Post-CPI Pullback or Pause?

Indexes digest early January gains as short-term trend remains intact.

Subscriber Note

A private update for Trading Adventures readers will be shared soon. Make sure you’re subscribed to receive it.

The Markets

CPI landed in line this morning.

Inflation hit the expected 2.7% year over year. No surprises. Futures popped briefly on the 8:30 a.m. release, then faded. Most indexes have been drifting lower since.

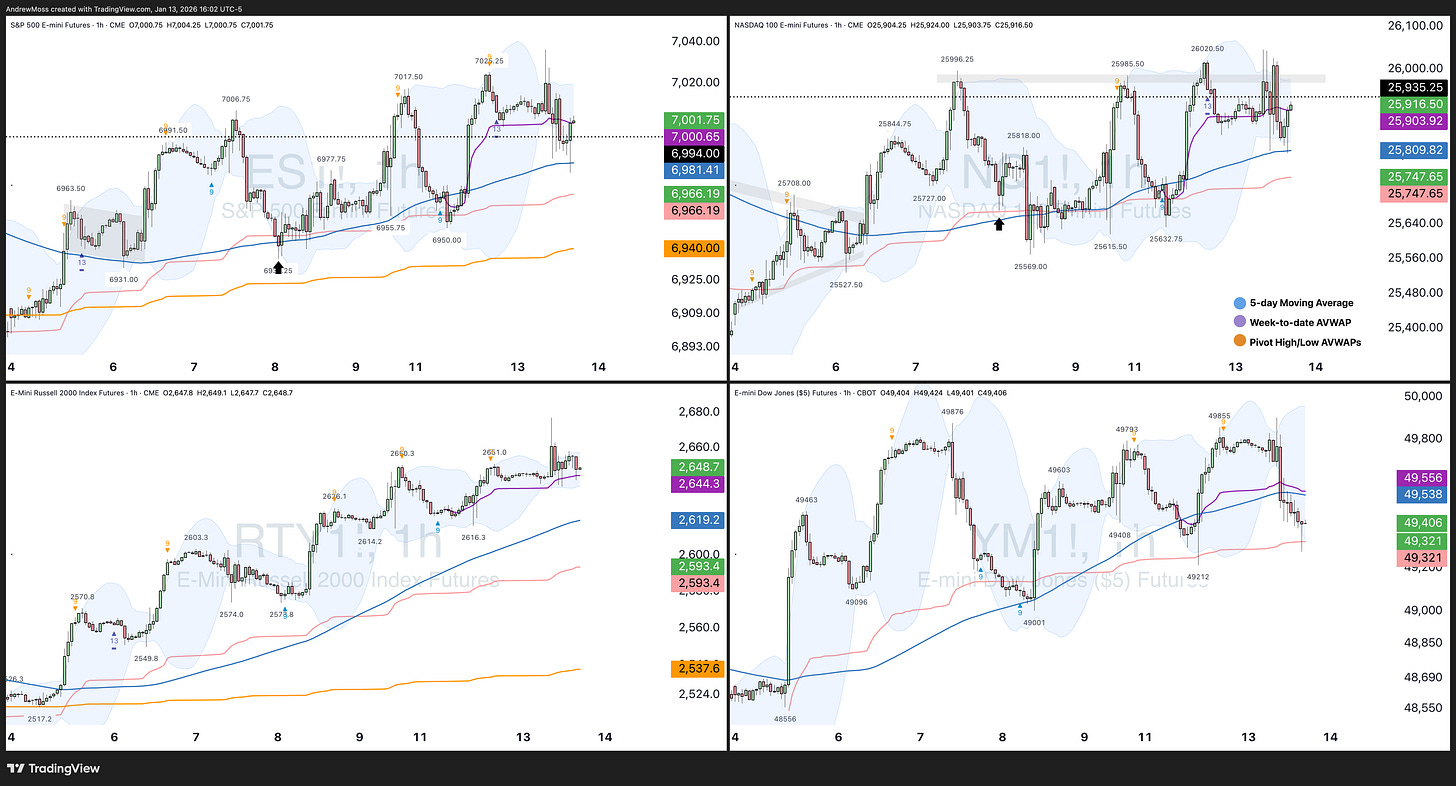

Still, trend structure holds. Futures on three of the four major indices — S&P, Nasdaq, and Russell — remain above a rising 5-day moving average. Only the Dow Futures have slipped below, and that average is now starting to decline. All four indexes are holding above their year-to-date anchored VWAPs (pink lines), although the Dow Futures are testing that level.

The Russell 2000 Futures were the sole index above its week-to-date AVWAP, but a late-day push is helping ES and NQ regain the area.

JPMorgan reported earnings this morning and dropped 4%. The move comes as credit card lenders face political pressure. Trump floated the idea of capping credit card interest rates at 10%, and while it’s unclear how real that risk is, the sector took notice.

Visa, Mastercard, and American Express all traded lower. AXP is now down more than 7% from recent highs. Some traders expected Affirm and SoFi to benefit. SoFi is up 2% and off Monday’s lows. But Affirm reversed hard — down 14% from Monday’s spike high to today’s low. It touched its 50-day moving average before bouncing back to the rising 21-day.

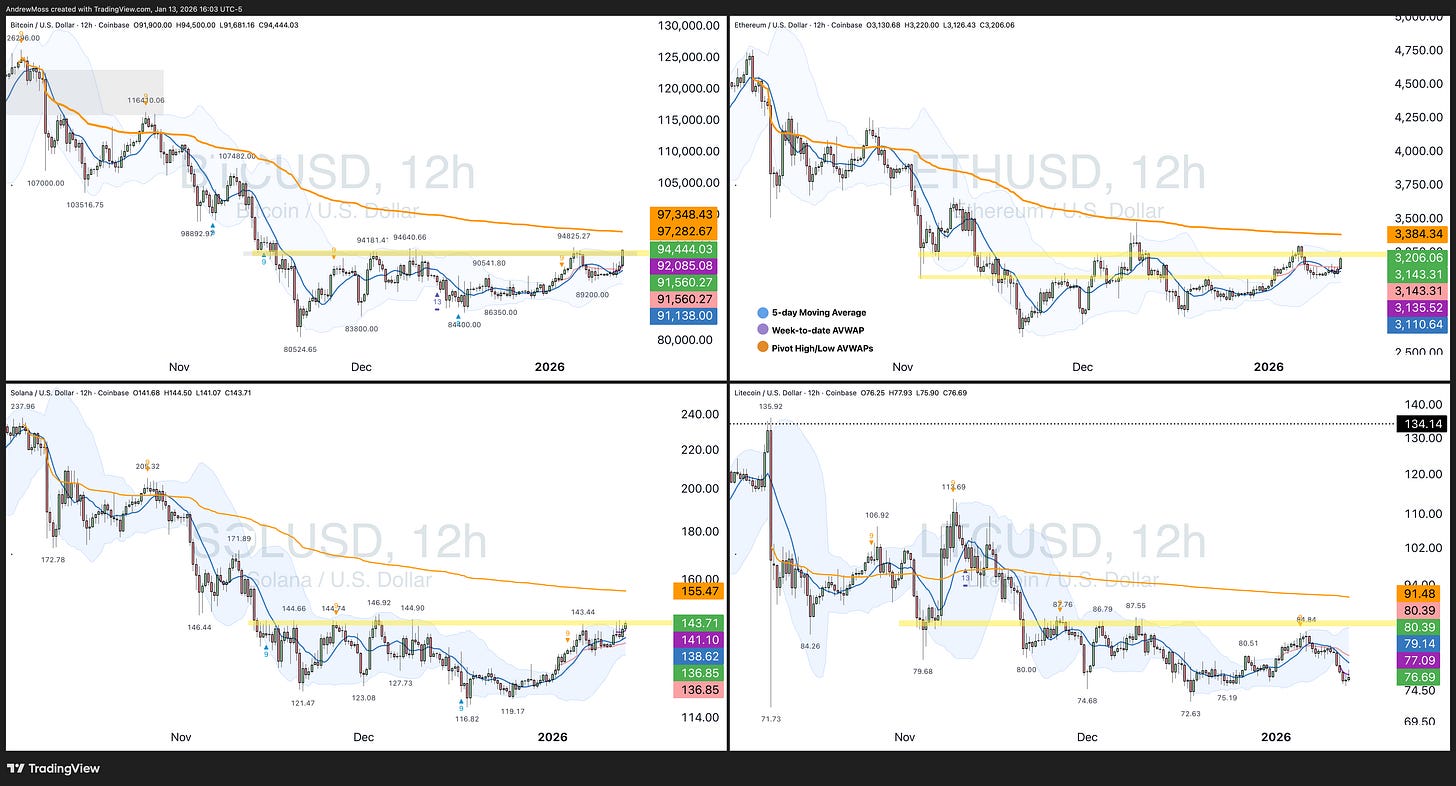

Meanwhile, Crypto is pressing into resistance. Bitcoin trades near $94,400, Solana just under $144, and Ethereum is approaching the upper end of its recent range. This area has capped price for six weeks. We’ll see if momentum can carry through this time.

Bitcoin’s anchored VWAP from the recent high sits at $47,289. That’s the level to watch. Similar setups are forming in Ethereum and Solana. If buyers reclaim those AVWAPs, control shifts.

Let’s go to the rest of the charts.

The Charts

SPY with a slight reversal day but still holding above all key moving averages on they daily chart.

QQQ has the pattern changing shape as the recent breakout over the downward sloping trendline has price probing previous resistance as it neared $629 before backing off.

IWM continues to lead and is nearly flat on the day.

DIA is, as noted above, the laggard today. Which makes sense considering the financial names included. It finishes off -0.80%, pennies above its rising 8-day MA. With price action contained in a roughly ~$5 range, it still looks like high-level bullish consolidation.

TLT continue along above the 8 adn 21-day MAs, but below the 200-day MA and two anchored VWAPs.

DXY US Dollar futures are having day 3 above the declining 200-day MA. Higher lows and lower highs continue to build the consolidation pattern here.

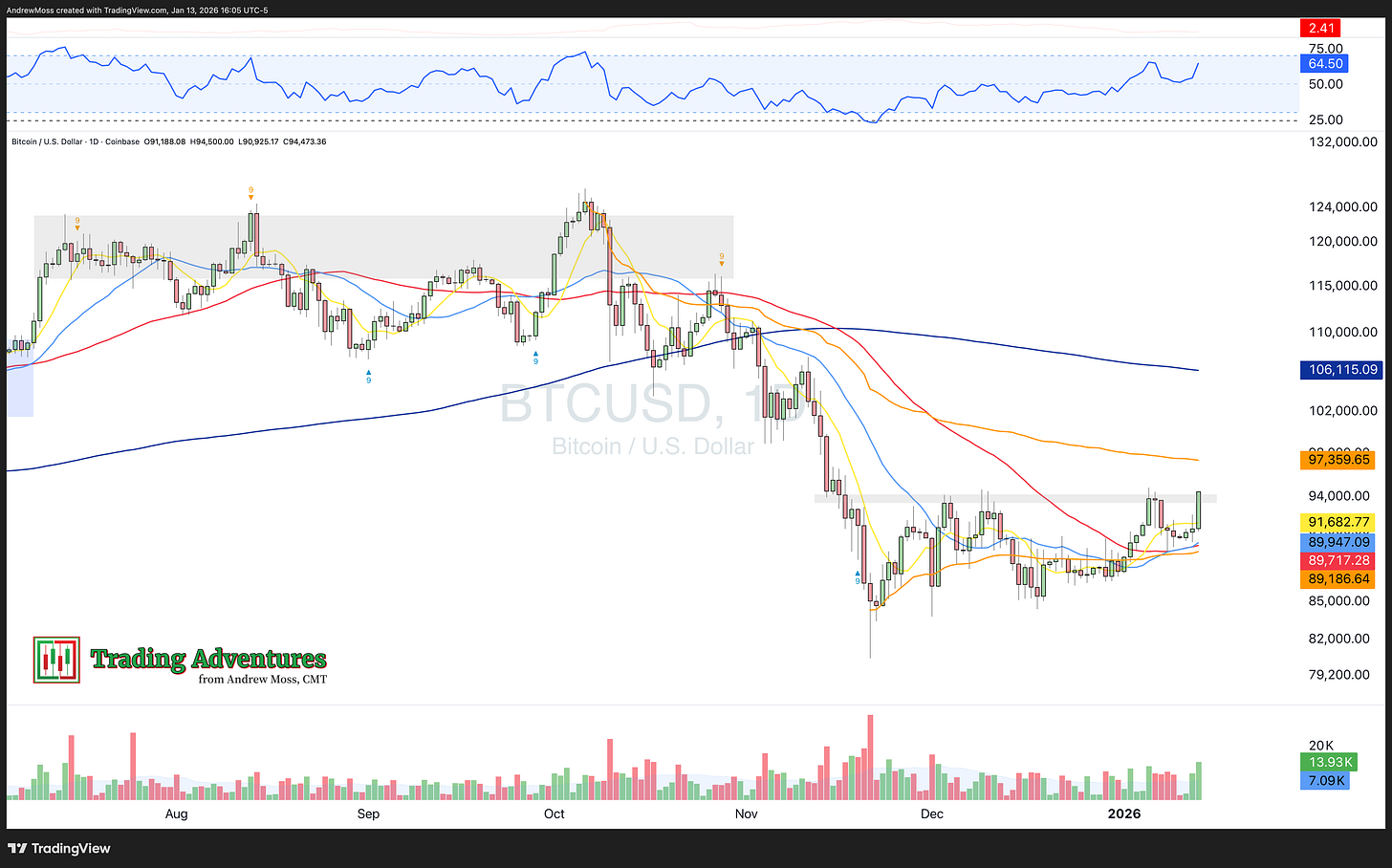

BTCUSD is up ~3.5%, trying to move beyond the previous resistance area noted above. The 8/21/50-day MAs are all sloping upward now, adding momentum. And the VWAP anchored from the all-time high rests near $97,359.

The Trade

With CPI out of the way and earnings season underway, the indexes are back in digestion mode. Structure remains intact above rising 5-day moving averages for the S&P, Nasdaq, and Russell. Only the Dow has slipped below — likely due to financial sector weakness.

So far, pullbacks look controlled. The key now is whether this week’s consolidation resolves higher — or if sellers push price back toward YTD AVWAPs.

Among sectors and individual names, the financials will remain in focus. JPM’s post-earnings drop, coupled with political headlines around interest rate caps, has the group on watch.

For now, the short-term trend still favors buyers — but the market is at a spot where follow-through needs to show up.

Stay disciplined, respect risk, and keep eyes on key levels.

The Disclosures

***This is NOT financial advice. This is NOT a recommendation to buy, sell, or trade any security. The content presented here is intended for educational purposes only.