New Highs, Old Risks

Indices break out, small caps reclaim leadership — but OPEX and September seasonality haven’t left the stage.

The Markets

It was a strong day for equities, with all four major indices — SPY, QQQ, DIA, and IWM — closing at new highs.

IWM deserves particular attention. Today’s close marked its first new all-time high in years, underscoring continued rotation into small caps.

Leaders & Laggards

TSLA (Tesla): Took a rest after showing strength in the morning, closing off highs but still within its recent range.

TEM (Tempus Ai): Continues to build energy, slowly working on a breakout from a developing bull flag pattern.

NVIDIA (NVDA): Back above all key moving averages, a constructive reset after recent consolidation.

MP Materials (MP): Surged +8% on the day, a clear standout in materials.

BMNR (Bitminer): Rallied +5% intraday, though it closed several points off its morning highs.

Breadth continues to be supportive, with rotation evident across sectors. Tech leaders are alternating between rest and follow-through, while small caps step into leadership. That balance is helping the tape hold up even as indices push into fresh highs.

The Charts

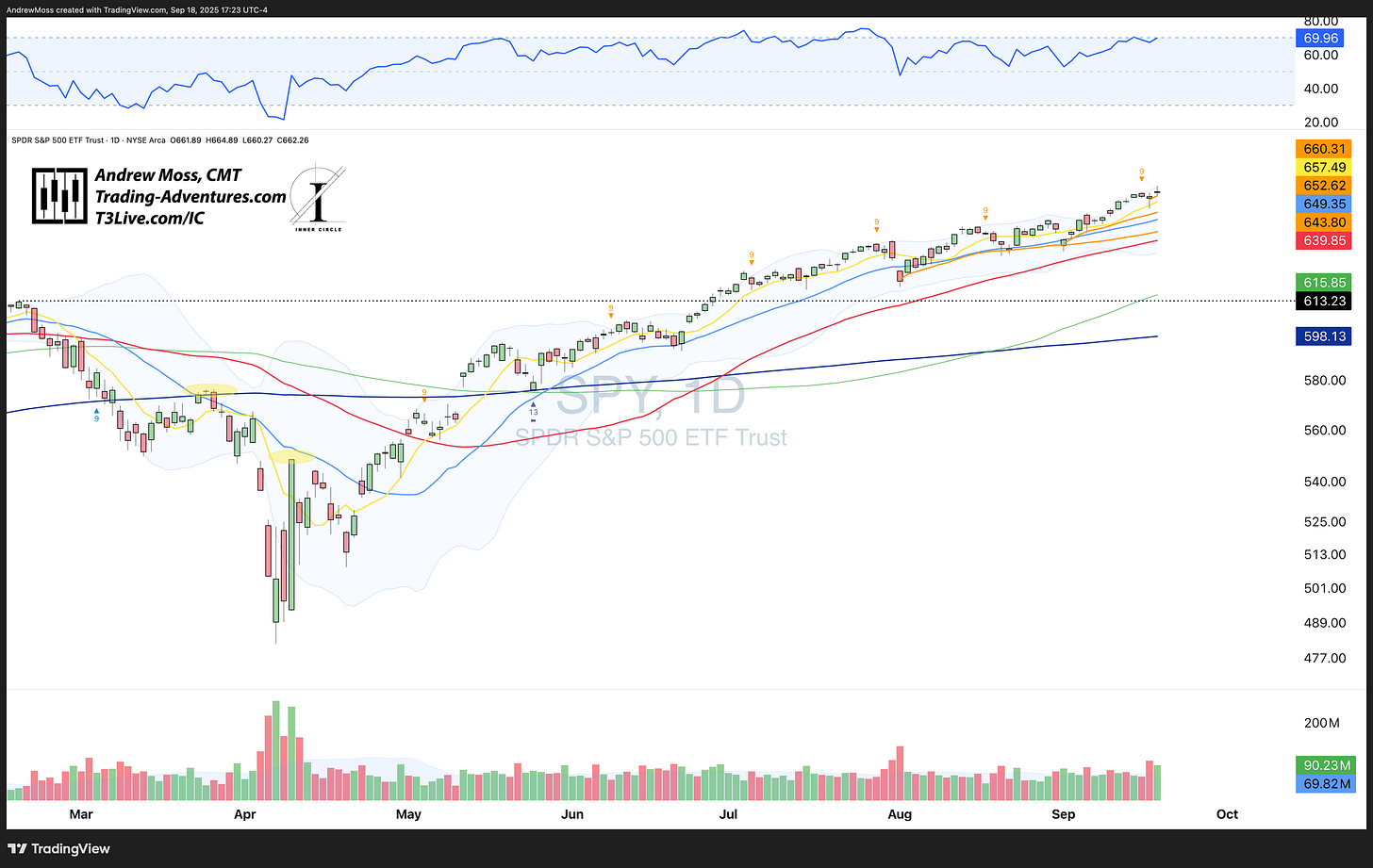

SPY added to yesterday’s post FOMC bounce, moving to a new closing high on heavy volume while avoiding an overbought RSI.

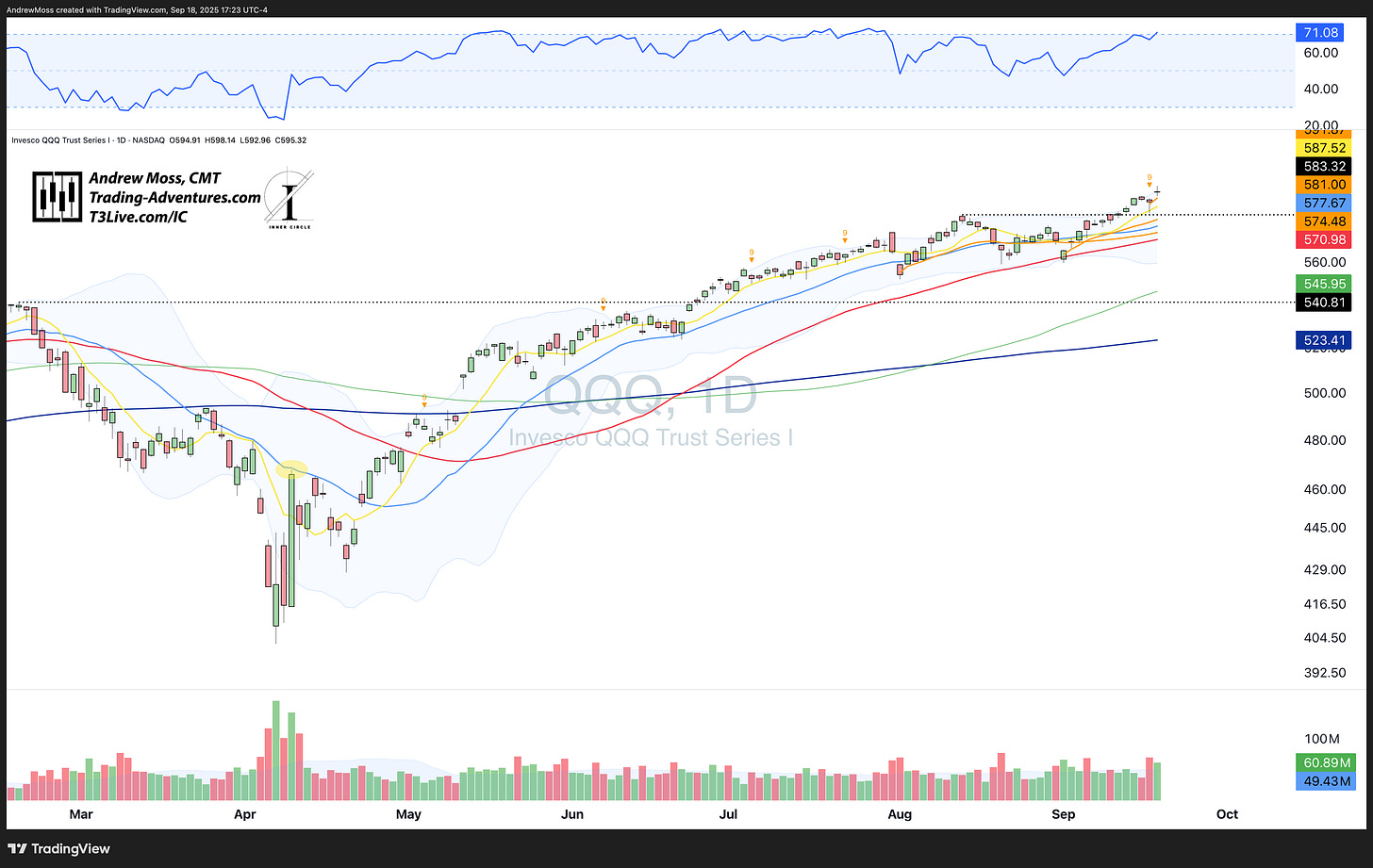

QQQ made a similar move with similar volume, but reached a little further into ‘new high’ territory, which took the RSI > 70.

IWM 👏👏👏 After dragging and lagging and frustrating many for much of the year, small-caps finally carried the momentum of this historic rise into a fresh new all-time high. And it did so with a decisiveness that carried into the day’s close despite the afternoon lull in large caps and many other areas. RSI is over 70, and the volume wasn’t quite as heavy. But it’s a landmark event regardless.

DIA pushed up to higher ground as well, rounding out the index strength for the day. Volume was high. RSI at 64 leaves plenty of room to build more momentum.

TLT gave back the gains of the last week or so. But the action is still better and more constructive as long as it stays over most of the moving averages (only the 8-day is above price now).

DXY The Dollar added to its bounce attempt, which started yesterday from a logical pivot area.

BTCUSD is back into the range and above its moving averages, too, with the 8-day carrying prices higher all month so far.

The Trade

OPEX Ahead

Tomorrow brings September options expiration (OPEX) — a recurring event that often introduces volatility, erratic price action, and unusual flows as positions are closed, rolled, or hedged. Historically, OPEX has been associated with choppier intraday action and less reliable directional trends.

Takeaway

A healthy session: broad indices at new highs, small caps reclaiming leadership, and individual names showing a mix of strong momentum and healthy consolidation. With OPEX on deck, traders should be prepared for heightened volatility and potential noise before the market (potentially) resumes its post-Fed trend.

The still-present risk of weaker seasonality is another factor to keep in mind as we move deeper into September.

Looking For More?

Elevate Your Trading Adventure Even Further With These Offerings.

EpicTrades Options Newsletter

Real-time trade ideas and insights, providing actionable trading insights focusing on options trades with short-term horizons, aiming to capitalize on weekly market movements.

The approach includes detailed reasoning for trades, specific options, and profit targets. It focuses on quick gains with a minimal time commitment from subscribers.

The Inner Circle

The Inner Circle is a Virtual Trading Floor (VTF) at T3 Live. I’ve been working and trading with this group since 2022. You may have noticed the logo in the watermarks on my charts.

Founded by David Prince and led by him, Rick March, and Kira Turner, the Inner Circle is a community of elite traders, including hedge fund managers, family office heads, corporate executives, financial advisors, and even professional poker players.

Fundamental, Macro, and Technical Analysis all combine to find and discuss the best opportunities in current markets.

The Disclosures

***This is NOT financial advice. This is NOT a recommendation to buy, sell, or trade any security. The content presented here is intended for educational purposes only.