Lower Highs, Lower Lows—and One Catalyst That Could Flip the Script

The Markets

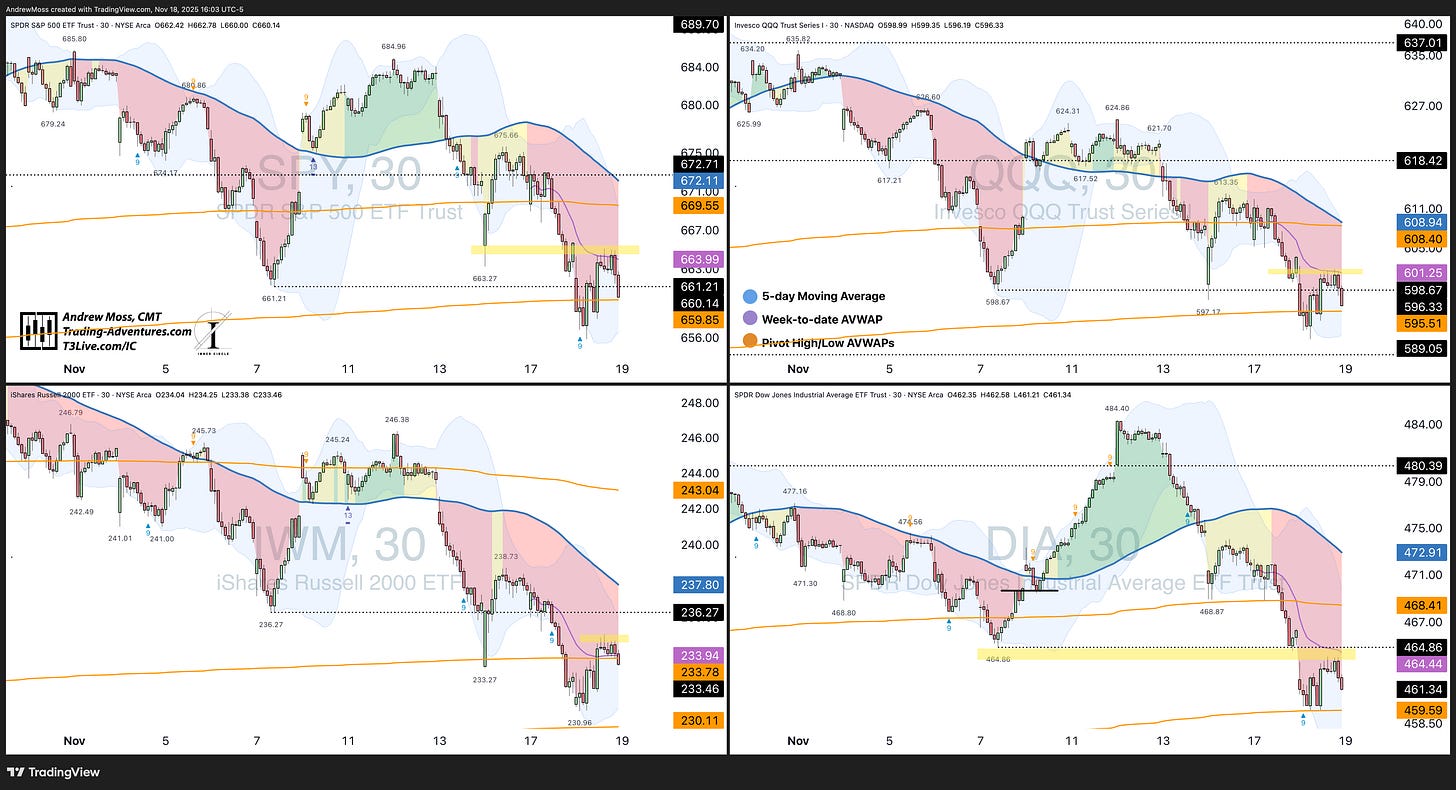

Across the major indices, we’re still in short-term downtrends.

SPY, QQQ, IWM, and DIA all failed to reclaim their week-to-date anchored VWAPs. The 5-day MAs remain firmly downward sloping—pressure remains intact.

SPY spent most of the session trying to clear overhead resistance before fading into the close. QQQ mirrored that action. IWM briefly popped above its WTD AVWAP but couldn’t hold. DIA didn’t even get there.

Until these levels are reclaimed—and the 5-day moving averages start to flatten and then turn—we remain in a cautionary environment.

There’s simply no evidence yet of sustained buying strength.

The Charts

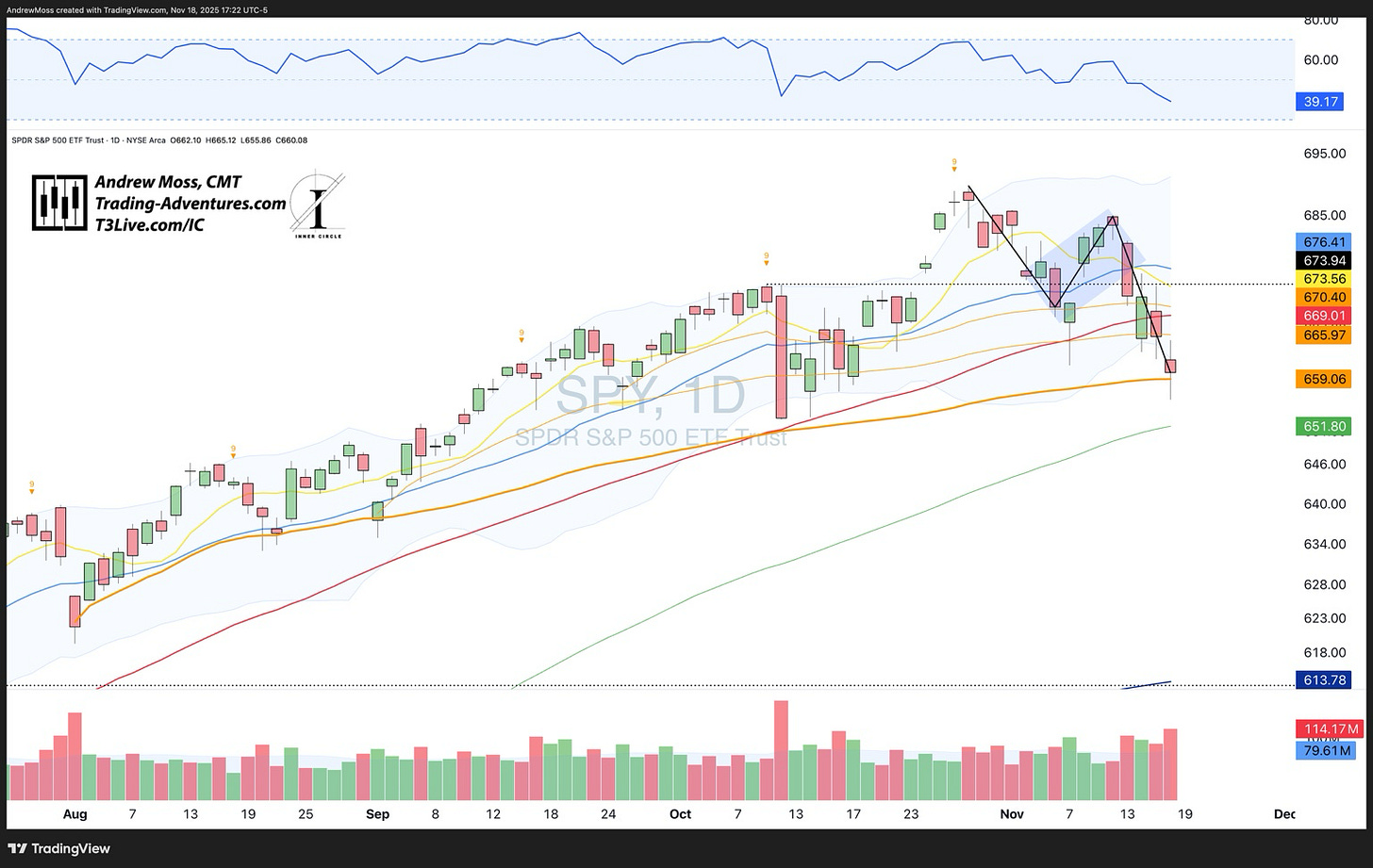

SPY / QQQ: Bear flag targets possibly achieved. Held VWAP from August lows—barely. RSI still sub-40, but not yet oversold.

IWM: Still the weakest. Two closes below the 100-day MA on rising volume. No evidence of stabilization.

DIA: Lost leadership. Closed outside lower BB with no bid. Potential support near 457–458.

VIX: Elevated and rising.

The index is back near 25, in line with levels seen during recent pullbacks. No signs of volatility easing—uncertainty remains elevated.

The Trade

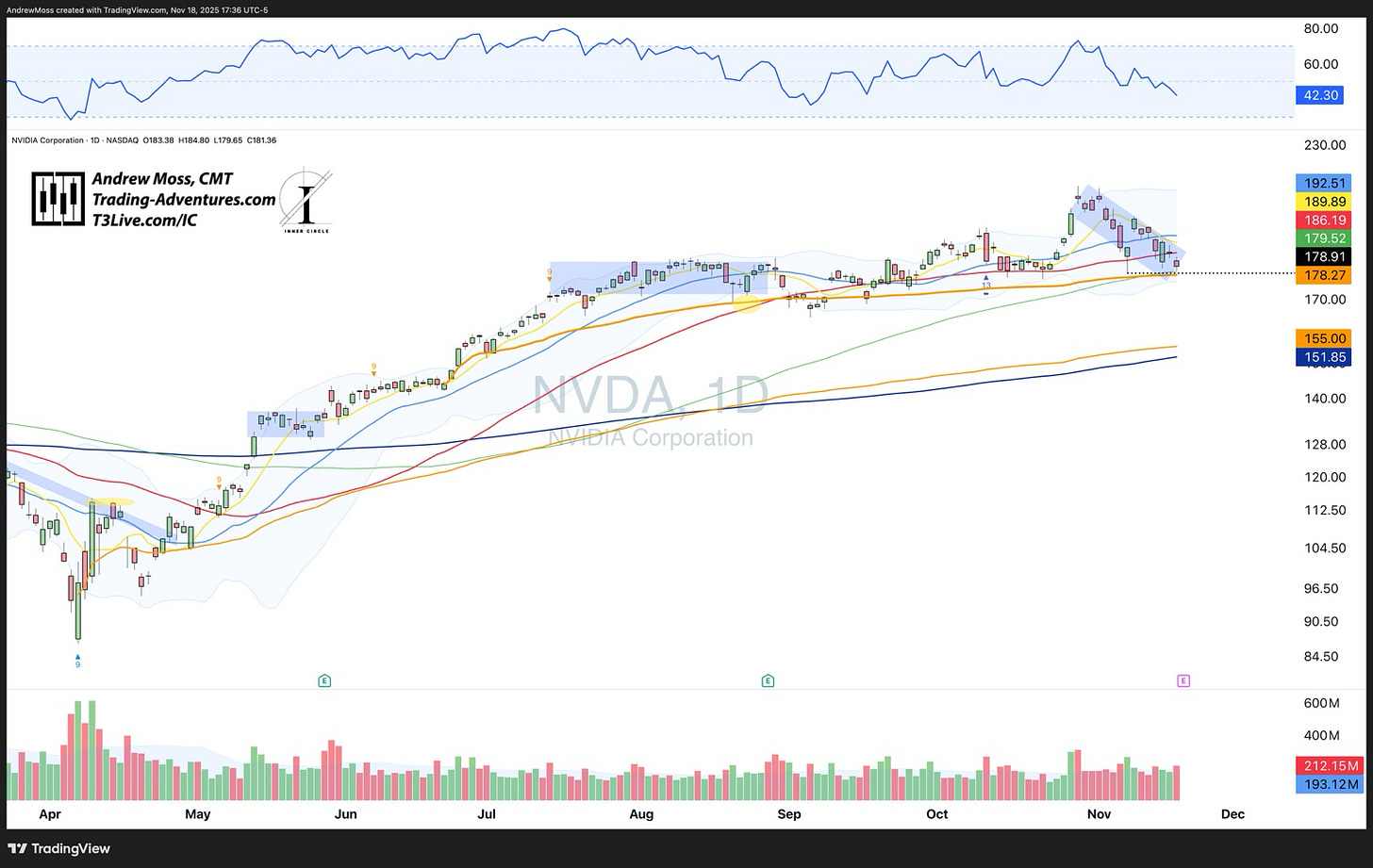

All eyes now turn to NVDA earnings after the close Wednesday.

Price has compressed into a tight range—classic coiling action ahead of a binary event.

Price action has been coiling inside a downward-sloping channel ahead of the report, currently testing the 100-day moving average and an anchored VWAP from the summer breakout.

The stock has gone nowhere for weeks—understandable ahead of a binary event. Jensen Huang’s commentary could ripple far beyond semiconductors, setting the tone for tech and the broader market. It’s a hinge moment.

We’ll be watching that closely. For now, the game plan is unchanged: avoid the urge to buy dips blindly. Let the short-term charts prove a shift. Let the roadmap turn. Until then, protect capital, stay patient, and wait for spots that offer clear, low-risk opportunity.

More updates in the morning.

Looking For More?

Elevate Your Trading Adventure Even Further With These Offerings.

EpicTrades Options Newsletter

Real-time trade ideas and insights, providing actionable trading insights focusing on options trades with short-term horizons, aiming to capitalize on weekly market movements.

The approach includes detailed reasoning for trades, specific options, and profit targets. It focuses on quick gains with a minimal time commitment from subscribers.

The Inner Circle

The Inner Circle is a Virtual Trading Floor (VTF) at T3 Live. I’ve been working and trading with this group since 2022. You may have noticed the logo in the watermarks on my charts.

Founded by David Prince and led by him, Rick March, and Kira Turner, the Inner Circle is a community of elite traders, including hedge fund managers, family office heads, corporate executives, financial advisors, and even professional poker players.

Fundamental, Macro, and Technical Analysis all combine to find and discuss the best opportunities in current markets.

The Disclosures

***This is NOT financial advice. This is NOT a recommendation to buy, sell, or trade any security. The content presented here is intended for educational purposes only.

Love this!