March 27, 2022 Market review/preview

$SPY $QQQ $IWM $TLT $VIX

Weekly Chart Time

$SPY

- Up ~9% in two weeks

- Back above the 10/40wk SMAs

- Exactly at the middle of the @bbands

- RSI back over 50

https://share.trendspider.com/chart/SPY/339539bk0we

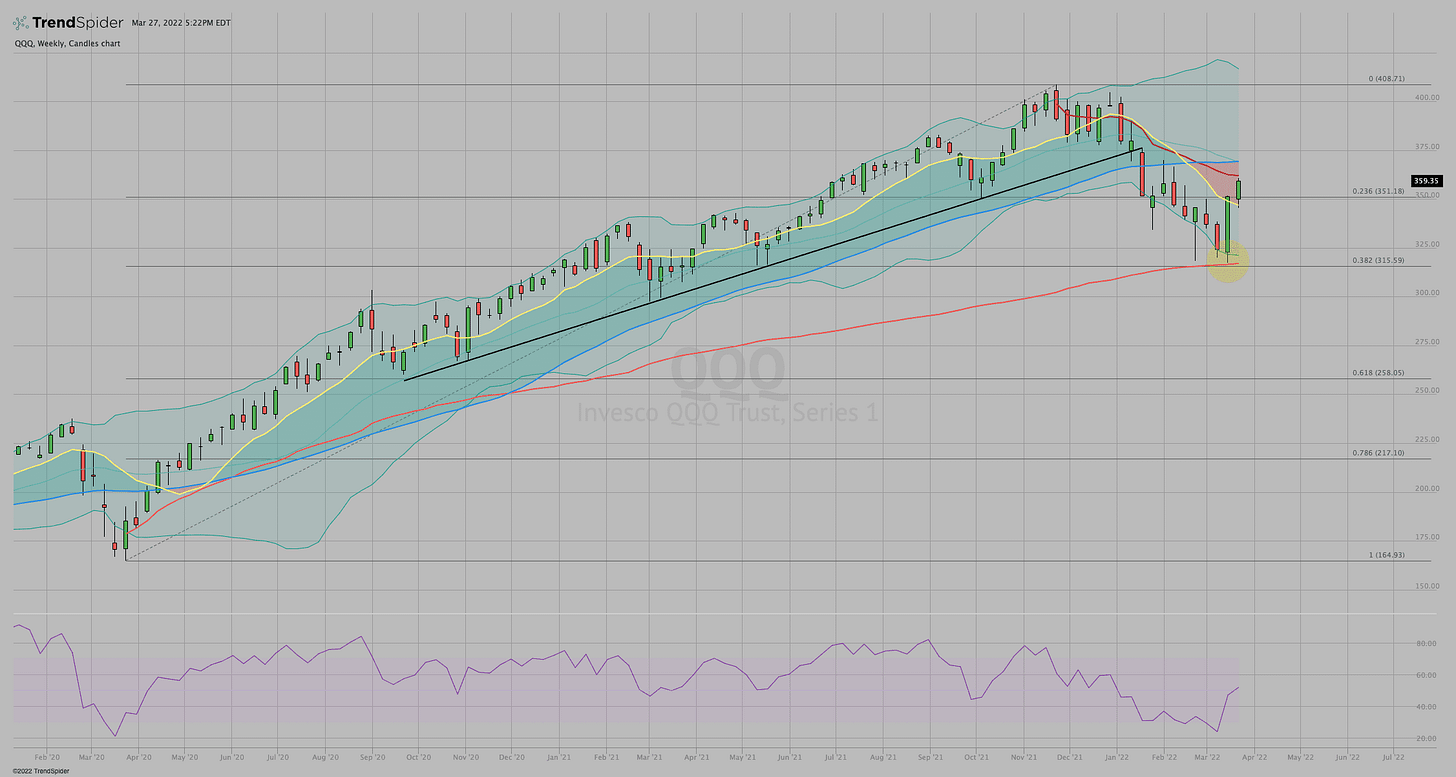

$QQQ

- ~13%+ low to high over two weeks

- Back into 10/40wk SMA cloud

- Strong bounce from the Covid low AVWAP and the 38.2% Fib retracement

- RSI just back over the 50 mark

- ATH AVWAP is just overhead

https://share.trendspider.com/chart/QQQ/339539sefdc

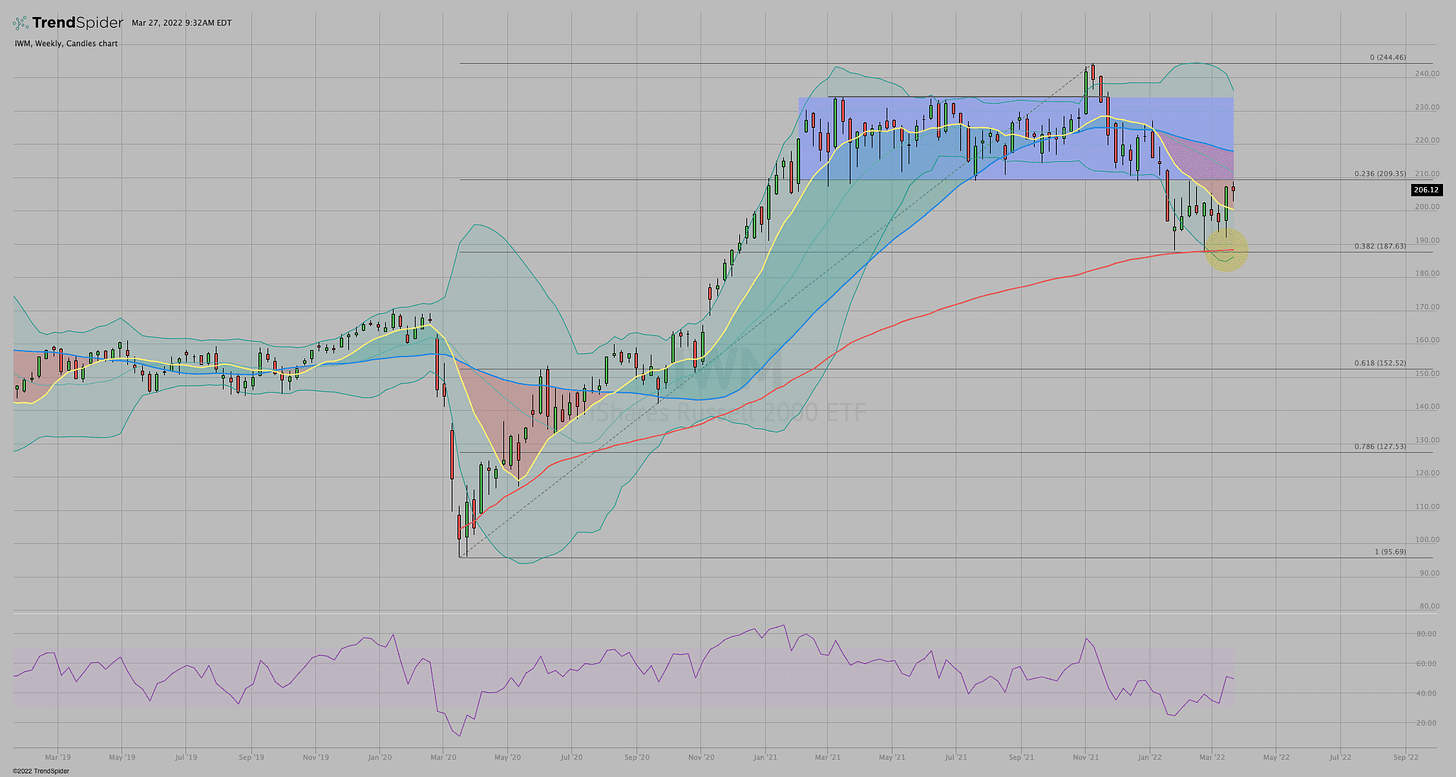

$IWM

- ~8%+ low to high over two weeks

- Back into the 10/40wk SMA cloud

- At bottom of the sideways channel

- Solid bounce from the Covid low AVWAP and the 38.2% Fib retracement

- $210 looks like resistance so far

- $211 is the ATH AVWAP

https://share.trendspider.com/chart/IWM/339539bn6x3

$TLT

- After showing a hammer last week that looked like it wanted to retest, TLT has confirmed the breakdown through 133.50-135

- RSI is low, oversold, and falling

https://share.trendspider.com/chart/TLT/339539bso4m

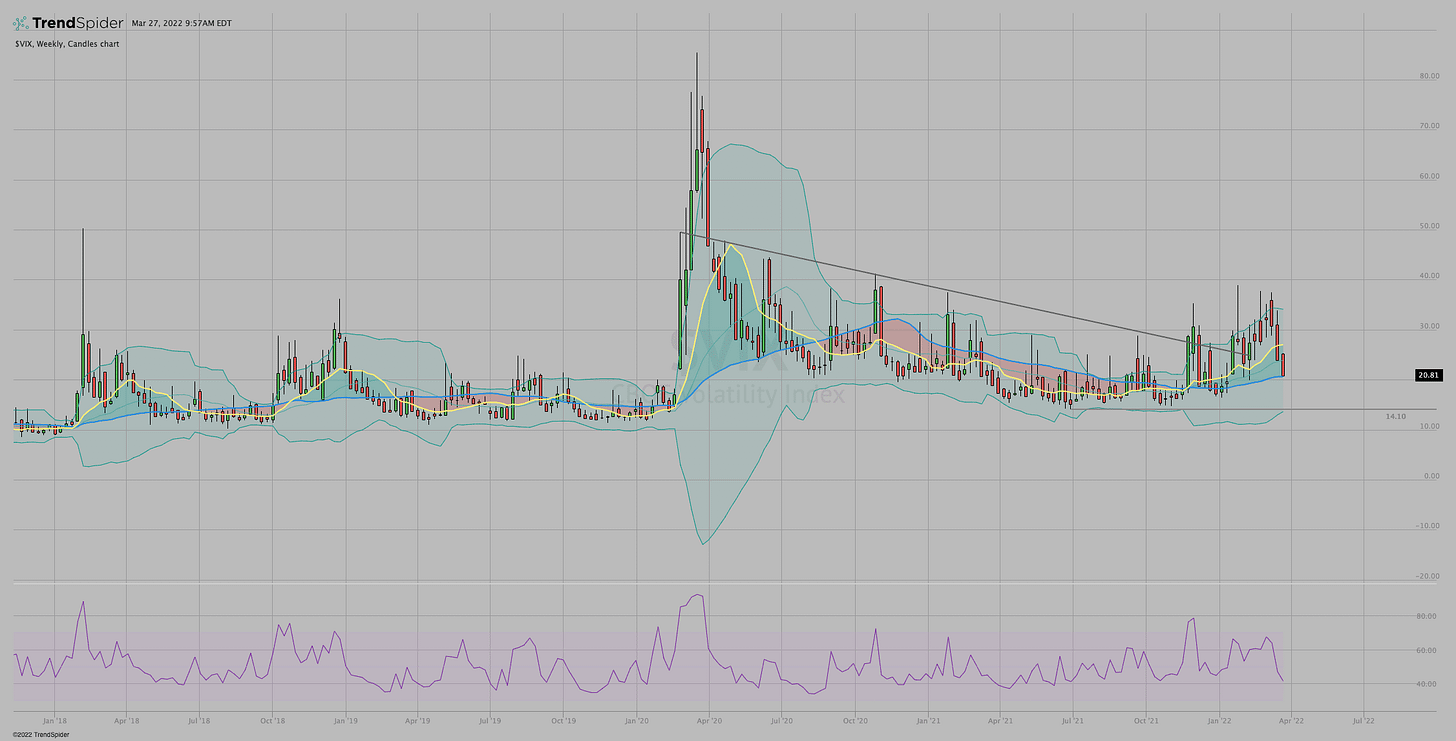

$VIX

- 3 consecutive lower weekly highs - 1/21/22 - 2/21/22 - 3/7/22

- Now back to 20

https://share.trendspider.com/chart/VIX/339539cirql

What next?

The sideways consolidation was actually more upward continuation. More layers of probability continue to show up adding to the bullish case. I remain cautious of "too far too fast", but in a bullish/buy-the-dip mindset and will work to choose entries carefully.

Adding fuel to the fire

Thanks to @Pdunuwila and @TheChartReport for pointing these out. This is the best, free, daily technical summary out there.

https://www.thechartreport.com/03-24-22/

I know, you know - "Past performance does not guarantee future results." There are no guarantees. But this helps the probabilities.

Good luck this week and trade 'em well.