Mid-week Market check in

$SPY $QQQ $IWM $VIX

Progress for the bulls. Here's what I see.

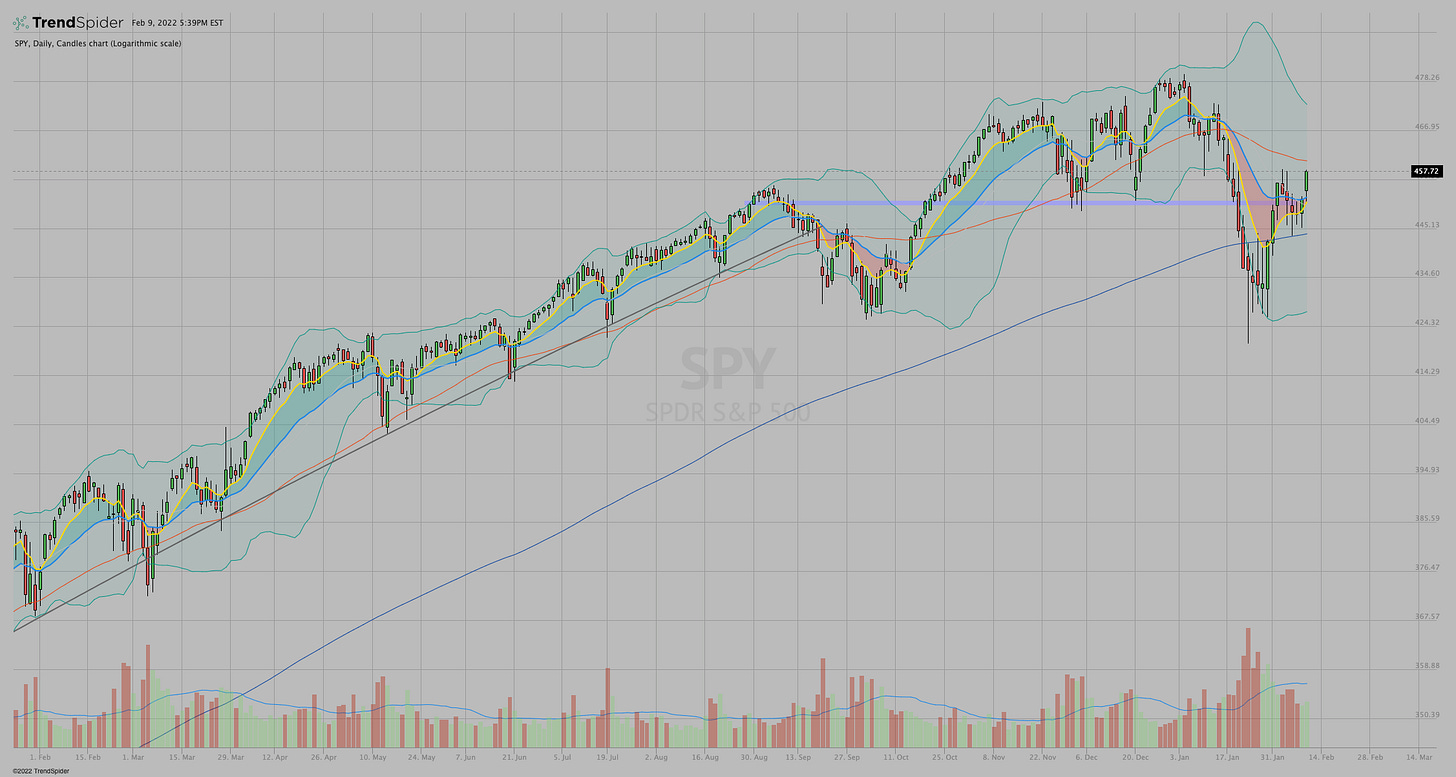

The SPY is back over the 8/21/200 day moving averages and close to the highs we saw this time last week.

Next hurdle is the 50sma.

After a big run up into last Wednesday its had a constructive consolidation and the 8ema is closer to crossing above 21ema.

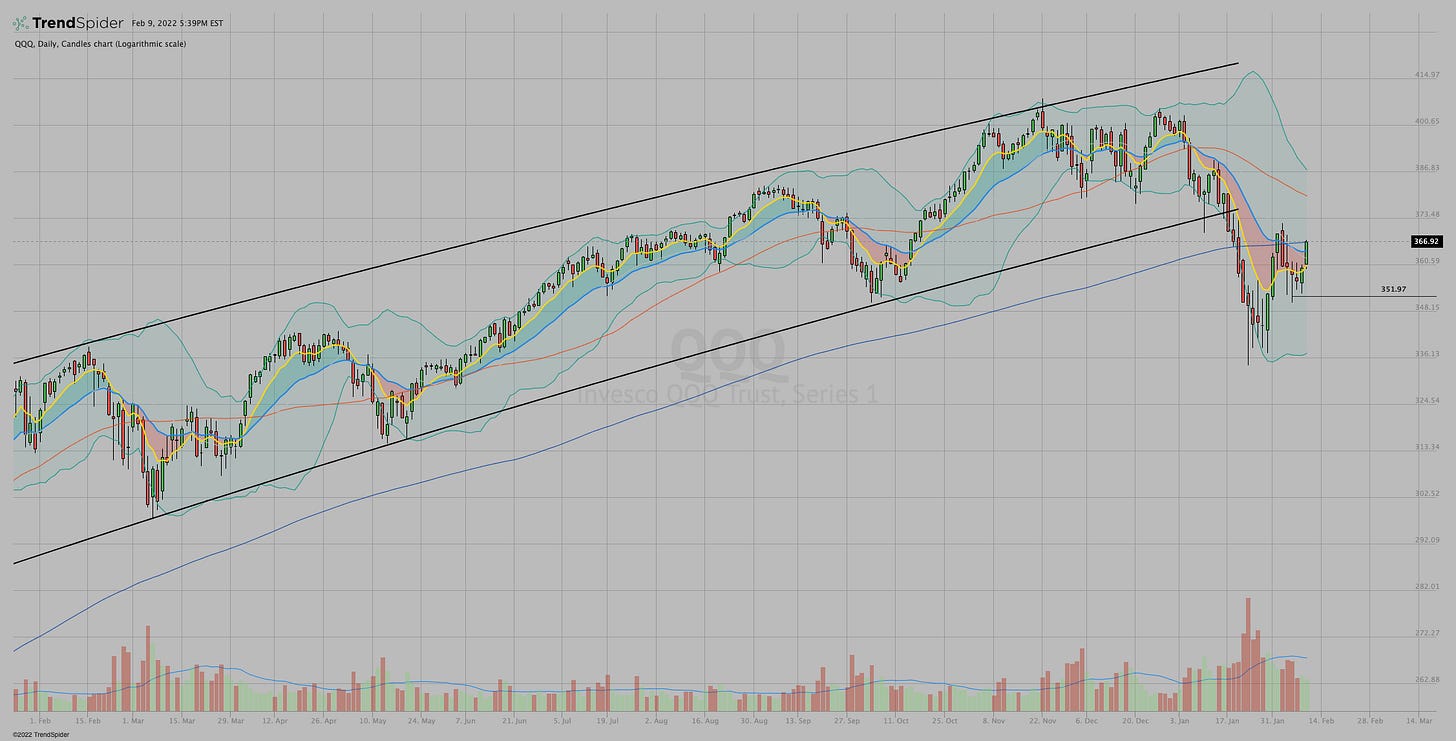

QQQ is following suit and while its not quite back to the level of last Wednesday it did close right at the 200ma.

The next test here is the high of last Wednesday and then the 50ma

IWM is rounding out the improvement in the major indexes.

The pattern here is encouraging for the bulls and the 8ema is close to crossing above the 21ema.

The next test here is to get back into the long consolidation range and then back over the 50sma

VIX continues to decline and is back below 20. Progress.

As always, position sizing and risk management are the keys to successful trading. We never know what's next in the markets. Be ready for anything.

Thanks for reading. If you liked this post from Trading Adventures, please leave a comment or share it with a friend?

You can also find me at these links:

https://medium.com/@Andy__Moss

www.linkedin.com/in/andrewcmoss

***This is NOT financial advice. NOT a recommendation to buy, sell, or trade any security. The content presented here is intended for educational purposes only.