Mid-week market update

Resistance

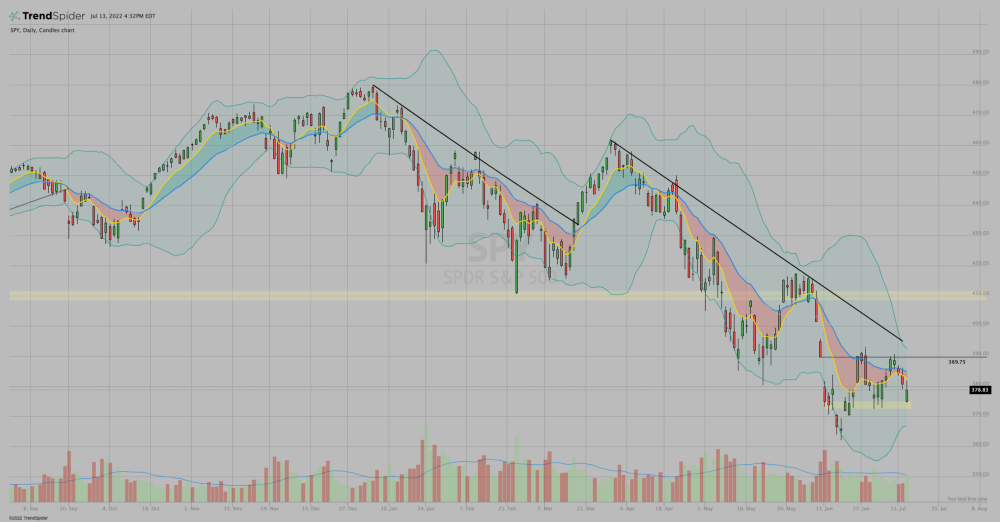

It hasn’t been a good week so far for the bulls. The story hasn’t changed much. Inflation rules all, for now. Over the weekend we examined a few changing trends and some potential opportunities and obstacles they could bring.

The first three trading days this week haven’t completely flipped the story upside down, but they haven’t been a lot of help either.

$QQQ hit resistance and reversed lower. It’s back below the 8 & 21-day EMAs and appears to be headed toward last week’s low, 276.75. On the positive side, it did seem to handle today’s hot CPI number fairly well and was even able to go green for a little while.

If you squint while looking at the chart above, you may be able to see that it found the bottom for the day right at the down trendline on this chart. Potential support? We’ll see. But I’m not counting on it.

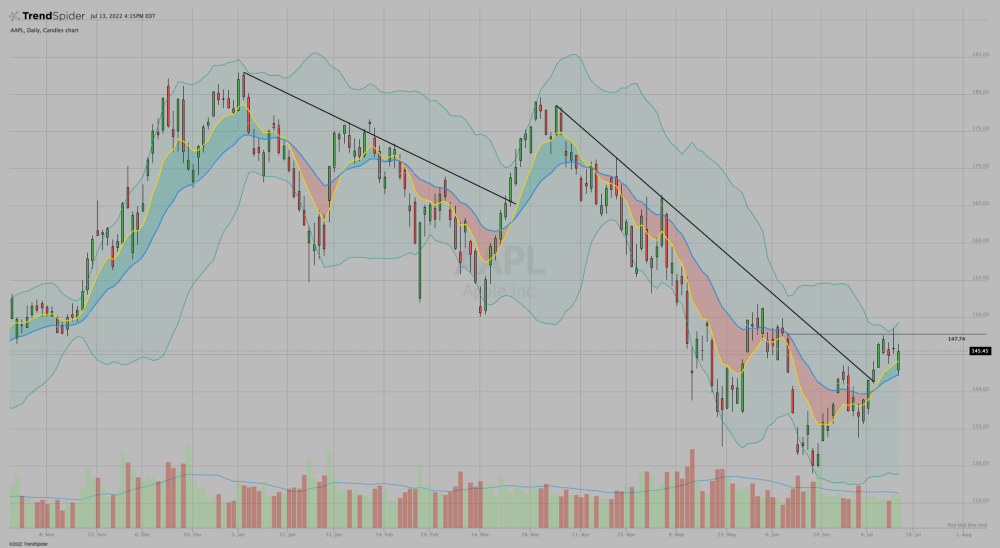

$AAPL also failed to close above the resistance level after trading above it Tuesday. It did find some short-term support today at the 21-day EMA. A move higher from here would be a higher low. If it loses the 21 EMA lookout for $140 and $135.

$ARKK couldn’t get follow through and subsequently moved lower. The $34.50-$47 sideways channel is could prove meaningful and a break from it in either direction should be a tradeable move. I don’t see much reason to be involved until that happens.

Many other charts tell a similar story. It’s the same story we’ve heard many times this year; a modest bounce in a down-trending bear market. So keep in mind the prevailing trend, know what levels are important, and structure your game plans accordingly.

$SPY 372.50 and $QQQ 276.60 could act as some support and I’ll watch for those levels to hold up first, if we sell down further.

Like every day lately, wait to see the price action tomorrow, follow the plan, and adjust along the way.