Hurry Up And Wait

Weekly Market Update

I am pleased to announce the launch of reader-supported subscriptions to Trading-Adventures.com. For just $15 a month, you can further support this work and enhance your Trading Adventure.

Go deeper than the indexes to analyze market moves beneath the surface.

More charts, more analysis, and more education to improve your trading and enhance your success.

Subscribe now to support this Trading Adventure and take a significant step forward on your own. It's all available for less than a cup of coffee each week.

Been here a while and enjoy the freebies? No worries. Free subscribers will continue to receive the Market Update articles twice a week.

And you can help in other ways.

Share Trading Adventures

Forward this email to friends, family, coworkers, and fellow traders

Thank you for considering a paid subscription to Trading Adventures. I look forward to supporting you on your trading journey!

The Markets

This week, we’ve been focused on earnings, election tensions, and elevated volatility — a perfect recipe for patience and taking it slow. While trading has slowed down (at least for me), the market hasn’t.

AAPL, AMZN, GOOGL, META, MSFT, and many others have announced mixed results. Only AMZN has been able to hold onto its gains (so far). GOOGL had a nice pop but quickly gave most of it back.

That leaves SPY and QQQ in a tricky spot. This was in my notes from Monday —

I just saw a post that we've come almost the whole month of October without a 1% up or down day in the S&P 500. I'm willing to bet we see one show up before the end of the month.

✅ done

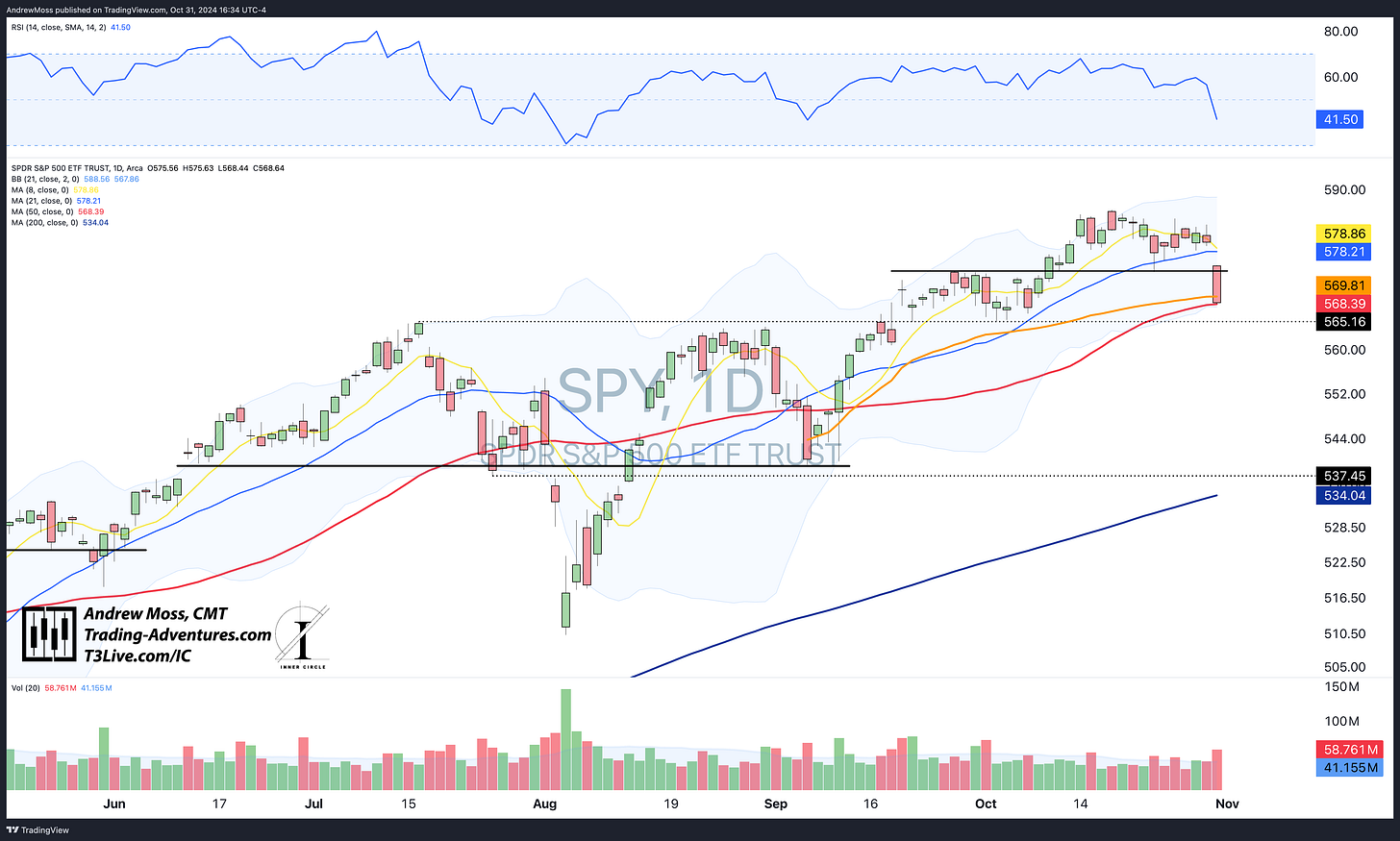

Now we see what the buyers are made of. Every dip has been bought. And as long as SPY holds above the $565 pivot from July, the series of higher highs and higher lows remains in place.

The problem is that we still have three more trading days until the election. And then, who knows when we’ll get the results? The market hates uncertainty.

In the meantime, price action will continue to tell us what we need to know. However, the charts could be a little messy. Pivot levels, price history, and moving averages may not hold precisely. Give plenty of wiggle room.

The Charts

SPY is down nearly -2% for the day, closing on the 50-day MA. $565.16 is the July pivot. If that doesn’t hold, there is a lot of room down to the 200-day MA, near $534, and a pivot at $537.45.

QQQ is down over -2.5% for the day and below the August pivot high of $485.54. There are two potential support levels close by with an AVWAP and the 50-day MA, $481-$482. Then it’s the 200-day MA down at $458.

IWM might be concerning if it hadn’t already numbed our senses to erratic moves and misdirection. Kidding aside, it is below its 50-day MA and testing the pivot low from last week. Not a great look. There is potential support near $214, $212, and the 200-day MA at $207.

DIA has broken the trendline this week and lost its 50-day MA today. $416.55 is the pivot to hold to maintain the sequence of higher highs and higher lows. If not, it could get messy below there, with room down to the $400 area.

TLT has stopped the downward move, temporarily at least. It’s still struggling with the 8-day MA, though. So, there is no change in the short-term trend yet.

DXY The Dollar has been basically inverse Treasury Bonds (TLT) recently, and the futures contracts have finally taken a break at the $104.56 pivot.

BTCUSD, in the last two days, has given back much of the breakout move. For the short term, we’ll see if this pivot at $70k holds or if the move fails and goes lower. In the longer term, the case for higher prices is still in place.

VIX Volatility has returned, as expected, adding to the pile of reasons to go slower, do less, and remain patient.

The Trade

Hurry up and wait.

There’s nothing to add here that hasn’t already been written.

Prices are looking more attractive, but we still have:

Nonfarm payrolls tomorrow

Election Tuesday

Election results?

FOMC rate decision Thursday

Plenty to shake things up over the next week or so.

In the longer view:

Tomorrow starts the six best months of the market, seasonally speaking.

We’re still very early in the average life cycle of a bull market.

The economy is strong.

The next bull cycle for Bitcoin is still on the horizon.

Be ready.

Looking For More? Elevate Your Trading Adventure Even Further With These Offerings

EpicTrades Options Newsletter

Real-time trade ideas and insights, providing actionable trading insights focusing on options trades with short-term horizons, aiming to capitalize on weekly market movements.

The approach includes detailed reasoning for trades, specific options, and profit targets, focusing on quick gains with less time commitment required from subscribers.

The Inner Circle

The Inner Circle is a Virtual Trading Floor (VTF) at T3 Live. It’s the group I’ve been working and trading with since 2022. You may have noticed the logo in the watermarks on my charts.

Founded by David Prince and led by him, Rick March, and Kira Turner, the Inner Circle is a community of elite traders, including hedge fund managers, family office heads, corporate executives, financial advisors, and even professional poker players.

Fundamental, Macro, and Technical Analysis all combine to find and discuss the best opportunities in current markets.

The Disclosures

***This is NOT financial advice. This is NOT a recommendation to buy, sell, or trade any security. The content presented here is intended for educational purposes only.