Liftoff!

Market Update

The Markets

Tuesday, the world witnessed a historic liftoff.

Polaris Dawn, the latest mission from SpaceX, embarked on a journey from the Kennedy Space Center in Florida carrying a manned spacecraft pushing the boundaries of private, commercial spaceflight. “Resilience” reached an orbit higher than any human-crewed spacecraft in over 50 years, peaking at about 870 miles above Earth. That’s higher than NASA's Gemini 11 mission in the 1970s. It was also the first occurrence of a spacewalk by a private crew.

A truly historic event.

Yesterday, we saw another ‘liftoff’ as stocks ignited their burners and rocketed higher from the launchpad.

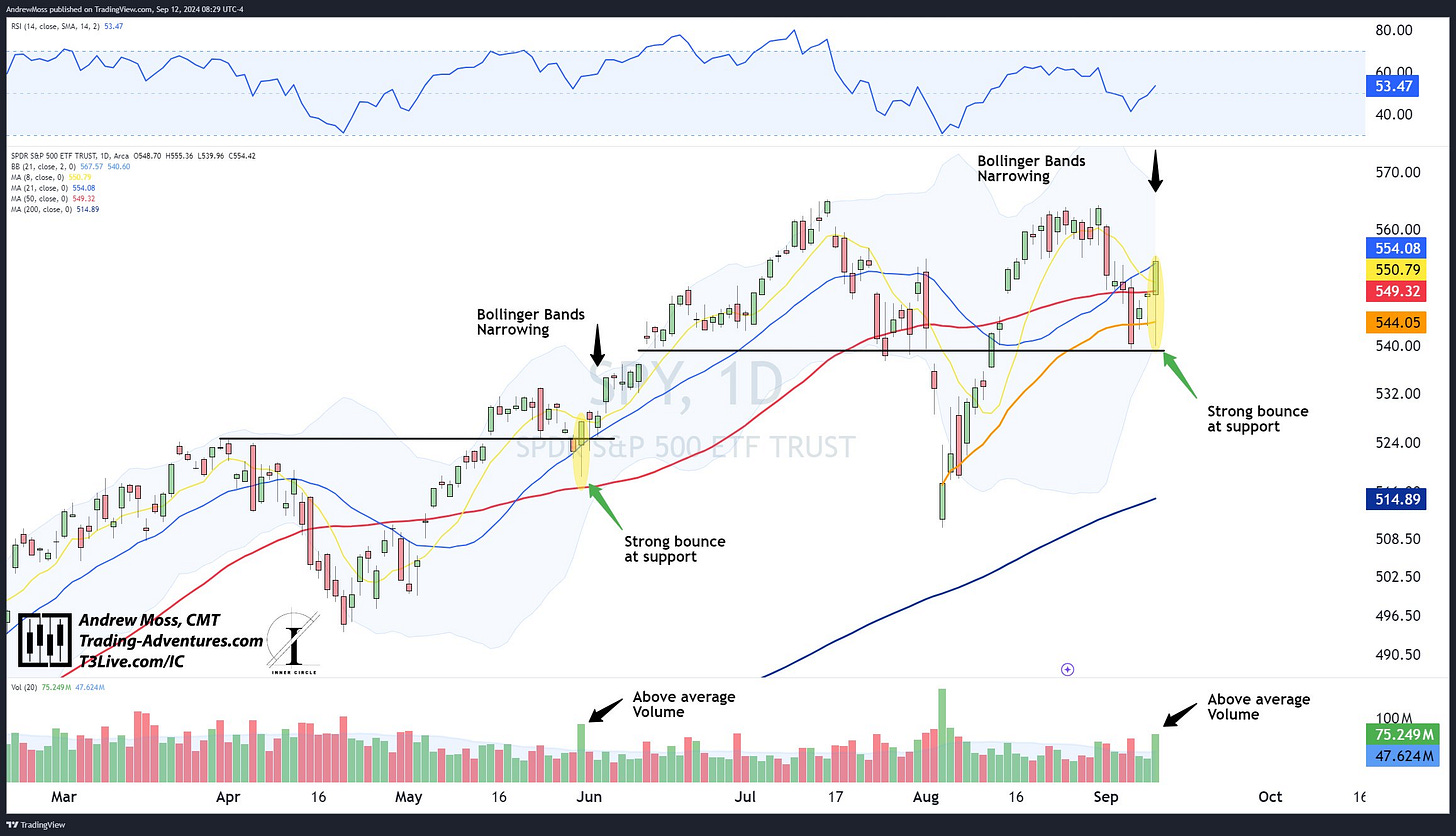

The latest CPI inflation data (Consumer Price Index) was released at 8:30 AM, initially sending stock prices lower. But then we saw an abrupt change. As SPY reached its pivot lows from Friday, August 6, buyers stepped in, taking over and sending prices sharply higher. This was largely attributable to a deeper consideration of inflation, the presumed impact on Federal Reserve interest rate policy, and some reassuring news from NVDA at the GPU Technology Conference.

Regardless of the supposed reasons, the price action was accute and has potentially significant implications.

Here’s my look from this morning, shared on X.

Let’s go to the rest of the charts for more updates.

The Charts

SPY gives day four higher and is back above all the key moving averages. Change happens fast. Just like that, it's back within striking distance of new highs. The logical expectation would be for a period of choppiness in front of recent highs, which should allow the 8-day MA to cross above the 21-day MA, putting all the technical pieces back into the proper place.

QQQ is also back above the key moving averages. However, the technical situation is a bit messy, with the 8-day MA below the 21-day MA, and both of those are still beneath the 50-day MA—no clear trend. Furthermore, price is still below $474-$475, the top of a major selling day in mid-July. The improvement is notable, but there is still work to be done.

IWM True to form, the small-cap index has even more work to do. It's back above the 8-day MA and the swing low AVWAP but below the 21 and 50-day MAs and the anchored VWAP from the July high—no clear trend.

DIA is doing almost everything right. Notice the bounce from trendline support last Friday and the top of the pivot area yesterday. The only thing askew is the 8-day MA crossing below the 21-day MA. That is worth watching, but it would be quickly resolved with a few more days of higher prices.

TLT continues to push higher, with the 8 and 21-day MAs rising in concert just beneath the price. Uptrend.

DXY didn’t stop cleanly at the declining 21-day MA, but after a brief trip above, it is sharply lower today and back below. Just the tailwind stocks needed. Now we can see if it tests the recent lows and bounces again or pushes even lower.

BTCUSD is percolating, trying to move higher. But it has only one job now — get and stay above ~$58,500 — a significant pivot level and the current home of the swing low anchored VWAP.

The Trade

Focusing on leaders and potential bounce/catch-up plays with reasonable risk management levels.

AMZN is breaking out.

META closed above is 8-day MA for the first time since the day it made a new all-time high.

GOOGL hit a key retracement level and bounced six points.

SBUX retested the swing high AVWAP and jumped $8.

All of these (and several more) were shared in real-time on X.

We never know when opportunities will show up. Often, it’s right when the world is most bearish. Patience, diligence, and consistency pave the way to success.

Always be prepared.

Elevate Your Trading

Education, training, and support for your Trading Adventure.

Options Trades - Weekly trade ideas are delivered to your email or text messages in language you can easily understand.

Check out EpicTrades from David Prince and T3 Live. Epic Trades from David Prince

Community - Are you an experienced trader seeking a community of professionals sharing ideas and tactics? Visit The Inner Circle, T3 Live’s most exclusive trading room - designed for elite, experienced traders.

The Inner Circle at T3 Live

Prop Trading - Or perhaps you are tested and ready to explore a career as a professional proprietary trader? 3 Trading Group has the technology and resources you need.

Click here to start the conversation:

T3TradingGroup.com

The Disclosures

***This is NOT financial advice. This is NOT a recommendation to buy, sell, or trade any security. The content presented here is intended for educational purposes only.

Andrew Moss is an associated member of T3 Trading Group, LLC (“T3TG”), an SEC-registered broker/dealer and member of FINRA/SIPC. All trades placed by Mr. Moss are done through T3TG.

Statements in this article represent that person’s opinions only and do not necessarily reflect those of T3TG or any other person associated with T3TG.

Mr. Moss may hold an investment position (or may be contemplating holding an investment position) that is inconsistent with the information provided or the opinion being expressed. This may reflect the financial or other circumstances of the individual, or it may reflect some other consideration. Readers of this article should consider this when evaluating the information provided or the opinions being expressed.

All investments are subject to the risk of loss, which you should consider in making any investment decisions. Readers of this article should consult with their financial advisors, attorneys, accountants, or other qualified investors before making any investment decision.

POSITION DISCLOSURE

September 12, 2024, 4:00 PM

Long: XBI0920C105

Short:

Options symbols are denoted as follows:

Ticker, Date, Call/Put, Strike Price

Example: VXX1218C30 = VXX 12/18 Call with a $30 strike

Enjoy your weekend! Nice work as always 🙂