Market Update – July 31, 2025

Meta & Microsoft rally — but the broader market stumbles.

Note: I’m off the desk today and tomorrow for one last long weekend family trip to the lake before the big college move-in day. But, with so much happening in the market, I wanted to send a quick look at the charts. However, there will not be a Weekly Chart article on Saturday.

Today’s “Good morning ☕” from X.

The Markets

META and MSFT crushed earnings expectations — jumping roughly +11% and +4% — but the celebration didn’t spread far. Outside of those names, the market lost steam into the close, with other sectors seeing little follow‑through.

The heaviest hitters of the week — the Fed decision, major Big Tech earnings, and PCE inflation data — are now in the rearview. The only catalyst left on this week’s crowded calendar is Nonfarm Payrolls tomorrow morning. Positioning and sentiment suggest many traders are content to wait for that number before making their next move.

After the bell, AAPL traded higher and AMZN lower on their earnings releases. Meanwhile, SPY closed below its 8‑day moving average, QQQ is testing it, the Dollar and VIX pushed higher, and TLT tagged its 100‑day.

Here’s a look at the charts.

The Charts

SPY closed below its 8‑day simple moving average for the first time in weeks, a notable short‑term momentum shift.

QQQ is still testing that same level.

IWM and DIA finished below their 21‑day SMAs, showing continued underperformance from small caps and industrials.

TLT tested its 100‑day SMA today before backing off — a sign that bonds are still trying to find their footing in this rate environment.

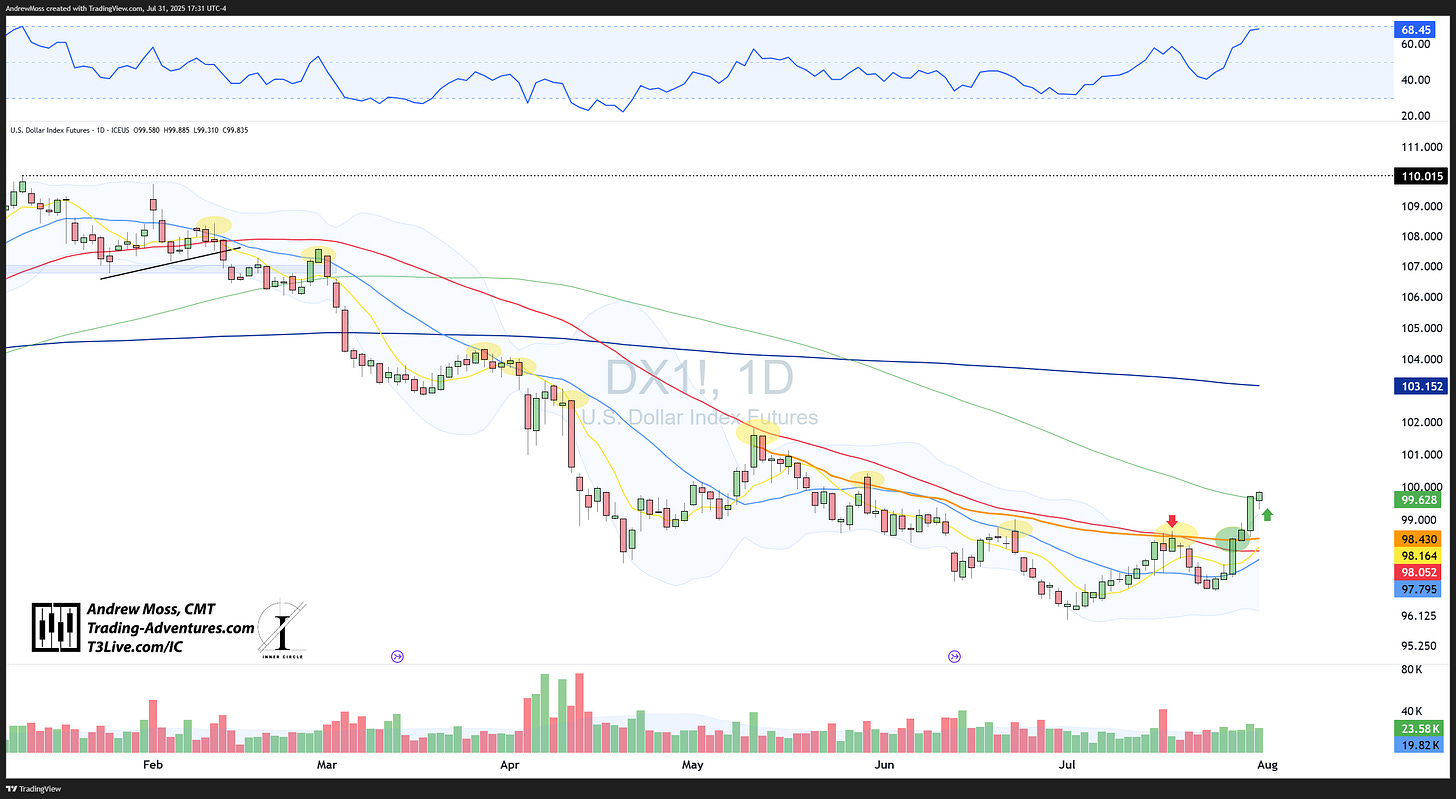

DX1! (Dollar) and VIX both pushed higher, adding pressure.

BTCUSD remains flat but not broken. Tech leadership is working, but crypto is currently sidelined.

The Trade

It’s still a bull market, but it’s now showing short‑term cracks. Earnings wins from mega‑caps are being offset by broader weakness, rising volatility, and a firm dollar.

With NFP ahead tomorrow, the focus is on risk control: tighten exposure, respect key moving averages, and avoid chasing until price confirms new momentum.

Looking For More?

Elevate Your Trading Adventure Even Further With These Offerings.

EpicTrades Options Newsletter

Real-time trade ideas and insights, providing actionable trading insights focusing on options trades with short-term horizons, aiming to capitalize on weekly market movements.

The approach includes detailed reasoning for trades, specific options, and profit targets. It focuses on quick gains with a minimal time commitment from subscribers.

The Inner Circle

The Inner Circle is a Virtual Trading Floor (VTF) at T3 Live. I’ve been working and trading with this group since 2022. You may have noticed the logo in the watermarks on my charts.

Founded by David Prince and led by him, Rick March, and Kira Turner, the Inner Circle is a community of elite traders, including hedge fund managers, family office heads, corporate executives, financial advisors, and even professional poker players.

Fundamental, Macro, and Technical Analysis all combine to find and discuss the best opportunities in current markets.

The Disclosures

***This is NOT financial advice. This is NOT a recommendation to buy, sell, or trade any security. The content presented here is intended for educational purposes only.