Selling Sweeps Stocks: Failed Breakouts Signal Caution as Safety Plays Rise

SPY, QQQ Breach Key MAs, IWM Sinks, While Traders Navigate Choppy Waters - Monday Market Update

The Markets

Straight to the action today.

The selling is the story: SPY, QQQ, and IWM are all lower, while DIA barely eeks out a positive day.

Here are a few highlights for anyone who didn’t get to read the 📈Weekly Chart📉 thread.

The longer-term weekly charts are not bearish. So far, stocks (specifically the SP 500) are selling off in accordance with the usual seasonal tendencies for February.

Looking deeper, we can see a few noteworthy occurrences that could be early indicators of defensive positioning and ‘safety seeking’ actions.

Drilling down to the daily chart view shows a few more precautionary events. Again, so far, this all falls well within the confines of the usual seasonal weakness.

The Charts

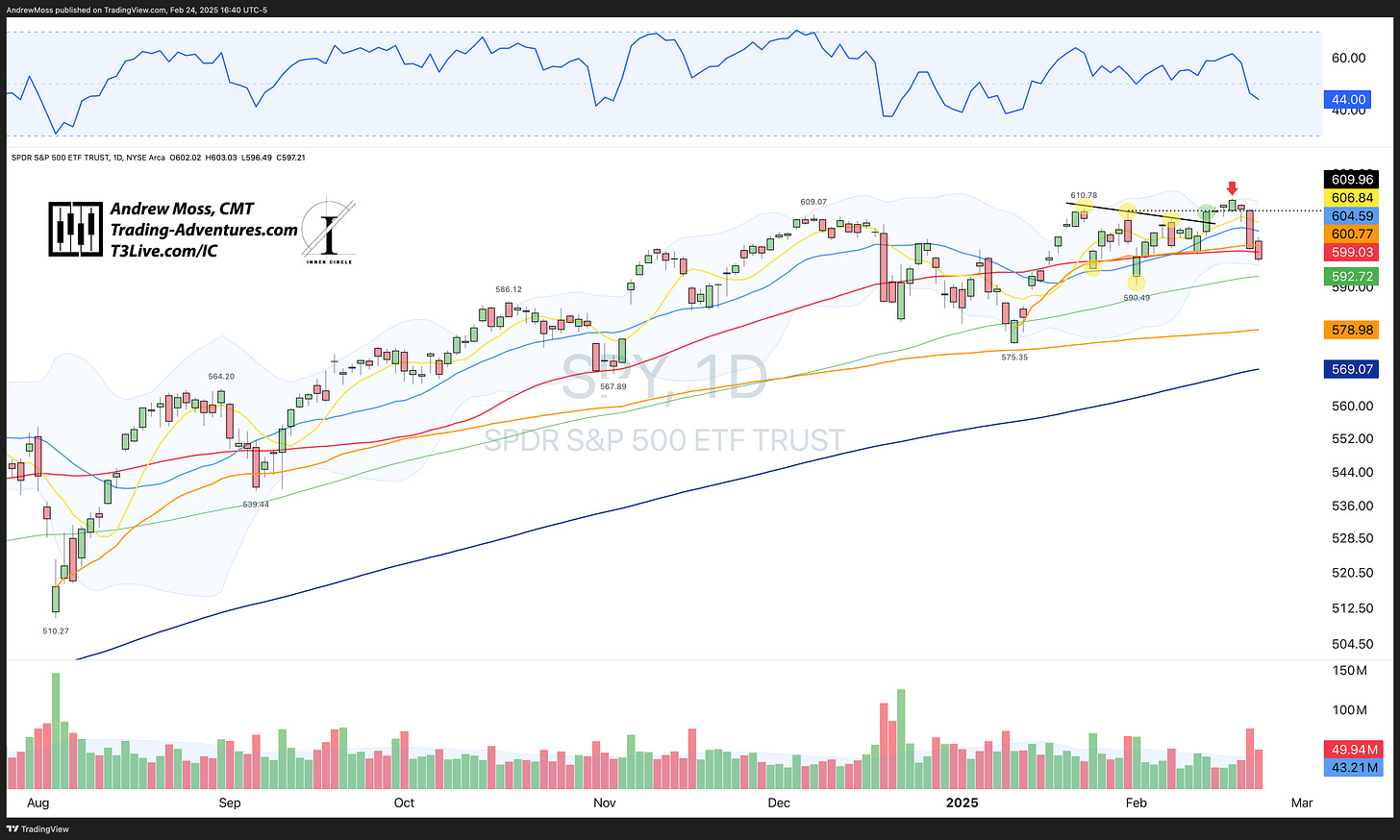

SPY closed below the 50-day MA and pivot low AVWAP and now has a bit of a ‘failed breakout’ look to add to the caution. The selling has come on higher-than-average volume, sending the RSI into the lower half of the range.

The next support is now the 100-day MA and a pivot at $590.49. The August low AVWAP and 200-day MA are near $579 and $569, respectively.

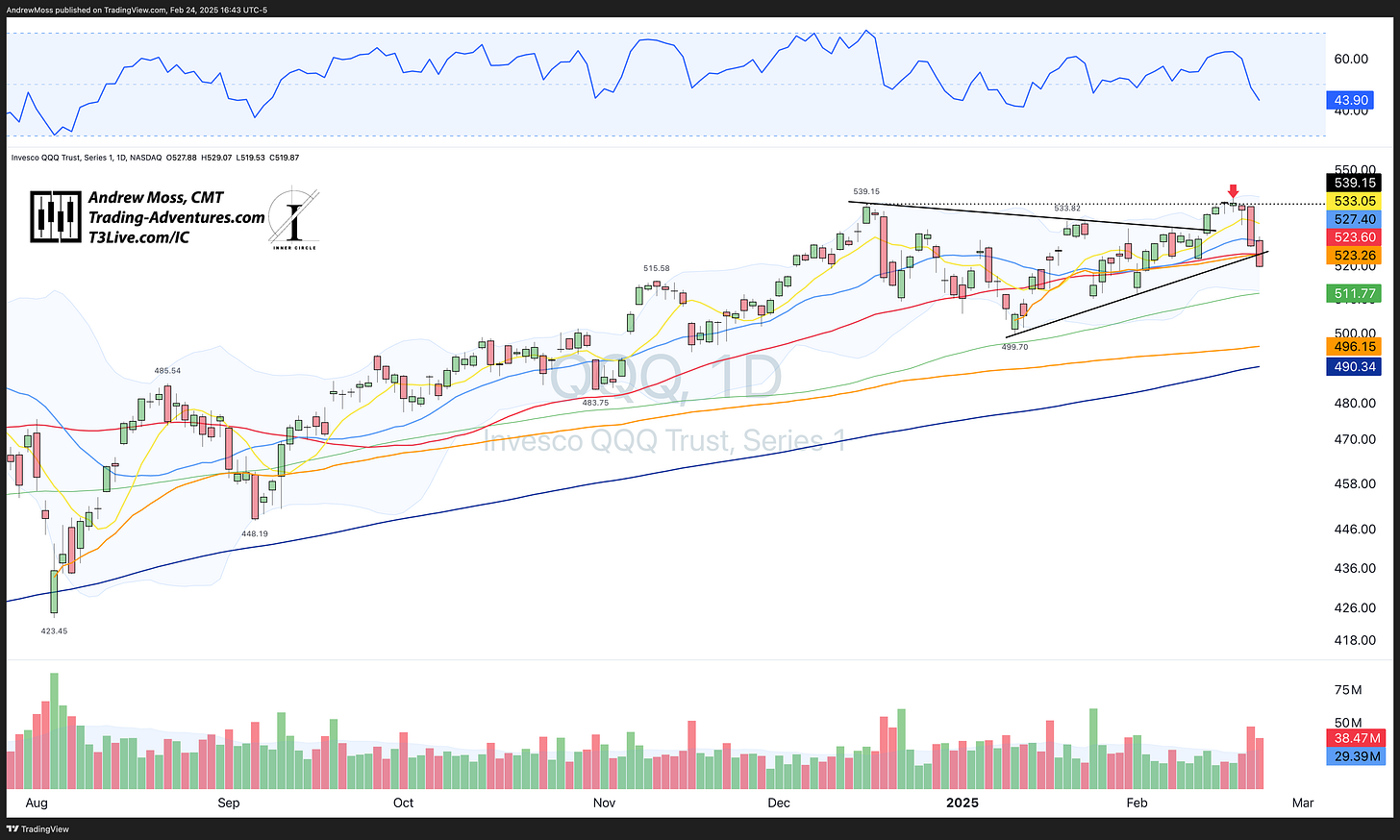

QQQ is following a similar story. A failed breakout led to a breach of several would-be support levels—the 8/21/50-day MAs, a pivot low AVWAP, and a trendline. All have been unable to hold prices up, and the 100-day MA and pivots near $510-$511 are next.

Volume is picking up while RSI dips below 50.

IWM continued lower from the 200-day MA, with further potential support near $214 and $212. The RSI is very low, though not yet oversold, and volume is higher than usual.

DIA is slightly constructive in that it —

closed positive for the day

gave in inside day

stayed above the $433.20 pivot

is still hugging the 100-day MA

Like the others, though, the selling has come on heavy volume and has driven RSI down into the bearish lower half.

TLT did its part today, rising slightly and nearly testing the next pivot level above.

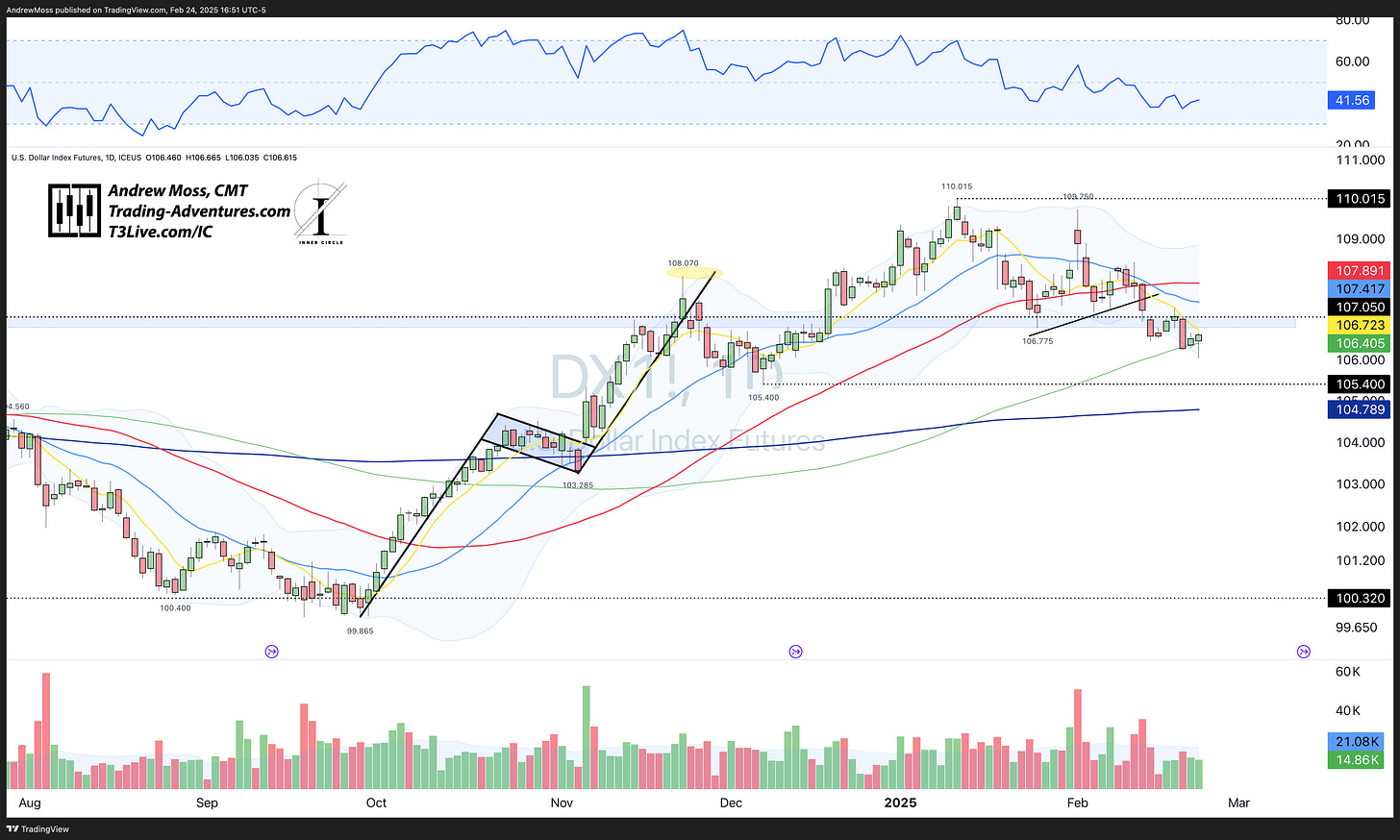

DXY Dollar futures gave a hammer candle on the 100-day MA while contained by the falling 8-day MA.

BTCUSD is, once again, testing the confines of the consolidation area. Will it get below and stay below? All but the 200-day MA are above the price, adding to the downward pressure.

The Trade

It’s a traders’s market.

The best setups have been for quick trades with quick exits. However, not much is sticking right now, as we see an abundance of failed moves and fast retracements.

Translation: that makes life tough for a swing trader.

For the long-term investor or position trader, it is just business as usual. Pullbacks from new highs at the exact time of year one should expect that type of thing.

So, the best tactics have been either a very short or very long-term approach.

For risk management, monitor the support levels noted for signs that a deeper pullback is beginning.

For opportunity, see how the week and month end. Can we get through February with minimal damage? If so, March and April may bring better days.

Looking For More?

Elevate Your Trading Adventure Even Further With These Offerings.

EpicTrades Options Newsletter

Real-time trade ideas and insights, providing actionable trading insights focusing on options trades with short-term horizons, aiming to capitalize on weekly market movements.

The approach includes detailed reasoning for trades, specific options, and profit targets. It focuses on quick gains with a minimal time commitment from subscribers.

The Inner Circle

The Inner Circle is a Virtual Trading Floor (VTF) at T3 Live. I’ve been working and trading with this group since 2022. You may have noticed the logo in the watermarks on my charts.

Founded by David Prince and led by him, Rick March, and Kira Turner, the Inner Circle is a community of elite traders, including hedge fund managers, family office heads, corporate executives, financial advisors, and even professional poker players.

Fundamental, Macro, and Technical Analysis all combine to find and discuss the best opportunities in current markets.

The Disclosures

***This is NOT financial advice. This is NOT a recommendation to buy, sell, or trade any security. The content presented here is intended for educational purposes only.