$META Trips, Markets Rip: New Peaks in Play

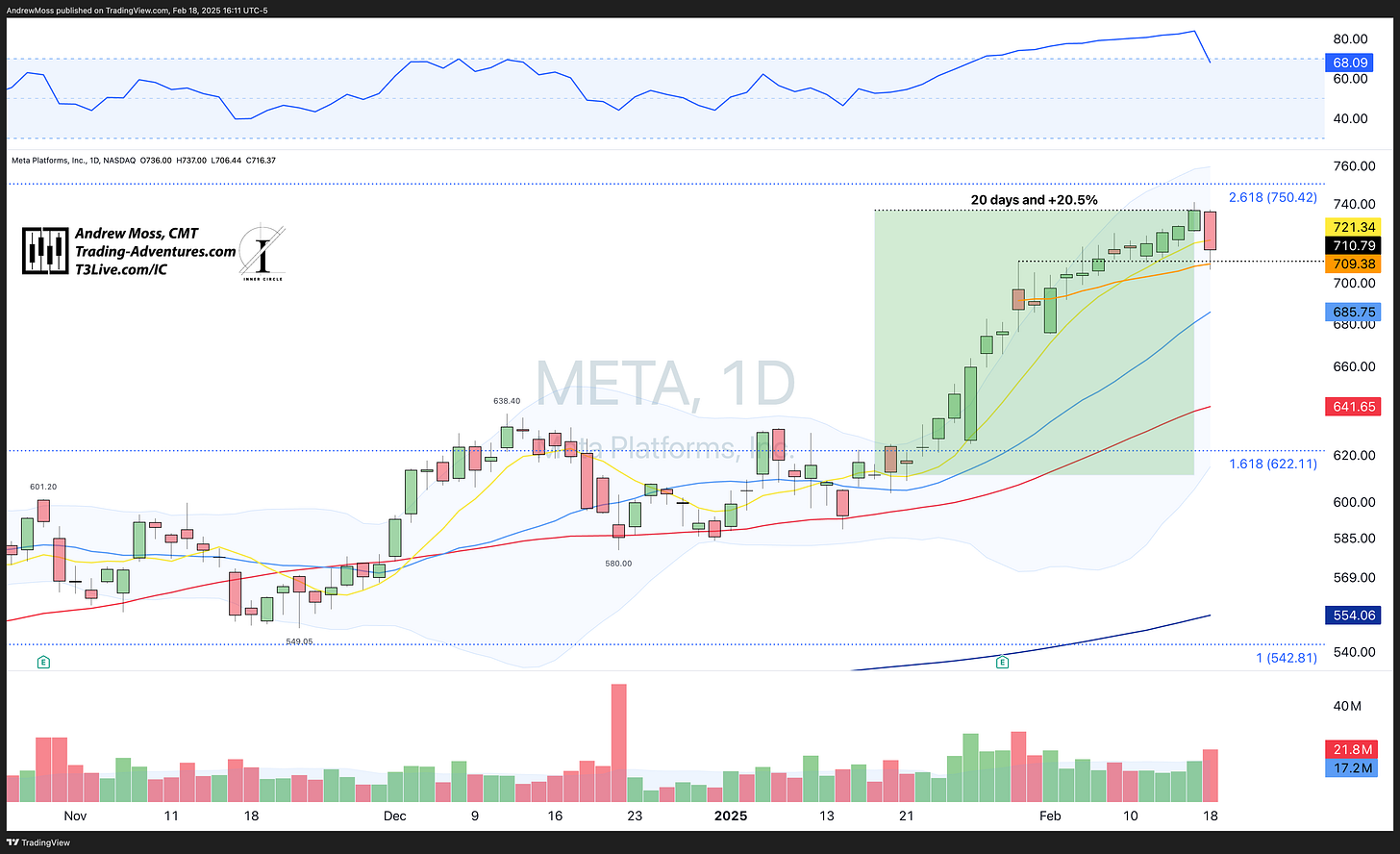

$META's 20-Day Record Run Hits the Wall

The Markets

META snaps the streak with a selloff day that wipes out the last six days of gains.

One big red candle brought the price back into equilibrium between the 8- and 21-day MAs. The RSI cooled, finishing the day near 68 after hitting nearly 84. All of this occurred with heavier-than-average volume, especially during the strong rally in the last 30 minutes of the session.

Nothing goes straight up forever. In fact, no mega-cap tech company stock has gone up for 20 days like META has since, well, ever.

Bearish?

Nope. In fact, the cooling off could very well lead to the next attractive buying opportunity. Early support has already been found at the $710.79 pivot and earnings AVWAP. We’ll see how that holds in the coming days.

The Charts

SPY clocks another new closing high. After feeling lethargic most of the day, stocks rallied into the close, finishing at new highs.

QQQ did it, too, closing above the Dec. pivot high and logging a new all-time daily closing high.

IWM is still in the fight. But it's 5 on 1 with a $226.69 pivot level, and the 8, 21, 50, and 100-day MAs are all ganging up. It closed above all of those, but not by much.

DIA is parked on its 8 and 21-day MAs to start the week.

TLT just can’t keep it up. It closed the day back below the pivot and 8/21/50-day MAs.

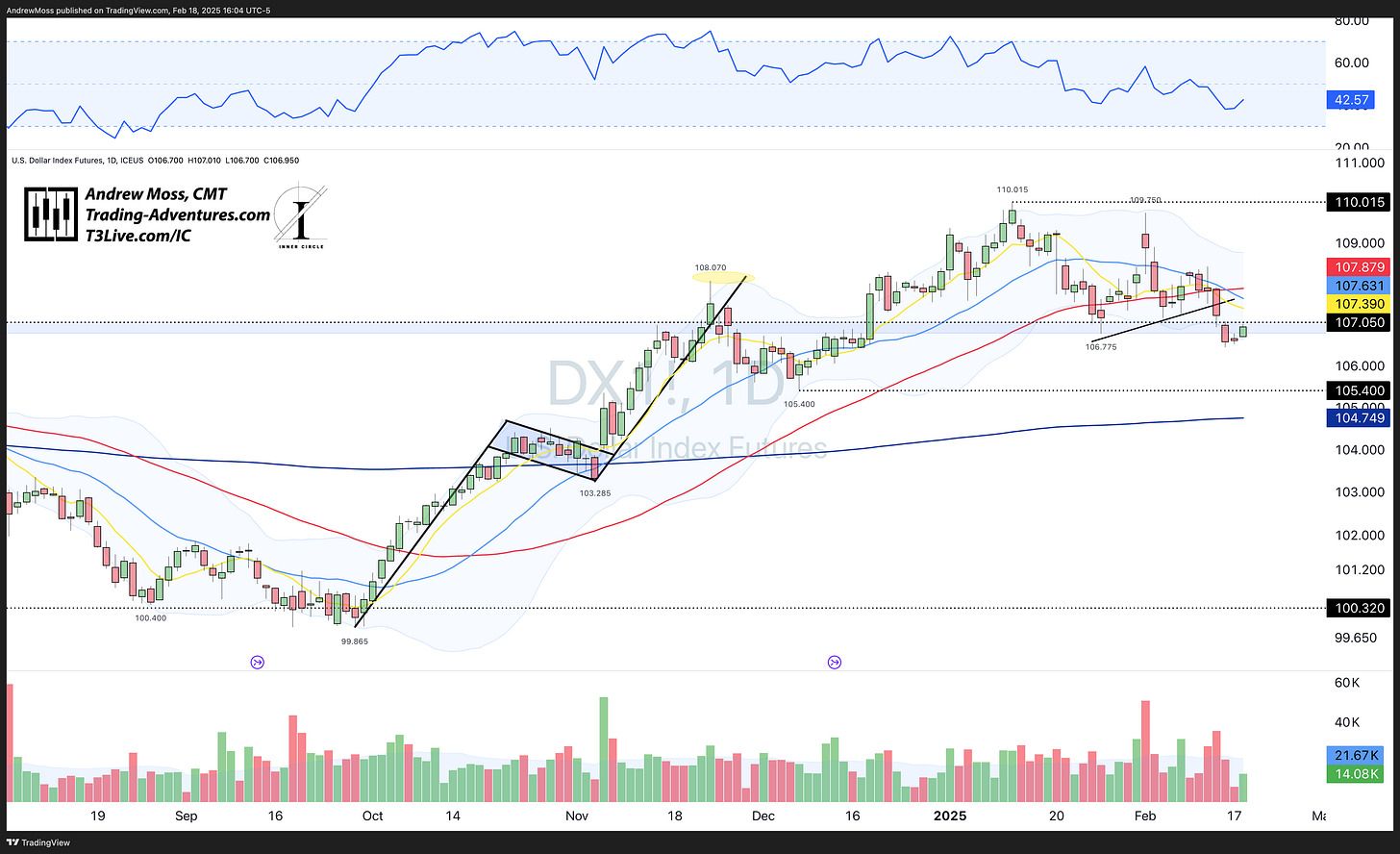

DXY Dollar futures found a reprieve and stopped the downward slide, at least for today. The $107.05 pivot is the lid.

BTCUSD broke lower from the consolidation area — a result that would normally produce a sizeable move. However, the resilience on dips coupled with an inability to break higher is exactly what has kept prices contained for the last three months or more. You can see on the chart that price has already rebounded back into the yellow-shaded area.

The Trade

Bull market things.

Stocks keep going up in the face of increasing worry and anxieties, mostly about rates, tariffs, Russia, political battles, etc. You know, all of the same things the market has worried about for the last 60 or 70 years.

So, what’s the best trade out there?

Looking For More?

Elevate Your Trading Adventure Even Further With These Offerings.

EpicTrades Options Newsletter

Real-time trade ideas and insights, providing actionable trading insights focusing on options trades with short-term horizons, aiming to capitalize on weekly market movements.

The approach includes detailed reasoning for trades, specific options, and profit targets. It focuses on quick gains with a minimal time commitment from subscribers.

The Inner Circle

The Inner Circle is a Virtual Trading Floor (VTF) at T3 Live. I’ve been working and trading with this group since 2022. You may have noticed the logo in the watermarks on my charts.

Founded by David Prince and led by him, Rick March, and Kira Turner, the Inner Circle is a community of elite traders, including hedge fund managers, family office heads, corporate executives, financial advisors, and even professional poker players.

Fundamental, Macro, and Technical Analysis all combine to find and discuss the best opportunities in current markets.

The Disclosures

***This is NOT financial advice. This is NOT a recommendation to buy, sell, or trade any security. The content presented here is intended for educational purposes only.