Nvidia Earnings Preview

What It Means For $NVDA Stock And The Whole Market

Nvidia Earnings Preview

Nvidia’s upcoming earnings report is a critical event for investors and traders, reflecting its substantial influence on the semiconductor industry and broader market dynamics.

As a powerhouse in the artificial intelligence (AI) sector, Nvidia’s performance is under intense scrutiny, with high expectations for robust growth and forward-looking guidance. This report arrives at a crucial juncture as the market evaluates the sustainability of Nvidia’s high valuation following its impressive recent performance.

I am pleased to announce the launch of reader-supported subscriptions to Trading-Adventures.com. For just $15 a month, you can further support this work and enhance your Trading Adventure.

Go deeper than the indexes to analyze market moves beneath the surface.

More charts, more analysis, and more education to improve your trading and enhance your success.

Subscribe now to support this Trading Adventure and take a significant step forward on your own. It's all available for less than a cup of coffee each week.

Been here a while and enjoy the freebies? No worries. Free subscribers will continue to receive the Market Update articles twice a week.

And you can help in other ways.

Share Trading Adventures

Forward this email to friends, family, coworkers, and fellow traders

Thank you for considering a paid subscription to Trading Adventures. I look forward to supporting you on your trading journey!

Analysts are optimistic and looking for continued growth in EPS and revenue. The outcome of this earnings report could either reinforce investor confidence or prompt a reevaluation of Nvidia’s market standing.

Key Factors —

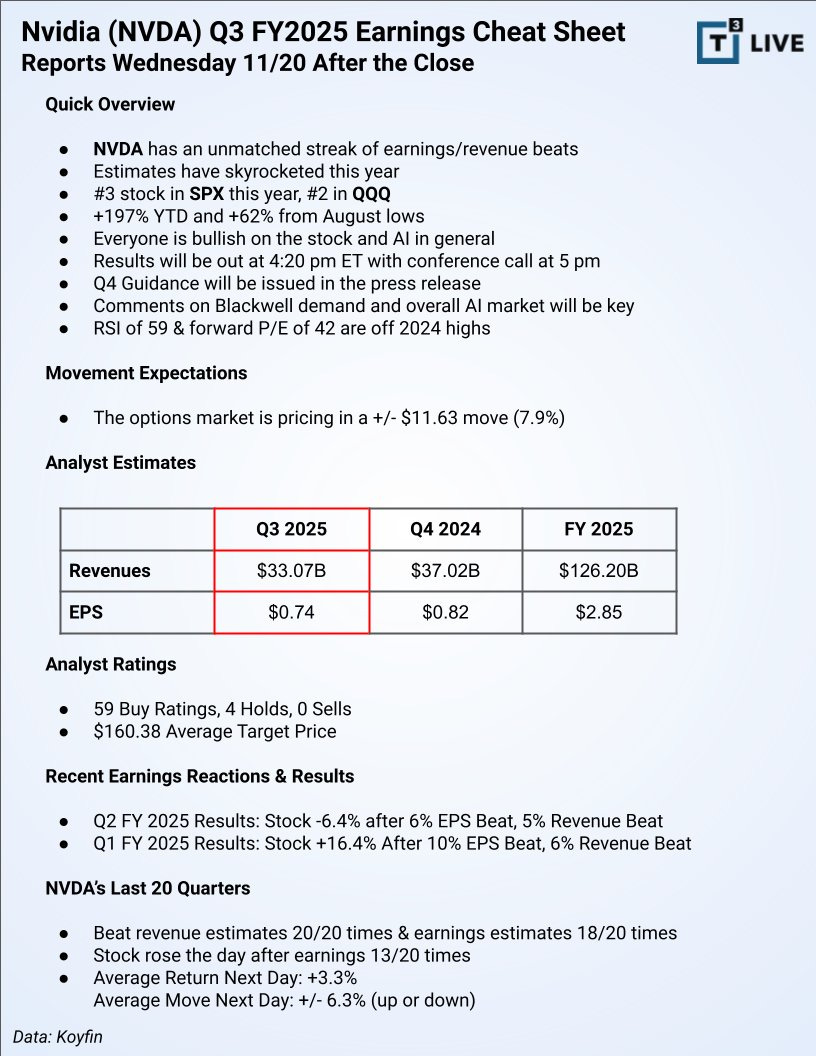

Revenue growth and guidance — Analysts forecast an 84% year-over-year increase to $33.07 billion, primarily driven by AI infrastructure demand — essential for validating the current valuation and sustaining investor confidence.

Earnings per share (EPS) — Projected at $0.74 for the quarter, EPS estimates indicate high hopes for substantial growth from the previous year.

Data center revenue - Expected to hit a record of more than $29 billion, underscoring its role as a significant growth driver.

Blackwell AI chips — This has been a key revenue driver. Positive updates are critical, as they could provide insights into future revenue streams and address potential supply constraints.

Market Influence — Nvidia’s results will influence market sentiment amid recent shifts towards fintech and other emerging sectors.

The options market is pricing in approximately a $13 move. Here’s the chart to show the potential impact in either direction.

The stock trades in a solid uptrend above all the key moving averages. After making new highs last week, it has been consolidating ahead of the report, even dipping below the 21-day MA and the June pivot highs briefly last week. So it's not extended and could have plenty of room to run higher.

The options implied move higher would do the job, carrying the stock well into new highs again. While the same move lower would have it testing its 50-day MA.

The results will be announced at 4:20 PM this evening. They have a history of delivering “beat and raise” announcements. (Beating EPS estimates and raising future guidance)

Will it be enough?

Here are some more tidbits courtesy of this cheat sheet from T3 Live.

The Disclosures

***This is NOT financial advice. This is NOT a recommendation to buy, sell, or trade any security. The content presented here is intended for educational purposes only.

Looking For More?

Elevate Your Trading Adventure Even Further With These Offerings.

EpicTrades Options Newsletter

Real-time trade ideas and insights, providing actionable trading insights focusing on options trades with short-term horizons, aiming to capitalize on weekly market movements.

The approach includes detailed reasoning for trades, specific options, and profit targets, focusing on quick gains with less time commitment required from subscribers.

The Inner Circle

The Inner Circle is a Virtual Trading Floor (VTF) at T3 Live. It’s the group I’ve been working and trading with since 2022. You may have noticed the logo in the watermarks on my charts.

Founded by David Prince and led by him, Rick March, and Kira Turner, the Inner Circle is a community of elite traders, including hedge fund managers, family office heads, corporate executives, financial advisors, and even professional poker players.

Fundamental, Macro, and Technical Analysis all combine to find and discuss the best opportunities in current markets.