Monday Market Update July, 8 2024

The Markets

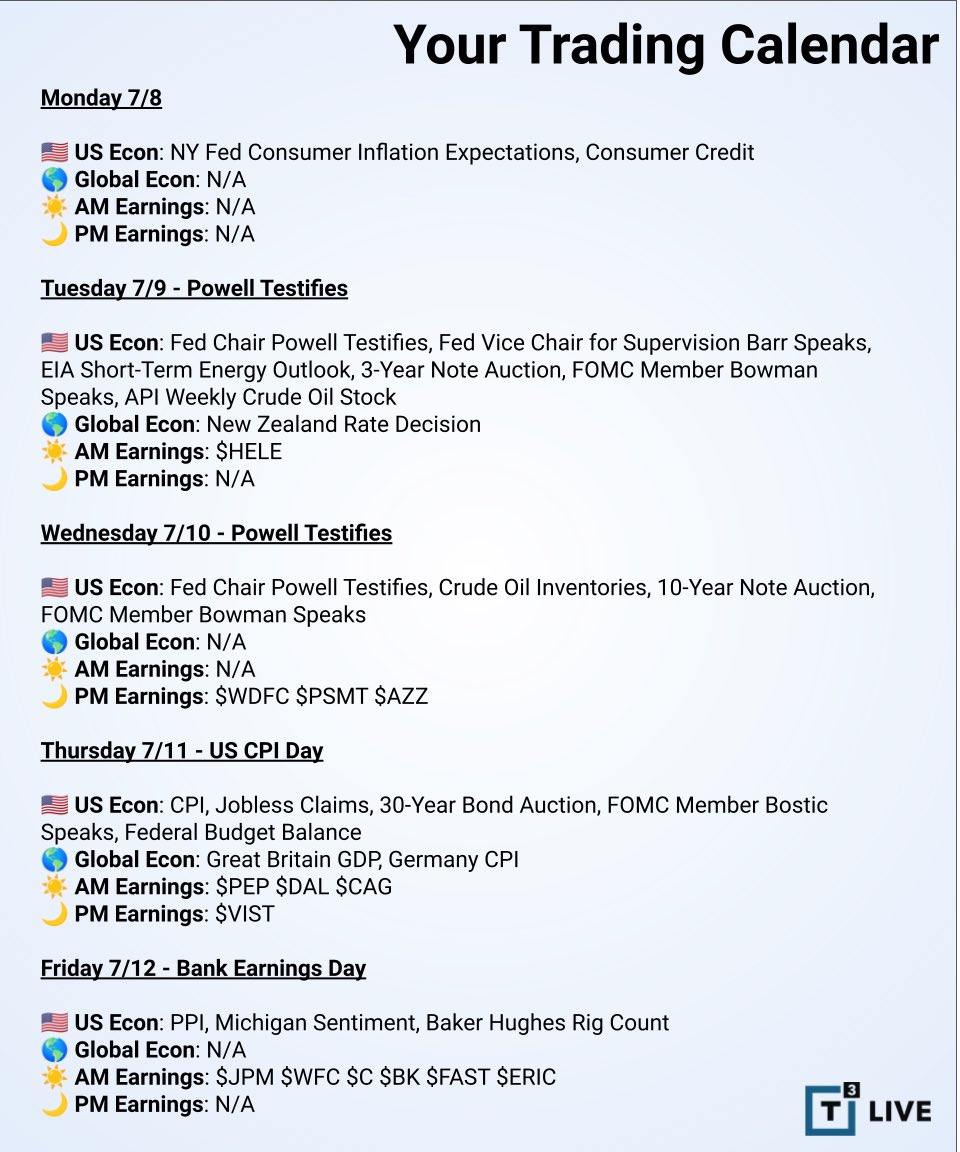

Stocks are still strong and still not resting. We have a hectic week ahead with:

Earnings season begins - JPM WFC C all reporting Friday

Chairman Powell is testifying twice, on Tuesday and Wednesday

CPI on Thursday

PPI on Friday

Here is a look at the charts to see how things set up moving into the news.

The Charts

SPY is slightly positive over Friday’s action and undecided on the day, with the opening and closing prices almost equal. Price above all key moving averages and is pushing the upper Bollinger Band higher. RSI clocks in just over 75. And there is a Fibonacci 1.618 extension level at $561.48.

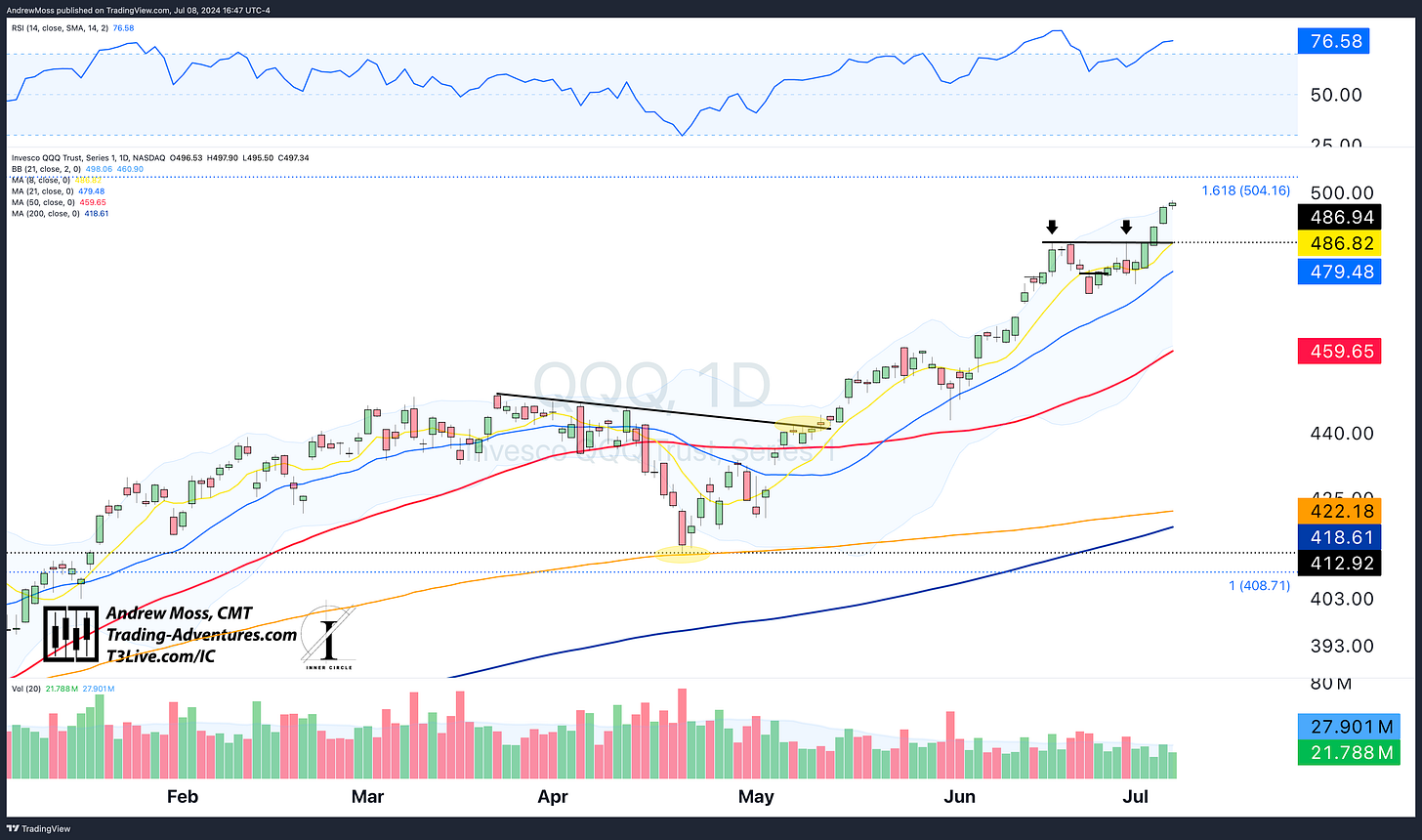

QQQ likewise makes another new high while staying in a more narrow daily range.

A nearly verbatim repeat:

Price is above all key moving averages and pushing the upper Bollinger Band higher. RSI is just over 76. There is a Fibonacci 1.618 extension level at $504.16.

IWM is still consolidating and failed to close above the 50-day MA today after moving past it for a while. RSI is ‘middle of the road,’ and the Bollinger Bands are very narrow. In fact, they haven’t been this narrow since January 2020 - before the Covid Crash.

DIA is still above all the key moving averages, but it couldn’t manage to close above the pivot high from 6/24.

TLT has been a rough road recently. But after coming down to retest the major trendline, it’s fighting its way back up and over all the key moving averages except the 21-day.

DXY US Dollar Futures $DX1! continued lower after putting in a ‘lower high’ last month — still helping stocks.

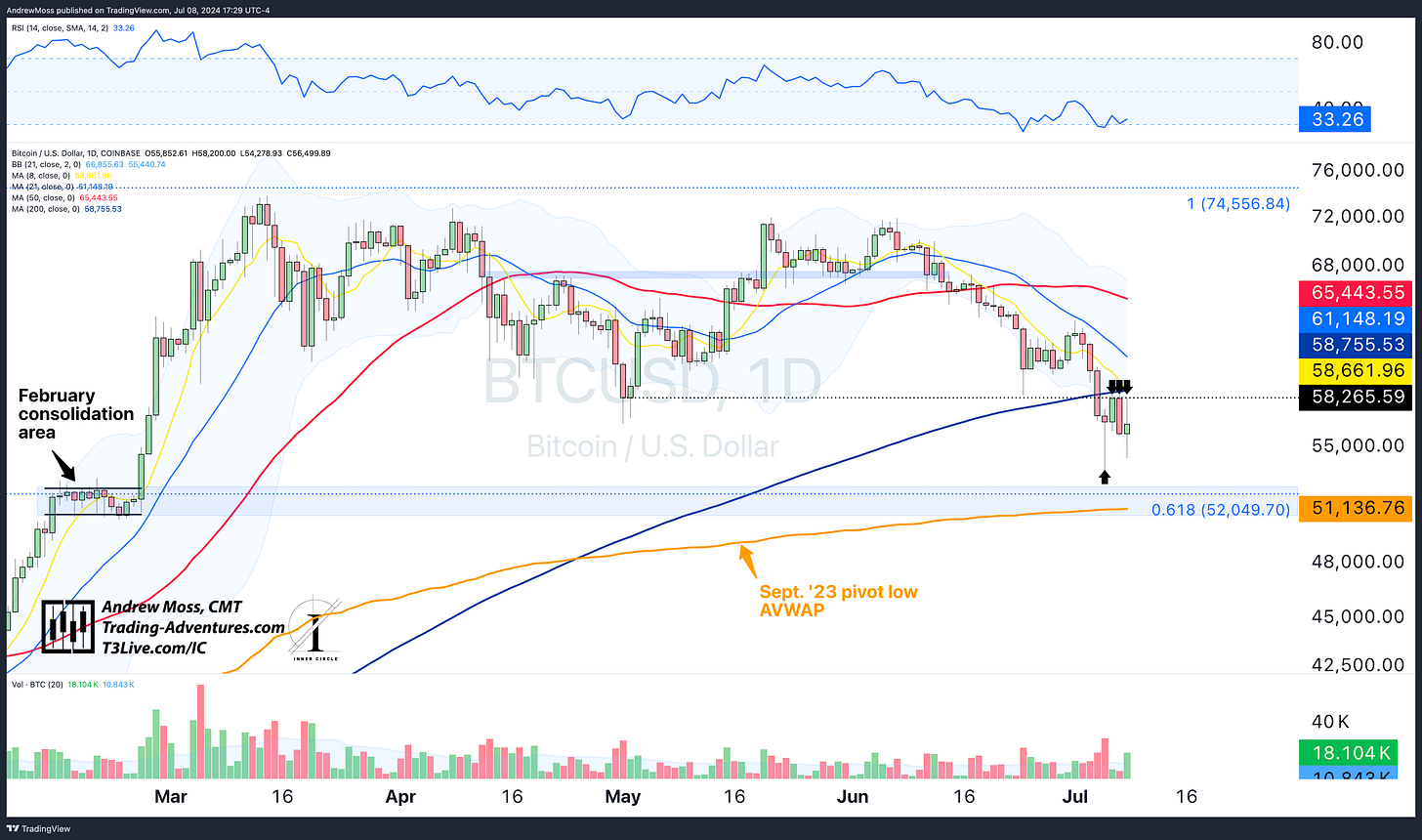

BTCUSD put in a dramatic low last week and bounced nicely but can not get above the $58,265 pivot area. After today’s rejection, number 3, it looks more like a trip to the $52k neighborhood is coming. That price level has:

A Fibonacci 38.2% retracement level

The Sept ‘23 pivot low anchored VWAP

A consolidation area from February

The Trade

The trade (for the more short-term, tactically oriented) is:

To trim into strength

Raise stops along the way

Remain cautious in starting new longs

Potentially add some tactical shorts or otherwise hedge long positions

Back with another look on Thursday to see how the events played out.

Elevate Your Trading

Education, training, and support for your Trading Adventure.

Options Trades - Weekly trade ideas are delivered to your email or text messages in language you can easily understand.

Check out EpicTrades from David Prince and T3 Live. Epic Trades from David Prince

Community - Are you an experienced trader seeking a community of professionals sharing ideas and tactics? Visit The Inner Circle, T3 Live’s most exclusive trading room - designed for elite, experienced traders.

The Inner Circle at T3 Live

Prop Trading - Or perhaps you are tested and ready to explore a career as a professional proprietary trader? 3 Trading Group has the technology and resources you need.

Click here to start the conversation:

T3TradingGroup.com

The Disclosures

***This is NOT financial advice. This is NOT a recommendation to buy, sell, or trade any security. The content presented here is intended for educational purposes only.

Andrew Moss is an associated member of T3 Trading Group, LLC (“T3TG”), an SEC-registered broker/dealer and member of FINRA/SIPC. All trades placed by Mr. Moss are done through T3TG.

Statements in this article represent that person’s opinions only and do not necessarily reflect those of T3TG or any other person associated with T3TG.

Mr. Moss may hold an investment position (or may be contemplating holding an investment position) that is inconsistent with the information provided or the opinion being expressed. This may reflect the financial or other circumstances of the individual, or it may reflect some other consideration. Readers of this article should consider this when evaluating the information provided or the opinions being expressed.

All investments are subject to the risk of loss, which you should consider when making any investment decisions. Readers of this article should consult with their financial advisors, attorneys, accountants, or other qualified investors before making any investment decision.

POSITION DISCLOSURE

July 8, 2024, 4:00 PM

Long: IBIT, QQQ0710P495

Short:

Options symbols are denoted as follows:

Ticker, Date, Call/Put, Strike Price

Example: VXX1218C30 = VXX 12/18 Call with a $30 strike