Rest and recharge?

Midweek Market Update April 5, 2023

The Markets

Today’s note will be brief, and there will not be a Weekend Market Update Friday due to the holiday.

Last Friday the markets capped off a powerful four-day move by rising steadily all day and closing near the highs. We entered the weekend with SPY about $10 above its 8-day moving average. The QQQs were in a similar state, extended higher by about $9.50.

Being mindful that the space between the 8 and 10-day MAs can be considered short-term price equilibrium helps us expect pullbacks like we’re seeing today. That doesn’t mean drastic action is needed. But it can be a signal to reduce some size, take some profits, and have some cash ready for new opportunities.

That’s where we are today as SPY and QQQ work off that extension and move back toward equilibrium.

As we close out the week, shortened by the Good Friday holiday, see if the short-term averages can continue to support prices. If they do, and if the nonfarm payroll number (which will still be released Friday morning) doesn’t come with a surprise, maybe the up-move can resume next week.

The Charts

With a couple of extras

SPY moved near its 8-day and below the 407.66 pivot before the ‘now typical’ late-day rally lifted it back above.

QQQ dipped below its 8-day and into the 314-315 pivot zone before closing very near the ATH AVWAP.

IWM continues to be a weaker index as it continued yesterday’s powerful selloff. It’s still vulnerable while below the declining 8 and 21-day MAs.

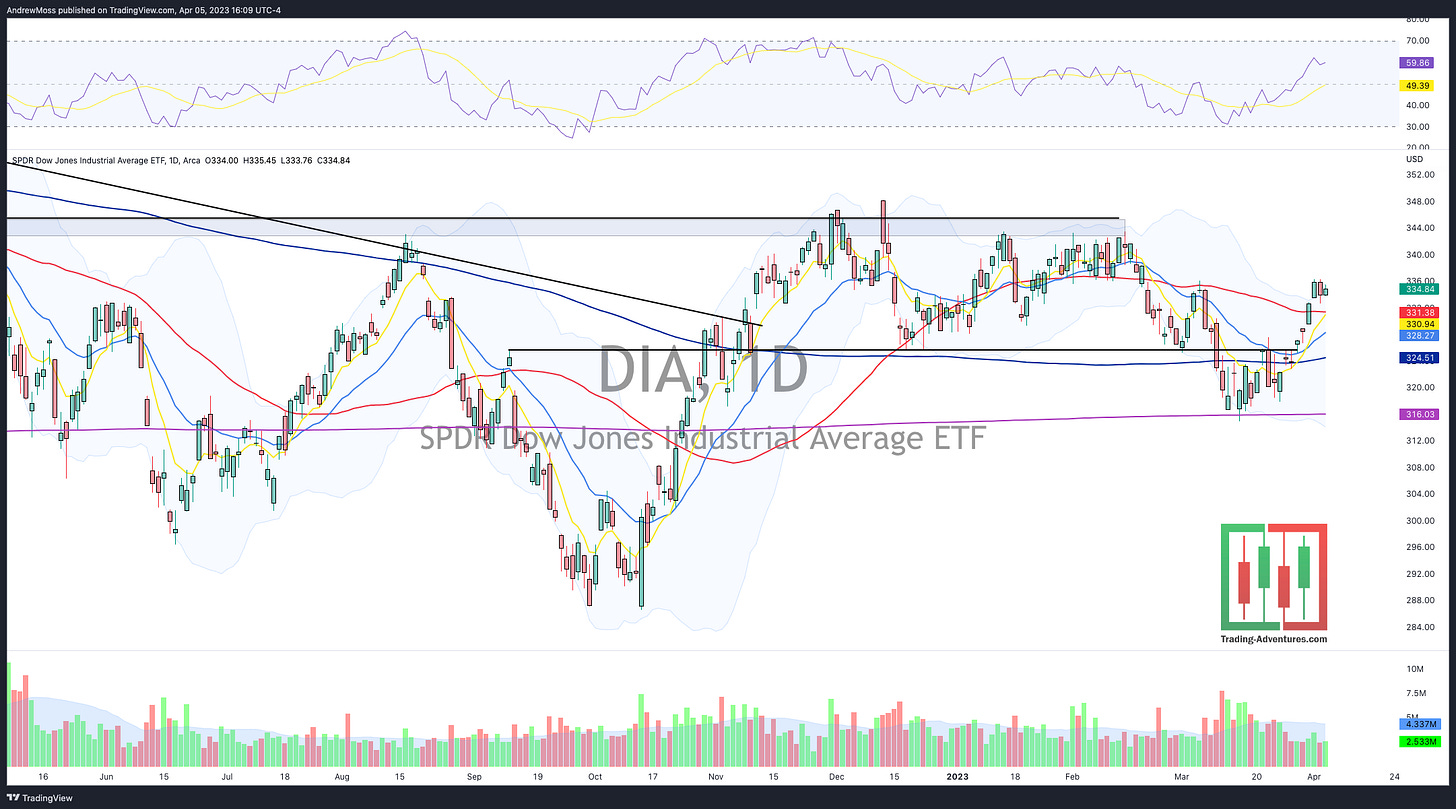

DIA held up well and looks like a bullish consolidation pattern.

DXY has day two beneath the 50% retracement level. What was starting to look like a 102-105 range now may be giving clues that it could keep going lower instead.

VIX is still low and quiet.

XLF looks very similar to IWM which has heavy exposure to the troublesome group of regional banks. This continues to be a red flag for stocks overall as bullish moves can be more difficult to sustain without bank participation.

XLE is holding recent gains well and staying above the 50-day MA and the AVWAP.

BTCUSD Bitcoin gets tighter and tighter as it tries to breach the ATH AVWAP.

ETHUSD Ethereum found itself in a box a little sooner and was able to break out only to then be slowed by its ATH AVWAP.

Speaking of currencies:

As “de-dollarization” is the crisis du jour it is important to remember that scary headlines get the clicks and the eyeballs. To refute this, there are some very thorough reports making the rounds that examine reasons why it is incredibly unlikely that the U.S. Dollar would lose its world reserve currency status any time soon.

I’ve linked to a few good ones on Twitter. If you’d like to read more you can find them on my timeline.

Here’s one.

Again, there will not be a Weekend Market Update Friday due to the holiday. Weekend Weekly Charts will still be up on Twitter at the usual Saturday morning schedule.

Have a beautiful Easter weekend for those of you who celebrate.

***This is NOT financial advice. NOT a recommendation to buy, sell, or trade any security. The content presented here is intended for educational purposes only.

Andrew Moss is an associated member of T3 Trading Group, LLC (“T3TG”) an SEC registered broker/dealer and member of FINRA/SIPC. All trades placed by Mr. Moss are done through T3TG.

Statements in this article represent the opinions of that person only and do not necessarily reflect the opinions of T3TG or any other person associated with T3TG.

It is possible that Mr. Moss may hold an investment position (or may be contemplating holding an investment position) that is inconsistent with the information provided or the opinion being expressed. This may reflect the financial or other circumstances of the individual or it may reflect some other consideration. Readers of this article should take this into account when evaluating the information provided or the opinions being expressed.

All investments are subject to the risk of loss, which you should consider in making any investment decisions. Readers of this article should consult with their financial advisors, attorneys, accountants, or other qualified investors prior to making any investment decision.

POSITION DISCLOSURE

April 5, 2023, 4:00 PM

Long: AMZN0421C102, SCHW0412C55, SQ0414P65

Short:

Options symbols are denoted as follows:

Ticker, Date, Call/Put, Strike Price

Example: VXX1218C30 = VXX 12/18 Call with a $30 strike