The Markets

Monday, we watched a brief pause in upward progress as the markets awaited the latest inflation data.

On Tuesday, we started gently higher after the PPI announcement, and on Wednesday, we hit new highs on the back of lighter-than-expected CPI data.

And, just like that, SPY QQQ and DIA are into new territory with no resistance above.

The Charts

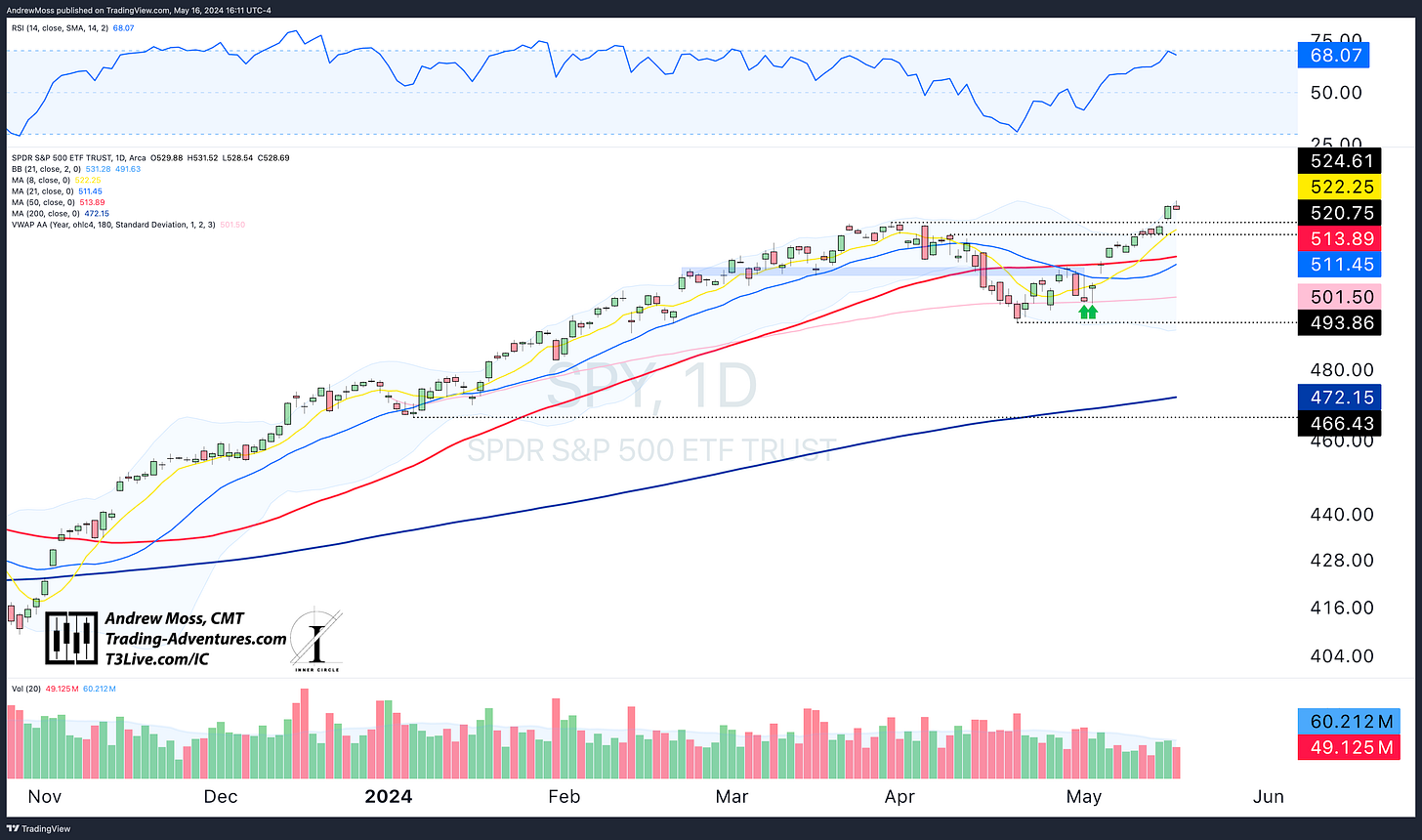

SPY has a potential evening star reversal candle today as the RSI just misses the 70 mark. If confirmed tomorrow (with an opening price below today’s closing price), be on the lookout for a retest of the two recent pivots and the 8-day MA.

QQQ has similar and corresponding price action. After the breakout, it got several days of advance and may now be due for a pause.

IWM is still the laggard. However, it has smoothed itself out since moving back over the 8 and 21-day MA. Some orderly rest and retesting here would likely help it move on to new highs.

DIA

TLT is back to the trend area and the 200-day MA adds another layer of probability to the case for a pause in the stock rally. Up and over this level likely takes stocks higher as well, while rejection here will mean more choppiness.

DXY: The final puzzle piece. A continued bounce in US Dollar futures would put further pressure on stocks.

BTCUSD finally got back over the 50-day MA. Can it stay?

The Trade

The tempting trade for many may be to buy the SPY, QQQ, and/or DIA breakout and hold on. Managed correctly, that could work out just fine.

However, the better trade may be to wait and be ready for the next rest or dip.

SPY has a potential reversal candle today while RSI approaches overbought territory, and the 8-day MA catches up to the breakout pivot. A very slight dip and retest of that level could provide a great reward/risk setup. And since it doesn’t always pay to be exact, the next pivot below, $520.75, is a level worth watching as well.

QQQ has a very similar potential setup.

And finally, IWM has yet to reach new 2024 highs, much less all-time highs. A retest of $206-$207 could be actionable there.

Once again, it is notable that TLT is facing a significant test, and the Dollar $DX1! is bouncing from an assortment of MAs and AVWAPs while this potential reversal is showing in stocks.

It will be important to watch all of these pieces for indications of what comes next.

Elevate Your Trading

Education, training, and support for your Trading Adventure.

Options Trades - Weekly trade ideas are delivered to your email or text messages in language you can easily understand.

Check out EpicTrades from David Prince and T3 Live. Epic Trades from David Prince

Community - Are you an experienced trader seeking a community of professionals sharing ideas and tactics? Visit The Inner Circle, T3 Live’s most exclusive trading room - designed for elite, experienced traders.

The Inner Circle at T3 Live

Prop Trading - Or perhaps you are tested and ready to explore a career as a professional proprietary trader? 3 Trading Group has the technology and resources you need.

Click here to start the conversation:

T3TradingGroup.com

The Disclosures

***This is NOT financial advice. This is NOT a recommendation to buy, sell, or trade any security. The content presented here is intended for educational purposes only.

Andrew Moss is an associated member of T3 Trading Group, LLC (“T3TG”), an SEC-registered broker/dealer and member of FINRA/SIPC. All trades placed by Mr. Moss are done through T3TG.

Statements in this article represent that person’s opinions only and do not necessarily reflect those of T3TG or any other person associated with T3TG.

Mr. Moss may hold an investment position (or may be contemplating holding an investment position) that is inconsistent with the information provided or the opinion being expressed. This may reflect the financial or other circumstances of the individual, or it may reflect some other consideration. Readers of this article should consider this when evaluating the information provided or the opinions being expressed.

All investments are subject to the risk of loss, which you should consider in making any investment decisions. Readers of this article should consult with their financial advisors, attorneys, accountants, or other qualified investors before making any investment decision.

POSITION DISCLOSURE

May 16, 2024, 4:00 PM

Long: AMC0517C10, AMZN0621C190, ENVX0621C10, HOOD0524C18, IMNM, IWM, PANW, SNAP, SNAP0621C17, VKTX0621C85

Short:

Options symbols are denoted as follows:

Ticker, Date, Call/Put, Strike Price

Example: VXX1218C30 = VXX 12/18 Call with a $30 strike