Santa Was Late

The rally arrived… just after the calendar closed.

Subscriber Note

Over the next couple of weeks, I’ll be sharing something special exclusively with Trading Adventures subscribers.

It’s not public and won’t be promoted broadly. Make sure you’re subscribed to receive the details.

Market Update — January 6, 2026

The Markets

The Santa Claus “rally” has come and gone and the result was a -0.11% decline.

Coined by the late Yale Hirsch, the Santa Claus Rally is not an event, but a period of time spanning the last 5 trading days of one year and the first two of the next. This year, it ran from December 24 to January 5. Hirsch was keen to quip,

“If Santa Claus should fail to call, bears may come to Broad and Wall.”

And it’s not just a clever rhyme — historical data backs it up. Annual S&P 500 performance tends to be better when this period finishes in the green.

So… was Santa just late this year?

Let’s check the price action.

The Charts

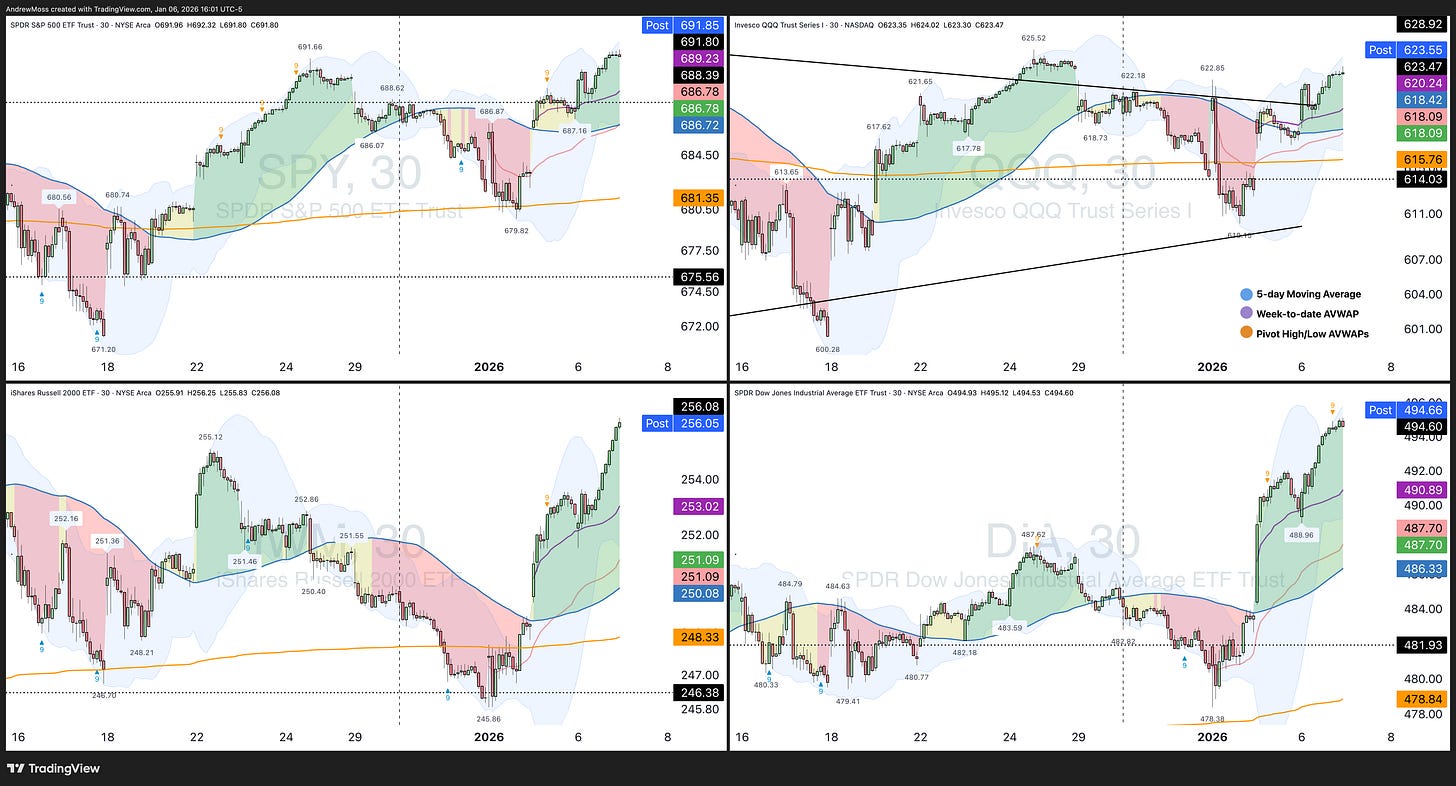

🚦The Roadmap

Our ‘roadmap’ chart shows green lights across the board with all four major indices making higher highs and higher lows above rising 5-day moving averages.

SPY moved beyond the October 2024 high to make fresh new all time closing high.

QQQ broke out higher from the multi-week consolidation pattern.

DIA pushed to a new all-time high, with RSI nearly tagging 70.

IWM extended a three-day bounce off its 50-day moving average.

TLT did not join the move. Price is below all key moving averages — each of them declining — and RSI remains below 50.

This is not an uptrend.

DX1! Dollar futures are attempting to stabilize, reclaiming the 8-day and 21-day MAs, but the anchored VWAP from the May 24 high continues to act as resistance.

BTCUSD even joined the fun. After weeks of choppy, directionless action, Bitcoin is back above a rising 8/21/50-day moving average cluster.

Price is entering a prior resistance zone near $94,000, with the anchored VWAP from the all-time high (~$97,776) as the next key level above.

So… Was Santa Just Late?

Fun idea. But no — that’s not how this works.

Once the calendar flips, the Santa Claus Rally window closes. The measurement is complete.

And while historical seasonality shows that positive SCRs often lead to stronger years, statistics are not signals. The two most recent negative SCRs also led to strong market years.

So what’s the takeaway?

Context matters.

Price matters more.

The Trade

Markets are trending higher. The roadmap is green. Major indices are aligned.

Stay focused on price, trend, structure, and risk.

Follow the charts. Follow the price.

The Disclosures

***This is NOT financial advice. This is NOT a recommendation to buy, sell, or trade any security. The content presented here is intended for educational purposes only.

Thanks Andy!