Monthly Closes, Quarterly Lessons

Perspective, catalysts, and the higher timeframe trend into Q4

The Markets

Quarter- and month-end closed on a strong note.

SPY finished at the highs of the week (granted, it’s only Tuesday), QQQ just shy, IWM is testing a key AVWAP, and DIA is back to a repeat pivot area.

The tone flipped positive despite government shutdown headlines.

Crypto followed equities higher with a solid afternoon bounce. Biotech bid persists. Housing names continue to firm up.

Catalysts:

The JOLTS report showed 7.23M openings in August, slightly above expectations. Labor demand is easing, but not collapsing.

Nike earnings beat on both revenue and EPS. The stock popped after hours, then gave some back.

Looking ahead: Friday’s NFP is the main event, assuming no shutdown.

Quarter-end rebalancing and headline sensitivity were the drivers.

Let’s go to the charts.

The Charts

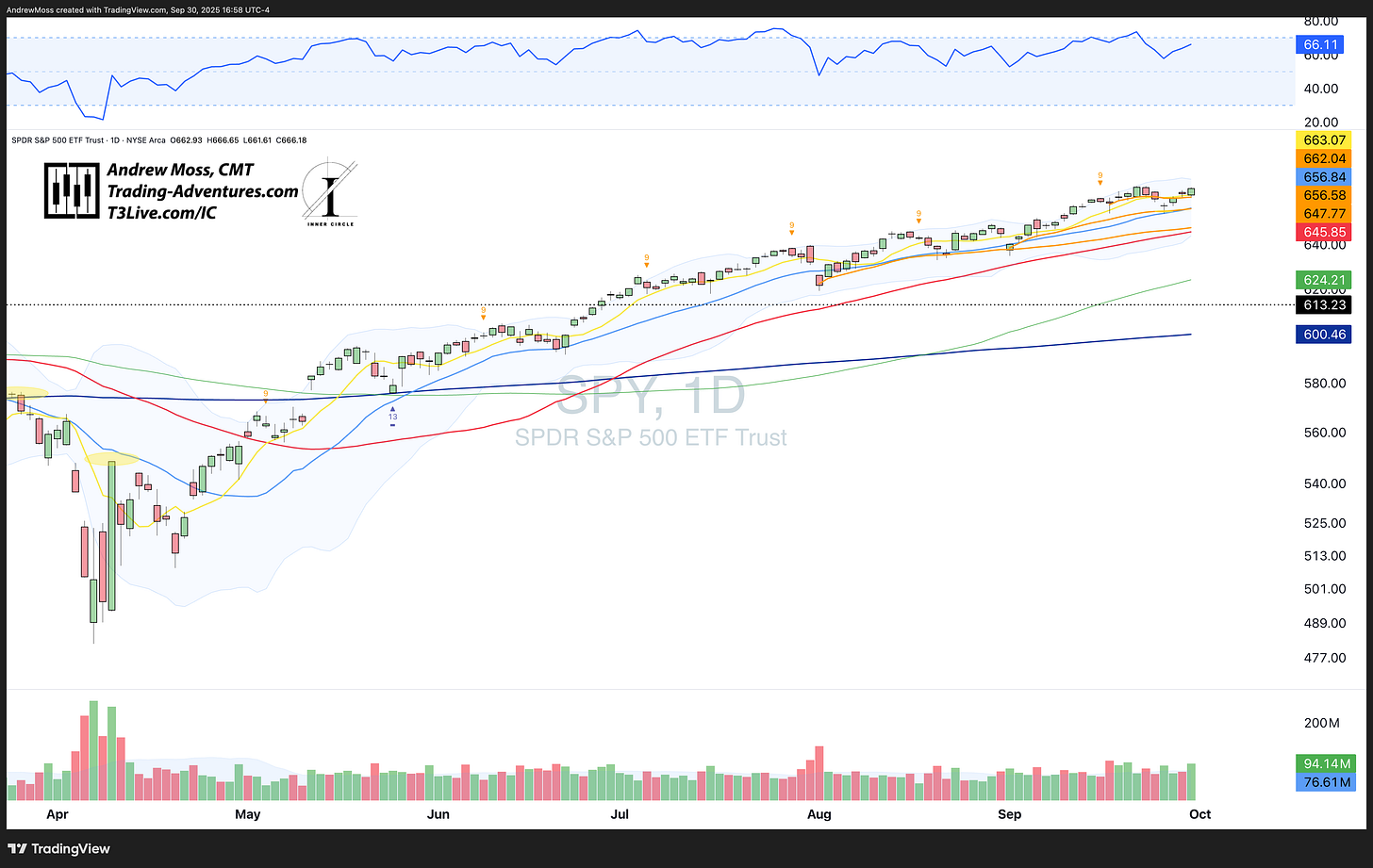

SPY put in the low for September on the first day of the month, but didn’t quite reach a new high on the last day. It got very close, though, pushing off the 8-day MA and the Fed Day AVWAP this afternoon, to finish the day with strength.

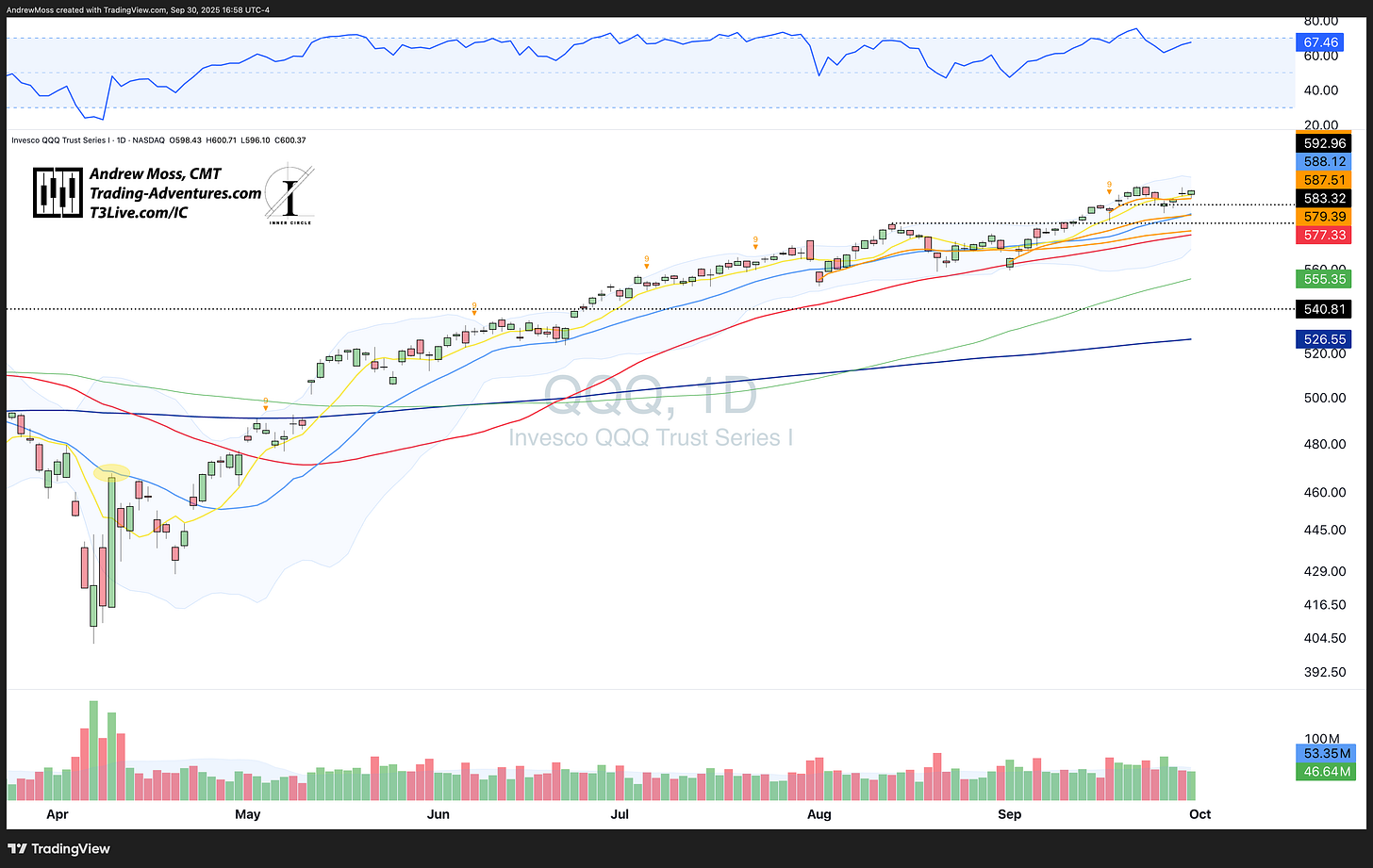

QQQ got a similar push from the 8-day MA and that key AVWAP level.

IWM touched its 21-day MA for the second time in four days. The 8-day MA and ~$242 pivot area marked the top of today’s rise.

DIA did put it in its highest daily close for the month.

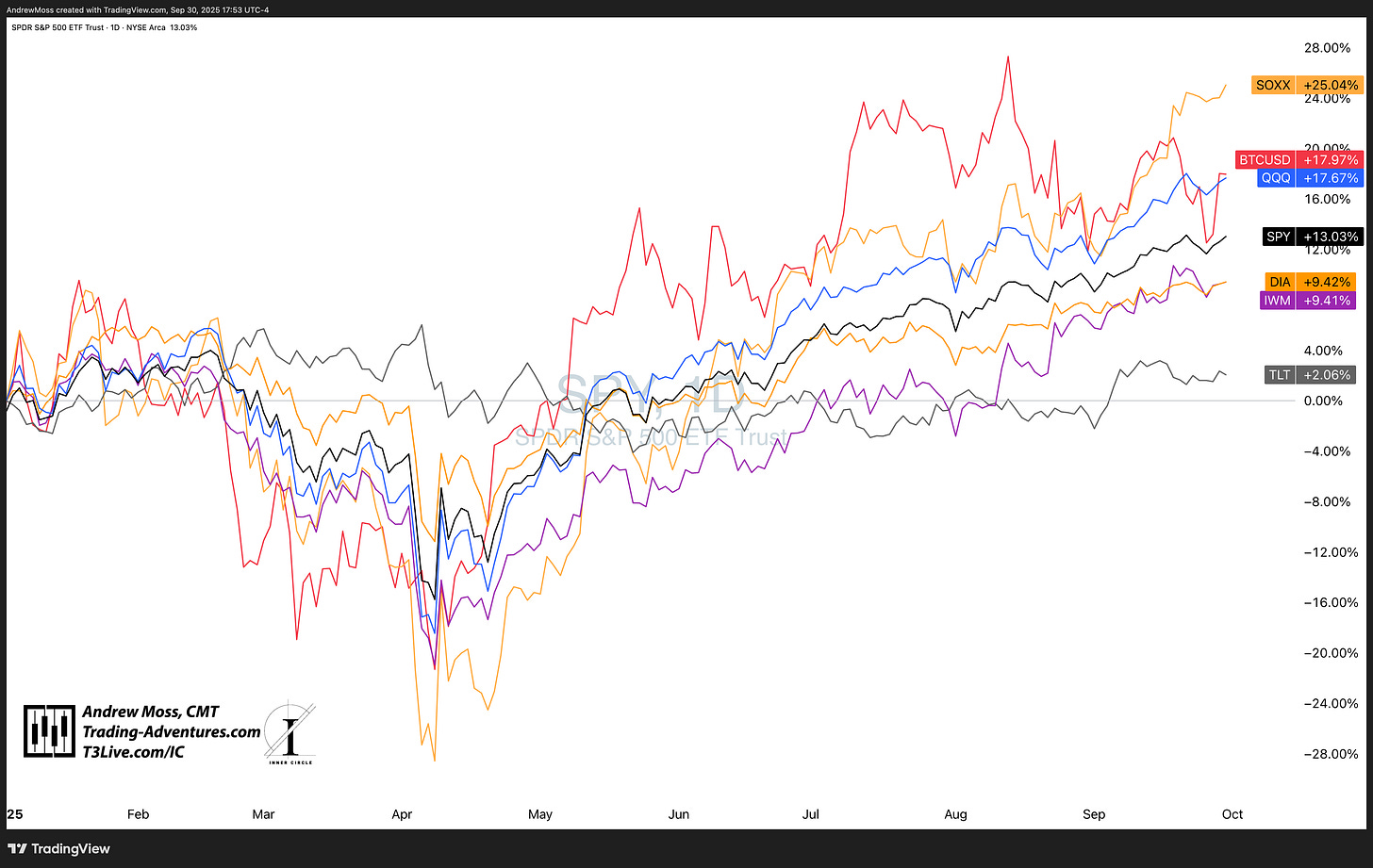

A strong September across the board for the major stock indices. Cryptocurrencies were another story.

BTCUSD did finish the month on a strong note, bouncing beyond the key moving averages and pivot AVWAP. But it’s still below the months-long consolidation area, and well off the all-time highs.

Now, let’s take a bigger view.

The BIG Big Picture

Monthly Closes Matter

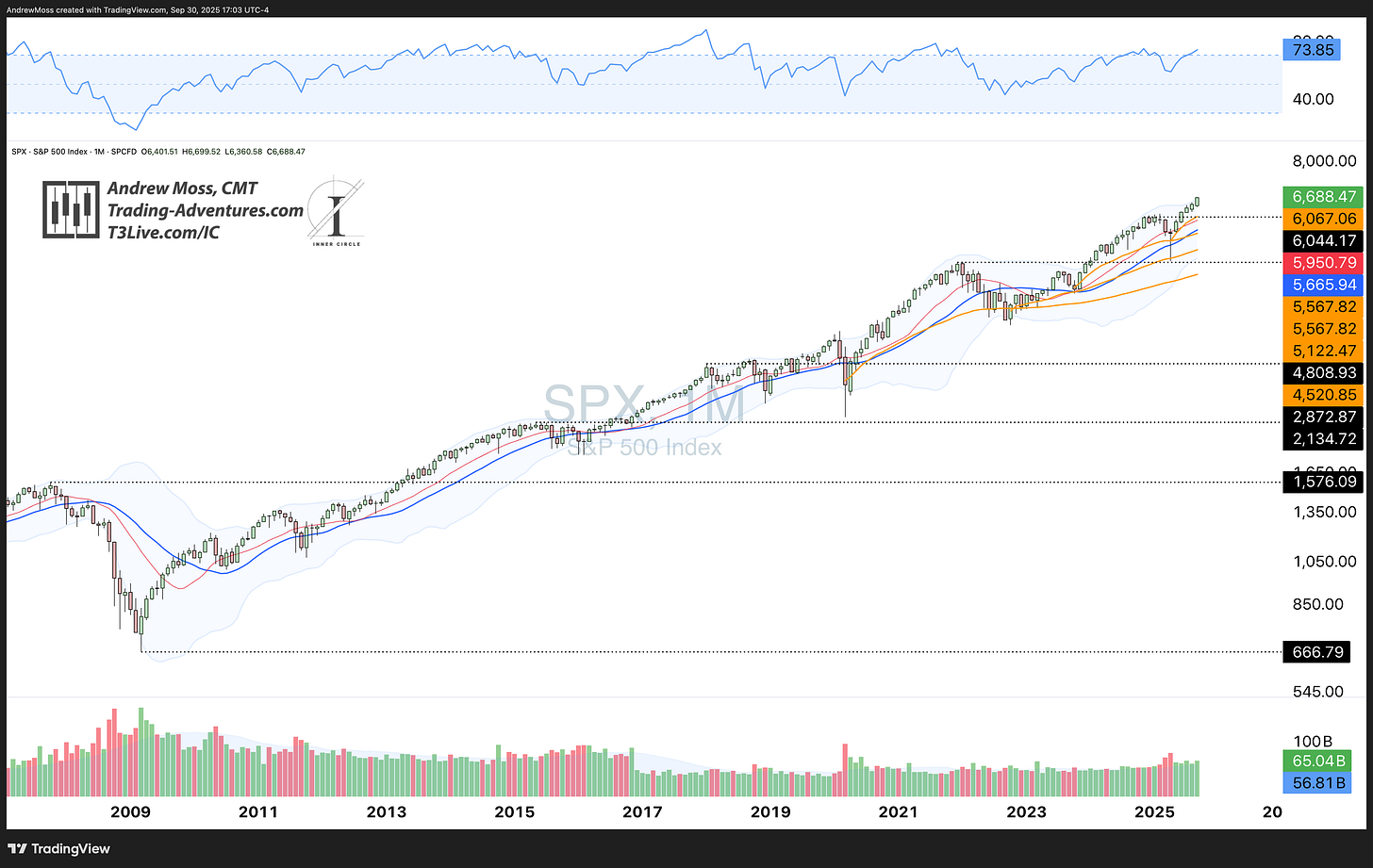

Today marks the end of September and the third quarter. Monthly and quarterly charts reveal the cleanest signals for long-term trend, momentum, and risk positioning.

Let’s step back from the noise and evaluate where we stand.

Monthly closes offer the cleanest perspective on trend. Pulling back to this timeframe highlights how resilient the market has been.

Even major shocks — COVID in 2020 and the 2021–22 bear market — register as short-term interruptions within the longer structural uptrend.

On these charts, both look more like blips than trend reversals.

The message: the long-term trend is the playing field. Day-to-day volatility, scary headlines, and even recessions are part of the game, but price continues to remind us that structural momentum remains higher until proven otherwise.

SPX Note the RSI on this monthly chart. This reinforces the point: despite volatility, the RSI barely dipped below 50 during the 2020 and 2021-22 downturns. It took the 2008–09 financial crisis — one of the worst bear markets in modern history — to push momentum into deeply oversold territory.

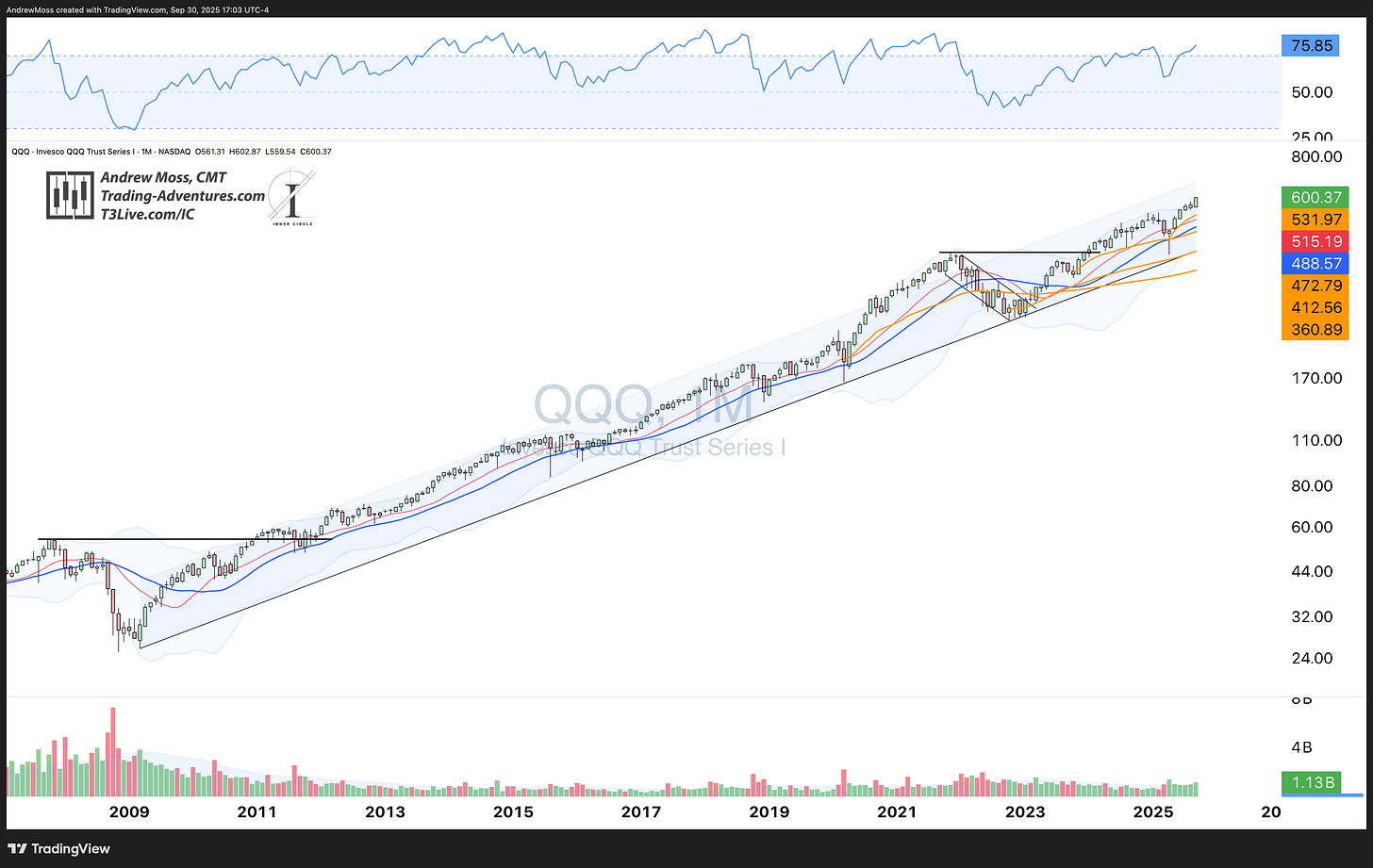

QQQ is still riding along in the upper half of the very long-term bullish channel.

IWM - After seeing it for the first time in late 2021, this small-cap index is back for its third test of the ~$244 level. Higher lows and less time between tests = bullish probabilities. Notice the pattern of tests on previous high levels, marked with solid horizontal lines. Nearly all of them took a third attempt to finally get prices into to new territory.

DIA puts in another new monthly high.

DXY/DX1! U.S. dollar Futures are still holding trend support dating back to the global financial crisis. The Greenback has been weak all year. But has it finally found a bottom?

BTCUSD Bitcoin, choppy and weaker on the daily timeframe, looks strong and orderly on the monthly trend. The inverse head and shoulders resolution hasn’t been explosive, but the upside target area is still valid. That orderly structure supports the broader risk-on backdrop, even if upside progress is slower.

The Trade

As Q4 begins, the charts remind us: noise is temporary, structure is enduring. The long-term uptrend remains intact, even with drawdowns and corrections along the way.

That perspective doesn’t eliminate risk — but it defines the field we’re playing on. The task now is to trade with that context in mind:

Respect near-term catalysts like Friday’s NFP and the .gov shutdown risk.

Anchor trades to levels and structure — VWAP, pivots, moving averages — not headlines.

Keep size and timing disciplined in the face of quarter-end volatility.

The opportunity in front of us is clear. Short-term swings will come and go, but the higher timeframe trend keeps pointing higher. Align with it, respect risk, and let Q4 come to you.

Looking For More?

Elevate Your Trading Adventure Even Further With These Offerings.

EpicTrades Options Newsletter

Real-time trade ideas and insights, providing actionable trading insights focusing on options trades with short-term horizons, aiming to capitalize on weekly market movements.

The approach includes detailed reasoning for trades, specific options, and profit targets. It focuses on quick gains with a minimal time commitment from subscribers.

The Inner Circle

The Inner Circle is a Virtual Trading Floor (VTF) at T3 Live. I’ve been working and trading with this group since 2022. You may have noticed the logo in the watermarks on my charts.

Founded by David Prince and led by him, Rick March, and Kira Turner, the Inner Circle is a community of elite traders, including hedge fund managers, family office heads, corporate executives, financial advisors, and even professional poker players.

Fundamental, Macro, and Technical Analysis all combine to find and discuss the best opportunities in current markets.

The Disclosures

***This is NOT financial advice. This is NOT a recommendation to buy, sell, or trade any security. The content presented here is intended for educational purposes only.