Pinched

The $SPX is feeling the squeeze

Two things this afternoon before the usual Market Update, which will be out tomorrow.

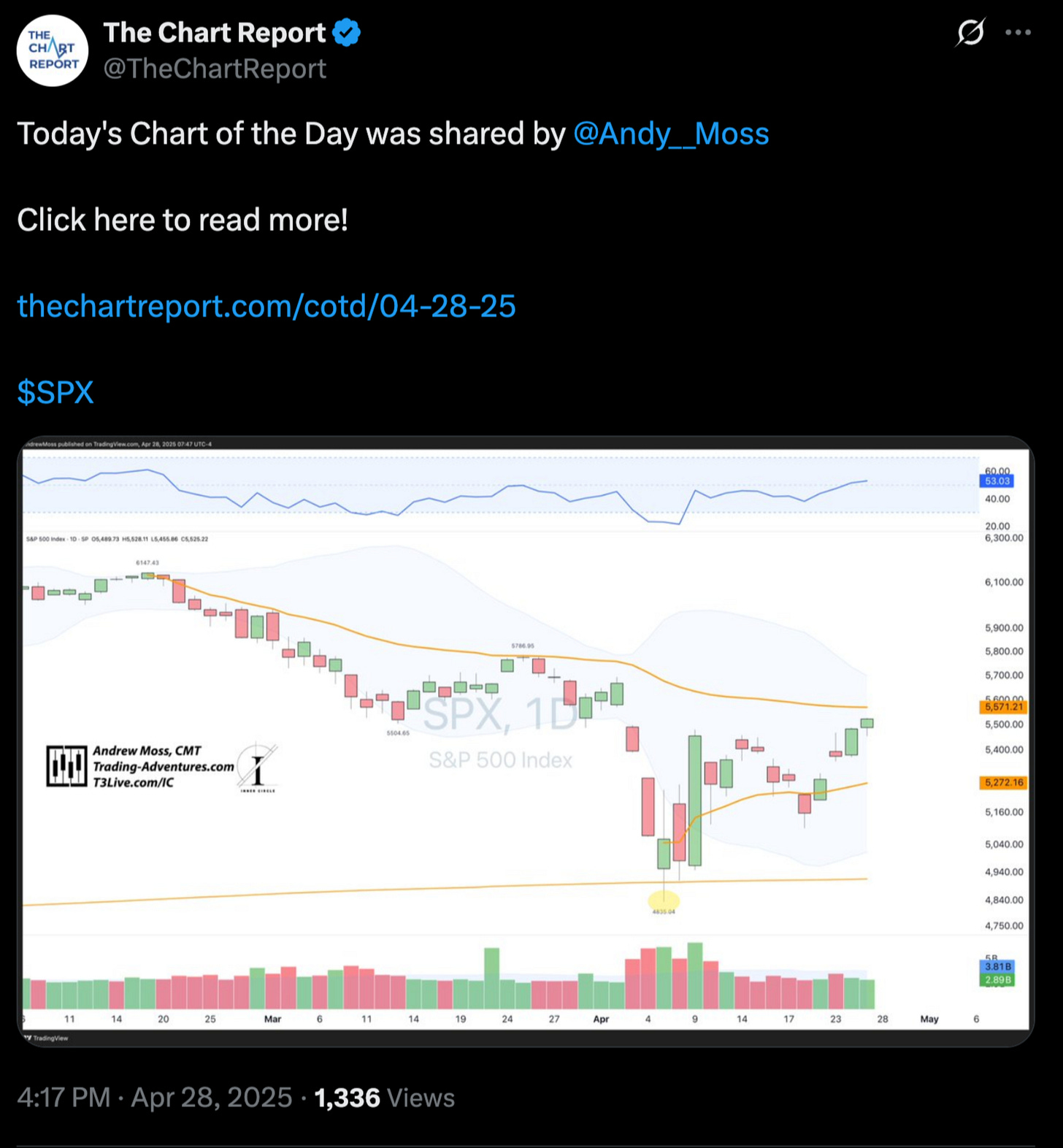

The SP 500 has been range-bound and is now getting ‘pinched’ between two significant anchored VWAPs. I shared this chart this morning, and The Chart Report was kind enough to feature it as their Chart Of The Day in today’s edition.

If you like charts and aren’t already a subscriber, you should be. Patrick Dunuwila (co-founder, editor of The Chart Report, and fellow CMT) scours Twitter/X for the best charts, articles, and technical analysis each day and then delivers a concise collection to help you get a read on the most important points. Hit the website and get it delivered for free, right to your email.

The Markets

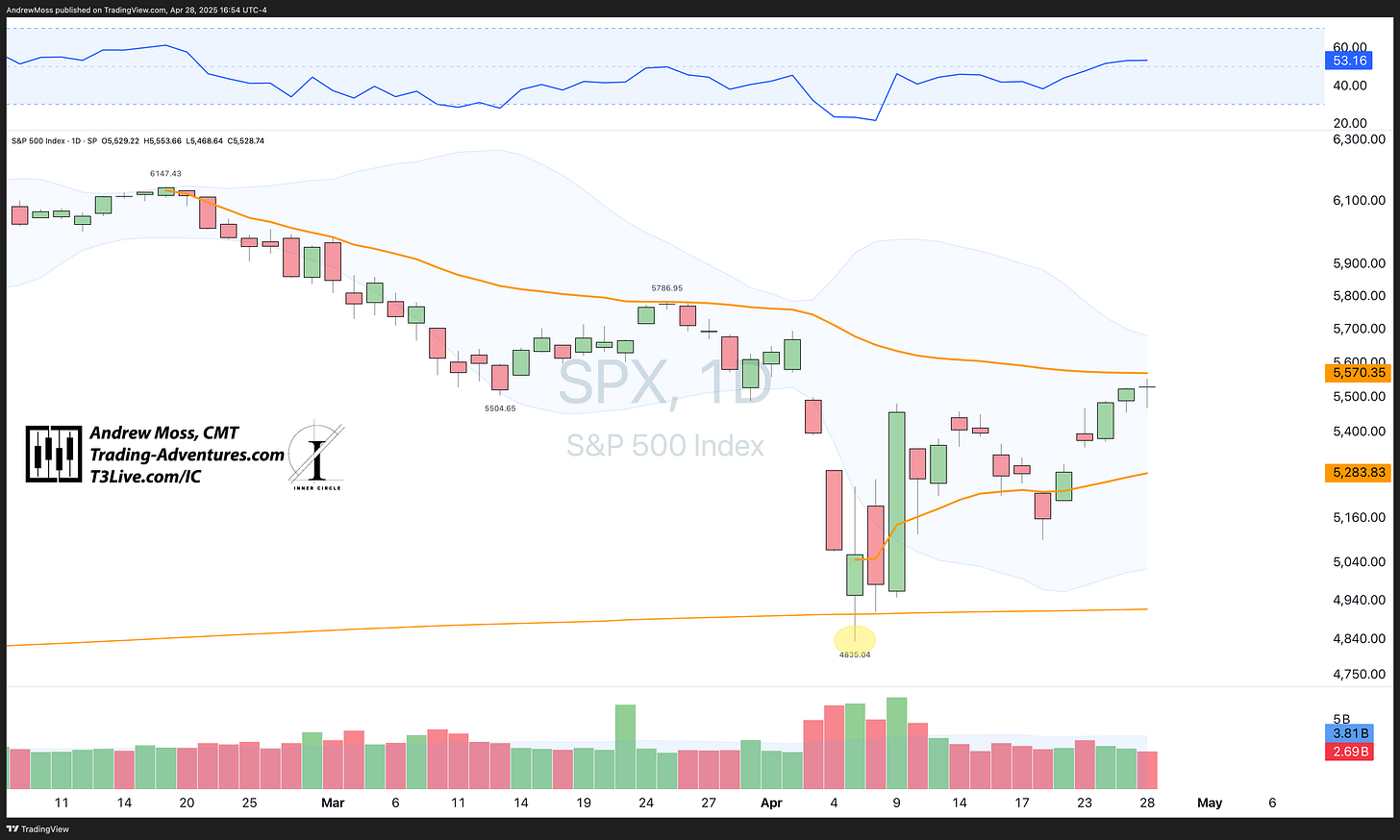

Here’s the original chart, updated through today’s close.

SPX - The S&P 500

The bounce has been impressive. However, there can be no lasting resumption of an uptrend until price gets (and stays) above the AVWAP from the Feb. 19 pivot high.

We have several key earnings reports coming up this week that will drive the action.

From the Magnificent 7 — AAPL, AMZN, META, and MSFT.

Other top SP 500 names — CVX, HON, KO, MA, PFE, V, XOM

We’ll consider the effect of those results in our later Market Updates, which will be released on Tuesday and Thursday after the close.

To revisit, here are two charts from the April 9, 2025, Market Update, titled “Tariffs, Stocks, Bonds, Oil, The Dollar,” which forecasted the bounce potential.

from the article

Two More Charts

Both of these weekly charts make the case that we are in the right spot to look for a bounce. Here’s why:

Jan. '22 pivot high

Oct. '22 low AVWAP

Multiple fibonacci levels

Extremely oversold - RSI ~26

% of stocks above a 50/200-day MA is very low

Sentiment is in the gutter

Fear and Greed ~3

Soaring VIX

Imagine if we got the slightest bit of good news.

SPX Weekly

QQQ - Weekly

/end

The Trade

Here’s the action:

Watch the AVWAP pinch for a directional resolution

Be ready for either outcome

Subscribe to The Chart Report and read it every day

Looking For More?

Elevate Your Trading Adventure Even Further With These Offerings.

EpicTrades Options Newsletter

Real-time trade ideas and insights, providing actionable trading insights focusing on options trades with short-term horizons, aiming to capitalize on weekly market movements.

The approach includes detailed reasoning for trades, specific options, and profit targets. It focuses on quick gains with a minimal time commitment from subscribers.

Don’t miss the next trade! Hit the link to get your real-time alerts.

The Inner Circle

The Inner Circle is a Virtual Trading Floor (VTF) at T3 Live. I’ve been working and trading with this group since 2022. You may have noticed the logo in the watermarks on my charts.

Founded by David Prince and led by him, Rick March, and Kira Turner, the Inner Circle is a community of elite traders, including hedge fund managers, family office heads, corporate executives, financial advisors, and even professional poker players.

Fundamental, Macro, and Technical Analysis all combine to find and discuss the best opportunities in current markets.

The Disclosures

***This is NOT financial advice. This is NOT a recommendation to buy, sell, or trade any security. The content presented here is intended for educational purposes only.