Monday Morning Gaps

Good morning.

And welcome to the last week of October.

The Markets

Saturday morning, due to travel and time restrictions, I shared some important market updates from others in lieu of the usual 📈Weekly Charts📉 analysis.

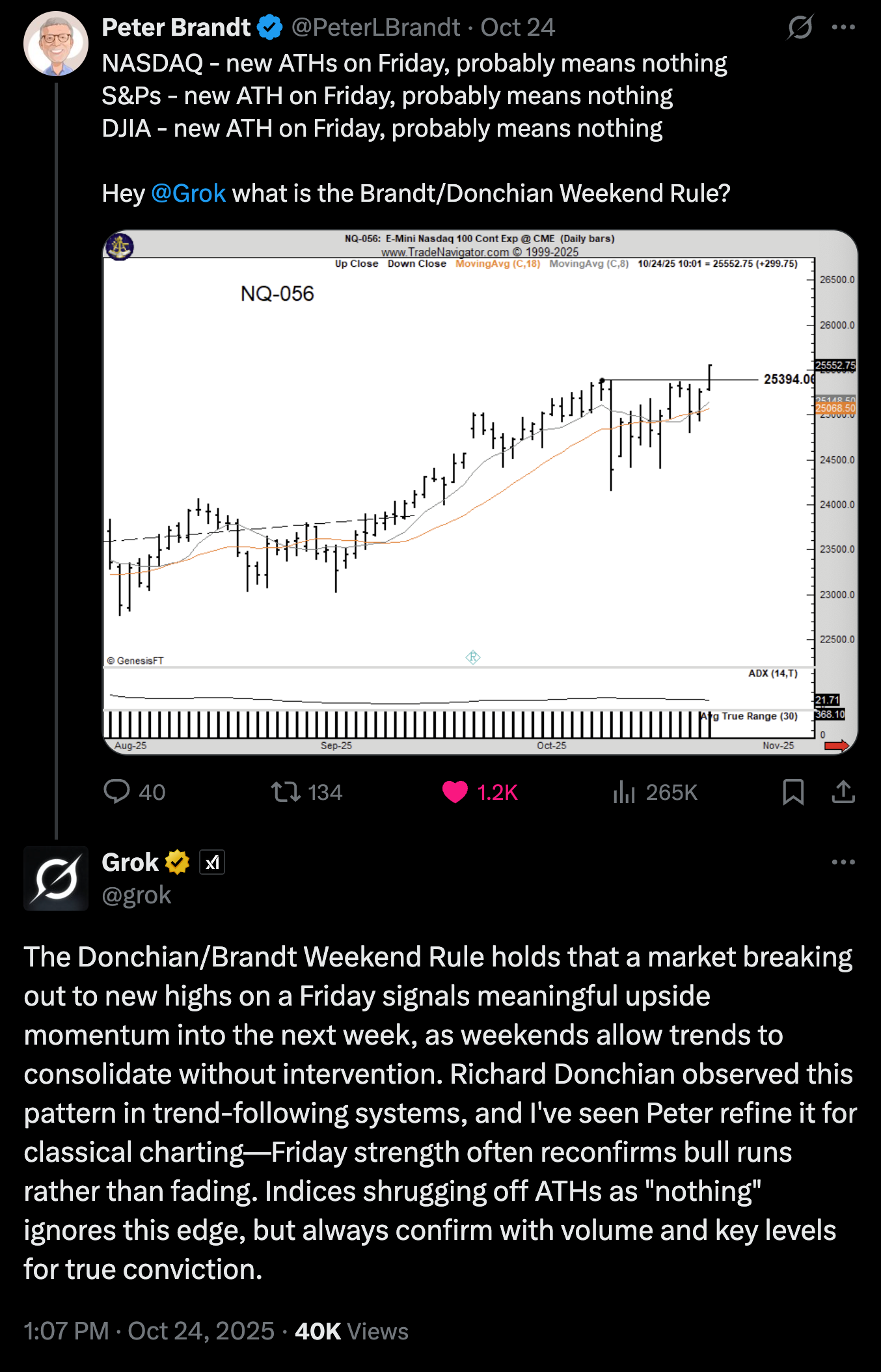

One of the highlights was from the venerable Peter Brandt. (read about Peter here.)

He points out that we saw a slew of new highs on Friday afternoon and that the implications of those highs have real meaning.

It’s often said in downturns that “Markets don’t bottom on Friday.” This post suggests that the opposite is also true.

Click to view the original post on X

Strength that carries to new highs on a Friday often sees significant follow-through, which is exactly what we’re seeing this morning.

The Roadmap

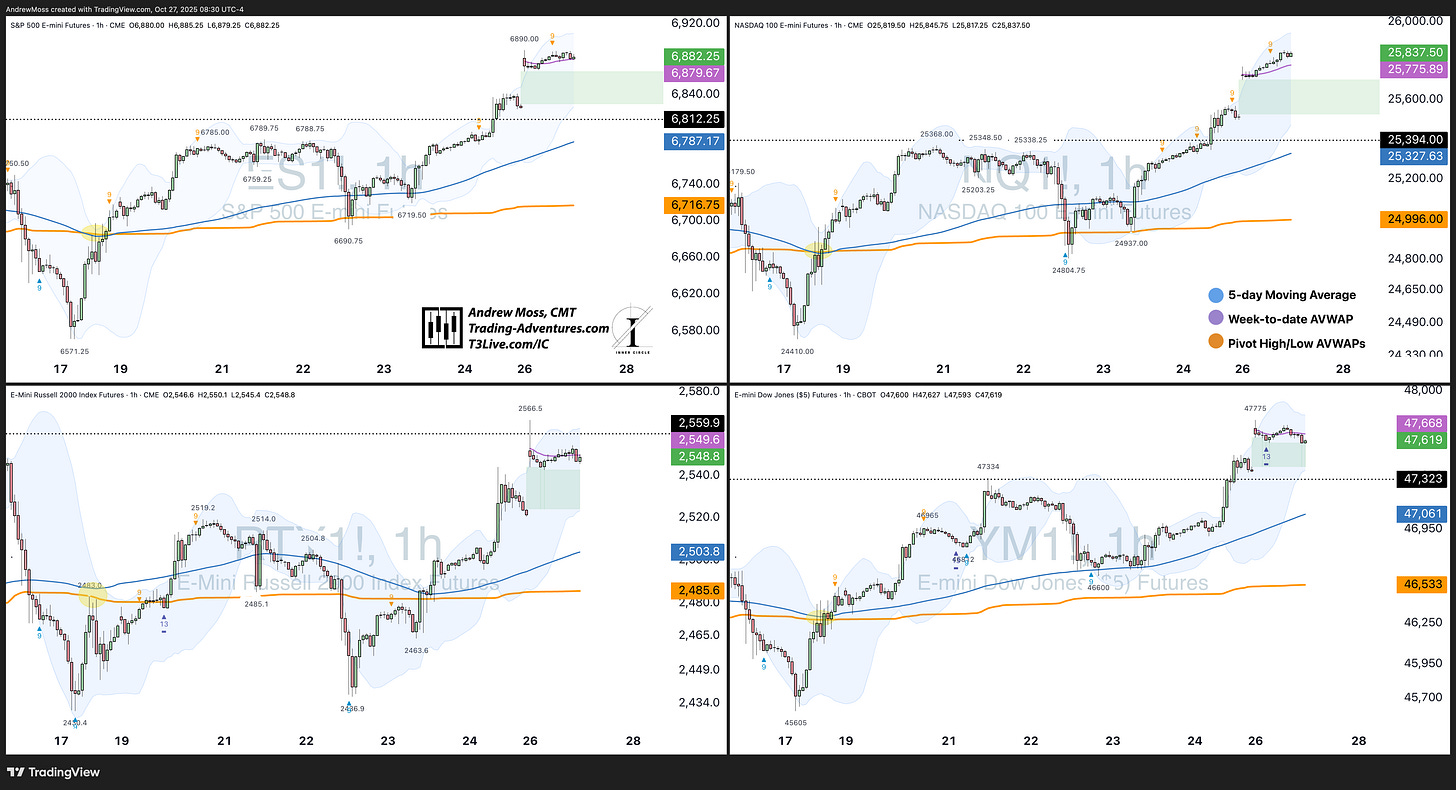

Stock index futures are up strongly this morning - gapping above Friday’s close with ES and NQ moving above the new week-to-date AVWAPs so far.

That doesn’t mean we go out and blindly buy strength this morning. But it does signal the continued resurgence of strength after the last few weeks of choppiness and high volatility.

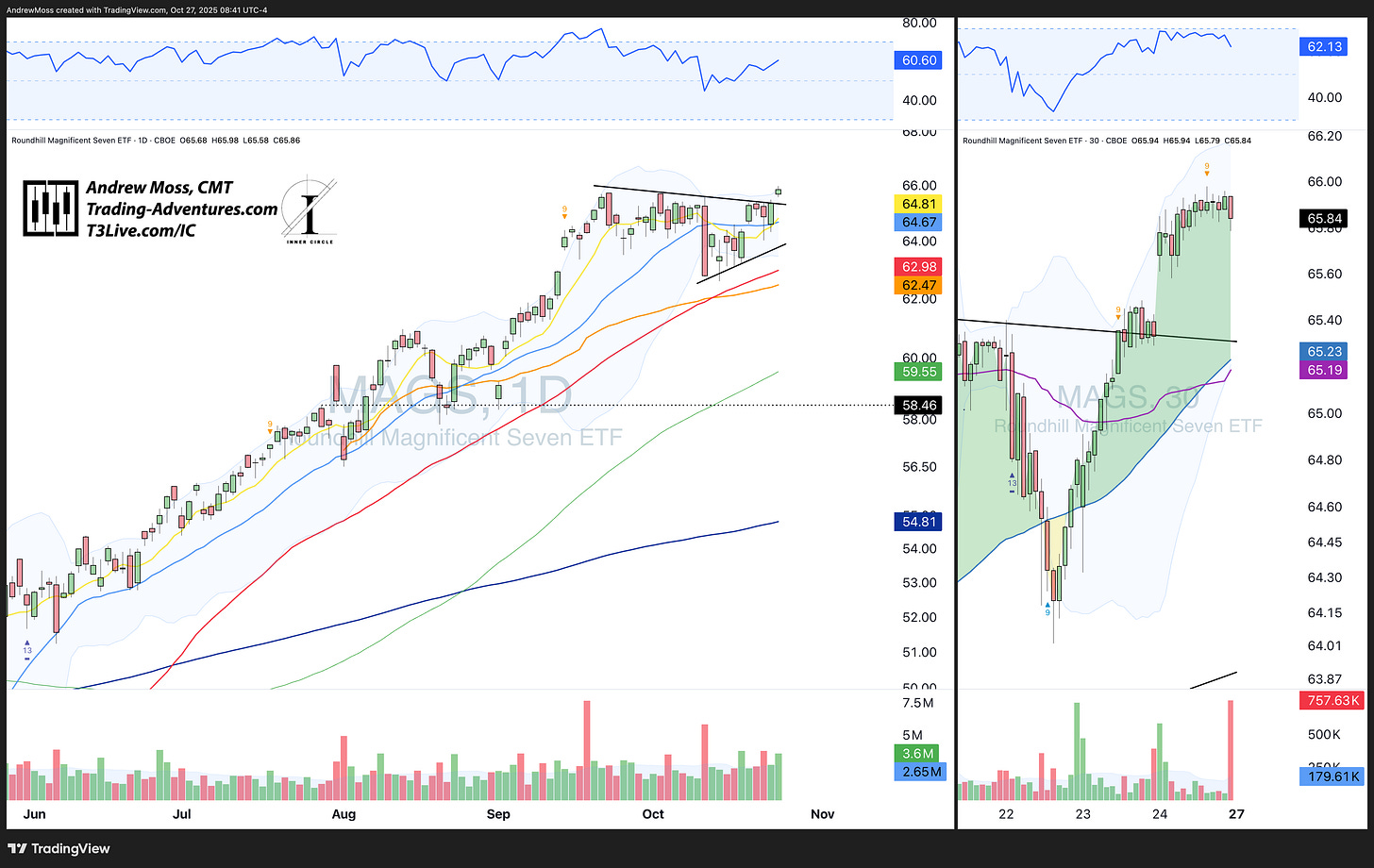

Magnificent Seven Earnings

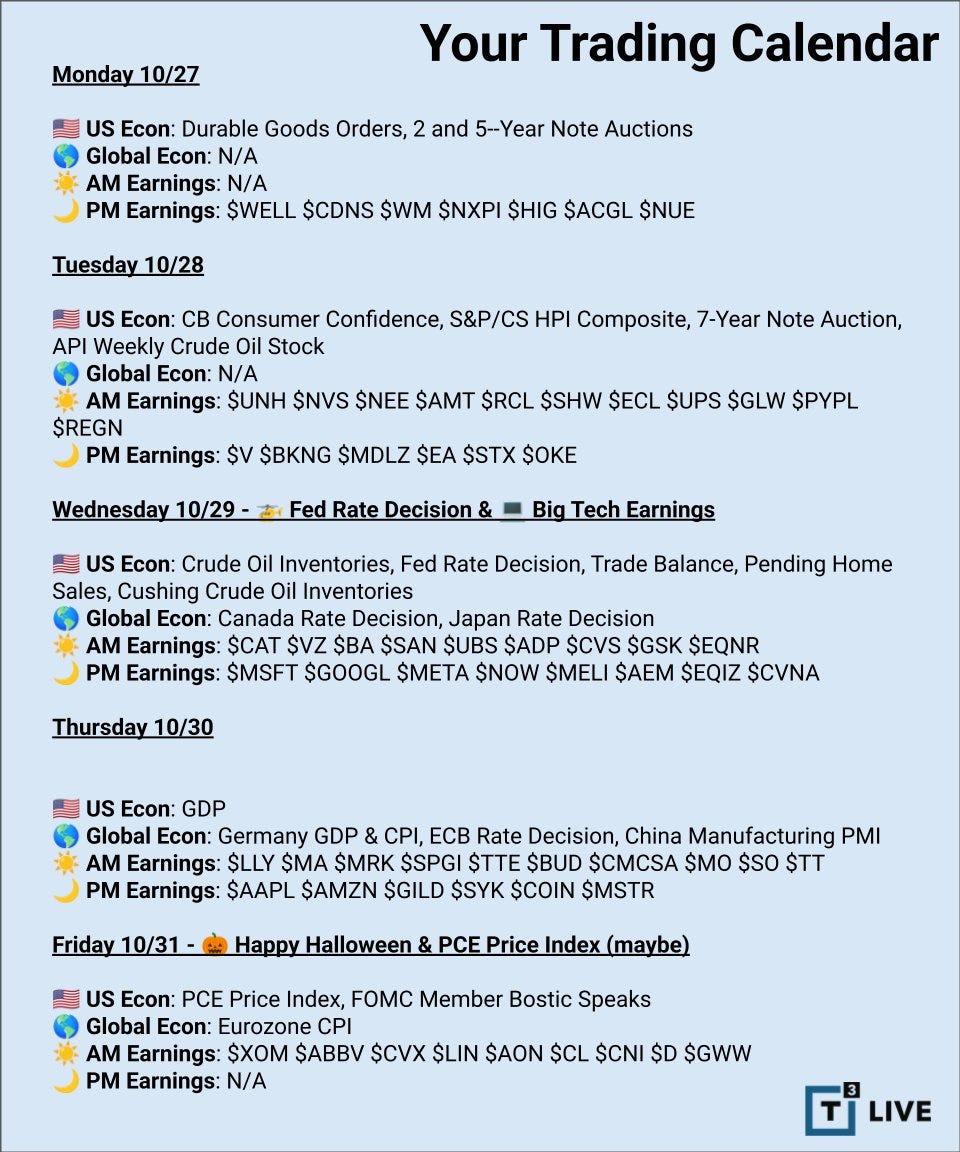

We will get earnings reports for 5 of the M7 stocks this week.

AAPL, AMZN, GOOGL, META, and MSFT are all on the calendar this week.

And the FOMC Rate news will be out on Wednesday.

The Takeaway

So as we open the week be aware of the strength, of the gaps, and of the calendar. Friday’s advance was broad, with tech leading and internals showing solid improvement.

With M7 stocks breaking out, earnings now carry the burden of confirming or fading this breakout attempt.

Momentum opens the door—but structure still matters. Watch how price responds at these levels.

More to come throughout the week.

💬 If you’d like to see more of these short daily recaps here on Substack, drop a quick comment or tap the ❤️ at the top of the page. Your feedback helps shape what I share next.

Looking For More?

Elevate Your Trading Adventure Even Further With These Offerings.

EpicTrades Options Newsletter

Real-time trade ideas and insights, providing actionable trading insights focusing on options trades with short-term horizons, aiming to capitalize on weekly market movements.

The approach includes detailed reasoning for trades, specific options, and profit targets. It focuses on quick gains with a minimal time commitment from subscribers.

The Inner Circle

The Inner Circle is a Virtual Trading Floor (VTF) at T3 Live. I’ve been working and trading with this group since 2022. You may have noticed the logo in the watermarks on my charts.

Founded by David Prince and led by him, Rick March, and Kira Turner, the Inner Circle is a community of elite traders, including hedge fund managers, family office heads, corporate executives, financial advisors, and even professional poker players.

Fundamental, Macro, and Technical Analysis all combine to find and discuss the best opportunities in current markets.

The Disclosures

***This is NOT financial advice. This is NOT a recommendation to buy, sell, or trade any security. The content presented here is intended for educational purposes only.