November 9, 2022 Mid-week Market Update

Headline sandwich

We made it through Election Day Tuesday and we're moving toward Inflation Thursday. If that's not enough market-moving news for you, we'll throw in some #CryptoCrash headlines too.

I won't pretend to know all the details, but it looks like the viability of the whole cryptocurrency system is being seriously questioned right now.

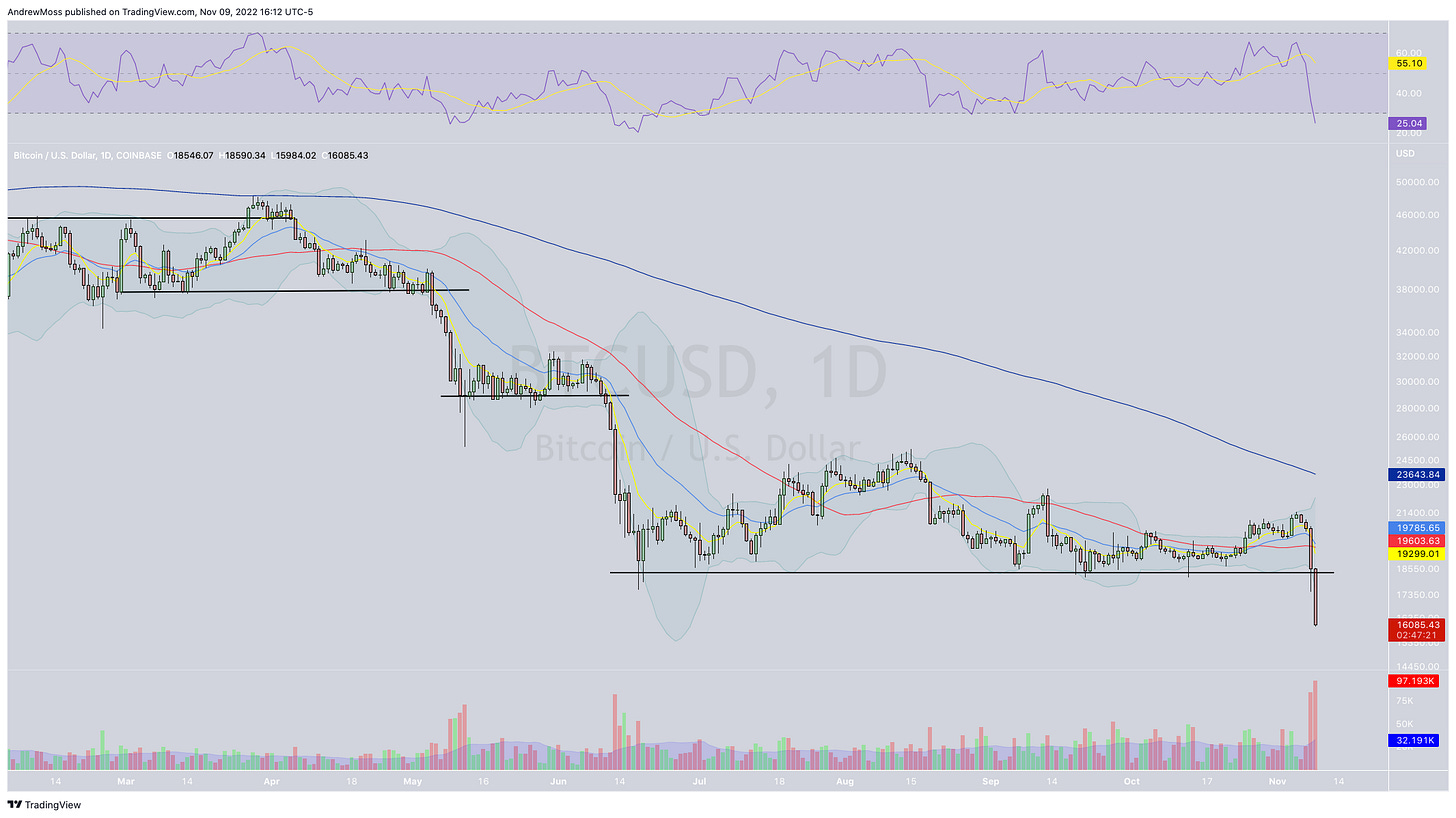

Here's the chart of $BTCUSD

Not bullish.

As for stocks, they may be suffering a little contagion. Or maybe they don't like the election results. Or maybe they're pricing in an undesirable CPI report tomorrow.

Or, or, or........

Starting with the leader, $DIA is still forging the path higher. It’s above, or very near the key moving averages. How it handles this trendline will be an important signal.

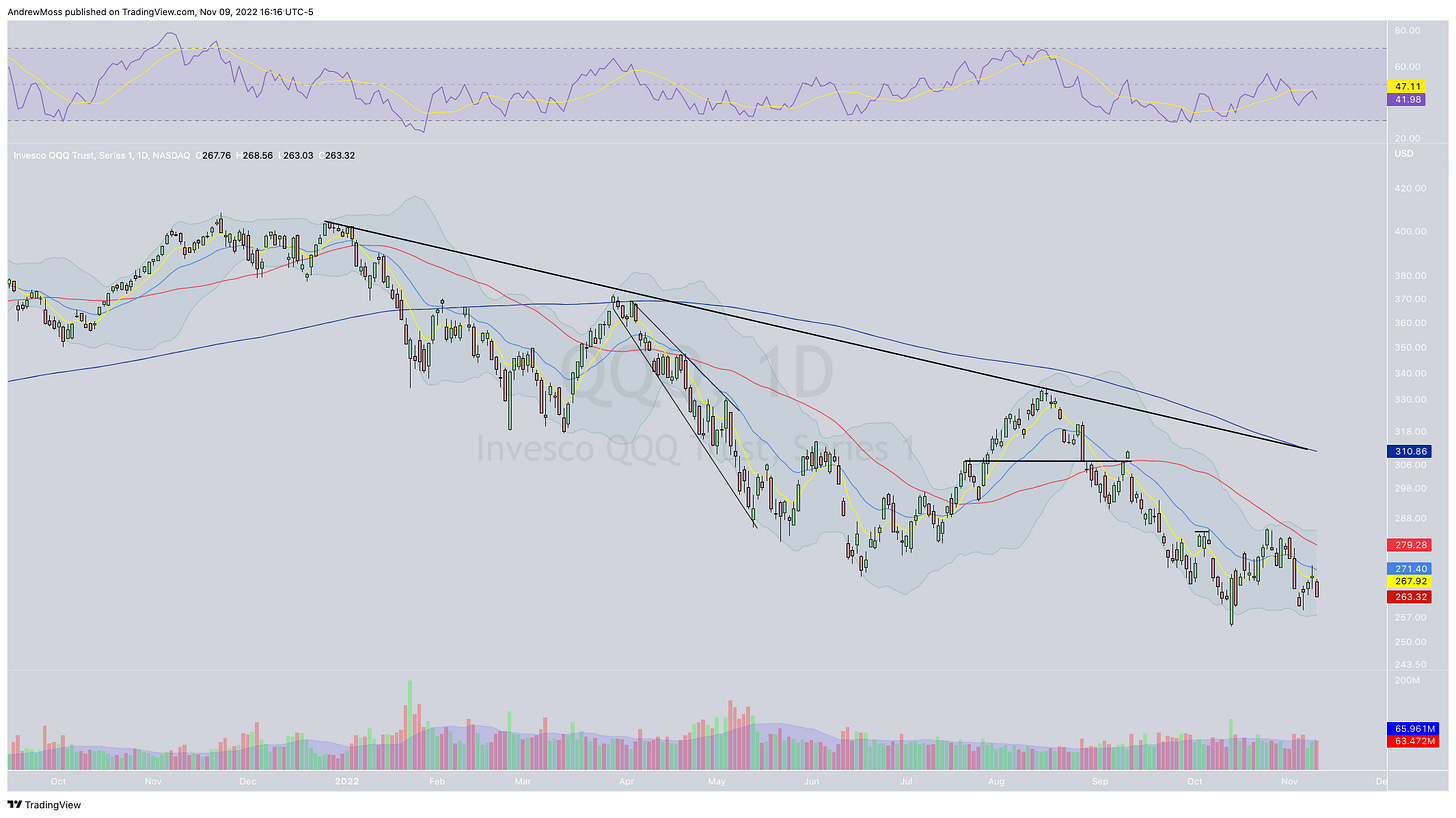

“Real" is outperforming "virtual."

Industrials over technology.

The Universe over the Metaverse.

It’s showing up in the DIA leadership. I shared quite a few of these comparison charts over the weekend.

click the image to view the complete thread

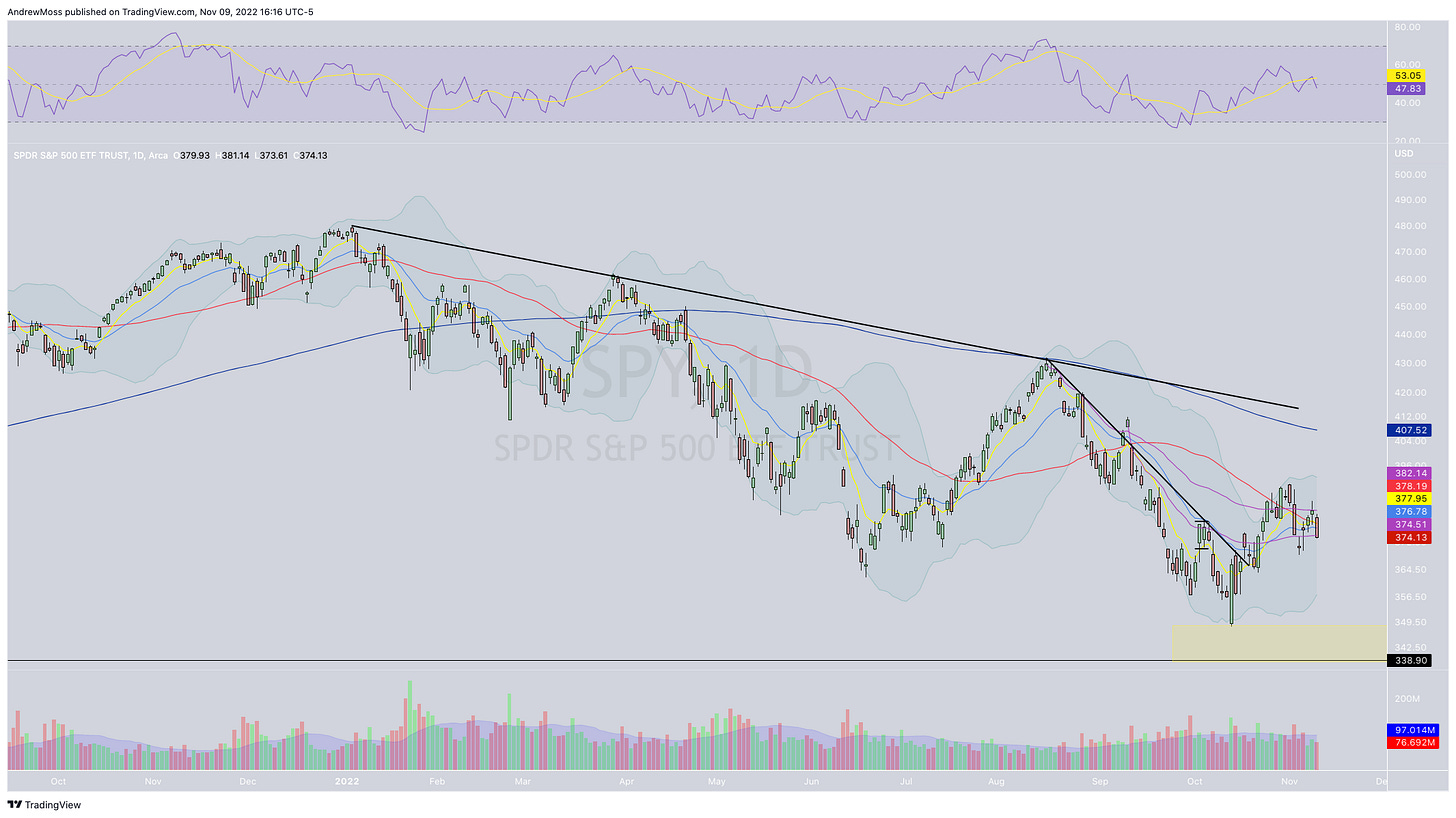

SPY started the week well enough but today it lost the 8,21, and 50-day moving averages today. The status is the same as I wrote last Friday — choppiness and indecision.

QQQ continues to be the weakest.

IWM looks like it wants to follow QQQ lower.

The Thursday/Friday low in the indexes is notable but it doesn't seem significant heading into tomorrow's CPI report. We know inflation data will set the mood for the rest of this week, and likely beyond that.

So know the levels, but also know that I'm not counting on them to be any real support. The significant "lines in the sand" are still the yearly lows and Nov 1 high for SPY.

We could see a lot more noise in between before any real direction resumes.

***This is NOT financial advice. NOT a recommendation to buy, sell, or trade any security. The content presented here is intended for educational purposes only.

Andrew Moss is an associated member of T3 Trading Group, LLC (“T3TG”) a SEC registered broker/dealer and member of FINRA/SIPC. All trades placed by Mr. Moss are done through T3TG.

Statements in this article represent the opinions of that person only and do not necessarily reflect the opinions of T3TG or any other person associated with T3TG.

It is possible that Mr. Moss may hold an investment position (or may be contemplating holding an investment position) that is inconsistent with the information provided or the opinion being expressed. This may reflect the financial or other circumstances of the individual or it may reflect some other consideration. Readers of this article should take this into account when evaluating the information provided or the opinions being expressed.

All investments are subject to risk of loss, which you should consider in making any investment decisions. Readers of this article should consult with their financial advisors, attorneys, accountants or other qualified investors prior to making any investment decision.

POSITION DISCLOSURE

Long: DRI, MCK

Short:

Options symbols are denoted as follows:

Ticker, Date, Call/Put, Strike Price

Example: VXX1218C30 = VXX 12/18 Call with a $30 strike