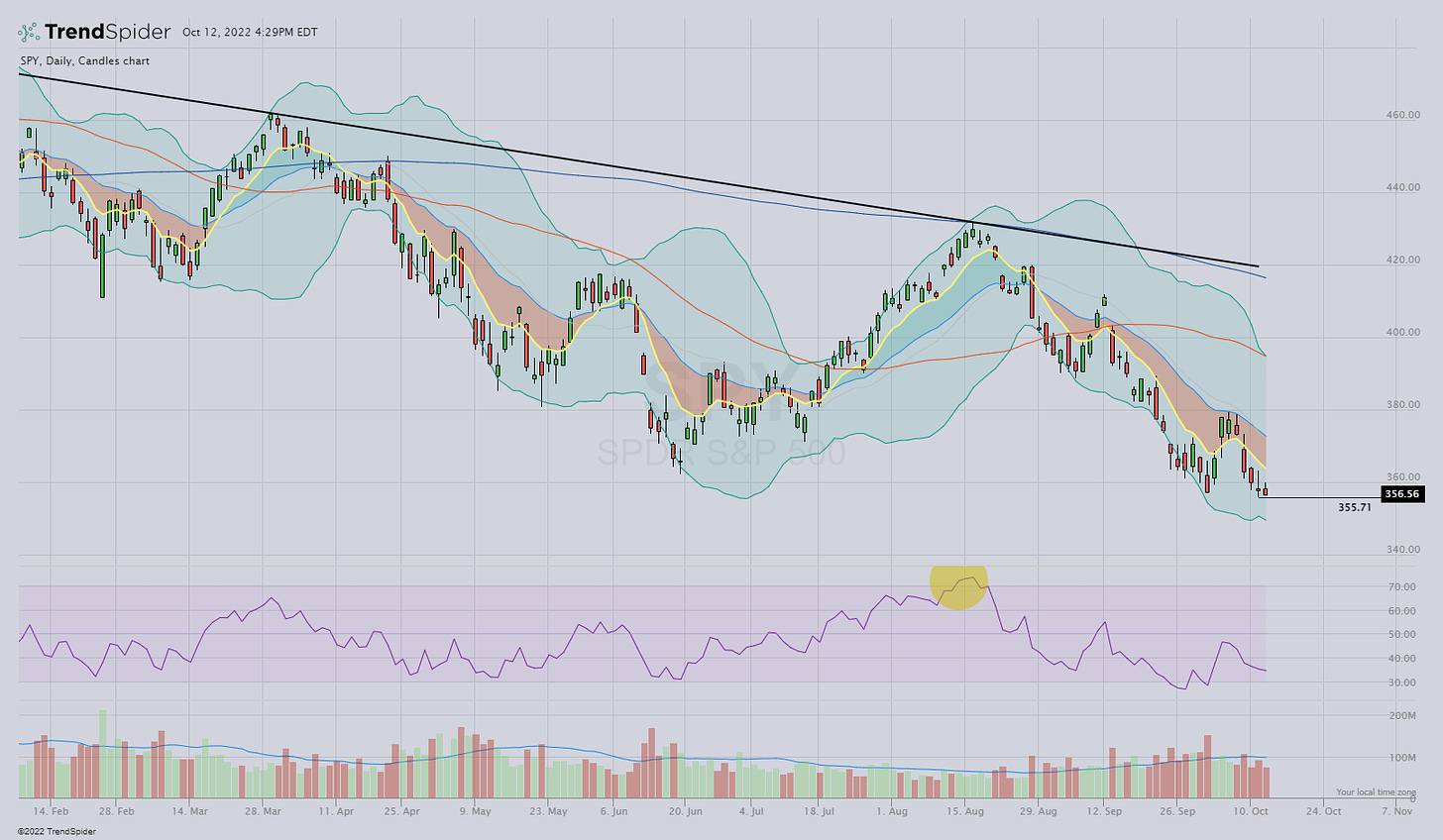

So far this week stocks have continued the decline that started last Friday.

Yesterday SPY and QQQ each made a new 2022 low while IWM holds up a little stronger but still has the potential bear flag in play. The trends are the same;

continuation down and below all the key moving averages.

The Bank of England has been cited as a primary market mover again. Last week their announcement of emergency bond purchases led to Tuesday's large gap and move higher. Yesterday comments that they would halt those purchases by the end of this week sent some stock owners looking for the exits.

Now all eyes will be on the Fed and its continuing battle against inflation.

The Consumer Price Index - CPI report comes out at 8:30 AM tomorrow morning. The expected numbers are 8.1% YoY vs. 8.3% in August, with core inflation 6.5% YoY vs. 6.3% in August.

$DXY

The mid-30s has mostly been a lid on volatility $VIX

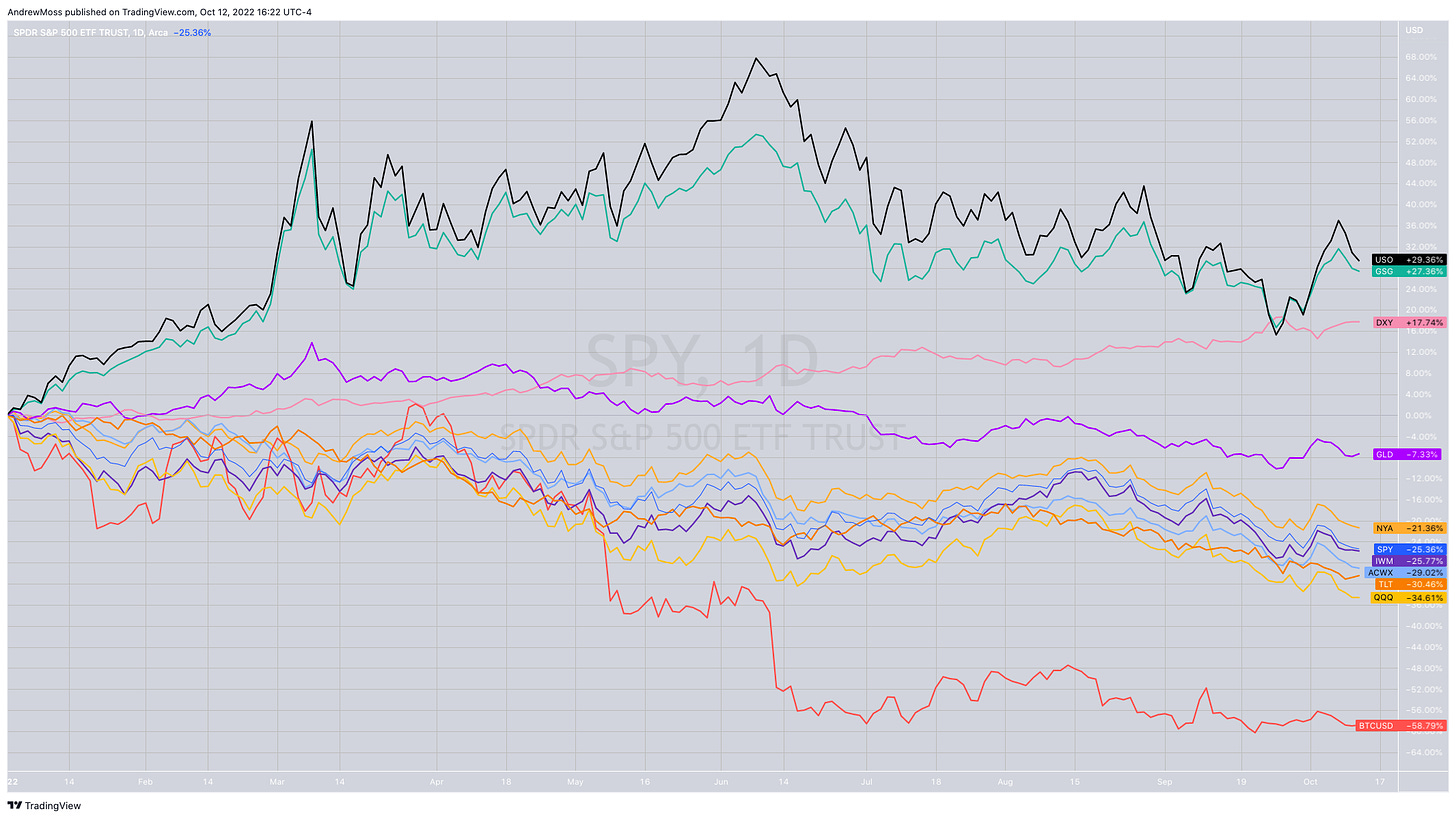

A look at some relative strength

It gets old looking at falling charts all the time. Believe it or not, there are some bull markets out there besides $VIX and $DXY

This chart shows YTD performance for some major asset classes. Commodities $GSG, specifically oil $USO, are leading the way.

Performance figures are on the right. Click the charts to enlarge them for more visibility.

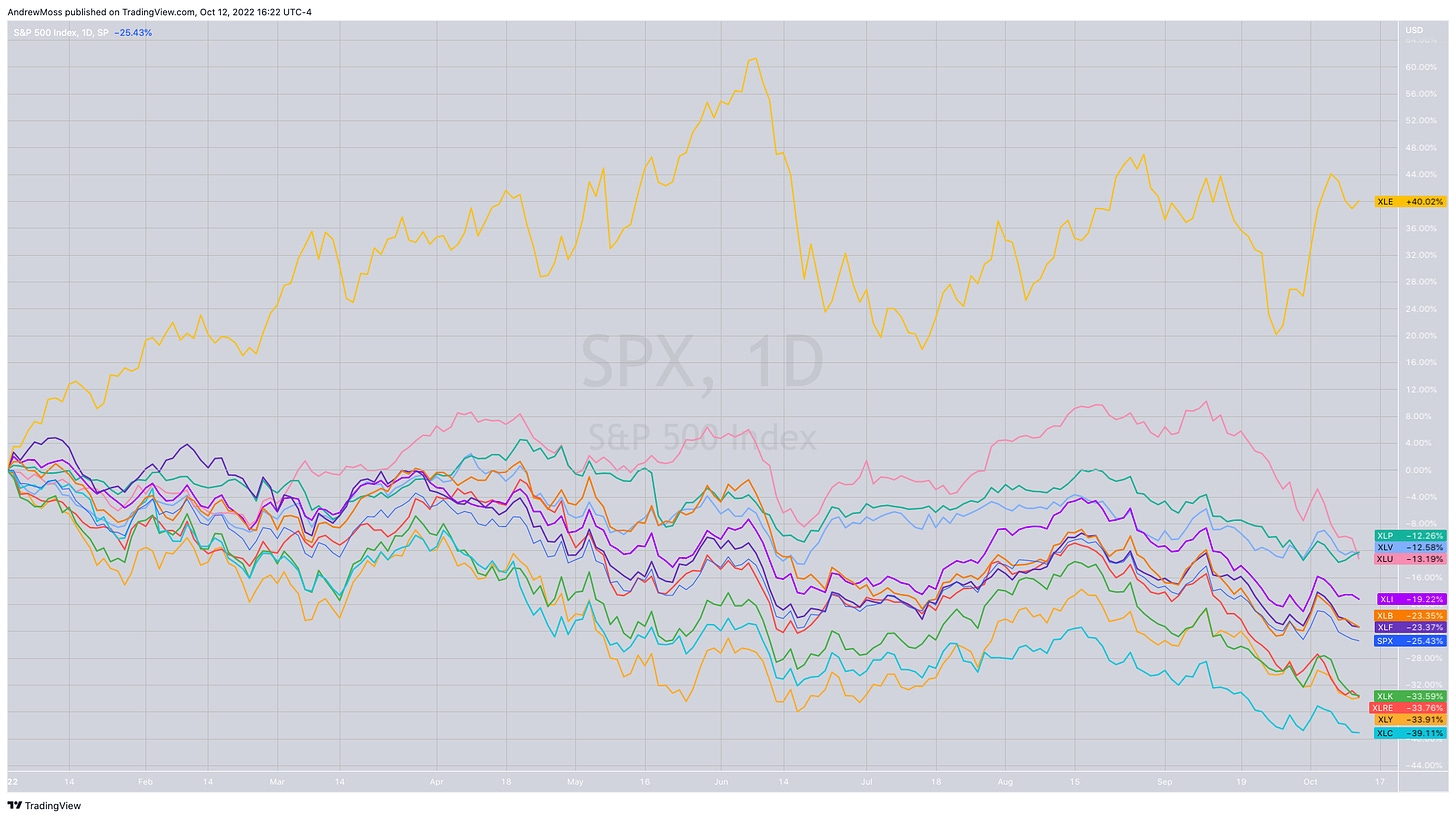

SP500 and each of its 11 sectors’ YTD performance

Once again, energy has been the only SP sector in a bull market. What you may not know is that there has been an even bigger bull market in the somewhat energy-related metals and mining sector; specifically in Coal stocks.

Take a look at the YTD performance for Consol $CEIX, Alpha $AMR, and Peabody $BTU, relative to some of the major oil companies.

Perhaps governments and utility companies around the world are remembering that they can still burn coal for electricity.

I'll share a closer look at the charts of those companies in the coming days. But for now, remember that there is almost always a bull market somewhere.

To close, I'd like to invite you to an Open House, next week, for the T3 Live ProDesk Virtual Trading Floor. If you've read my description of what, how, and where I do my trading you know that the ProDesk is the next best thing to physically being on a trading floor in NYC.

If you haven't read that, look here. Info about the VTF is towards the bottom.

Click here —> T3 Live ProDesk Virtual Trading Floor Open House - October 17-21

You can register at that link for:

5 full days of trading room access with Derrick & team

Interactive prep/recap meetings 2x a day to reinforce skills

Total access to video, audio, and Q&A chat with our Senior Trader and Managing Supervisor, Derrick Oldensmith

An exclusive experience shadowing a pro trader in real market condition

If you ever considered a career as a full-time professional trader this is a great opportunity to get a look behind the curtain of a real prop trading firm before taking the leap.

And if you're trading on your own but looking for a group to learn from and share ideas with there is no better place.

So come in next week and see how we do it. And feel free to invite a friend as well. Simply forward this email, or click “share” button below.

See you next week!

***This is NOT financial advice. NOT a recommendation to buy, sell, or trade any security. The content presented here is intended for educational purposes only.

Andrew Moss is an associated member of T3 Trading Group, LLC (“T3TG”) a SEC registered broker/dealer and member of FINRA/SIPC. All trades placed by Mr. Moss are done through T3TG.

Statements in this article represent the opinions of that person only and do not necessarily reflect the opinions of T3TG or any other person associated with T3TG.

It is possible that Mr. Moss may hold an investment position (or may be contemplating holding an investment position) that is inconsistent with the information provided or the opinion being expressed. This may reflect the financial or other circumstances of the individual or it may reflect some other consideration. Readers of this article should take this into account when evaluating the information provided or the opinions being expressed.

All investments are subject to risk of loss, which you should consider in making any investment decisions. Readers of this article should consult with their financial advisors, attorneys, accountants or other qualified investors prior to making any investment decision.

POSITION DISCLOSURE

Long: SPY 1021P350

Short: SPY1021P330

Options symbols are denoted as follows:

Ticker, Date, Call/Put, Strike Price

Example: VXX1218C30 = VXX 12/18 Call with a $30 strike