June 29, 2022, Mid-Week Market Update

There's not much for the bulls to hang onto today. The bears are growling and seem to be winning the battle.

We can see bear flags and/or rising wedges on the daily charts of the major indexes.

They didn't do what they needed to do; stay above the 8/21 EMAs. A retest of recent lows looks probable.

$SPY - bearish rising wedge breakdown with price closing below the 8-day EMA. Maybe a hammer? But I don't like it very much.

$QQQ bear flag breakdown with price closing below the 8-day EMA

$IWM bear flag breakdown with price closing at support from the pre-Covid high

The USD $ continues to rise $UUP

Commodities, a former leader, continue to get sold $GSG. And another bear flag breakdown could be in the works here.

$AMD is continuing lower towards the Bear flag measured move target

$NVDA is really struggling to hold 155 support

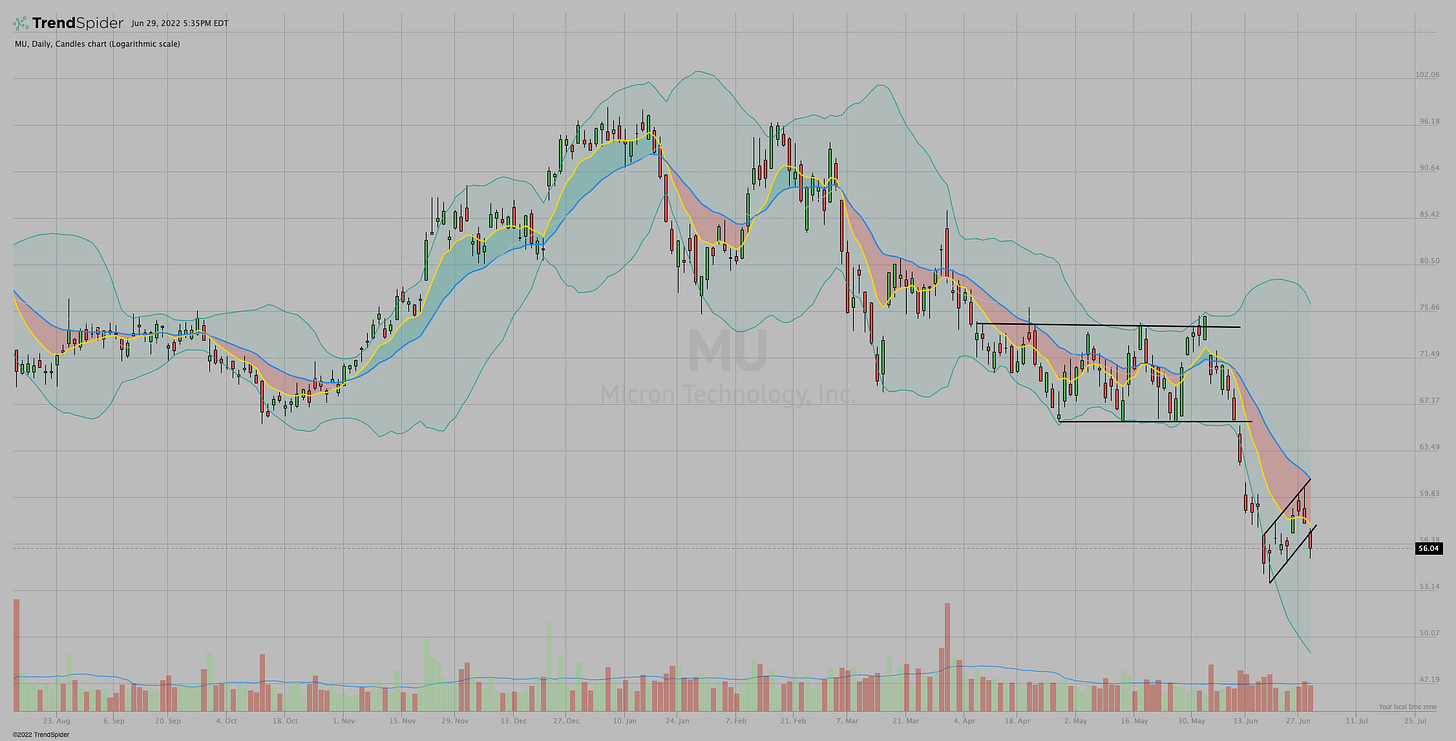

$MU earnings tomorrow, June 30. Bear flag break. Remember, usually, the news follows the price. We'll see how it goes this time.

So not much for me to do here on the long side. Attractive setups are few and far between.

On the bright side, one more trading day and we'll have some monthly and quarterly charts to go through.