The News

Friday afternoon, it was announced that SMCI would be added to the SP 500. That ignited an after-hours run in the already firey stock that continues today. The stock went up more than 25%, moving past $1,150 a share at the peak of the day.

Other chipmakers moved in sympathy. NVDA touched a new all-time high today at $876.95, and AMD was up more than 3% before backing off some.

In other news, AAPL stock continues to struggle amid a lack of new products and innovation. Last week, the company announced that it would abandon the “Apple Car” project, leaving some hopeful that it would free up more time and resources for an AI focus. The hope is not showing up on the chart as sellers continue pushing lower.

A breakdown from this consolidation pattern doesn’t look healthy, and the stock could see the low to mid $160s soon.

The war on obesity continues to be profitable for the makers of weight loss drugs and could be a damper on more traditional health and fitness businesses.

This chart shows a comparison of Eil Lilly LLY and Planet Fitness PLNT.

Weight loss drugs💉 vs. Gym memberships 💪

The Markets

Markets were mixed to start the week, with large caps down and small caps up and Bitcoin making new highs. It’s another busy week of earnings, Federal Reserve commentary, and employment data.

The calls for a pullback keep coming, and they will be right at some point. But so far, the strong, steady uptrend continues.

Mind the charts and the trailing support levels on the way up.

The Charts

SPY started strong and had a late-day selloff, resulting in a potential reversal candle on the daily chart. It remains above the recent pivot level and all key moving averages.

QQQ was able to get into positive territory for a short while today before closing down. It, too, remains above the recent pivot level and all key moving averages.

IWM was the leader most of the day, but its late-day selloff left it closing down nearly as much as SPY. This move is proving to be a pretty frustrating breakout. However, once again, it remains above the recent pivot level and all key moving averages.

DIA keeps moving sideways as it recollects the 8 and 21-day MAs.

TLT is still in the range.

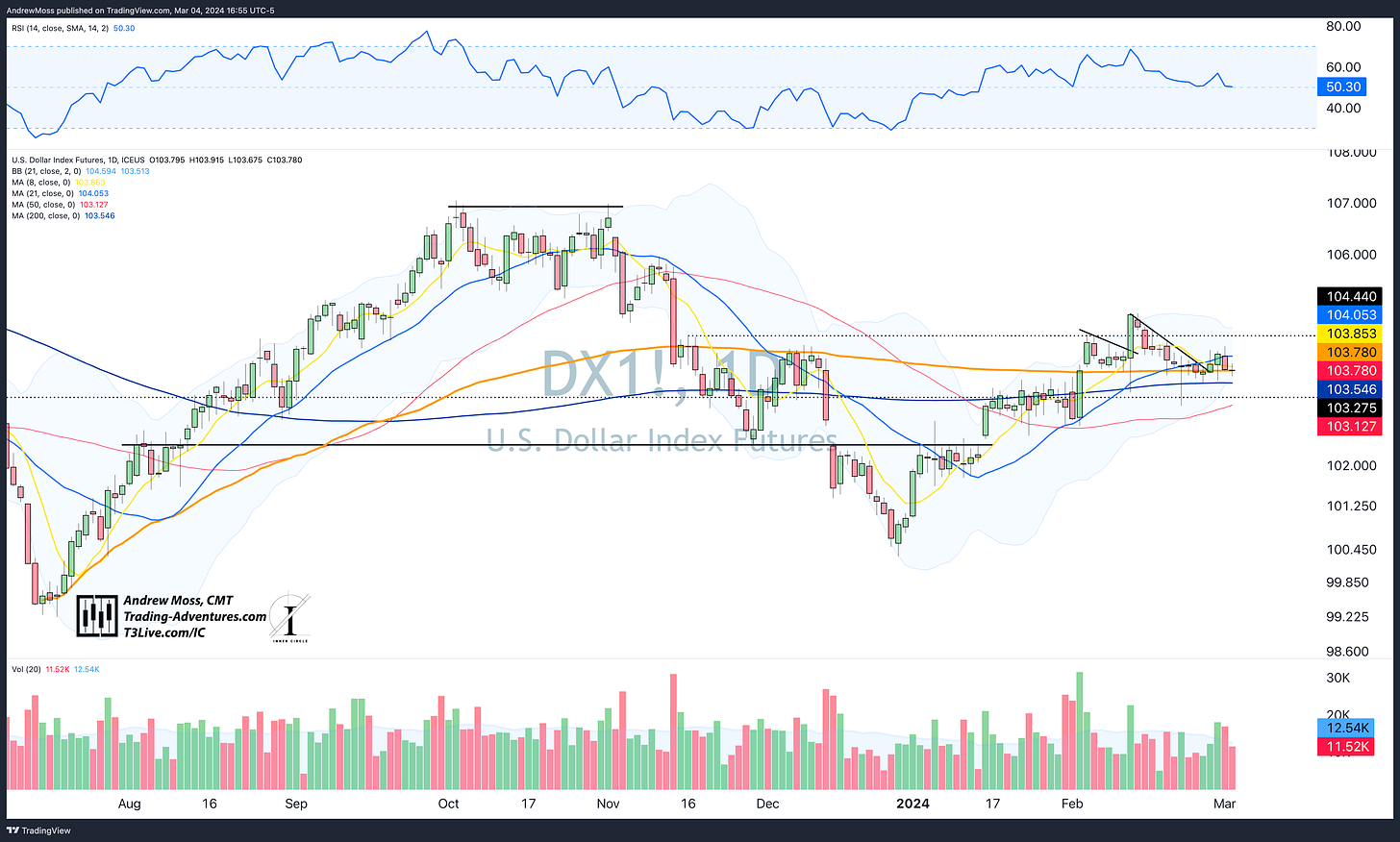

DXY US Dollar futures continue to ride along the volume weighted average price anchored to the July low.

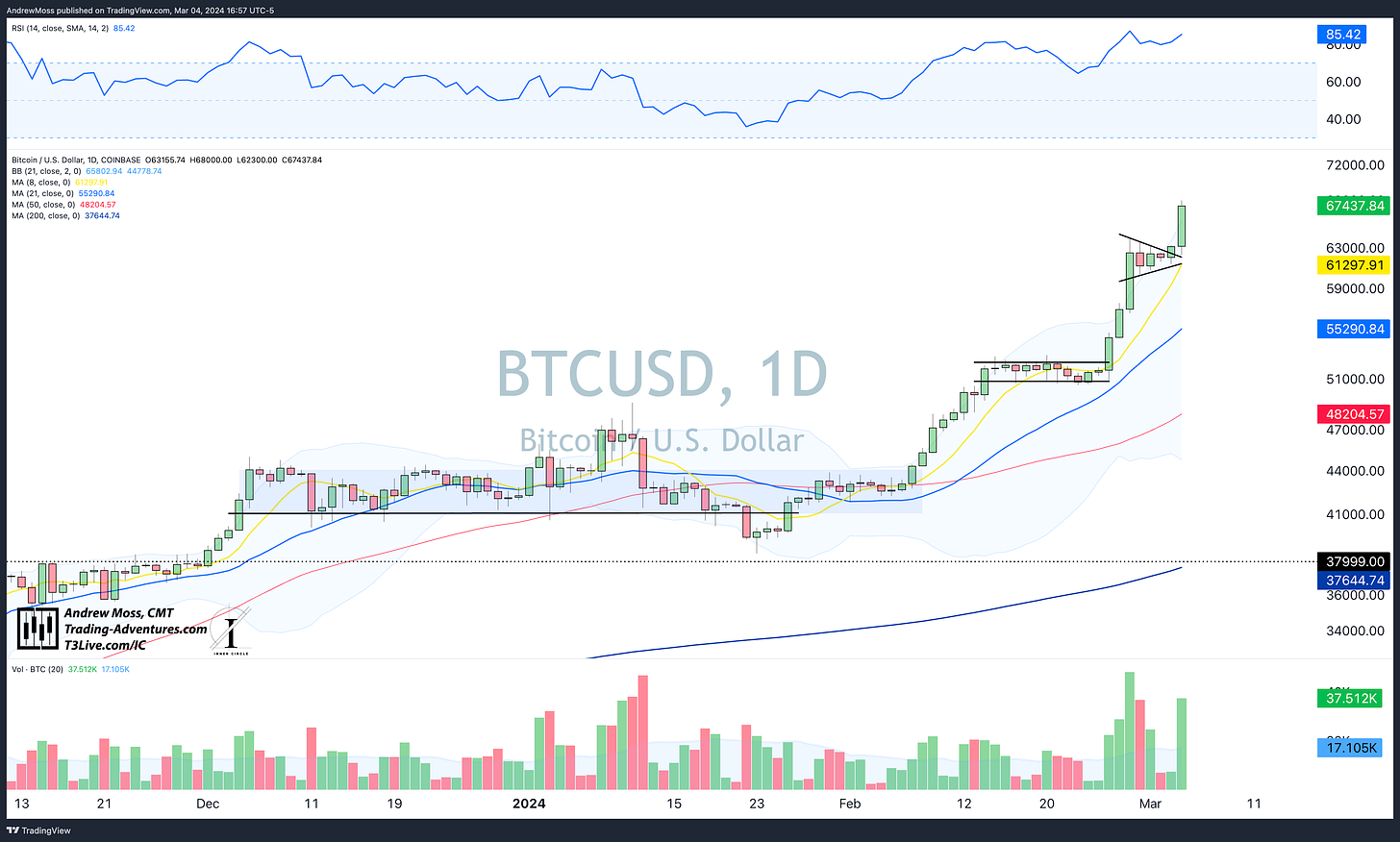

BTCUSD with another breakout.

Consolidate > break higher > Consolidate > break higher > Consolidate > break higher

In other words - an uptrend.

The Closing Bell

There is the start of the first full week of March. The stocks are strong and trending higher still. And with that are the calls for a much-needed rest or pullback. Those are getting louder and more frequent as well.

It will happen at some point. Maybe today’s late-day selloff is the start?

That’s not an attempt to inject fear but a reminder to guard against complacency. As traders, we take some profit along the way and move stops up underneath.

That way, when the pullback comes, we remain clear-headed rather than rattled by losses. And a clear head is better at managing risk and more willing to jump at new opportunities.

Elevate Your Trading

Education, training, and support for your Trading Adventure.

Options Trades - Weekly trade ideas are delivered to your email or text messages in language you can easily understand.

Check out EpicTrades from David Prince and T3 Live. Epic Trades from David Prince

Community - Are you an experienced trader seeking a community of professionals sharing ideas and tactics? Visit The Inner Circle, T3 Live’s most exclusive trading room - designed for elite, experienced traders.

The Inner Circle at T3 Live

Prop Trading - Or perhaps you are tested and ready to explore a career as a professional proprietary trader? 3 Trading Group has the technology and resources you need.

Click here to start the conversation:

T3TradingGroup.com

The Disclosures

***This is NOT financial advice. This is NOT a recommendation to buy, sell, or trade any security. The content presented here is intended for educational purposes only.

Andrew Moss is an associated member of T3 Trading Group, LLC (“T3TG”), an SEC-registered broker/dealer and member of FINRA/SIPC. All trades placed by Mr. Moss are done through T3TG.

Statements in this article represent that person’s opinions only and do not necessarily reflect those of T3TG or any other person associated with T3TG.

Mr. Moss may hold an investment position (or may be contemplating holding an investment position) that is inconsistent with the information provided or the opinion being expressed. This may reflect the financial or other circumstances of the individual, or it may reflect some other consideration. Readers of this article should consider this when evaluating the information provided or the opinions being expressed.

All investments are subject to the risk of loss, which you should consider in making any investment decisions. Readers of this article should consult with their financial advisors, attorneys, accountants, or other qualified investors before making any investment decision.

POSITION DISCLOSURE

March, 4, 2024, 4:00 PM

Long:

Short:

Options symbols are denoted as follows:

Ticker, Date, Call/Put, Strike Price

Example: VXX1218C30 = VXX 12/18 Call with a $30 strike