Mid-week market update

$SPY $QQQ $IWM pivots

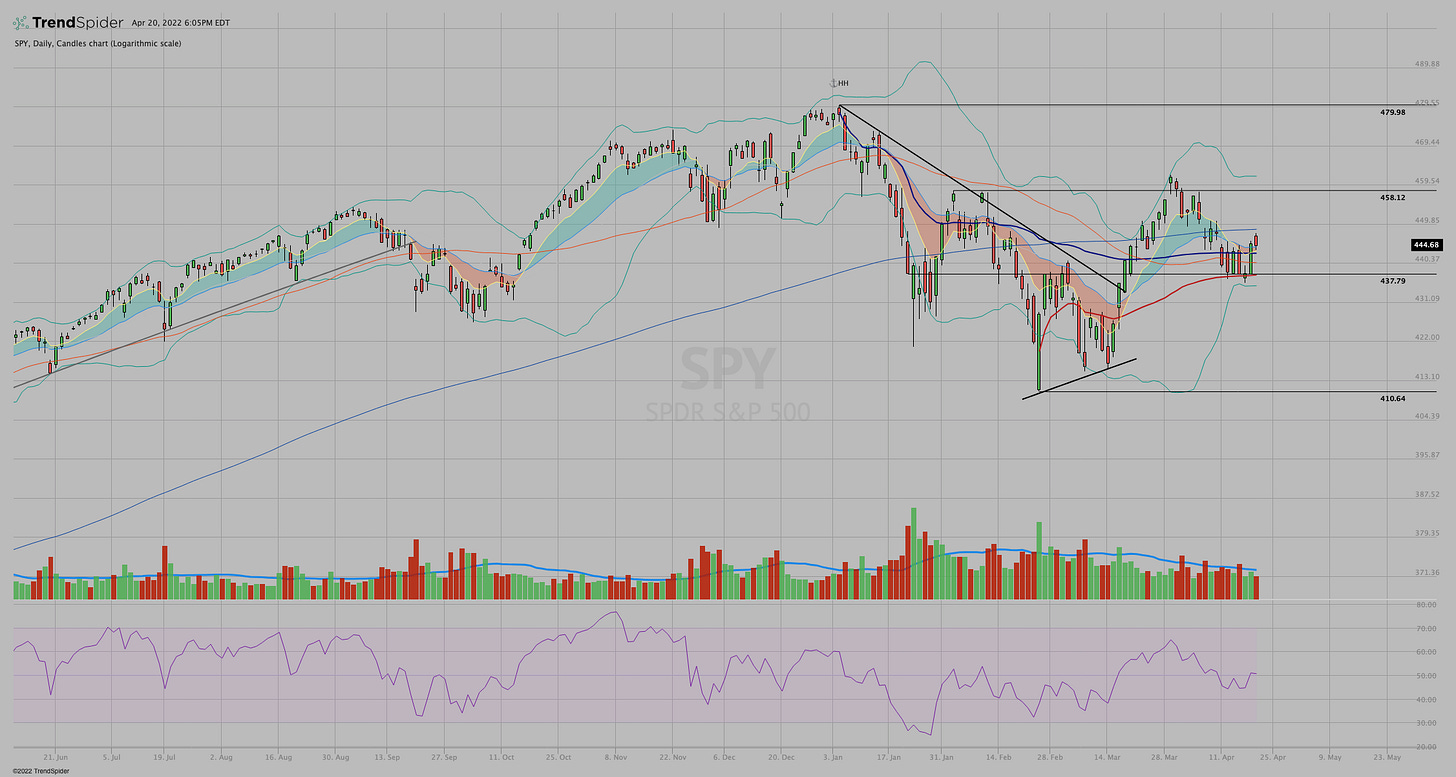

The choppiness continues as Monday’s concerning action has given way to a bounce that takes the $SPYback above the 8/21 EMAs. That’s progress, but it’s not all that convincing yet. But, casting opinions aside and looking solely at the chart we can see that price is back over all of the usual moving averages (8/21 EMA, 50 SMA, swing high and low AVWAP) except for the 200 SMA, which is less than $1 above today’s high price.

$QQQ looks a bit worse as it was pushed lower in part by $NFLX lousy earnings action. It’s below all the previously mentioned indicators.

$IWM is more like the $SPY but it still has the massive consolidation zone overhead to deal with.

We have a mixed market at best.