Gauley Season is here in WV as the US Army Corp of Engineers has started releasing water from the Summersville Dam further enhancing the already world-class whitewater section of the Gauley River.

It kinda feels the same in the market this week, right?

Is it the leaky dam?

Or the rough water?

I’m not sure.

This quote, attributed to Jesse Livermore, has been especially apt in this market which keeps giving us day after day of chop and misdirection.

It’s been difficult to find and finish good, long trades. When signs of strength show up — whether in the form of sharp moves higher (like last week), breadth thrusts (when up volume is significantly more than down volume definition here), or a decline in the number of stocks making new 52-week lows — there seems to be an imminent "rug pull" soon after.

All of this works to grind away at profits and confidence; if you let it. Losing money is hard. But mounting frustration that leads to a loss of confidence is even worse.

Brian Shannon frequently warns that if the market doesn't scare you out, it may wear you out.

As traders, we have to preserve capital.

But that doesn't only mean financial capital. We must preserve our mental and emotional capital as well. We already know that trading is probably 90% psychological and 10% knowledge and skill. Erosion of a positive mental state will surely cost us money.

We must have awareness. We must know what market types suit us best. And we must know when it is better to step away and be patient.

Patience pays. And it's one of the most critical attributes of successful trading. I share reminders of this every chance I get.

You can read through them here. It’s an extensive list from a variety of sources.

Trading & Adventure?

When I titled this collection of writing "Trading Adventures" the idea was that I would write about both - Trading and Adventure. I'm lucky enough to live in one of the most spectacular outdoor playgrounds east of the Mississippi. Adventure is everywhere. And I work to experience it as much as possible.

I've been reluctant to veer away from trading when writing here, though. I can’t help wondering if maybe a separate publication would be more appropriate. I don't know. Feel free to give me your input.

For this article, I will share a small taste.

With the markets looking a bit listless Wednesday morning I decided my time could be better spent outside. So I hopped in the Jeep with my wife and dog and we made the short trip over to the New River Gorge, the country's newest National Park.

Time in the woods always recharges.

📸 click here for more pictures 📸

Quick trips like these consistently have a positive effect on my trading. I'm trying to make it a regular recurrence. We'll see how that goes.

What do you do to get away and recharge? I'd love to read about it, wherever you share.

Facebook, Instagram, Twitter, your own Substack? Let's see it.

The Market

So what did I miss Wednesday? Very little. The SP 500 traded in a range of about 1.25% but ultimately closed right about where it opened. Snooze......

The other days this week, of course, have been a bit more eventful.

Leading up to Tuesday's heavily anticipated CPI report prices seemed to defy gravity as the melt-up gained velocity and even continued into the pre-market hours Tuesday morning. But we all know what happened next. Inflation came in a bit hotter than expected.

( poor attempt at sarcasm👇 )

Can you tell on this 10-minute chart when the announcement occurred?

Then what?

Before the market opened this morning, at roughly 9:00 AM, SPY had already moved in a range of almost 7% for the week. (I take back the "snooze" comment).

Those bear market rallies can sure disappear in a hurry.

The move below yesterday’s lows was worrisome and many thought the likelihood of a nasty Friday selloff was increasing. Now, just after the close, the indexes are a little the 9 am level and still sitting at or near some type of potential support.

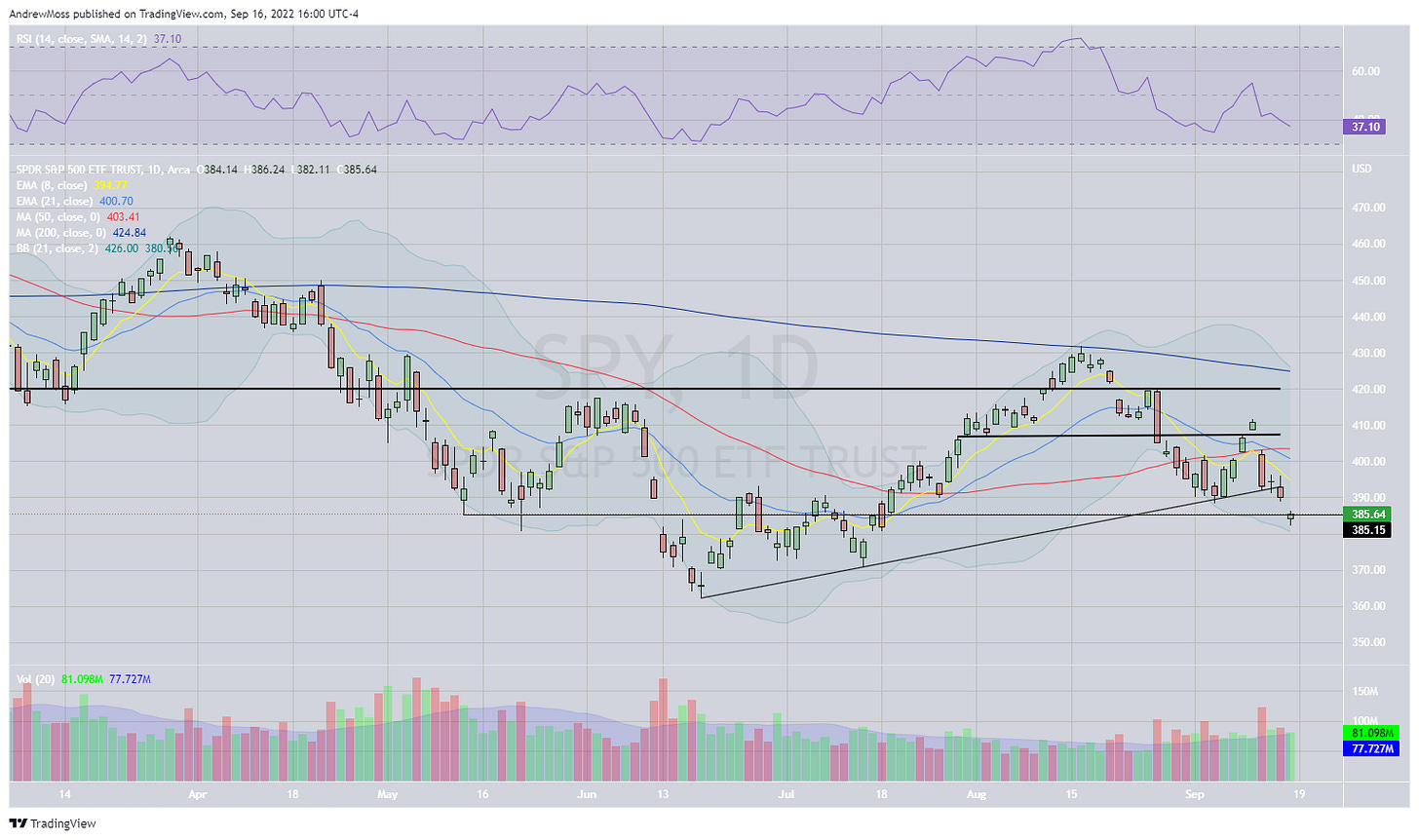

Here are the charts

$DXY

$VIX

Bull and bear case

The story hasn’t changed much. Prices must stop going down in order to start going back up. Right now it’s just that simple. SPY and QQQ haven’t done that yet.

I won’t hazard a guess at what event could prompt that to happen. In this environment of saber rattling, Fed tightening, and the inflation battle, good news can be bad, and vice versa.

Many are wrapped up in the debate on whether or not we see the June lows again. The only thing I can say for sure is that we moved closer to that today. And as long as prices are below the key moving averages and heading lower, it’s hard to make a case against that happening.

Again, keep it simple.

Monday morning I’ll be watching today’s lows.

Can we hold above?

If so, can we move up to, and then over the 8-day EMA?

How about the 21-day?

If we break this week’s lows then we’re looking at:

slight pivot on July 14 (SPY 371.04)

followed by the June low mentioned previously (SPY 362.17)

We shall see.

What I'm reading and listening to

Great story about Huy Fong foods and Sriracha

Michael Gayed speaks with Tommy Thornton on Lead-Lag Live

Side note: David Senra of FoundersPodcast introduced me to the Snipd app (no affiliation) last week and I used it to listen to this episode. The reason; Snipd lets me take notes and clips from the show for sharing and review. I've only used it this one time so far, but I really like what I see.

Here are some really short clips from the show:

You Can Profit In Tactical Markets

From Twitter

On CPI day

US Dollar going down helps SPY go up. This didn't last long.

On weekend preparations

Last ones:

Willie Nelson is a living legend. This concert was great!

The Marshall Thundering Herd had the upset of the week beating Notre Dame in South Bend!

We Are......Marshall!

Anything else?

That's all for now. Thanks always for reading, subscribing, and sharing with your friends and family.

I hope you have a fantastic weekend.

Cheers.

***This is NOT financial advice. NOT a recommendation to buy, sell, or trade any security. The content presented here is intended for educational purposes only.

Andrew Moss is an associated member of T3 Trading Group, LLC (“T3TG”) a SEC registered broker/dealer and member of FINRA/SIPC. All trades placed by Mr. Moss are done through T3TG.

Statements in this article represent the opinions of that person only and do not necessarily reflect the opinions of T3TG or any other person associated with T3TG.

It is possible that Mr. Moss may hold an investment position (or may be contemplating holding an investment position) that is inconsistent with the information provided or the opinion being expressed. This may reflect the financial or other circumstances of the individual or it may reflect some other consideration. Readers of this article should take this into account when evaluating the information provided or the opinions being expressed.

All investments are subject to risk of loss, which you should consider in making any investment decisions. Readers of this article should consult with their financial advisors, attorneys, accountants or other qualified investors prior to making any investment decision.