Introducing Chart School - Organized Principles for Repeatable Trading

A growing library of short, plain-English lessons on trend, AVWAP, moving averages, and risk framing.

Chart School is live.

Most traders don’t struggle due to a lack of information, but because they don’t have a repeatable decision-making process.

That’s why I built Chart School — a simple, growing library of lessons that explain the why behind price action.

If you’ve followed my work, you know I lean on a simple, durable toolkit: trend structure, anchored VWAPs, DeMARK context, moving averages, and clear risk framing. Chart School turns those ideas into concise lessons with plain‑English explanations, examples, and light exercises you can apply the same day.

What you’ll find inside

Foundations of trend and timeframes

AVWAP anchoring — how I choose levels and why they matter

Moving averages that actually add signal

The thesis → plan → risk framework you can repeat trade after trade

Coming next

DeMARK 9s in context

Multi‑timeframe alignment without overfitting

Checklists for entries, adds, and exits

Reader‑requested lessons — tell me what you want broken down

Why this matters

Markets reward clarity and consistency.

Most traders don’t lack information — they lack a repeatable decision process. Chart School is about creating repeatable logic that helps you size correctly, trim into strength, avoid chasing, and stick to the plan.

When the why is clear, the what and when become easier.

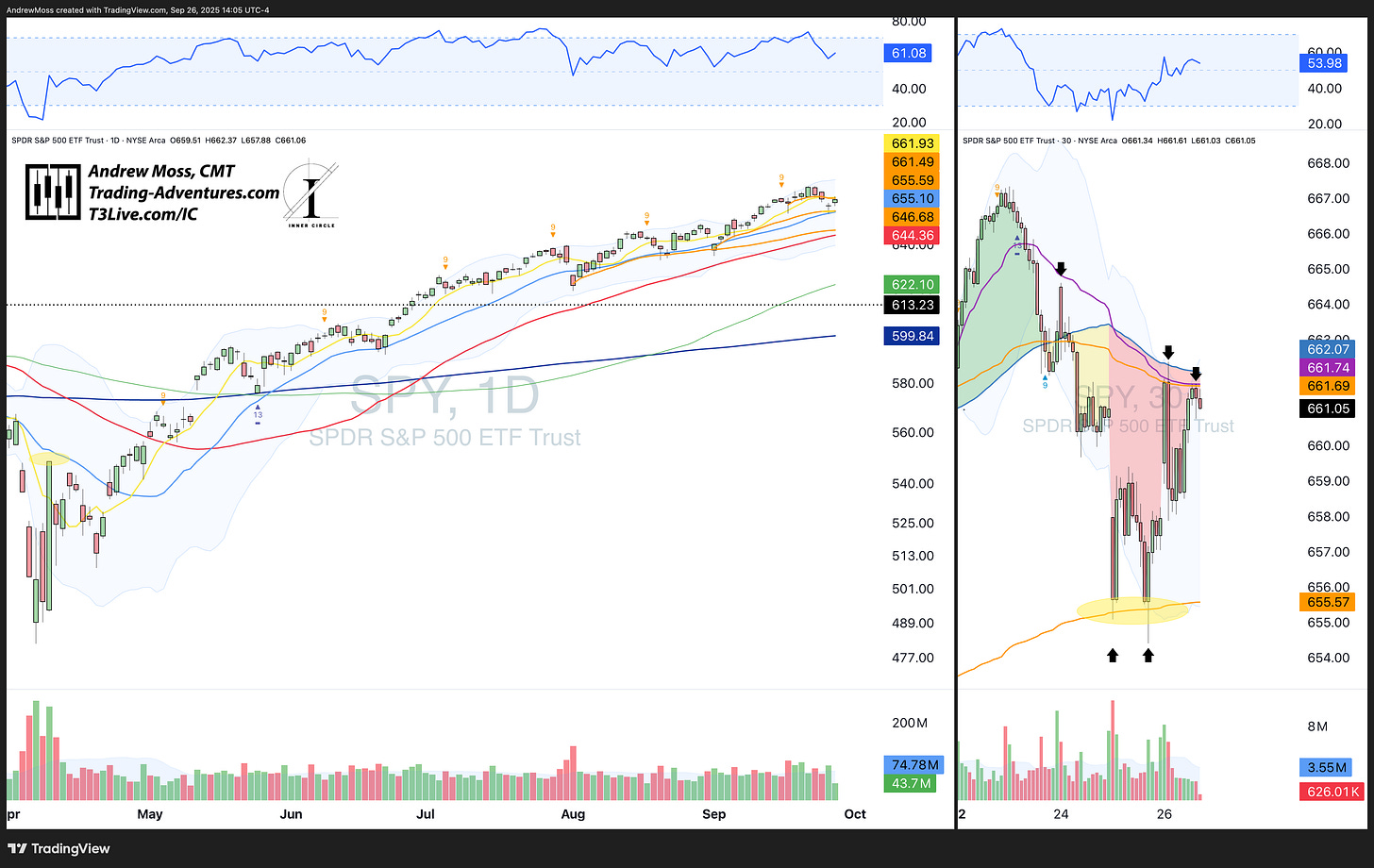

SPY chart showing Daily and 30-minute timeframes - with some preferred indicators — moving averages, AVWAPs, RSI, etc.

How to use Chart School

Find it in the top navigation under Chart School

Or jump straight to the Chart School index

Work lessons in sequence or dip into the index as needed

Reply with topic requests and examples you want me to cover

Visit the Chart School index and subscribe to get new lessons as they publish. These are the same tools I’ve used as a portfolio manager and continue to rely on in live markets every day.

Looking For More?

Elevate Your Trading Adventure Even Further With These Offerings.

EpicTrades Options Newsletter

Real-time trade ideas and insights, providing actionable trading insights focusing on options trades with short-term horizons, aiming to capitalize on weekly market movements.

The approach includes detailed reasoning for trades, specific options, and profit targets. It focuses on quick gains with a minimal time commitment from subscribers.

The Inner Circle

The Inner Circle is a Virtual Trading Floor (VTF) at T3 Live. I’ve been working and trading with this group since 2022. You may have noticed the logo in the watermarks on my charts.

Founded by David Prince and led by him, Rick March, and Kira Turner, the Inner Circle is a community of elite traders, including hedge fund managers, family office heads, corporate executives, financial advisors, and even professional poker players.

Fundamental, Macro, and Technical Analysis all combine to find and discuss the best opportunities in current markets.

The Disclosures

***This is NOT financial advice. This is NOT a recommendation to buy, sell, or trade any security. The content presented here is intended for educational purposes only.

Disclaimer

This content is for educational purposes only and is not investment advice.

This is like going to the candy store!