The Markets

The indexes are grinding higher this week as we continue to work through earnings season. But they are doing so in a different fashion. Tech and semiconductors have been sleepy while industrials and financials have shown strength.

XLF and XLI are very close to the recent highs now. Even the regional banks KRE appear to be on the verge of a major weekly breakout. XLU Utilities are strong, and Consumer Staples XLP is at its new highs for the year.

The Defensive plays are in the spotlight.

Risk-off sectors are up while growth and technology take a break. So far, the message seems to me to be more about rotation than a red flag or cautionary signal. And what do we know about rotation?

It’s the lifeblood of a bull market.

The Charts

SPY is grinding higher, up for the week, and almost into the next pivot level. New closing highs are not far away.

QQQ appears to be at a critical spot after four days of consolidation beneath both a pivot level and a downtrend resistance line. A move above $442 would likely take it quickly to new highs.

IWM, after Monday’s gap fill, this small-cap index moved higher and then came back to test the 50-day MA again. Buyers are in control, keeping it above all the moving averages and, somehow, above the $200 level again.

DIA Banks and Industrials have been the recent leaders, so it’s no surprise that the Dow Jones Industrial Index is producing some of the best price action. $384 to $392 was a congestion area for months last time around. This time, the Dow 30 cut through it in barely a week. Be on the lookout for new closing highs soon.

TLT Slow and steady progress. A week of action above the 8 and 21-day MAs may let the Treasury bonds have a crack at the 50 and 200-day MAs soon.

DXY Despite a strong bounce at the 50-day MA, the bearish action still looks dominant in the US Dollar futures. A bear flag is forming, with the 21-day MA acting as a lid. See if this tests and then loses the 50-day MA in the coming weeks.

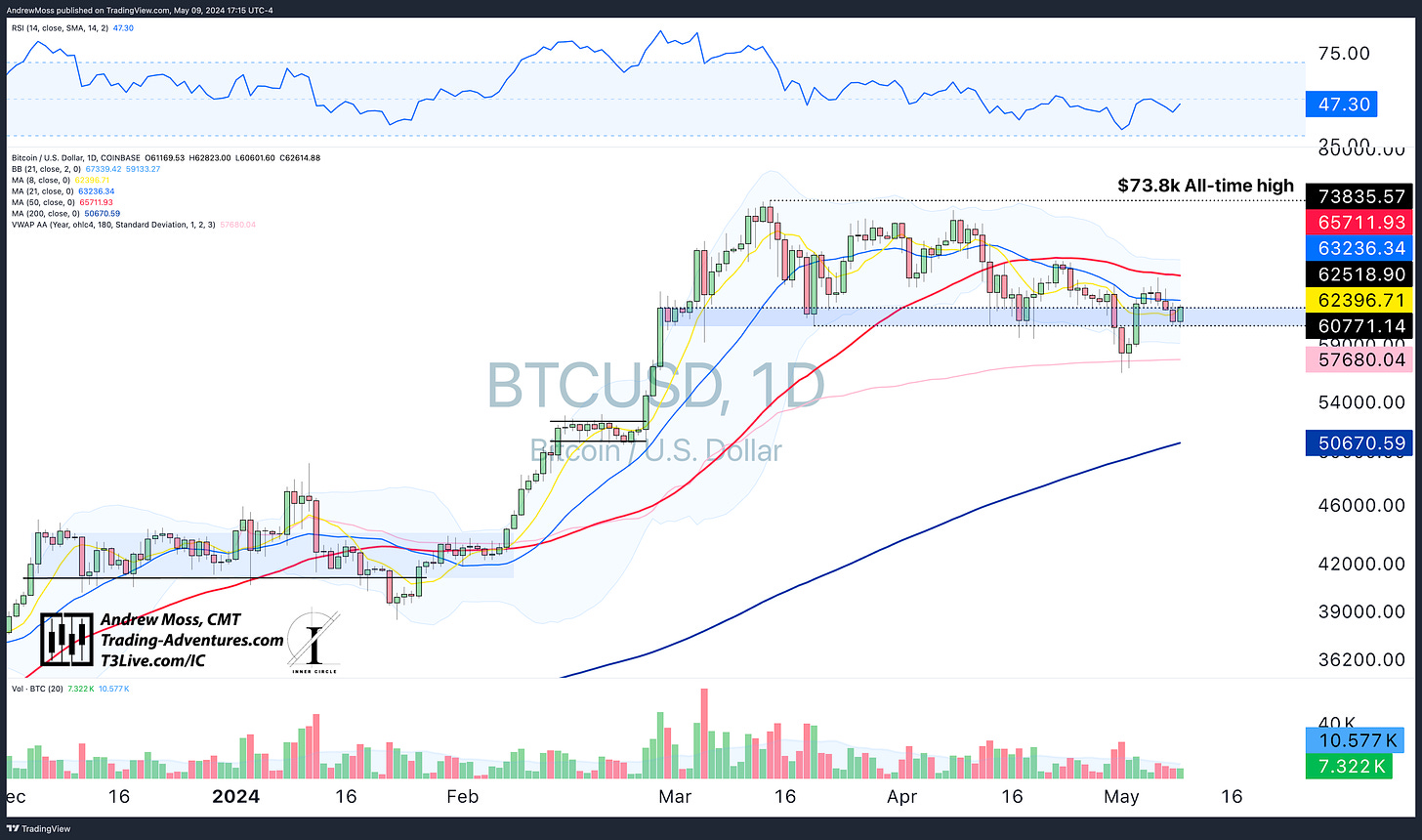

BTCUSD “Risk On” has been taking a rest, so that means Bitcoin has too. Each of the recent week’s long consolidations has resolved to the upside. We’ll see if this one can do it, too. If the other “Risk On” areas of the market resume strength and head higher, there’s no reason why this one shouldn’t do the same.

The Trade

It’s still a ‘wait-and-see’ market. Specific trades are working, but the big broad-based trending moves in the indexes are absent. For now, less is more as we head into the summer months.

What could change that?

Re-emerging leadership from the risk-on areas of the market would be a good start. Once we begin to see that, the loading process will likely be complete producing new highs in the indexes.

Elevate Your Trading

Education, training, and support for your Trading Adventure.

Options Trades - Weekly trade ideas are delivered to your email or text messages in language you can easily understand.

Check out EpicTrades from David Prince and T3 Live. Epic Trades from David Prince

Community - Are you an experienced trader seeking a community of professionals sharing ideas and tactics? Visit The Inner Circle, T3 Live’s most exclusive trading room - designed for elite, experienced traders.

The Inner Circle at T3 Live

Prop Trading - Or perhaps you are tested and ready to explore a career as a professional proprietary trader? 3 Trading Group has the technology and resources you need.

Click here to start the conversation:

T3TradingGroup.com

The Disclosures

***This is NOT financial advice. This is NOT a recommendation to buy, sell, or trade any security. The content presented here is intended for educational purposes only.

Andrew Moss is an associated member of T3 Trading Group, LLC (“T3TG”), an SEC-registered broker/dealer and member of FINRA/SIPC. All trades placed by Mr. Moss are done through T3TG.

Statements in this article represent that person’s opinions only and do not necessarily reflect those of T3TG or any other person associated with T3TG.

Mr. Moss may hold an investment position (or may be contemplating holding an investment position) that is inconsistent with the information provided or the opinion being expressed. This may reflect the financial or other circumstances of the individual, or it may reflect some other consideration. Readers of this article should consider this when evaluating the information provided or the opinions being expressed.

All investments are subject to the risk of loss, which you should consider in making any investment decisions. Readers of this article should consult with their financial advisors, attorneys, accountants, or other qualified investors before making any investment decision.

POSITION DISCLOSURE

May 9, 2024, 4:00 PM

Long: AMD0517P150, ENVX0621C10, IMNM, IWM, META0517P470, MU0517C120, RDDT, VKTX0419C80

Short: SPY

Options symbols are denoted as follows:

Ticker, Date, Call/Put, Strike Price

Example: VXX1218C30 = VXX 12/18 Call with a $30 strike