September 21, 2022 Mid-Week Market Update

Hump day has been hard for stocks

Another big, red Wednesday.

Hump day has been hard for stocks. Last Wednesday we had CPI. Today the FED hiked rates another 75 bps today. An event that seemed like a foregone conclusion to many. But the price action indicates at least some surprise. After a quick move down and then up, things sold off heavily into the close.

So where does that leave us?

The bull case scenario from my Weekend Review looked to be progressing slightly at the start of the week.

Monday morning I’ll be watching today’s lows.

Can we hold above?

If so, can we move up to, and then over the 8-day EMA?

How about the 21-day?

Now, not so much.

SPY tried to hold the lows. Today it even moved up to the 8-day EMA. But that's as far as it would get. At the close, it is still below the key moving averages and looks to be headed lower. So shifting to the bear case:

slight pivot on July 14 (SPY 371.04)

followed by the June low mentioned previously (SPY 362.17)

The move lower in stocks was accompanied (unsurprisingly) by a rise in VIX and the US Dollar.

For short-term active traders, remember that sitting on the sidelines is free.

For long-term investors, there may be bargains out there. But I'd rather be buying on the way up than the way down.

***This is NOT financial advice. NOT a recommendation to buy, sell, or trade any security. The content presented here is intended for educational purposes only.

Andrew Moss is an associated member of T3 Trading Group, LLC (“T3TG”) a SEC registered broker/dealer and member of FINRA/SIPC. All trades placed by Mr. Moss are done through T3TG.

Statements in this article represent the opinions of that person only and do not necessarily reflect the opinions of T3TG or any other person associated with T3TG.

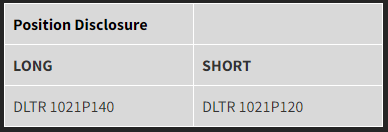

It is possible that Mr. Moss may hold an investment position (or may be contemplating holding an investment position) that is inconsistent with the information provided or the opinion being expressed. This may reflect the financial or other circumstances of the individual or it may reflect some other consideration. Readers of this article should take this into account when evaluating the information provided or the opinions being expressed.

All investments are subject to risk of loss, which you should consider in making any investment decisions. Readers of this article should consult with their financial advisors, attorneys, accountants or other qualified investors prior to making any investment decision.

Please Note: short puts are synthetic longs, and short calls are synthetic shorts

Options symbols are denoted as follows:

Ticker, Date, Call/Put, Strike Price

Example: VXX1218C30 = VXX 12/18 Call with a $30 strike