

Monday Market Update

The Markets

New highs again? I’m afraid so.

I know the doomers, gloomers, and perma-bears will be crushed. But this is what bull markets do. They keep going up.

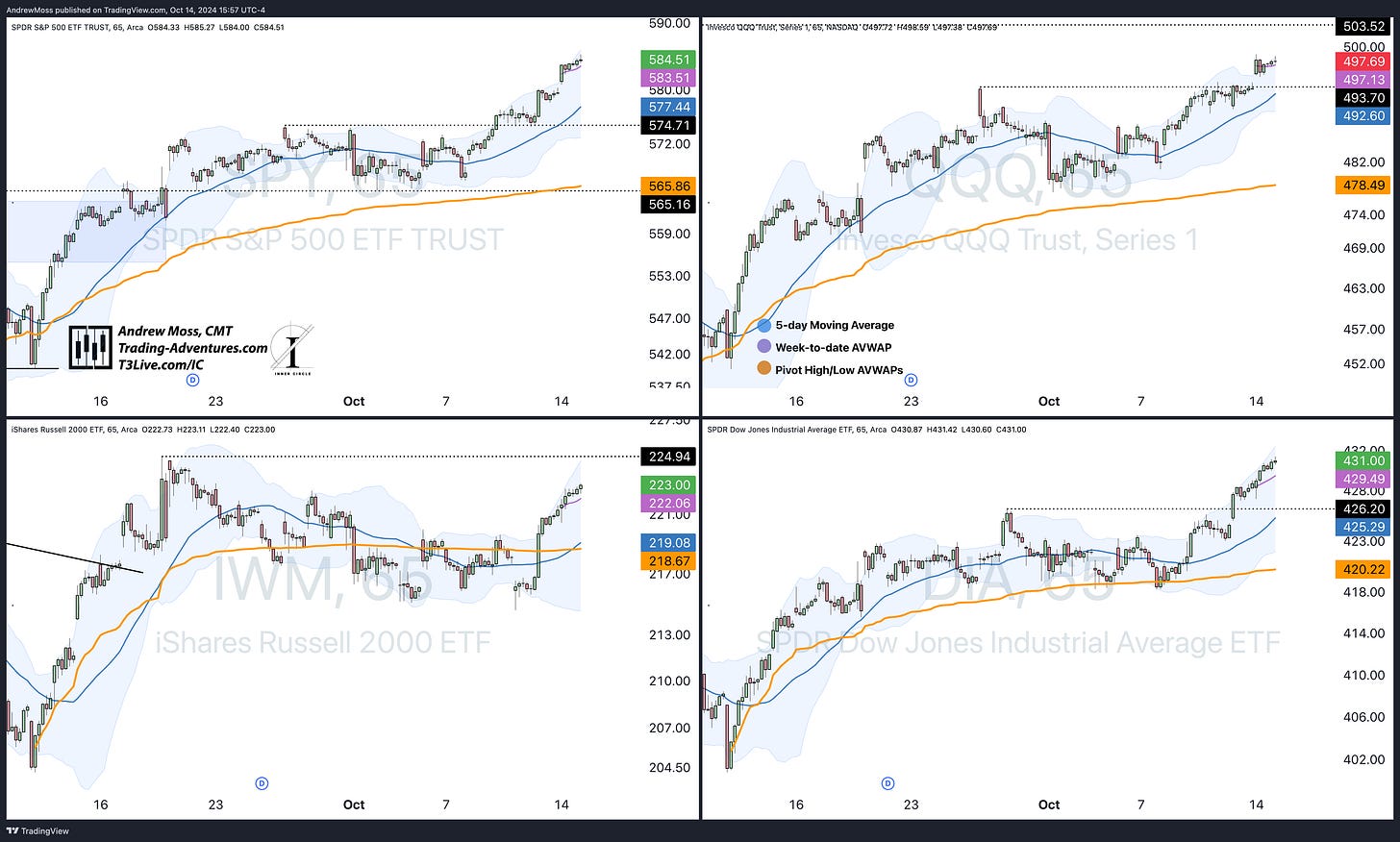

SPY and DIA made new highs again today after each set a new weekly closing high on Friday.

QQQ isn’t quite there yet. And IWM still has a long way to go. But the action in those indexes is equally as impressive.

There isn’t much else to say.

So, rather than rehash the same old story, I’ve included a gallery of the index charts (to save some page space) followed by some other charts of interest.

The Charts

SPY QQQ IWM DIA TLT DXY

Notes:

QQQ is just over 1% away from new highs. IWM continued its strong breakout move. TLT has a DeMark 9 buy setup today — so watch for a reversal this week. And US Dollar Futures hit the pivot high anchored VWAP today — maybe some resistance. If TLT starts back up (sending yields lower) and the Dollar reverses lower to give stocks some pressure relief (stocks clearly haven’t been pressured much lately) that could kick these moves into another gear.

A few more:

BTCUSD is finding its legs today, moving up about 5% and back into the pivot highs from mid-September. We are still watching for a breakout move out of the range (shaded area) to open the door to much more upside.

IBIT — a Bitcoin ETF — trades with similar action, though a slightly different consolidation pattern is shown on this chart.

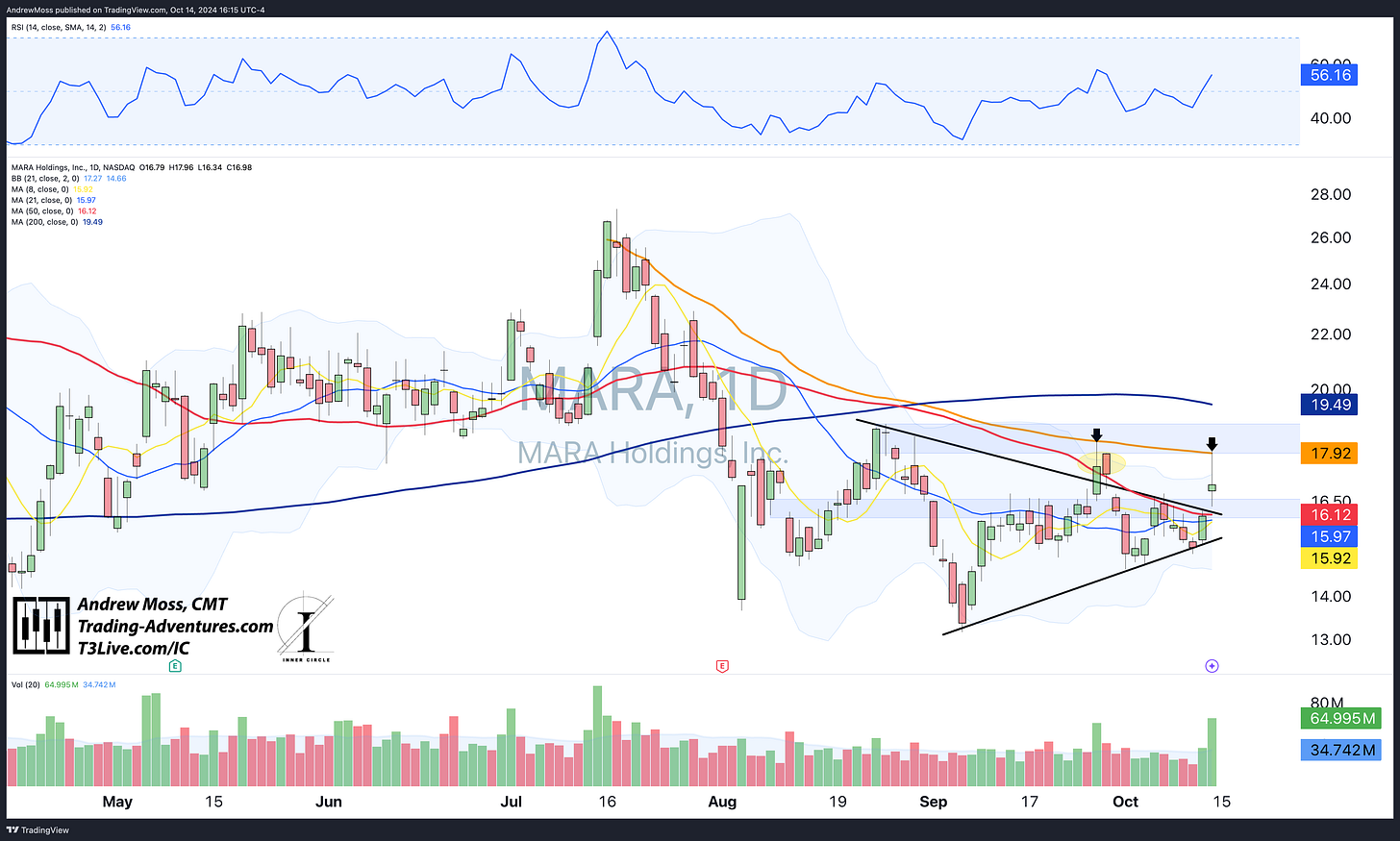

MARA — a bitcoin mining company — moved higher from its consolidation pattern, showing a nice breakout. However, significant resistance was found at the pivot high AVWAP (orange line), and prices reversed. We’ll see if it can make another attempt.

COIN — one of the biggest cryptocurrency exchanges — moved right through its pivot high AVWAP after getting rejected precisely at that level twice in recent weeks. If the strength in Bitcoin remains, the moves in these proxy names are just getting started.

Moving beyond cryptocurrencies —

CRM broke out of its short-term consolidation pattern and moved above the pivot highs from early May. It could have room for a move up to nearly $320 from here.

SG - a popular name in the fast-casual restaurant space, is battling its way above and beyond this $35-$36 pivot area. $40.10 is the all-time high, which came very soon after the IPO. Above there? Nothing but clear skies.

NVDA continued upward, nearly reaching its all-time high, which happens to be the upper boundary of this months-long consolidation area. If you didn’t catch it on 𝕏, a target area of $228 can be seen on the weekly chart. Click here to view

The Trade

Trim and trail.

The setups that have materialized over recent weeks are working out well and adding profits. Now is the time (if you’re active) to lock in some of those profits and move stops up on the remainder of the positions.

The market remains strong in the face of worrisome news (there is always some kind of worrisome news). But there will be dips, bumps, and new emerging trade setups along the way.

At the risk of sounding like a broken record, keep the shopping lists fresh (more coming on that soon 😉). Be ready. And take trades when they present.

Elevate Your Trading

Education, training, and support for your Trading Adventure.

Options Trades - Weekly trade ideas are delivered to your email or text messages in language you can easily understand.

Check out EpicTrades from David Prince and T3 Live. Epic Trades from David Prince

Community - Are you an experienced trader seeking a community of professionals sharing ideas and tactics? Visit The Inner Circle, T3 Live’s most exclusive trading room - designed for elite, experienced traders.

The Inner Circle at T3 Live

Prop Trading - Or perhaps you are tested and ready to explore a career as a professional proprietary trader? 3 Trading Group has the technology and resources you need.

Click here to start the conversation:

T3TradingGroup.com

The Disclosures

***This is NOT financial advice. This is NOT a recommendation to buy, sell, or trade any security. The content presented here is intended for educational purposes only.