Over The Line

The Bulls Have The Ball

The Markets

Meta and Microsoft both jumped on earnings, leading stocks higher this morning and boosting the S&P 500 to as high as 5658.91. That was enough to put it in contact with the upper Bollinger Band, which proved to be the top for the day.

Refresher: Bollinger Bands are based on a centerline, usually a 20-period moving average, and upper and lower bands that are each one standard deviation away from that centerline.

The important thing is that SPX moved “Over The Line!”

So, the bulls are in control. Yeah, they slipped a bit and let prices close on the lows. But it did hold up, staying over the pivot, over the AVWAP, and over 5570, our line in the sand.

More on the charts below.

The Charts

SPX Monday, Tuesday, Wednesday, testing the limits. Today, Over The Line, with some earnings help. Previous resistance becomes potential support. Apple and Amazon are reporting now. We’ll see if prices can hold up tomorrow and next week.

QQQ gapped higher as well and is over its line (which was more of an area), adding to the case that the worst is behind us. $475 and the 50-day MA should provide support if the bulls are serious about this move.

More on the possibility that 'the worst may be behind us.’

First, take a look at that rebound on the monthly candle! +15%

That’s not something we see very often.

We talked about Breadth Thrusts in the Weekly Charts thread on Saturday. More bullish info. You can revisit those here:

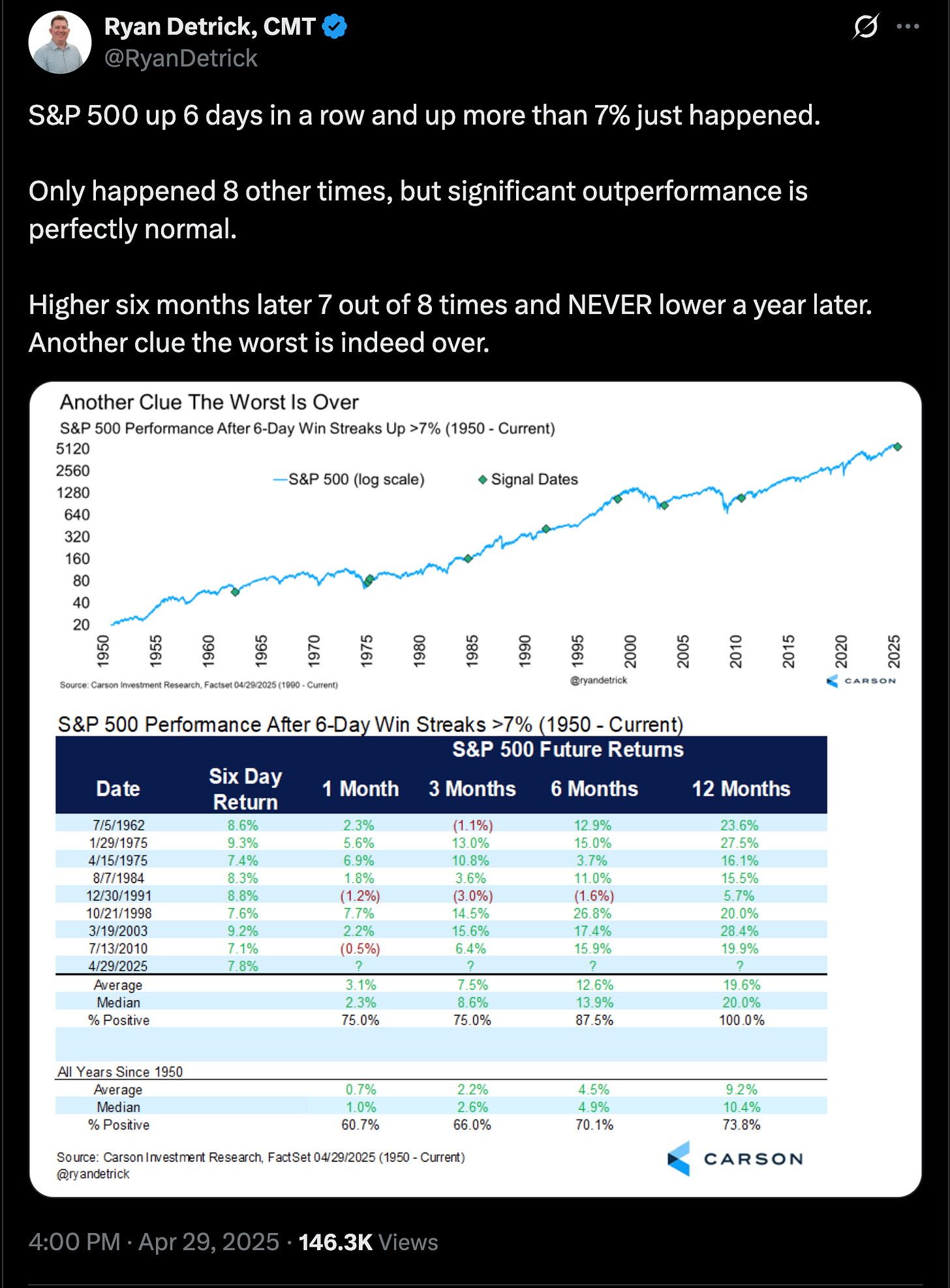

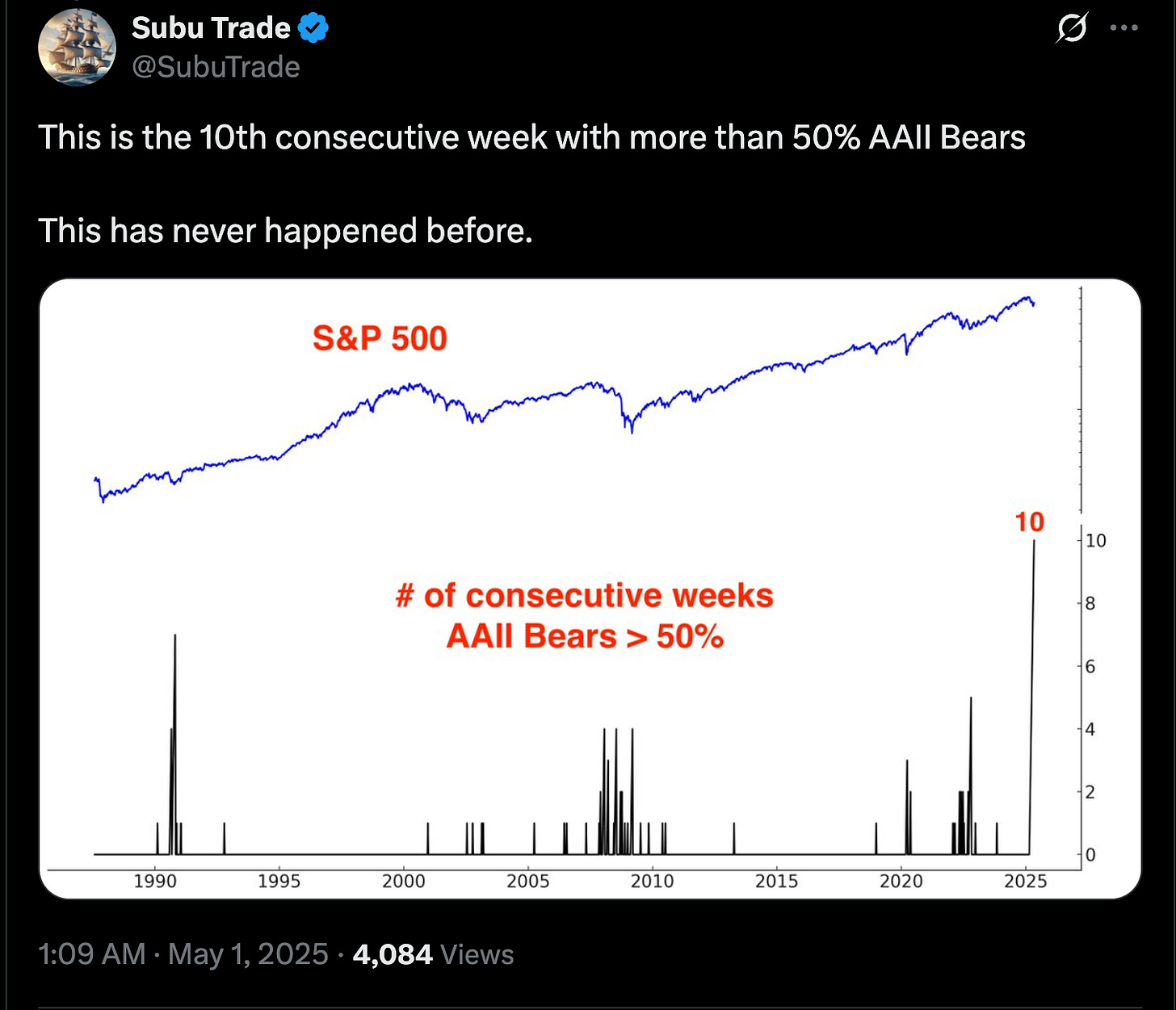

Finally, here are some more stats from Ryan Detrick and SubuTrade looking at what happens after similar previous occurrences.

All while bearish sentiment was breaking records.

The Trade

Price action has improved.

Earnings season, so far, is not a disaster. (Reddit actually raised guidance this evening.)

Historical precedent suggests we’ve seen the worst.

That doesn’t necessarily mean that higher volatility is over, and we go straight up from here. But it certainly helps us form a more favorable outlook for the rest of the year.

Looking For More?

Elevate Your Trading Adventure Even Further With These Offerings.

EpicTrades Options Newsletter

Real-time trade ideas and insights, providing actionable trading insights focusing on options trades with short-term horizons, aiming to capitalize on weekly market movements.

The approach includes detailed reasoning for trades, specific options, and profit targets. It focuses on quick gains with a minimal time commitment from subscribers.

Don’t miss the next trade! Hit the link to get your real-time alerts.

QQQ puts were a well-timed home run on the quick pullback yesterday, gaining 130%! Don’t miss the next one!

The Inner Circle

The Inner Circle is a Virtual Trading Floor (VTF) at T3 Live. I’ve been working and trading with this group since 2022. You may have noticed the logo in the watermarks on my charts.

Founded by David Prince and led by him, Rick March, and Kira Turner, the Inner Circle is a community of elite traders, including hedge fund managers, family office heads, corporate executives, financial advisors, and even professional poker players.

Fundamental, Macro, and Technical Analysis all combine to find and discuss the best opportunities in current markets.

The Disclosures

***This is NOT financial advice. This is NOT a recommendation to buy, sell, or trade any security. The content presented here is intended for educational purposes only.